Roll-down return is a concept in the world of finance, particularly in the realm of bonds and fixed-income instruments. It measures the potential return on a bond if the yield curve remains unchanged, minus any impact from accrued interest or coupon payments. A roll-down return is often used when investors anticipate shifts in interest rates or changes in the yield curve, indicating potential earnings on a bond or portfolio of bonds. Roll-down return holds immense significance in the financial landscape, particularly for bond portfolio managers and bond traders. It allows these individuals to anticipate potential returns on their bond investments, especially in the face of interest rate fluctuations or shifts in the yield curve. This measure can influence their strategies regarding whether to hold, buy, or sell bonds and can provide valuable insights into the risks associated with their bond portfolios. The calculation of roll-down return involves several steps. Here's a more detailed step-by-step explanation of how roll-down return is calculated: The first step in calculating the roll-down return is to identify the bond's current yield. The yield is the rate of return earned on a bond if it is held until maturity and all payments are made as scheduled. The yield is usually expressed as an annual percentage of the bond's face value or market price. After determining the current yield, the next step is to ascertain the expected yield of the bond at a future date. This requires an assumption that the yield curve remains unchanged. Once you have both the current and expected yields, subtract the current yield from the expected future yield. This difference gives you the roll-down return. As a bond moves closer to its maturity date, it's said to "roll down" the yield curve. If the shape of the yield curve remains the same, the bond yield will decrease. This happens because, as time passes, a long-term bond becomes a short-term bond. If the yield for short-term bonds is lower than for long-term bonds (which is usually the case under a normal yield curve), the bond yield will decrease as it rolls down the yield curve. The roll-down return measures the potential increase in the bond's price. The bond's price increases when the yield decreases (as the bond rolls down the yield curve). This potential price increase is the roll-down return. It's important to note that while the roll-down return provides a useful estimate of potential returns, it does not guarantee these returns. Changes in the yield curve, interest rates, and other market conditions can influence the actual return on the bond. Interest rates are a key factor in determining roll-down returns. When interest rates decline, bond prices generally increase, and vice versa. Hence, an anticipated decrease in interest rates can imply a higher roll-down return, assuming the yield curve remains unchanged. The shape of the yield curve significantly impacts roll-down return. Under a normal yield curve scenario, where longer-term bonds have higher yields than shorter-term bonds, bonds will typically have positive roll-down returns. However, the situation can vary under different yield curve scenarios. The time left until a bond's maturity also influences roll-down return. A bond that is further away from its maturity date has a longer duration to roll down the yield curve, potentially providing a higher roll-down return. Coupon payments, or the bondholder's regular interest payments, can also influence roll-down returns. Higher coupon payments can contribute to a higher roll-down return as they increase the bond's total return. Roll-down returns are typically positive in a normal yield curve scenario, where short-term bond yields are lower than long-term bond yields. This is because, as a bond moves closer to maturity, it rolls down the yield curve, and its yield decreases, implying an increase in the bond's price. Roll-down returns can be negative under an inverted yield curve, where short-term bond yields are higher than long-term bond yields. This is due to the bond's yield increasing as it gets closer to maturity, decreasing its price. In a flat yield curve scenario, where short and long-term bond yields are virtually the same, roll-down return is typically minimal, as the bond yield remains more or less constant as it approaches maturity. Bond pricing and roll-down return have an inverse relationship. As a bond rolls down the yield curve and its yield decreases, its price typically increases, implying a positive roll-down return. If the bond's yield increases as it moves closer to maturity, this can result in a lower bond price and potentially a negative roll-down return. Coupon payments can enhance the roll-down return of a bond. The higher the coupon payments, the higher the total return of the bond, contributing to a higher roll-down return. However, it is essential to consider that higher coupon payments may also indicate higher risk. Changing interest rates can significantly influence roll-down returns. If interest rates decline, bond prices typically increase, resulting in a higher roll-down return. Conversely, bond prices usually decrease if interest rates rise, leading to a lower roll-down return. Roll-down return can be a powerful tool in bond portfolio management. Providing an estimate of potential bond returns allows portfolio managers to strategize their bond holdings more effectively and manage their exposure to interest rate risk. Traders also utilize roll-down returns in their bond trading strategies. For instance, a trader anticipating a decrease in interest rates may choose to invest in bonds with high roll-down returns to maximize potential earnings. A trader expecting interest rates to rise may opt for bonds with low or negative roll-down returns to minimize potential losses. From a risk management perspective, roll-down returns can be used to assess the interest rate risk associated with a bond or a portfolio of bonds. Bonds with high roll-down returns may entail higher interest rate risk, while bonds with low or negative roll-down returns may carry lower interest rate risk. One of the key limitations of roll-down return analysis is that it assumes the yield curve will remain unchanged. However, the yield curve can and does change due to various economic factors. This discrepancy can lead to inaccurate estimates of roll-down returns. Reliance on roll-down return can pose several risks. For instance, if interest rates rise unexpectedly, a bond with a high anticipated roll-down return can result in significant losses. Bonds with high roll-down returns often carry higher interest rate risk, leading to increased volatility in bond prices. Roll-down return offers insights into potential bond returns and provides valuable information for strategizing bond holdings and managing interest rate risk. It also carries certain limitations and risks, which must be considered. While roll-down return can provide useful estimates of potential bond earnings and assist in risk management, its effectiveness is contingent upon the accuracy of its underlying assumptions. Given its assumption of an unchanged yield curve, the actual roll-down return can vary if it changes. High roll-down returns can also signal higher interest rate risk, increasing price volatility. Given the complexities and potential pitfalls of roll-down return analysis, it's wise to engage a professional wealth management firm or financial advisor who understands these nuances. They can help you navigate these complexities and formulate strategies that align with your financial goals and risk tolerance.What Is a Roll-Down Return?

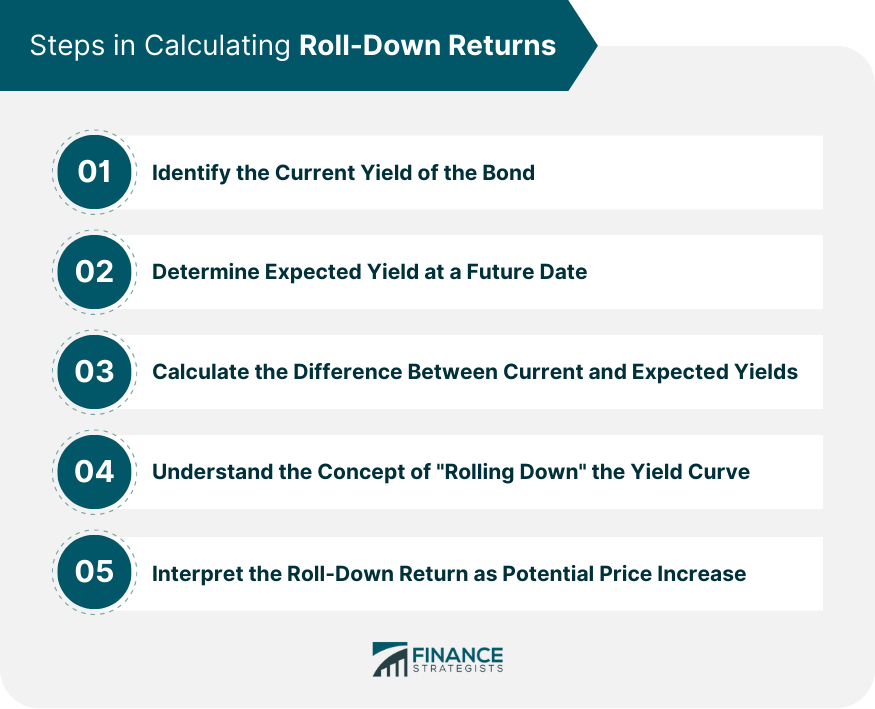

How Roll-Down Return Is Calculated

Identify the Current Yield of the Bond

Determine the Expected Yield at a Future Date

Calculate the Difference Between the Current and Expected Yields

Understand the Concept of "Rolling Down" the Yield Curve

Interpret the Roll-Down Return

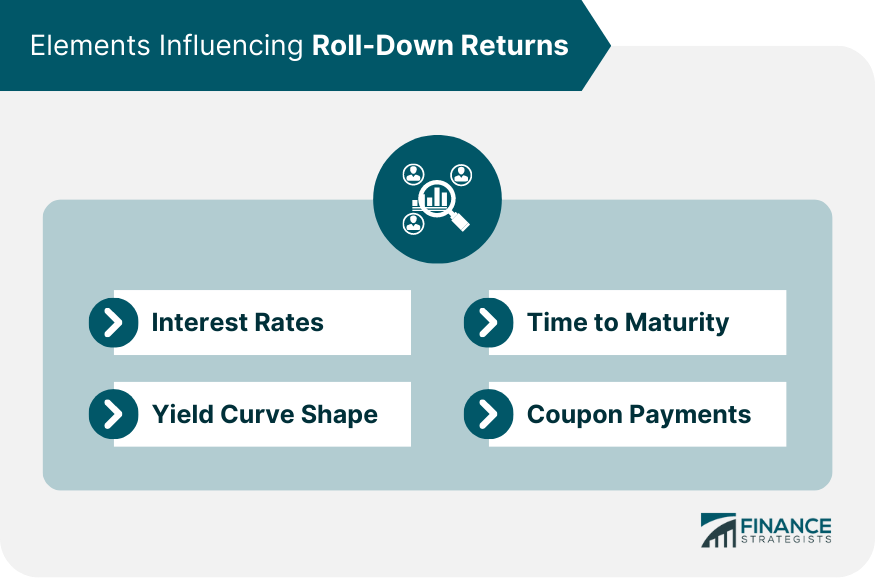

Elements Influencing Roll-Down Return

Interest Rates

Yield Curve Shape

Time to Maturity

Coupon Payments

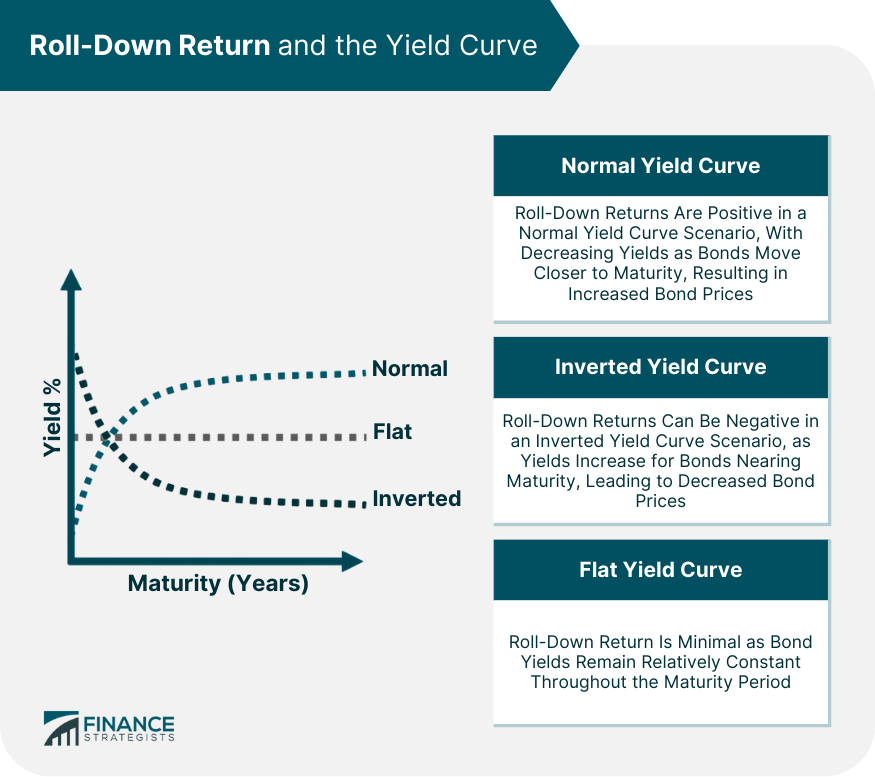

Roll-Down Return and the Yield Curve

Normal Yield Curve Scenario

Inverted Yield Curve Scenario

Flat Yield Curve Scenario

Roll-Down Return in Bond Pricing

Relationship Between Bond Pricing and Roll-Down

Impact of Coupon Payments on Roll-Down

Effect of Changing Interest Rates on Roll-Down

Practical Application of Roll-Down Return

Bond Portfolio Management

Bond Trading Strategies

Considerations for Risk Management

Limitations and Risks of Roll-Down Return Analysis

Assumptions and Potential Errors

Risk Factors in Reliance on Roll-Down

Conclusion

Roll-Down Return FAQs

Roll-down return is a measure of potential return on a bond if the yield curve remains unchanged, excluding the impacts from accrued interest or coupon payments.

Roll-down return is calculated by comparing the current yield of a bond with its expected yield at a future date, assuming the yield curve remains unchanged. The difference between these two figures represents the roll-down return.

Roll-down return indicates potential earnings on a bond or portfolio of bonds. It allows investors to anticipate returns, especially in the face of interest rate changes or shifts in the yield curve, and aids in strategizing whether to hold, buy, or sell bonds.

Several factors can influence roll-down return, including interest rates, the shape of the yield curve, time to maturity, and coupon payments.

One key limitation of roll-down return analysis is its assumption that the yield curve will remain unchanged. The yield curve can shift due to various economic factors, leading to potential inaccuracies in the estimated roll-down return. Additionally, bonds with high roll-down returns often carry higher interest rate risk, potentially leading to increased price volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.