The term 'Bid Wanted in Competition' refers to a situation where a seller, often a portfolio manager or other institutional investor, seeks to sell a particular security and invites interested buyers to submit competitive bids. The highest bid is usually accepted, ensuring a fair market value for the seller. The primary purpose of this process is to ensure the seller receives the best possible price for their securities. It is often used when dealing with illiquid assets or in a thin market, where finding a single buyer might take a lot of work. In addition, this method provides transparency and can increase the level of trust in financial transactions. The process of a bid wanted in competition follows a sequence of carefully managed steps. Each step plays a vital role in ensuring a successful and fair transaction. 1. Announcement: The process begins with the seller, often a portfolio manager or other institutional investor, announcing their intention to sell a particular security. 2. Invitation to Bid: Interested buyers are then invited to submit their bids for the specified security within a given timeframe. These bids, representing the price each buyer is willing to pay for the security, are submitted independently without knowledge of other bids. 3. Collection and Evaluation of Bids: All bids are collected and evaluated once the bidding window closes. 4. Selection of Winning Bid: The bid with the highest offered price is usually selected as the winning bid. However, the seller may also consider other factors, such as the buyer's reliability or the speed at which the transaction can be completed. 5. Completion of Transaction: The transaction is then completed based on the terms specified in the winning bid. This typically involves transferring ownership of the security from the seller to the buyer and the buyer transferring the agreed payment to the seller. In a bid wanted in competition, several parties play key roles: The Seller: The seller’s main responsibility is to provide detailed information about the security being sold. The Buyers: The buyers' role is to evaluate the provided information about the security, determine its potential value, and submit a competitive bid. The Intermediary/Broker: In some instances, a third party, such as an intermediary or a broker, might be involved to facilitate the process. One of the significant advantages of the bid wanted in the competition process for the seller is the possibility of securing a higher selling price than in a typical market transaction. Because multiple interested parties bid on the security, competition often increases the final selling price. This is especially advantageous when the seller wants to offload many securities quickly. Bid wanted in competition can also expedite the selling process. Finding a willing and suitable buyer might take significant time in a standard market situation, especially with illiquid securities. However, the bid wanted in competition invites multiple buyers simultaneously, potentially speeding up the sale. The competitive nature of the bid wanted in the competition process also helps ensure that the seller receives a fair price for their security. With multiple independent bids, the final selling price tends to reflect the true market value of the security, preventing the seller from selling at a price lower than the market is willing to pay. For buyers, bid wanted in competition offers a unique opportunity to acquire securities that might not be readily available in the open market. This is particularly beneficial when dealing with rare or illiquid securities or when a buyer wants to acquire a large volume of securities simultaneously. Moreover, the bid wanted in the competition process fosters a competitive and fair market environment. Since multiple buyers are involved, each buyer is motivated to present their best bid, fostering healthy competition. Additionally, the transparent process ensures fairness, as each buyer has an equal opportunity to secure the security, provided they present the highest bid. This promotes a more balanced and equitable market. While the bid wanted in the competition process can potentially yield higher selling prices due to the competitive nature of bidding, sellers may also receive lower bids than expected. This could occur if the security being sold is less desirable or if market conditions have changed negatively since the bid was announced, thereby affecting buyers' perception of the security's worth. Another risk for sellers is receiving bids that they need improvement. Even though multiple buyers are invited to bid, the offers may not meet the seller's expectations due to various factors, such as market sentiment, information asymmetry, or simply because the buyers' valuation of the security differs from that of the seller. In such cases, the seller may have to repeat the process or explore alternative methods of selling their securities The competitive nature of bid wanted in competition can lead buyers to pay more for a security than they would in a less competitive setting. In their effort to outbid others and secure the security, buyers may end up submitting a bid that's higher than the intrinsic value of the security, thereby risking an overpayment. Another risk that buyers face is making an uninformed bid, particularly if they need to receive or correctly interpret the full information about the security on sale. If the seller provides comprehensive information, or if the buyer needs to understand the provided details fully, the buyer could submit a bid that accurately reflects the security's true worth. This risk underscores the importance of due diligence in the bid wanted in the competition process. One of the primary roles of the bid wanted in the competition process in stock markets is improving liquidity, especially for less popular or illiquid stocks. Inviting multiple buyers to bid on a particular stock can stimulate trading activity and make it easier for sellers to offload their stocks. Moreover, the bid wanted in the competition process can provide a more accurate reflection of a stock's true value. Since multiple independent buyers determine the final selling price, it's more likely to reflect the stock's true market value rather than being influenced by a single buyer's valuation. This feature is particularly important in the context of stock markets, where the perceived value of stocks can often fluctuate significantly. In bond markets, the bid wanted in the competition can be critical in facilitating the transaction of large blocks of bonds. Such large blocks might be difficult to sell in the open market due to their size or the limited number of interested buyers. By inviting multiple buyers to bid, the process can facilitate a quicker and more efficient sale. Furthermore, a bid wanted in competition can provide a reliable price discovery mechanism in bond markets, particularly for infrequently traded bonds. In these cases, the market price of a bond might not accurately reflect its true value due to a lack of trading activity. By soliciting bids from multiple buyers, sellers can better understand the bond's value, thereby ensuring a fairer transaction. In an auction, multiple buyers are also involved, and this, much like the bid wanted in the competition process, creates a competitive environment. However, a key difference lies in the ability of bidders to adjust their bids based on other bids. In an auction, bids are made publicly and sequentially, allowing bidders to increase their bids if outbid by another party. In contrast, in the bid wanted in the competition process, all bids are submitted simultaneously, without the knowledge of other bids. Consequently, bidders need to have the opportunity to adjust their bids based on what others are willing to pay. This aspect of the process can result in a higher or lower selling price than an auction, depending on the strategies and perceptions of the bidders involved. With the direct negotiation method, the seller typically negotiates with a single buyer at a time. This can be time-consuming, particularly if the first negotiation does not result in a sale, and the seller has to negotiate with a second buyer, and so on. Also, because there is no competition from other buyers, the final selling price may not reflect the highest price that buyers in the market are willing to pay. On the other hand, the bid wanted in competition method involves multiple buyers, creating competition that can secure a higher selling price. Since all invited buyers submit their bids simultaneously, the seller can quickly and efficiently compare bids and choose the most attractive offer. As a result, the bid wanted in the competition process can be more efficient and yield a better outcome for the seller than the direct negotiation method. Bid Wanted in Competition is a process where a seller invites potential buyers to submit competitive bids for a specific security, aiming to select the highest bid and ensure fair market value. This method is particularly useful for illiquid assets or thin markets. The seller's role involves providing detailed information about the security, while buyers independently assess its value and submit bids. An intermediary or broker may facilitate the process and ensure transparency. Benefits for sellers include the potential for a higher selling price, an expedited selling process, and assurance of a fair price. Buyers benefit from the opportunity to acquire unique securities and participate in a competitive and fair market. However, there are risks, such as receiving lower bids than expected or overpaying for a security. Bid Wanted in Competition plays a significant role in improving market liquidity and accurate price discovery in both stock and bond markets. Compared to other selling methods, it offers distinct advantages in terms of efficiency and outcome.What Is Bid Wanted in Competition?

Process of Bid Wanted in Competition

Step-By-Step Process

This announcement is typically made to a select group of potential buyers or through a broker acting as an intermediary.

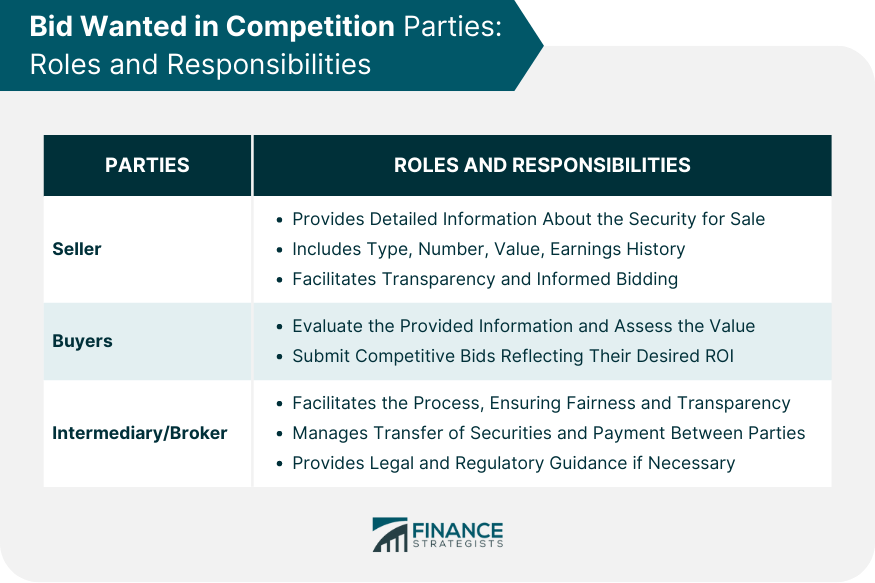

Role of Parties Involved

This may include the type and number of securities, the current value, earnings history, and any other relevant information that can affect the value or desirability of the security.

By providing clear and accurate information, the seller helps potential buyers to make informed bids.

They must independently assess the security's value and decide how much they will pay. Each buyer’s bid should reflect their assessment of the security’s value and their desired return on investment.

The broker’s role is to gather the bids, ensure that the process is conducted fairly and transparently, and manage the transfer of securities and payment between the buyer and the seller.

The broker may also advise the seller or the buyer to ensure they meet legal and regulatory requirements.

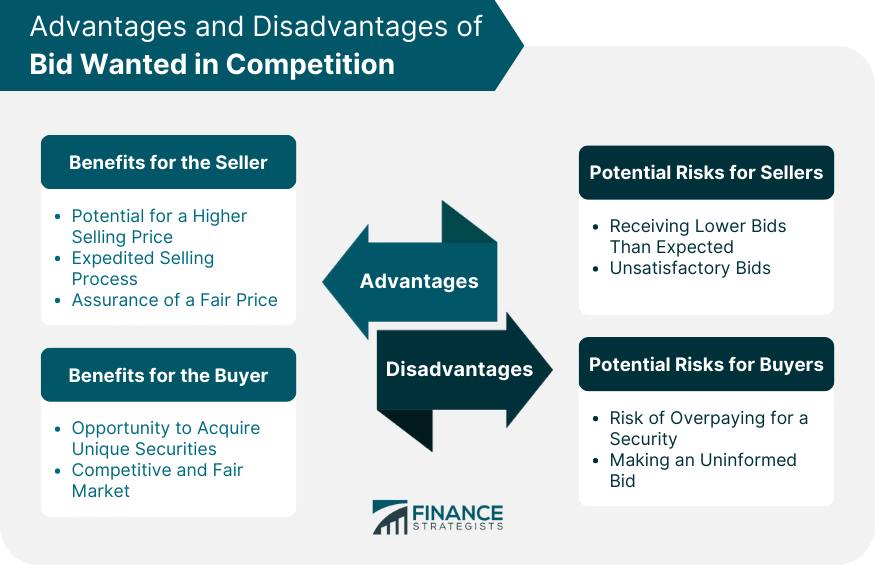

Benefits of Bid Wanted in Competition

Benefits for the Seller

Potential for a Higher Selling Price

Expedited Selling Process

Assurance of a Fair Price

Benefits for the Buyer

Opportunity to Acquire Unique Securities

Competitive and Fair Market

Risks Associated With Bid Wanted in Competition

Potential Risks for Sellers

Receiving Lower Bids Than Expected

Unsatisfactory Bids

Potential Risks for Buyers

Risk of Overpaying for a Security

Making an Uninformed Bid

Bid Wanted in Competition and Financial Markets

Role in Stock Markets

Improve Market Liquidity

Accurate Reflection of Stock Value

Impact on Bond Markets

Facilitation of Large Bond Blocks Transaction

Reliable Price Discovery Mechanism

Comparison of Bid Wanted in Competition and Other Selling Methods

Auction Method

Ability to Adjust Bids

Bids Submitted at Once

Direct Negotiation Method

Single Buyer Negotiation

Increased Competition and Potential for Higher Selling Prices

Conclusion

Bid Wanted in Competition FAQs

Bid Wanted in Competition is a scenario where a seller invites potential buyers to submit bids for security. The highest bid is typically accepted.

This method can fetch a higher selling price for securities, expedite the selling process, and ensure the seller gets a fair price, especially in illiquid markets.

For sellers, there's a risk of receiving lower bids than expected. For buyers, there's a risk of overpaying for securities or making uninformed decisions if adequate information isn't provided.

This method can improve liquidity, provide a reliable price discovery mechanism, and promote fair trading practices in stock and bond markets.

Unlike auctions where bidders can adjust their bids based on others', all bids are submitted at once in bid wanted in competition. It differs from direct negotiation by involving multiple buyers, increasing competition, and potentially securing higher prices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.