Treasury bonds, or T-bonds, are U.S. government debt securities with a maturity term of more than ten years. They offer a fixed rate of interest paid semiannually, acting as a consistent income source for the holder. Upon maturity, the bond's face value is returned to the investor. The bonds are fully backed by the U.S. government, making them a low-risk investment. Investors typically use T-bonds to preserve capital while earning a steady return. They can be purchased directly from the U.S. Department of the Treasury via the TreasuryDirect system or from other investors in the secondary market. Treasury bonds come with a fixed interest rate with a maturity date of 10 to 30 years. They are backed by the full faith and credit of the U.S. government, making them one of the safest investment vehicles in the market.

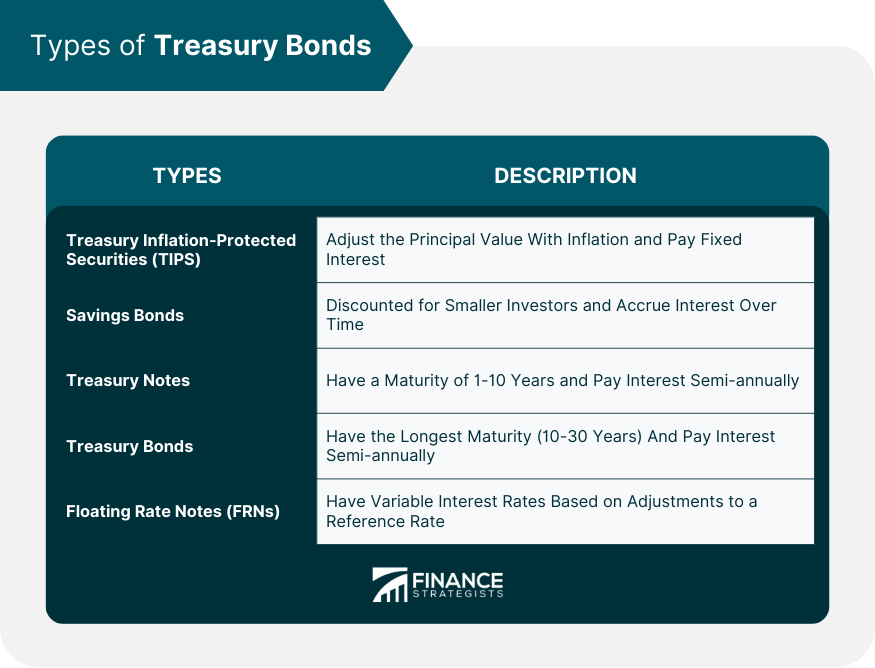

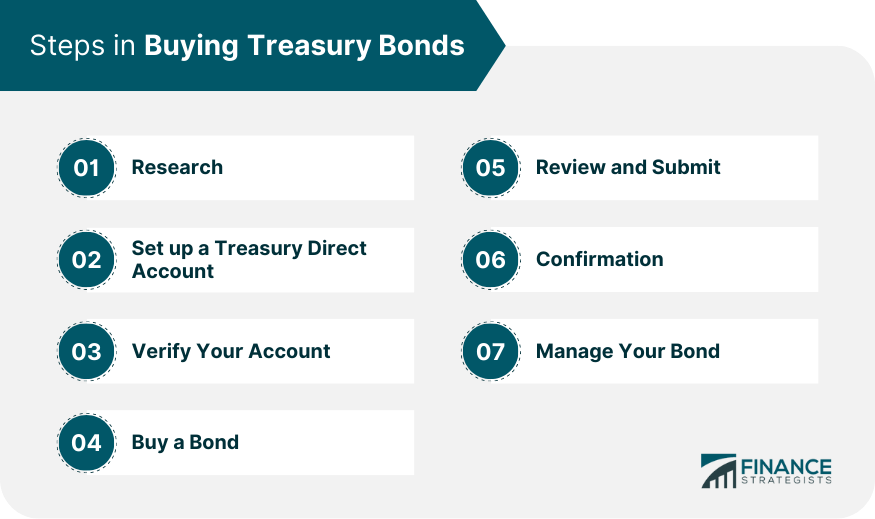

Several types of treasury bonds are distinguished primarily by their maturity date. Treasury Inflation-Protected Securities (TIPS): These treasury bonds protect against inflation. The principal value of TIPS adjusts with changes in the Consumer Price Index (CPI), ensuring that the bond's value keeps pace with inflation. Savings Bonds: These treasury bonds are specifically designed for smaller investors. They are issued at a discounted price and accrue interest over time. Treasury Notes: These treasury bonds have a 1 to 10 years maturity period. They pay interest every six months and are suitable for investors looking for intermediate-term fixed-income investments. Treasury Bonds: Treasury bonds, also known as T-bonds, have the longest maturity period among treasury securities. They typically have a maturity range of 10 to 30 years. Floating Rate Notes (FRNs): FRNs are treasury bonds with variable interest rates. The interest rate is periodically adjusted based on changes in a reference rate, such as the 13-week treasury bill rate. FRNs protect against rising interest rates, as their interest payments increase when rates go up. Each type of treasury bond offers different features and benefits, allowing investors to tailor their investment strategy based on their risk tolerance, investment horizon, and financial goals. Steady Stream of Income: Treasury bonds offer a reliable source of income through semi-annual interest payments. Capital Preservation: Treasury bonds are considered low-risk investments as the full faith and credit of the U.S. government back them. This means that the likelihood of default is extremely low. Diversification Benefits: Including treasury bonds in an investment portfolio can help diversify risk. Treasury bonds are negatively correlated with other asset classes, such as stocks or corporate bonds. Treasury bonds play a vital role in financing the federal budget of a country such as the United States. When the government needs to borrow money to fund its operations, it issues treasury bonds. These bonds allow the government to raise capital from investors, including individuals, institutions, and foreign governments. The funds raised from the sale of treasury bonds are used to cover expenses such as public services, infrastructure projects, defense, healthcare, education, and more. The government can effectively manage its finances by issuing treasury bonds and ensuring the smooth functioning of public services and projects. Treasury bonds also have a significant impact on interest rates and inflation. The yield of treasury bonds serves as a benchmark for interest rates across the economy. Investors are willing to accept lower yields when there is high demand for treasury bonds. This high demand drives up the price of the bonds and reduces their yield. As a result, interest rates in the broader economy also tend to decrease. Conversely, if there is a low demand for treasury bonds, their prices may decline, leading to higher yields and potentially increasing interest rates. In terms of inflation, treasury bonds play a role in monitoring and responding to changes in the purchasing power of money. If the inflation rate is higher than the fixed interest rate on treasury bonds, the real value of the bond's interest payments decreases over time. This means that the purchasing power of the bond's interest income may be eroded by inflation. As a result, investors may seek higher-yielding investments to offset the effects of inflation. Central banks and policymakers closely monitor inflation and adjust interest rates and monetary policies accordingly to maintain price stability and support economic growth. Before deciding to purchase treasury bonds, it is crucial to evaluate your risk tolerance. Treasury bonds are considered low-risk investments due to their backing by the U.S. government. They are ideal for conservative investors who prioritize capital preservation and are less inclined to take on higher levels of risk. If you have a lower risk tolerance and prefer a stable investment with a lower potential for loss, treasury bonds can be a suitable option. When considering the purchase of treasury bonds, it is important to analyze both current and forecasted economic conditions. The interest rate environment plays a significant role in determining the attractiveness of treasury bonds. In a low-interest-rate environment, the fixed interest payments from treasury bonds may be less appealing than other investments offering higher returns. Assessing economic indicators, such as inflation rates, GDP growth, and central bank policies, can provide insights into the overall economic landscape and potential impacts on treasury bond performance. Your investment goals should guide your decision-making process when considering treasury bonds. If your goal is to accumulate wealth over the long term, you may find other investment options, such as stocks or real estate, more suitable, as they offer the potential for higher returns. However, if your primary objective is to generate a stable income stream while preserving capital, treasury bonds can be an excellent choice. Treasury bonds provide regular interest payments, which can be attractive for income-oriented investors seeking a reliable source of cash flow. Yield: The yield of a treasury bond is an important factor to consider. It represents the interest rate that the bond pays about its price. Current Interest Rate Environment: The prevailing interest rate environment should be considered when selecting treasury bonds. Investment Goals and Horizon: Consider your investment goals and time horizon. Longer-term bonds may be suitable if you have a long-term investment horizon and seek higher returns. The yield curve is a graphical representation of the interest rates on debt securities with different maturities. It provides valuable insights for investors in treasury bonds. An upward-sloping yield curve indicates that longer-term bonds offer higher yields than shorter-term ones. This suggests that investors may be compensated for holding bonds for a longer period. Conversely, a downward-sloping yield curve implies that shorter-term bonds offer higher yields, potentially making them more attractive. The choice of maturity dates depends on your investment horizon and cash flow needs. Longer-term treasury bonds, such as those with 10- or 30-year maturities, typically offer higher yields due to the longer time commitment. These bonds are suitable for investors with a longer investment horizon and a willingness to lock in their money for an extended period. Shorter-term treasury bonds, such as those with 1- or 5-year maturities, provide more flexibility as they mature sooner. They are preferred by investors who anticipate needing access to their funds or who have shorter-term investment goals. Investing in Treasury bonds is a popular way to safeguard capital while earning a steady return. These are long-term, low-risk investment instruments backed by the U.S. government, offering fixed interest paid semiannually. Here is a step-by-step guide to buying a treasury bond: Research: Understand how treasury bonds work, their terms, rates, and potential risks. Visit the U.S. Department of the Treasury's website to access updated information. Set up a TreasuryDirect Account: Go to the TreasuryDirect website and click on "Open An Account." Follow the instructions to set up your account. You will need your Social Security Number, email address, U.S. bank account number, and bank routing number. Verify Your Account: TreasuryDirect will mail you a confirmation after setting up your account. Log in and verify your account with the confirmation code provided. Buy a Bond: Log in to your TreasuryDirect account. Click on "BuyDirect," then select "Treasury Bonds." Fill in the necessary details, like the bond amount and the source of funds (savings or checking account). Review and Submit: Review your bond purchase details carefully. If everything looks correct, submit your purchase. Confirmation: You will receive a confirmation message on the site and an email that your purchase was successful. Manage Your Bond: Over time, check on your bond via your TreasuryDirect account. You can see the interest accrued and current value and manage the bond as you see fit. Remember, Treasury bonds have a fixed interest rate and a maturity period of more than ten years. The U.S. government pays interest on the bond every six months until it matures. Regularly reviewing your bond portfolio is essential to ensure it aligns with your financial goals. This involves assessing the performance of your treasury bonds and monitoring changes in their market value. By reviewing your bond portfolio, you can determine if it is generating the expected income and evaluate its overall performance within the context of your investment strategy. Economic factors, particularly changes in interest rates, can significantly impact the value of your treasury bonds. When interest rates rise, the value of existing bonds typically decreases as newer bonds with higher yields become more attractive. Conversely, when interest rates decline, the value of existing bonds tends to increase. It is important to stay informed about economic indicators and make adjustments to your bond portfolio as needed. If interest rates are expected to rise, consider reallocating your bond investments or exploring other fixed-income alternatives. As your treasury bonds mature, you can reinvest the principal or redeem it. The decision will depend on your financial needs and investment objectives at the time. Reinvesting the principal allows you to generate income by purchasing new treasury bonds. On the other hand, redeeming the principal provides you with cash that can be used for other purposes, such as covering expenses or making different investment choices. Assessing your financial situation, liquidity requirements, and prevailing market conditions will help you make an informed decision regarding reinvestment or redemption. When investing in treasury bonds, it's important to consider the tax implications. Here are some key points to understand: The interest earned on treasury bonds is generally subject to federal income tax. This means that the interest income you receive from your treasury bonds will be included in your taxable income for the year in which it is received. It is important to report this interest income accurately on your federal income tax return. While treasury bond interest is subject to federal income tax, it is typically exempt from state and local income taxes. This exemption can vary depending on your specific state or locality, so it's important to consult with a tax advisor or refer to your state's tax laws to confirm the exact tax treatment. Treasury bonds may also have estate tax implications. The value of your treasury bonds could be included in your taxable estate for estate tax purposes. If your total estate value exceeds the applicable estate tax exemption threshold, your treasury bond holdings could be subject to estate tax. It is advisable to consult with an estate planning professional or tax advisor to understand the potential estate tax implications and explore strategies to minimize tax liabilities. The U.S. Treasury issues a 1099-INT form to individuals who earn interest on treasury bonds. This form reports the amount of interest earned during the tax year. It is important to ensure that you accurately report the interest income from your treasury bonds on your federal income tax return using the information provided on the 1099-INT form. Given the complexities of tax regulations and individual tax situations, seeking advice from a qualified tax professional or financial advisor is prudent. They can provide personalized guidance based on your specific circumstances, helping you understand the tax implications of owning treasury bonds and develop tax-efficient strategies. Putting all your investment capital into a single type of treasury bond or solely investing in treasury bonds without considering other asset classes can expose your portfolio to unnecessary risks. Diversification helps spread risk and may enhance potential returns. Consider diversifying across different maturities, yields, and even asset classes to create a well-balanced portfolio. Treasury bond prices are inversely related to interest rates. Bond prices tend to fall when interest rates rise, resulting in potential capital losses if you need to sell your bonds before maturity. It is important to be mindful of the interest rate environment and consider the potential impact on the value of your treasury bonds. While treasury bonds are considered relatively low-risk investments, they may not provide sufficient protection against inflation. If the inflation rate exceeds the fixed interest rate on your treasury bonds, the purchasing power of the bond's interest income may erode over time. Assessing your investment goals and considering whether treasury bonds alone can adequately hedge against inflation risks is important. It is essential to understand the terms and conditions of the bonds, evaluate the creditworthiness of the U.S. government, and stay informed about economic factors that can impact bond prices. Researching historical performance, analyzing yield curves, and consulting with financial advisors can help you make informed investment decisions. Many investors need to set and remember their treasury bond investments. It is important to regularly reassess your portfolio, considering changes in your investment goals, market conditions, and economic factors. Adjusting your bond holdings when necessary can help optimize your portfolio and align it with your changing needs and market dynamics. When it comes to selling your treasury bonds, several factors must be considered. Here is a discussion of important points to keep in mind: Reasons for Selling: Understanding the reasons behind selling your treasury bonds is crucial. You may choose to sell your bonds due to changes in your financial goals, liquidity needs, or a shift in your investment strategy. Process of Selling Through TreasuryDirect: If you hold treasury bonds through a TreasuryDirect account, selling is typically done through the same platform. Market Conditions and Bond Prices: It's essential to consider market conditions and bond prices when selling your treasury bonds. The market price of a bond can fluctuate based on factors such as interest rates, economic indicators, and investor demand. Transaction Costs and Fees: When selling treasury bonds, it's important to be aware of any transaction costs or fees associated with the sale. Tax Considerations: Selling Treasury bonds can have tax implications. If you sell your bonds at a profit, you may be subject to capital gains tax. On the other hand, if you sell at a loss, you may be eligible for a capital loss deduction. Reinvestment or Utilization of Proceeds: Once you have sold your treasury bonds, you can reinvest the proceeds into other investments or utilize the funds for other financial needs. Corporate bonds, issued by corporations, typically offer higher yields than treasury bonds due to their higher risk. They are a good alternative for investors willing to take on more risk for higher returns. Mutual funds and exchange-traded funds (ETFs) that invest in a diversified portfolio of bonds can provide higher returns and still maintain a relatively low level of risk. They also offer more liquidity than individual bonds. For those with higher risk tolerance, stocks, and real estate can provide significant capital appreciation over the long term. However, they also come with higher volatility and potential for loss. Understanding how to buy treasury bonds is crucial for low-risk portfolio diversification. These bonds provide stability, and consistent income, and act as a safe haven during economic uncertainty. To make informed decisions, assess risk tolerance, evaluate economic conditions, and align with investment goals. The process involves setting up a TreasuryDirect account, navigating a user-friendly interface, and following a detailed purchase process. Consider factors like yield, yield curve, and maturity dates. Regularly monitor investments, review portfolios, and make adjustments based on economic factors. Understand tax implications, and avoid common mistakes like lack of diversification and ignoring interest rate and inflation risks. Treasury bonds can be sold through TreasuryDirect if needed. While reliable, alternative investments like corporate bonds, mutual funds, ETFs, stocks, and real estate offer diversification and potentially higher returns. Maximize your investment potential by seeking guidance from experienced wealth management experts.Overview of Treasury Bonds

Types of Treasury Bonds

TIPS also pays a fixed interest rate.

Savings bonds can be purchased in different denominations and have specific maturity periods. They offer a safe and accessible way for individuals to invest in treasury bonds.

Treasury bonds pay interest every six months, providing investors with a long-term investment option.

Importance in an Investment Portfolio

These fixed-income payments give investors a predictable cash flow, making treasury bonds suitable for individuals seeking regular income or diversifying their income sources.

As a result, treasury bonds are often used as a means to preserve capital. They provide a relatively safe haven for investors seeking stability and a way to protect their principal investment.

This means that when the value of one asset class is declining, the value of treasury bonds may remain stable or even increase. By diversifying across different asset classes, investors can reduce the overall risk of their portfolio and smooth out investment returns.Role of Treasury Bonds in the Economy

Treasury Bonds and the Federal Budget

Impact on Interest Rates and Inflation

Assessing the Risibility of Purchasing Treasury Bonds

Evaluating Your Risk Tolerance

Analyzing Current and Forecasted Economic Conditions

Understanding Your Investment Goals

Deciding Which Treasury Bonds to Buy

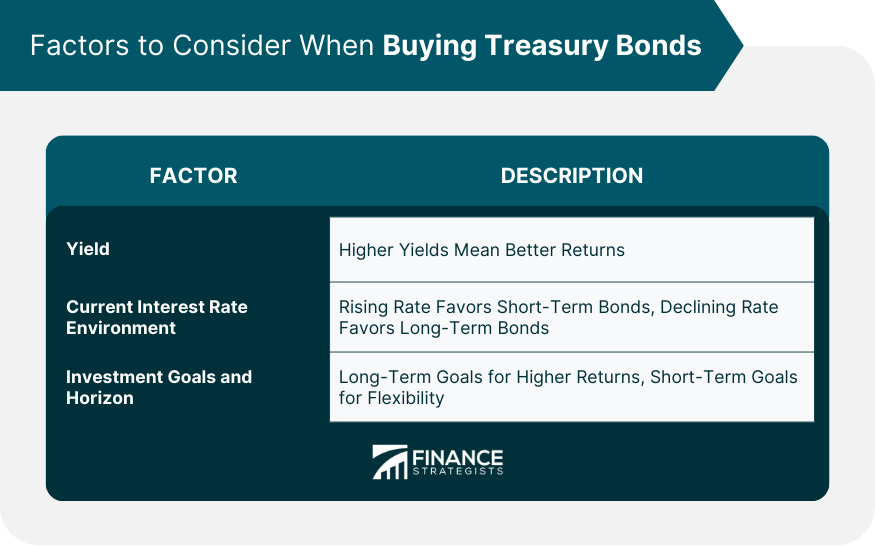

Factors to Consider

Higher yields generally indicate better returns. Comparing the yields of different treasury bonds can help you assess their potential income generation.

If interest rates are expected to rise, buying shorter-term bonds may be beneficial as they will mature sooner, allowing you to reinvest at higher rates.

Conversely, if interest rates are expected to decline, longer-term bonds may be more attractive as they lock in higher rates.

However, shorter-term bonds may be more appropriate if you have short-term goals or anticipate needing access to your funds shortly.

Analyzing the Yield Curve

Consideration of Maturity Dates

How to Buy Treasury Bonds

Monitoring Your Treasury Bonds Investment

Reviewing Your Bond Portfolio

Making Adjustments Based on Economic Factors

Considering Reinvestment or Redemption

Tax Implications of Treasury Bonds

Taxable Interest

Exemption From State and Local Taxes

Estate Tax Considerations

Reporting Requirements

Tax Planning and Professional Advice

Common Mistakes When Buying Treasury Bonds

Lack of Diversification

Ignoring Interest Rate Risks

Neglecting Inflation Risks

Lack of Research and Due Diligence

Neglecting to Reassess and Adjust

Factors to Consider When Selling Your Treasury Bonds

It is important to clearly understand your motivations for selling before proceeding with the transaction.

The process involves accessing your account, navigating to the selling options, and specifying the bonds you wish to sell. The sale details, such as the quantity and price, are typically provided during the selling process.

Monitoring bond prices and evaluating market conditions can help you make informed decisions about the timing of your sale.

While TreasuryDirect generally does not charge fees for selling Treasury bonds, other brokerage platforms or financial institutions may have their own fee structures.

Understanding the costs involved can help you assess the overall impact on your returns.

It is important to consult with a tax advisor or financial professional to understand the specific tax implications of selling your treasury bonds and plan accordingly.

Consider your investment goals, risk tolerance, and liquidity requirements when deciding how to allocate the proceeds from the sale.Alternative Investments to Treasury Bonds

Corporate Bonds

Mutual Funds and ETFs

Stocks and Real Estate

Takeaway

How to Buy Treasury Bonds FAQs

Treasury bonds can be purchased by setting up a TreasuryDirect account and following the provided purchase process.

The minimum investment for treasury bonds is $100.

Treasury bonds can only be purchased directly from the U.S. government through the TreasuryDirect platform.

When deciding which treasury bonds to buy, consider factors such as yield, maturity dates, and the current interest rate environment.

TreasuryDirect charges no fees for buying treasury bonds. However, other financial institutions or brokers may have their own fee structures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.