Make-Whole Call Provision is a clause in a bond contract that allows issuers to repay debt early. Its purpose is to protect bondholders from the risk of reinvestment at lower interest rates. When utilized, the issuer repays the bond's principal plus a premium, calculated to cover the present value of future interest payments lost. This provision is often found in corporate bonds and significantly impacts investors as it reduces their risk but potentially limits their upside if interest rates fall. Understanding it is essential for bond investors as it influences their potential return and the security of their investment. The provision reflects the complex interplay of interest rates, time, and risk, which are fundamental in financial markets. To compute the Make-Whole call premium, the issuer uses a discount rate equivalent to a similar maturity Treasury yield plus a spread, then multiplies this rate by the remaining coupon payments and principal. When investing in bonds with an MWC, investors should comprehend the mechanism behind the calculation and the potential impact on their returns. Understanding the risk and return trade-off is crucial in this scenario. In corporate bonds, the make-whole-call provision works as a protective feature for investors. Issuers have to pay a premium, discouraging them from calling bonds unless it's highly beneficial. This ultimately results in stability for the investors. A traditional call provision permits the issuer to repurchase bonds at a predetermined price after a specified period. In contrast, a make-whole call provision permits the issuer to call the bond at any time, compensating the bondholder for the present value of future interest payments. Callable bonds offer the issuer the right to repay the bond before its maturity. Non-callable bonds do not provide this option. Make-Whole call provisions are callable bonds that offer additional protection to the investor. Yield-to-Call calculates the yield assuming that a bond is called at the earliest possible date. Yield-to-Worst calculates the lowest yield, whether it's yield-to-maturity or yield-to-call. With an MWC, an investor is likely to receive more than the yield-to-call and potentially closer to the yield-to-maturity. For issuers, the significant advantage of MWC is the increased flexibility. It provides them with an option to call the bond at any point without waiting for the call date. On the downside, an MWC often necessitates a premium payment, which might be significantly more than the amount saved from retiring the debt early. Investors gain an increased level of protection, ensuring they are compensated if the issuer calls the bond early. Investors face reinvestment risk. The received premium must be reinvested, often in a lower interest rate environment. Making whole call provisions can increase the attractiveness and, therefore, the value of a bond because they offer protection to investors. From the yield perspective, the yield-to-worst method provides a lower bound for the yield, which includes scenarios where the bond is called under a Make-Whole call provision. MWC provisions can potentially reduce market volatility by discouraging the premature calling of bonds, thus maintaining market stability. In the U.S., Make-Whole call provisions are governed by contract law. Disputes about these provisions can be taken to court, as evidenced by cases such as the Energy Future Holdings case in 2016. In Europe, laws vary from country to country. However, the principle of contractual freedom typically applies, meaning parties are generally free to negotiate the terms of the bond contract, including making whole-call provisions. In Asian markets, laws also vary. However, as in the West, bonds are typically governed by the terms of the bond contract and any applicable securities regulations. As interest rates remain low globally, it is anticipated that the use of Make-Whole call provisions will continue to increase. They offer an attractive compromise between issuer flexibility and investor protection. The continued evolution of the bond markets, including the emergence of green and sustainable bonds, may lead to further innovation and changes in the use of Make-Whole call provisions. Advancements in financial technology and artificial intelligence could influence how Make-Whole call provisions are calculated and managed in the future. For instance, AI could be used to optimize the timing and pricing of bond calls. A Make-Whole Call Provision is a crucial part of bond contracts that allows issuers to retire their bonds early by compensating investors for the net present value of future interest payments they would otherwise lose. This mechanism operates using a benchmark U.S. Treasury rate plus a spread to calculate the premium. There are advantages and disadvantages to these provisions. For issuers, it offers financial flexibility, but it could also necessitate a significant premium payment. Investors benefit from the protection offered, as they are assured compensation if the bond is called early. However, they may face reinvestment risk, often resulting in having to reinvest the premium at lower interest rates. Understanding Make-Whole Call Provisions is essential in corporate finance, assisting both issuers and investors to navigate the intricacies of bond markets.What Is a Make-Whole Call Provision?

Functioning of Make-Whole Call Provisions

Calculation Methods

Considerations for Investors

Application in Corporate Bonds

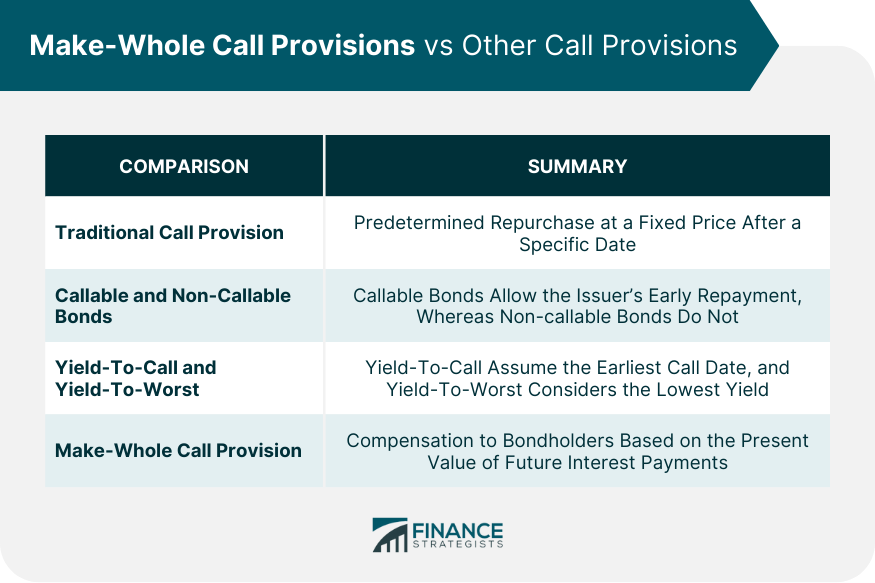

Differences Between Make-Whole Call Provisions and Other Call Provisions

Traditional Call Provisions

Callable and Non-callable Bonds

Yield-To-Call and Yield-To-Worst

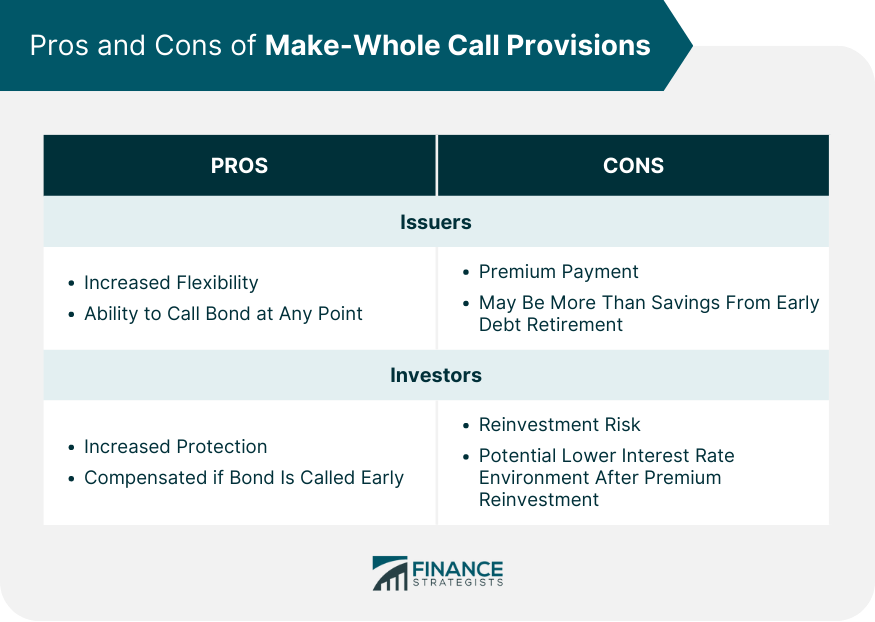

Pros and Cons of Make-Whole Call Provisions

For Issuers

For Investors

Role of Make-Whole Call Provisions in Bond Pricing

Impact on Bond Value

Impact on Yield

Influence on Bond Market Volatility

Legal and Regulatory Considerations for Make-Whole Call Provisions

Laws and Regulations in the United States

Laws and Regulations in Europe

Laws and Regulations in Asia

Recent Developments and Future Trends of Make-Whole Call Provisions

Trends in Financial Markets

Predicted Future Changes

Impact of Technology and AI

Bottom Line

Make-Whole Call Provision FAQs

A Make-Whole Call Provision is a clause in a bond contract that allows the issuer to retire the bond early. It requires the issuer to pay the bondholder a premium, calculated to cover the present value of the future coupon payments that the investor would miss due to the early call.

A traditional call provision allows the issuer to repurchase bonds at a predetermined price after a certain date. A Make-Whole Call Provision, on the other hand, allows the issuer to call the bond early but requires the issuer to compensate the bondholder for the present value of future interest payments.

For issuers, Make-Whole Call Provisions offer flexibility as they can call the bond at any time. However, they have to pay a premium which might be substantial. For investors, these provisions provide protection as they get compensated if the bond is called early. Yet, they face reinvestment risk as the received premium may have to be reinvested at lower interest rates.

Make-Whole Call Provisions can increase a bond's attractiveness and hence its value because they provide protection to investors. They can also reduce market volatility by discouraging premature bond calls. However, they might lower the yield in certain scenarios when considering the yield-to-worst method.

As global interest rates remain low, the use of Make-Whole Call Provisions is expected to rise. Moreover, advancements in financial technology and artificial intelligence may influence how these provisions are calculated and managed in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.