The term "Taper Tantrum" refers to the swift and dramatic reaction of financial markets to the prospect or actual process of curtailing quantitative easing (QE) policies by a central bank, particularly the U.S. Federal Reserve. This typically includes sudden spikes in interest rates, market volatility, and abrupt outflows from emerging markets. It was first coined during the summer of 2013. It occurred after then-Chairman of the Federal Reserve, Ben Bernanke, stated that the Fed might begin tapering or gradually reducing its QE program. This involved large-scale purchases of government bonds to stimulate the economy in the aftermath of the 2008 financial crisis. The term "Taper Tantrum" refers to the reaction of financial markets to the announcement made by the then-Federal Reserve Chair Ben Bernanke in May 2013. Post-Financial Crisis Era (2008-2013): After the 2008 global financial crisis, the Federal Reserve (Fed) implemented unconventional policy measures to stabilize the economy. This included quantitative easing, a policy in which the central bank buys government securities or other securities from the market to increase the money supply and encourage lending and investment. Quantitative Easing: Between 2008 and 2013, the Federal Reserve carried out multiple rounds of QE, known as QE1, QE2, and QE3. These actions helped to keep interest rates low to stimulate economic growth but also led to a lot of new money being introduced into the financial system. May 2013 - The "Taper" Announcement: In May 2013, Bernanke suggested that the Fed might start to "taper" its asset purchases due to improvements in the economic outlook. This surprised many investors who had become accustomed to the Fed's policy of QE. Market Reaction - The "Tantrum": The suggestion that the Fed would reduce its level of support led to a sharp increase in U.S. Treasury yields as markets anticipated the end of easy money. This was the "tantrum." The markets coined the term "Taper Tantrum" to describe this volatile reaction. Global Impact: Emerging markets, many of which had benefited from the search for yield in the era of QE, were also severely affected. They experienced significant capital outflows and currency depreciation as investors returned money to the U.S. Learning Experience: The Taper Tantrum taught the Fed and other central banks valuable lessons about communication and the impact of changing monetary policy after a long easing period. This experience has influenced how such transitions are handled to minimize market disruptions. Investor expectations played a crucial role in the Taper Tantrum. The Fed's announcement about tapering its QE program surprised many investors who had grown accustomed to the low-interest-rate environment. The prospect of reduced liquidity and higher interest rates led to a sell-off in bond markets and a shift away from riskier assets. The Taper Tantrum underscored the importance of communication and forward guidance in monetary policy. The sudden announcement about tapering QE, without clear guidance about the timing and pace, created uncertainty in financial markets. This episode highlighted the need for central banks to communicate their policy intentions clearly and transparently to avoid sudden market reactions. Market liquidity, or the ease with which assets can be bought or sold without affecting their price, was another factor behind the Taper Tantrum. The prospect of the Fed reducing its bond purchases raised concerns about lower liquidity in the bond market, leading to higher yields and increased volatility. One of the most significant effects of the Taper Tantrum was the sharp increase in bond yields, especially U.S. Treasury yields. This rapid rise in yields reflected investors' expectations of higher interest rates and reduced liquidity in the bond market. The increase in yields also led to capital losses for bondholders, as bond prices fall when yields rise. Emerging markets were particularly affected by the Taper Tantrum. The prospect of tighter monetary policy in the U.S. led to capital outflows from emerging markets, putting downward pressure on their currencies and upward pressure on their interest rates. This posed challenges for these economies, increasing their borrowing costs and leading to higher inflation. The Taper Tantrum had significant implications for monetary policy. It underscored the importance of clear and transparent communication in managing investor expectations. It also highlighted the global spillover effects of monetary policy decisions by major central banks, underscoring the need for careful coordination and communication at the global level. One of the key lessons from the Taper Tantrum is the importance of clear and predictable communication in monetary policy. Central banks must provide clear guidance about their policy intentions to manage investor expectations and avoid sudden market reactions. In the wake of the Taper Tantrum, the Fed has sought to improve its communication and provide more explicit guidance about its policy path. Monetary policy plays a crucial role in managing a Taper Tantrum. Central banks can influence market conditions and investor expectations by setting interest rates and controlling the money supply. In the event of a Taper Tantrum, central banks may need to adjust their policy stance to stabilize markets and mitigate the adverse effects on the economy. Diversification is another strategy to manage a Taper Tantrum. By diversifying their portfolios across different asset classes and geographies, investors can mitigate the risks associated with changes in monetary policy. The Taper Tantrum provided important lessons for central banks. It demonstrated the critical role of clear, forward-looking communication in monetary policy. By providing markets with explicit guidance about their policy intentions, central banks can better manage investor expectations and reduce the likelihood of abrupt market reactions. Furthermore, it underscored the global spillover effects of policy decisions by major central banks, highlighting the need for international coordination and cooperation in monetary policy. Investors, too, learned valuable lessons from the Taper Tantrum. It served as a reminder of the risks associated with abrupt changes in monetary policy, particularly in a globalized financial system where policy decisions in one country can have far-reaching impacts. Investors were reminded of the importance of portfolio diversification as a means to mitigate risks and weather market volatility. Policymakers also gained insights from the Taper Tantrum. It illustrated the potential impact of monetary policy decisions on economic stability, particularly in emerging markets. The Taper Tantrum highlighted the need for policymakers to closely monitor economic and financial conditions and have contingency plans to respond to sudden market shocks. Taper Tantrum refers to the market disruption following the 2013 announcement by the Federal Reserve about curtailing its QE program. This event underlined the significance of effective communication and forward guidance in monetary policy, international policy coordination, and their global repercussions. It impacted worldwide financial markets and economies, especially emerging markets, leading to escalated bond yields, increased market volatility, and capital outflows. The event imparted valuable lessons about clear communication in monetary policy, portfolio diversification, and contingency planning. To manage wealth effectively, understanding global financial markets' intricacies is crucial. One can better handle market volatility and secure a financial future by staying abreast of economic trends and policy shifts and diversifying investments. Consulting a financial advisor for personalized wealth management advice could be beneficial.What Is Taper Tantrum?

Background of Taper Tantrum

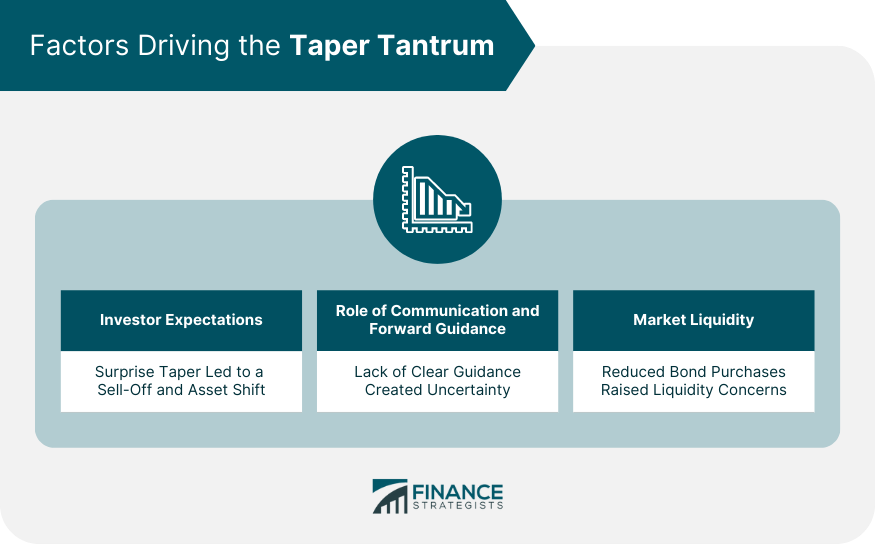

Factors Driving the Taper Tantrum

Investor Expectations

Communication and Forward Guidance

Market Liquidity

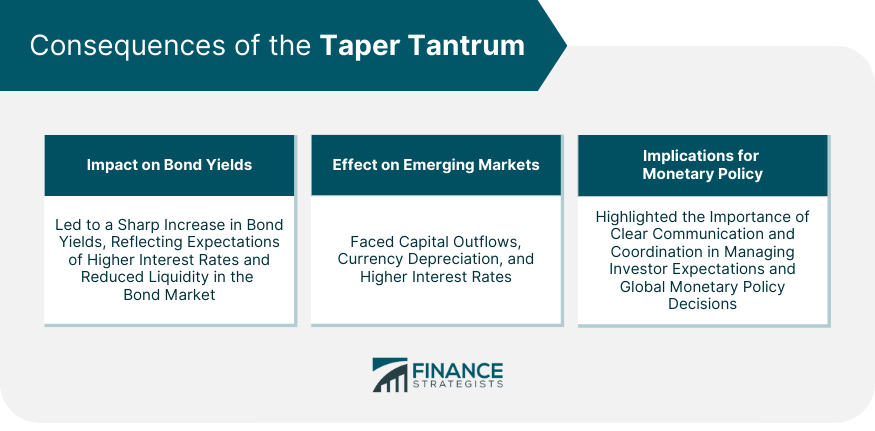

Consequences of the Taper Tantrum

Impact on Bond Yields

Effect on Emerging Markets

Implications for Monetary Policy

Managing a Taper Tantrum

Clear and Predictable Communication

Monetary Policy

Diversification as a Mitigation Strategy

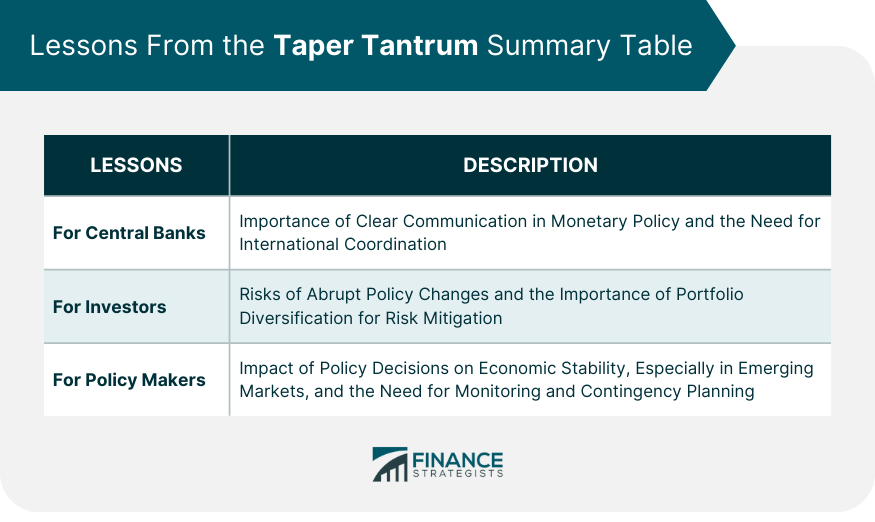

Lessons From the Taper Tantrum

For Central Banks

For Investors

For Policy Makers

Conclusion

Taper Tantrum FAQs

The Taper Tantrum was triggered by an announcement by the U.S. Federal Reserve in 2013 that it was considering tapering its QE program.

The Taper Tantrum led to a sharp rise in bond yields and increased market volatility. It also caused capital outflows from emerging markets, leading to currency depreciation and higher interest rates in these countries.

The Taper Tantrum underscored the importance of clear communication in monetary policy, the global spillover effects of policy decisions by major central banks, and the need for portfolio diversification to mitigate risks.

Investors can prepare for a potential Taper Tantrum by diversifying their portfolios across different asset classes and geographies. Staying informed about economic trends and policy developments can also help investors navigate market volatility.

Policymakers can also closely monitor economic and financial conditions and have contingency plans to respond to sudden market shocks. International coordination and cooperation in monetary policy can also help mitigate the global spillover effects of a Taper Tantrum.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.