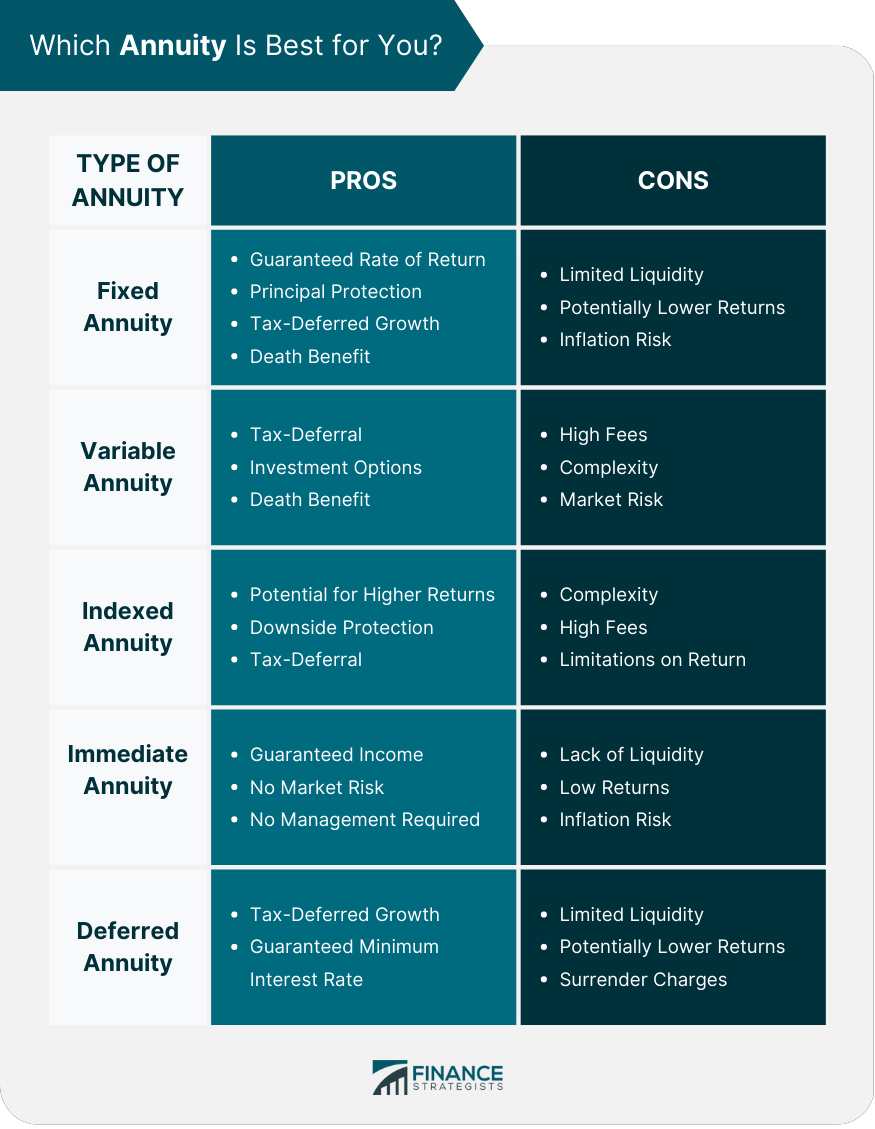

An annuity is a financial product designed to provide regular payments to an individual over a specified period. These are usually sold by insurance companies and can be purchased with a lump sum or a series of payments. An annuity is designed to offer a consistent source of income, usually throughout retirement. The funds accumulate on a tax-deferred basis, and just like 401(k) contributions, can only be withdrawn without incurring penalties once you reach the age of 59½. Have questions about Annuities? Click here. This is a type of annuity contract in which an individual makes a lump sum payment to an insurance company in exchange for a guaranteed fixed rate of return over a specified period. Here are some pros and cons of fixed annuities: Pros: Guaranteed Rate of Return: Fixed annuities offer a fixed interest rate for a specified period. The interest rate remains constant for the duration of the contract. Principal Protection: The investor’s initial investment is protected from market downturns and will not decrease in value. Tax-Deferred Growth: The investors are not required to pay taxes on the earnings until they withdraw the money. Death Benefit: Fixed annuities offer a death benefit that pays out to the beneficiary if the investor dies before the contract’s maturity date. Cons: Limited Liquidity: Fixed annuities are designed for long-term investments. There are surrender charges for withdrawals made before the end of the annuity term. Potentially Lower Returns Than Other Investments: While fixed annuities offer guaranteed returns, those returns are typically lower than what you might earn from other investments with more risk, such as stocks or mutual funds. Inflation Risk: Fixed annuities typically offer a fixed rate of return, which means that the earnings may not keep pace with inflation over time. Fixed annuities are an ideal choice for those who want to invest with the least amount of risk and secure a guaranteed source of income during retirement. In addition, fixed annuities come without any market volatility, making them an excellent option for conservative investors. Variable annuities are a reliable form of financial protection that rewards investors with regular payments for an initial investment. In contrast to fixed annuities, variable annuity holders can invest in various assets such as stocks, bonds, and mutual funds. The value of a variable annuity can fluctuate depending on the performance of the underlying investments. Some benefits of variable annuities include: Tax-Deferral: The growth in the account is tax deferred until withdrawals are made later. Thus, the money that would have been paid annually in taxes remains in the account and has the opportunity to grow until withdrawal. Investment Options: Variable annuities offer a range of investment options, allowing investors to choose the investments that best fit their goals and risk tolerance. Death Benefit: Most variable annuities come with a death benefit that guarantees that a beneficiary will receive a certain amount of money if the investor dies before the annuity payments begin. However, variable annuities have several drawbacks, including: Fees: Variable annuities often incur high fees, including management and surrender charges. These fees can eat into the investor's returns over time. Complexity: Variable annuities can be complex financial products, and it can be difficult for investors to understand all the associated features and fees. Market Risk: Variable annuities are subject to market risk, which means that the value of the annuity can fluctuate depending on the performance of the underlying investments. Variable annuities are a good choice for investors seeking a tax-deferred investment vehicle and who are comfortable with the potential market risk. However, it is crucial for investors to carefully consider all associated fees and features of variable annuities before investing. Indexed annuities, also known as fixed indexed annuities, allow investors to earn returns based on the performance of a market index, such as the S&P 500. Indexed annuities combine features of both fixed and variable annuities, offering investors the potential for higher returns than fixed annuities while still providing some protection against market downturns. Some benefits of indexed annuities include: Potential for Higher Returns: Indexed annuities offer higher returns than fixed annuities, as the interest credited to the annuity is linked to the performance of a market index. Downside Protection: Most indexed annuities provide some protection against market downturns, guaranteeing that the annuity value will not decrease below a certain level, even if the market index declines. Tax-Deferral: Like other types of annuities, indexed annuities offer tax-deferred growth, which can benefit investors looking to save money for retirement. Indexed annuities also have several drawbacks: Complexity: Indexed annuities can be complex financial products, and it can be difficult for investors to understand all the associated features and fees. Fees: Indexed annuities often incur high fees, including management and surrender charges. Limitations on Returns: Most indexed annuities limit the amount of interest credited to the annuity, limiting the investor's potential for returns. Indexed annuities are a good choice for investors seeking to protect their principal investment while earning a fixed or variable interest rate. Immediate annuities are insurance products typically purchased with a lump sum payment and begin making payments immediately, hence the name "immediate" annuities. Pros of immediate annuities: Guaranteed Income: Immediate annuities provide a guaranteed income stream, making them an attractive option for those who want to ensure a steady income in retirement. No Market Risk: Since immediate annuities are not tied to the stock market, they offer a stable source of income that is not subject to market volatility. No Management Required: Immediate annuities do not require any ongoing management or monitoring, making them a low-maintenance investment option. Cons of immediate annuities: Lack of Liquidity: Purchasing an immediate annuity results in locking in principal with no available option to access it. Low Returns: Immediate annuities typically offer lower returns than other investment options, such as stocks or mutual funds. Inflation Risk: Since the income payments from an immediate annuity are fixed, there is a risk that inflation will erode the purchasing power of the income over time. Immediate annuities can be a good choice for people who want a guaranteed income stream during retirement and are willing to trade liquidity for a steady income. Deferred annuities are insurance products that provide individuals with a means to save for retirement and receive a fixed income stream at a later stage. However, unlike immediate annuities, they entail a waiting period before income payments start. Pros: Tax-Deferred Growth: Deferred annuities allow for tax-deferred growth, allowing the investment to grow without being subject to annual taxes. Guaranteed Minimum Interest Rate: Deferred annuities offer a guaranteed minimum interest rate, providing safety to the investment. Death Benefit: A death benefit may be included in the annuity, providing a payout to beneficiaries if the annuitant dies before receiving the full value of the annuity. Cons: Limited Liquidity: Deferred annuities are not easily liquidated, meaning that once an individual invests in the annuity, they may not be able to access the funds until the payout period begins. High Fees: Deferred annuities often come with high fees, including administrative fees, mortality expense fees, and surrender charges, which can reduce investment returns. Complex Contracts: Deferred annuities can be complex and difficult to understand, making it challenging for individuals to understand the investment's terms and conditions fully. The best annuity choice varies based on individual circumstances and retirement goals. It is important to weigh the pros and cons of each type of annuity and consult with a financial advisor. Key factors to consider when selecting an annuity include risk tolerance, investment horizon, and liquidity preferences to make an informed decision that aligns with retirement goals and financial needs. Annuities are complex financial products with several fees and charges, so investors must carefully review all associated costs before making any investment decisions. Some of the most common fees are as follows: Commissions are paid to insurance agents or brokers who sell annuities to investors. These can be paid upfront, known as front-end loads, or over time, known as trail commissions. An annuity's front-end load is a one-time fee, calculated as a percentage of the initial investment, ranging from 1% to 10% or more. Trail commissions, on the other hand, are ongoing fees calculated as a percentage of the annuity's value, ranging from 0.25% to 2% or more per year. Commissions can create a conflict of interest for agents or brokers and may lead to high fees or unsuitable investment options. Insurance companies charge administrative fees for managing annuities, which cover expenses like record-keeping and account maintenance. These fees may be assessed monthly or annually and can differ depending on the type of annuity and the insurer. These are fees charged when an investor withdraws money from an annuity before the end of the surrender period, typically 3 to 10 years. Surrender charges can be up to 10% of the withdrawal amount and decrease over time. Surrender charges can be a barrier for investors who need to access their money early, and investors should understand the charges and consider annuities with shorter surrender periods or no charges. Mortality and expense fees are charged by insurance companies to cover the costs of administering an annuity, such as underwriting and mortality costs. They are typically a percentage of the account value, ranging from 0.5% to 1.5% per year. Investors should consider these fees and compare them across different providers to find the best option for their investment goals. Additionally, the value of features and benefits that the annuity offers should be considered when evaluating the impact of the fees on investment returns. The investment expense ratio is a fee charged for managing the investment portfolio of an annuity, expressed as a percentage of the account balance, typically ranging from 0.5% to 2% per year. It covers the costs of managing the portfolio, but other fees may apply. Investors should compare fees across different annuity providers and consider investment performance and potential returns when evaluating the impact of fees on overall investment returns. These are optional features that can be added to an annuity to customize its benefits and features. Riders can provide additional protection or income streams, but they also come with additional fees and charges. The death benefit rider pays out the remaining annuity value to a beneficiary after the annuitant's death, while the guaranteed minimum withdrawal benefit allows the annuitant to withdraw a specific amount of funds from the annuity annually without penalty. The cost of rider fees varies depending on the annuity and which riders are selected, with fees typically ranging from 0.25% to 1.15% of the annuity's value per year. Rate spreads refer to the difference between the rate that an insurance company earns on annuity investments and the rate paid to the annuity holder, representing the company's profit margin. The rate spread can significantly impact the overall return on the investment, and investors should carefully review it before investing. Comparing rate spreads across multiple providers can help investors find the best option for their needs. Choosing an annuity can be a complex decision, and there are several factors that should be carefully considered to ensure that the right choice is made. The number of years until retirement is crucial when choosing an annuity as it can affect the type of annuity that is most appropriate for the investor. Younger investors may prefer a deferred annuity to grow their investment over a longer period, while older investors may opt for an immediate annuity to receive a guaranteed income in retirement. An investor's risk tolerance is another crucial factor to consider when choosing an annuity. Fixed annuities could be preferred for those who are more risk-averse, as they offer a guaranteed rate of return and protection from market risk. Conversely, investors who are comfortable with market risk may prefer variable annuities, which provide the flexibility to invest in a range of underlying funds. Retirement goals should be considered while selecting an annuity, as they can impact the type of annuity that is most appropriate. For instance, an investor who wants a guaranteed income stream in retirement may prefer an immediate annuity, while an investor focused on growth may prefer a variable annuity. It is crucial to align the investment with the investor's retirement goals to ensure that they can meet their objectives. An annuity is a financial product that provides regular payments to an individual over a specified period, often sold by insurance companies. Fixed annuities offer a fixed interest rate for a specified period, with principal protection, tax-deferred growth, and a death benefit. They are a good choice for those who want to invest with the least risk and secure a guaranteed source of income during retirement. Variable annuities, on the other hand, allow holders to invest in various assets such as stocks, bonds, and mutual funds, and the value of the annuity can fluctuate depending on the performance of the underlying investments. They offer tax-deferral, investment options, and a death benefit, but often incur high fees, are complex, and are subject to market risk. Indexed annuities offer the potential for higher returns than fixed annuities, as the interest credited to the annuity is linked to the performance of a market index while still providing some protection against market downturns. However, they can also be complex, have high fees, and limit the investor's potential for returns. They are a good choice for investors seeking higher returns than fixed annuities while still providing some protection against market downturns. Immediate annuities are a great option for those who want a steady income during retirement, while deferred annuities are good for those looking to grow their investments without being subject to annual taxes. When choosing the best annuity for you, be sure to take into consideration your retirement goals, your tolerance for risk, and the number of years until your retirement. These factors can help you make a more informed decision for your future.What Are Annuities?

Fixed Annuities

Variable Annuities

Indexed Annuities

Immediate Annuities

Deferred Annuities

Summary of Types of Annuities: Pros & Cons

Annuity Fees and Charges

Commissions

Administrative Fees

Surrender Charges

Mortality Expenses

Investment Expense Ratio

Riders

Rate Spreads

Factors to Consider When Choosing an Annuity

Number of Years Until Retirement

Risk Tolerance

Retirement Goals

Final Thoughts

Types of Annuities FAQs

The different types of annuities are: fixed annuities, variable annuities, indexed annuities, immediate annuities, and deferred annuities.

Annuities are financial products designed to provide regular payments to an individual over a specified period.

Some alternatives to annuities are dividend-paying stocks, real estate investments, mutual funds, and savings accounts.

The best annuity choice varies based on individual circumstances and retirement goals. When selecting an annuity, the key factors to consider include risk tolerance, investment horizon, and liquidity preferences to make an informed decision that aligns with retirement goals and financial needs.

The cost of purchasing an annuity varies based on several factors, such as the type of annuity, the initial investment, the age and health of the annuitant, the payout option selected, and the fees associated with the annuity. Annuities can have administrative fees, mortality and expense fees, and surrender charges, which vary depending on the insurance company and the specific annuity product.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.