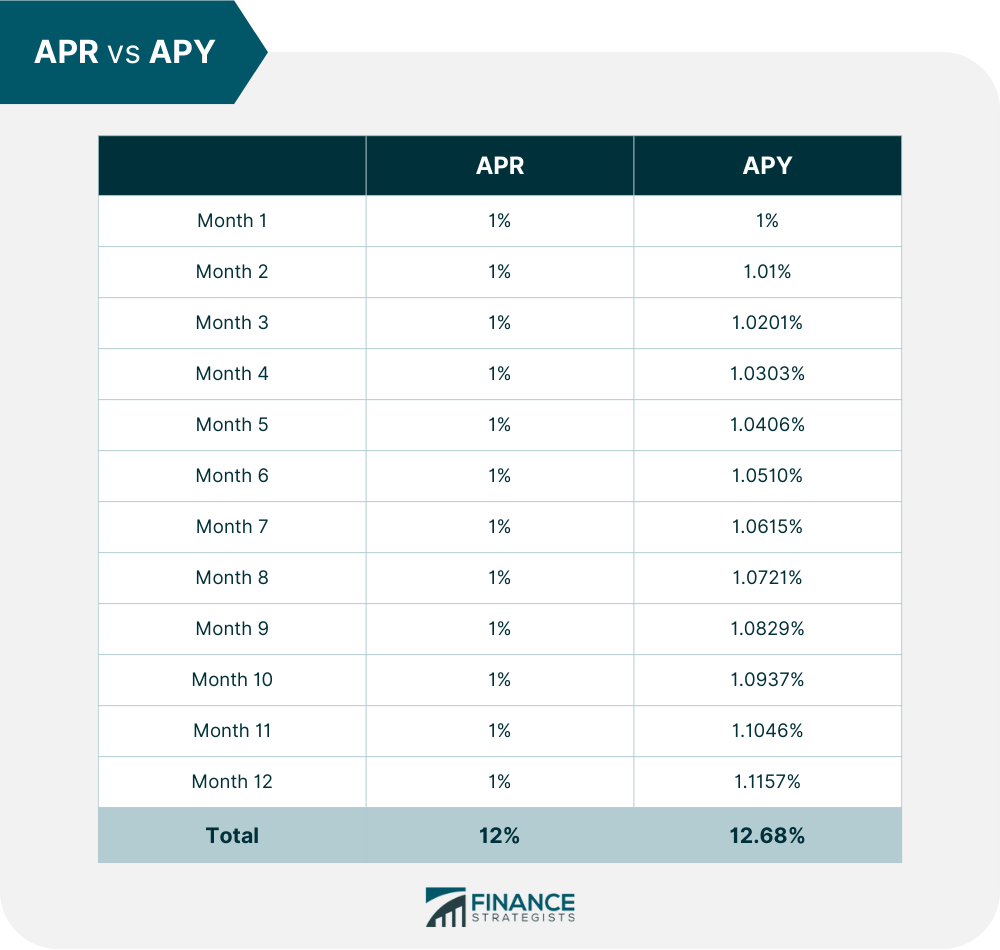

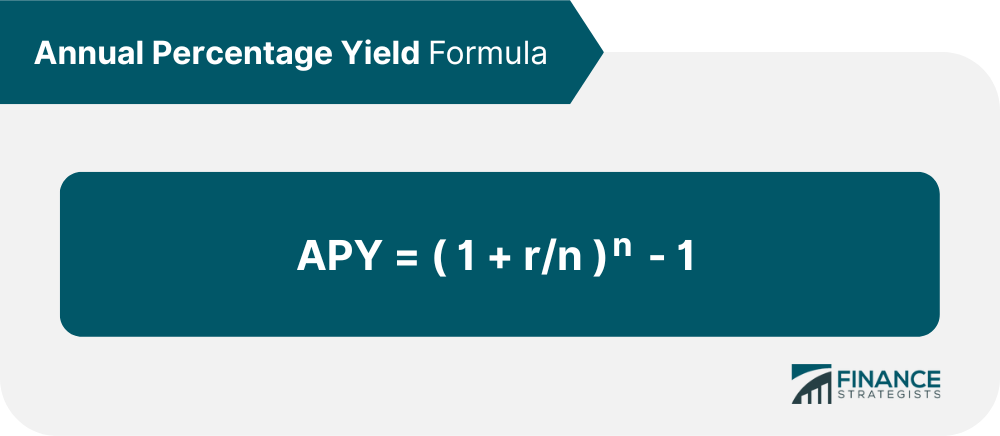

Annual percentage yield (APY) is the real annual rate of return earned on an investment, often a savings account, which accounts for interest rates compounding on a smaller time frame than annually. Compounding interest on smaller time frames increases the annual interest rate. For example, an investment compounded monthly with a 12% APR will have a 12.68% APY. The formula for computing the Annual Percentage Yield is: APY = 1 plus r divided by n to the power of n, minus 1, where "r" is the stated annual interest rate and "n" is the number of compounding periods each year. The smaller the time frame interest compounds, the higher the APY will be. Interest earned and interest borrowed are calculated the same way, but stated differently whether it is stated from the perspective of an investor or creditor. APY is the same as the Effective Annual Rate, or EAR, but APY is stated from the investor's perspective. The EAR computes the actual interest paid to a creditor after factoring all fees and interest compounding on smaller time frames. Here is how to remember nominal interest rate, APR, and APY:Annual Percentage Yield (APY) Definition

How Does APY Work?

Nominal Interest Rate, APR and APY

Annual Percentage Yield (APY) FAQs

APY stands for Annual Percentage Yield.

Annual percentage yield (APY) is the real annual rate of return earned on an investment, often a savings account, which accounts for interest rates compounding on a smaller time frame than annually.

Annual Percentage Rate (APY) factors in additional fees and whether the rate is compounded on a smaller time frame.

Interest earned and interest borrowed are calculated the same way, but stated differently whether it is stated from the perspective of an investor or creditor.

APY = 1 plus r divided by n to the power of n, minus 1, where “r” is the stated annual interest rate and “n” is the number of compounding periods each year. The smaller the time frame interest compounds, the higher the APY will be.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.