Tax brackets are a range of income levels used to determine how much tax an individual or business owes based on their taxable income. The tax system typically imposes higher tax rates on higher levels of income, which means that the percentage of tax owed increases as an individual or business moves into a higher tax bracket. Tax brackets are an important component of the tax system as they help ensure that individuals and businesses pay their fair share of taxes based on their ability to pay. Understanding tax brackets is crucial for effective tax planning and financial management. Progressive tax brackets are the most common type used in many countries, including the United States. Under a progressive system, tax rates increase as taxable income rises. This means that individuals with higher incomes pay a higher percentage of tax on the portion of their income within each bracket. Flat tax brackets, also known as proportional tax brackets, apply a constant tax rate to all levels of taxable income. In a flat tax system, everyone pays the same percentage of tax regardless of their income. Regressive tax brackets are the opposite of progressive tax brackets. In a regressive system, the tax rate decreases as income increases. This means that individuals with lower incomes pay a higher percentage of tax compared to those with higher incomes. Tax brackets work by dividing taxable income into different ranges, with each range or bracket taxed at a specific rate. The tax system typically imposes higher tax rates on higher levels of income, which means that the percentage of tax owed increases as an individual or business moves into a higher tax bracket. For example, in a progressive tax system, as taxable income increases, individuals or businesses move into higher tax brackets with higher tax rates. The portion of income within each bracket is taxed at that rate, while the portion of income within the lower brackets is taxed at the respective lower rates. The marginal tax rate is the tax rate applied to the last dollar of taxable income earned, which determines which tax bracket applies to a specific level of income. The tax brackets for 2024 determine the rates at which individuals are taxed based on their taxable income. The brackets indicate the income ranges within which different tax rates apply, with higher rates applicable to higher income levels. There are seven tax brackets ranging from 10% to 37%. Deductions and credits can help reduce taxable income and lower the amount of tax owed. Tax deductions are expenses that taxpayers can subtract from their income to reduce their taxable income. For example, taxpayers can claim deductions for charitable contributions, mortgage interest, and state and local taxes. Tax credits are dollar-for-dollar reductions in the amount of tax owed. Taxpayers can claim credits for various purposes, such as education expenses, childcare expenses, and energy-efficient home improvements. Maximizing deductions and credits is a straightforward way to reduce taxable income and optimize tax liability. Timing income and deductions can help taxpayers optimize their tax position. By strategically planning when to receive income or make deductible expenses, taxpayers can potentially minimize their tax liability. For example, taxpayers may be able to defer income until the following year or accelerate deductible expenses to the current year. By doing so, taxpayers can potentially reduce their taxable income for the current year and optimize their tax liability. Investing in tax-advantaged accounts, such as retirement plans and health savings accounts (HSAs), can provide significant tax benefits. Contributions made to these accounts are generally tax-deductible, which reduces taxable income. Moreover, investment earnings within these accounts grow tax-free until withdrawn. Retirement plans include individual retirement accounts (IRAs), 401(k) plans, and other employer-sponsored plans. HSAs are available to individuals with high-deductible health insurance plans and can be used to pay for qualified medical expenses tax-free. By investing in these accounts, taxpayers can potentially reduce their tax liability and increase their savings. Tax brackets are subject to change over time due to various factors such as inflation, legislative changes, and other economic factors. It's essential for taxpayers to stay informed about changes to tax brackets to understand how their tax liability may be affected. Tax brackets are often adjusted for inflation to account for changes in the cost of living. The adjustment ensures that taxpayers are not pushed into a higher tax bracket due to inflation and that their tax liability remains fair. The adjustment is typically based on the Consumer Price Index (CPI), which measures the cost of goods and services. Adjustments for inflation occur annually and ensure that tax brackets keep pace with the changing economy. Tax brackets can also change due to legislative reforms aimed at modifying tax rates or adjusting income thresholds. For example, tax reform legislation can increase or decrease tax rates, create new tax brackets, or change the income levels associated with each bracket. Such changes can have a significant impact on taxpayers, particularly those who are close to the income thresholds of different tax brackets. Changes in tax brackets can have a direct impact on taxpayers. For example, if tax rates increase or new tax brackets are created, taxpayers may owe more in taxes than before. Conversely, if tax rates decrease, taxpayers may owe less in taxes. Changes in tax brackets can also affect taxpayers' financial planning and decision-making, such as how much to save, invest, or spend. Taxpayers should stay informed about changes in tax brackets to understand how their tax liability may be affected and how they can adjust their financial planning accordingly. Tax brackets refer to a range of income levels used to determine the applicable tax rate. Tax brackets can be structured as progressive, flat, or regressive, with each type having a different tax rate structure. Understanding how tax brackets work is essential for effective tax planning and financial management. Taxable income, marginal tax rates, and tax calculation examples are all critical components of how tax brackets work. By strategically managing taxable income, individuals and businesses can potentially reduce their tax liability and increase their savings. Effective tax planning strategies can help taxpayers minimize their tax liability and optimize their tax position. Maximizing deductions and credits, timing income and deductions, and investing in tax-advantaged accounts are all effective tax planning strategies. Tax bracket changes due to inflation or legislative reforms can have a significant impact on taxpayers. Taxpayers should stay informed about changes in tax brackets to understand how their tax liability may be affected and adjust their financial planning accordingly.What Are Tax Brackets?

Types of Tax Brackets

Progressive Tax Brackets

Flat Tax Brackets

Regressive Tax Brackets

How Tax Brackets Work

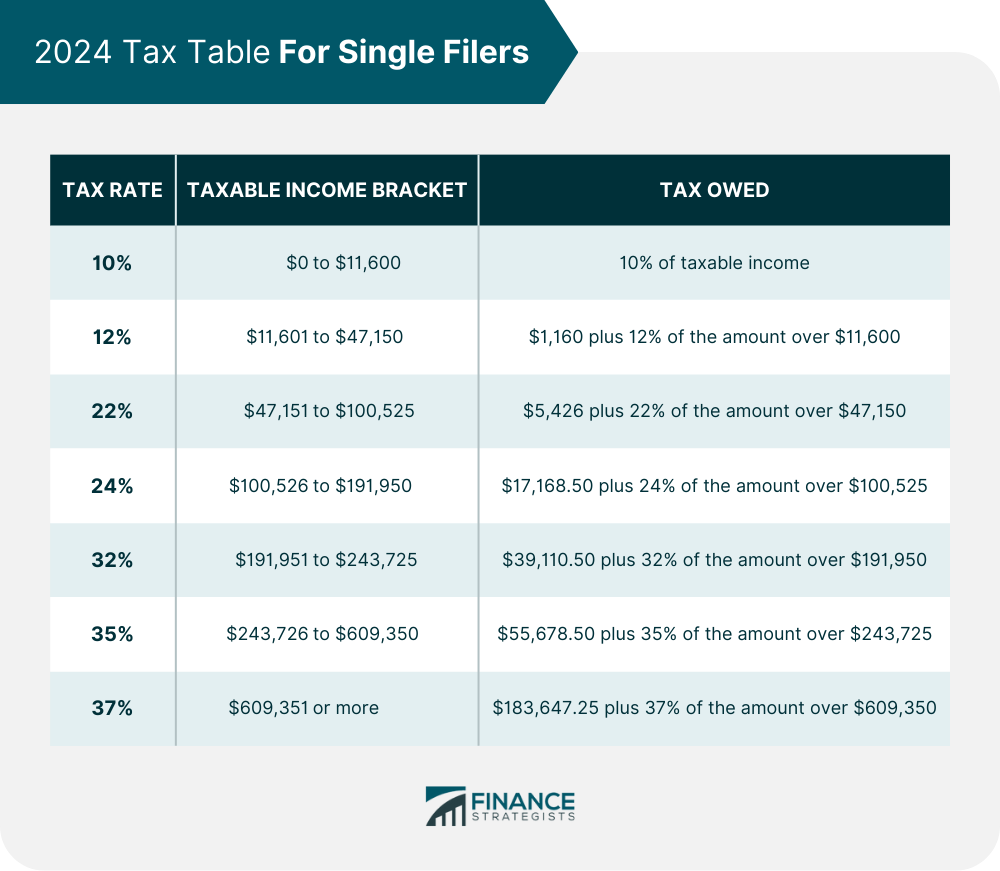

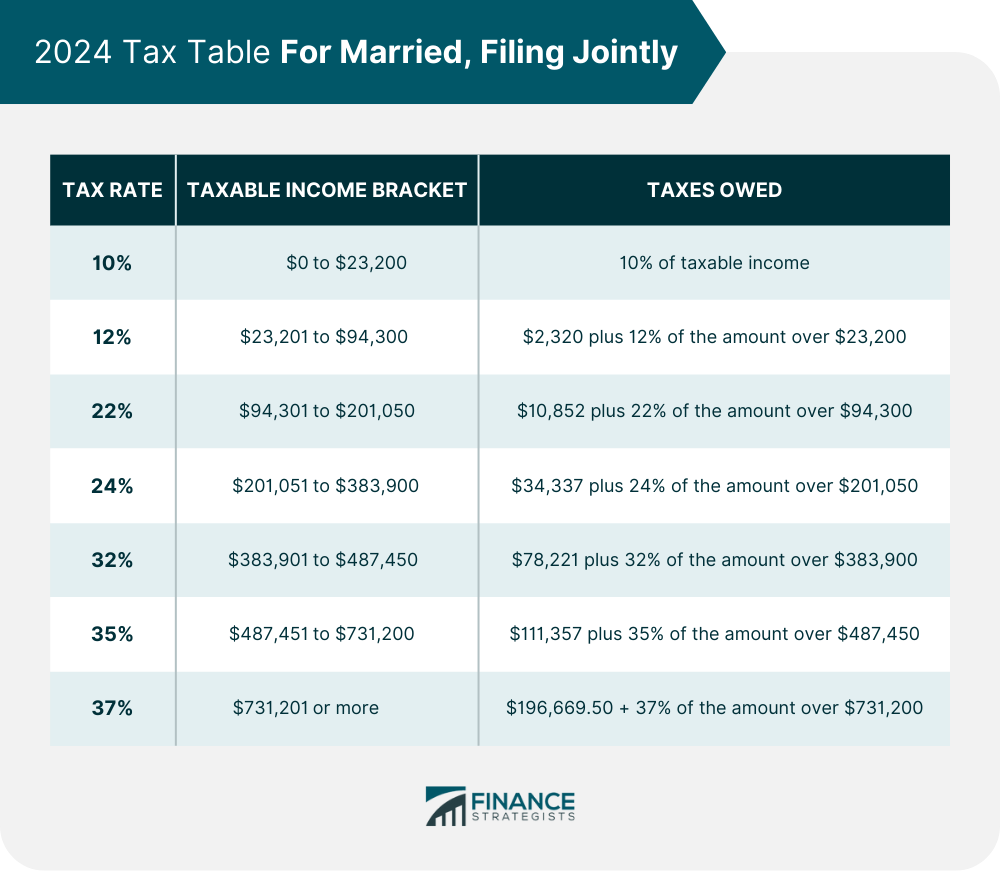

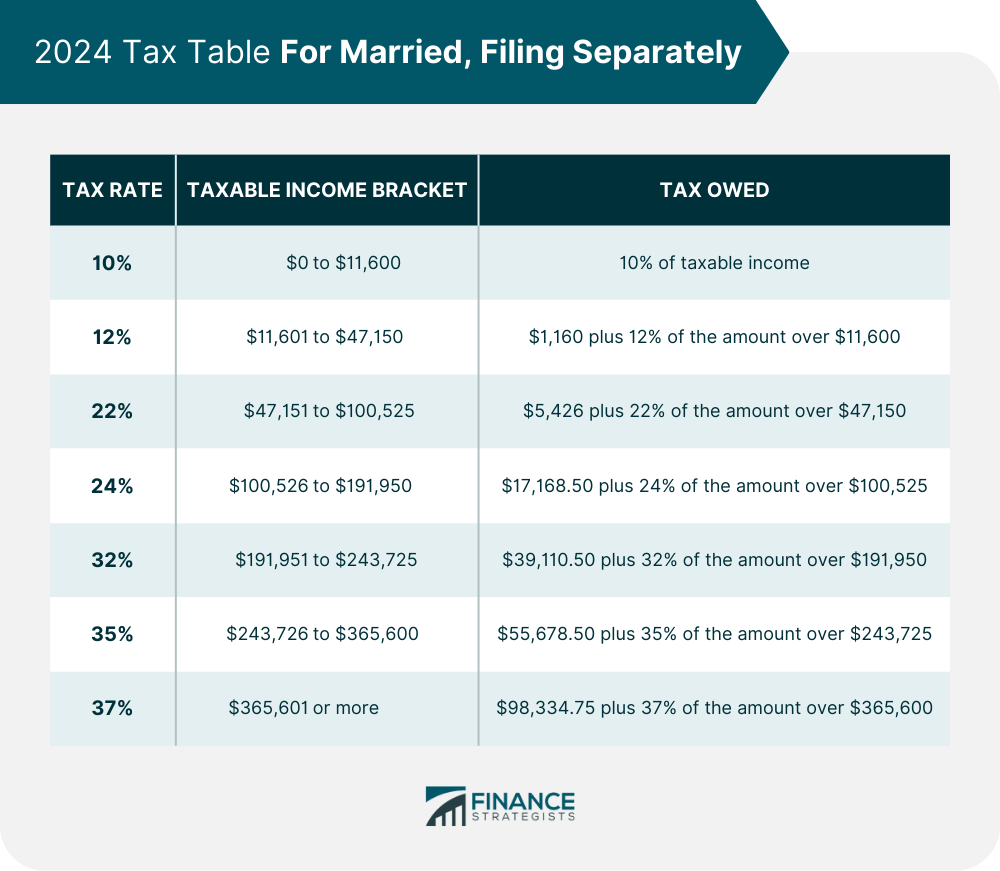

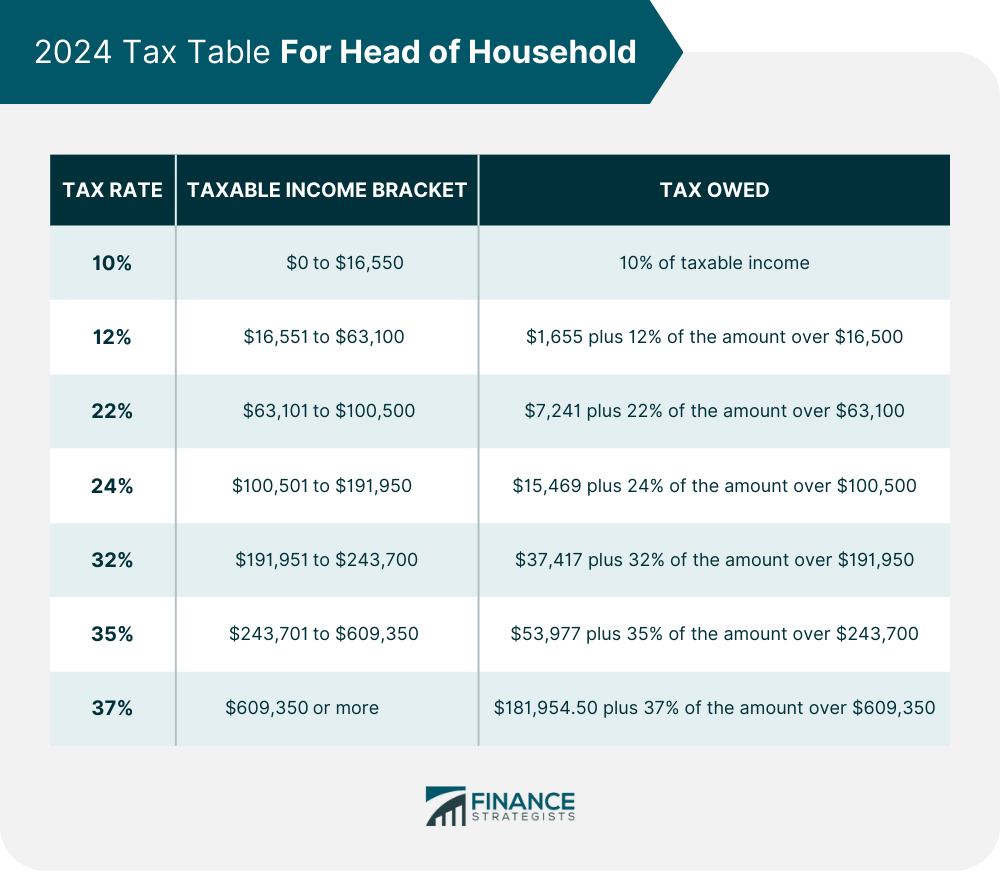

2024 Tax Brackets

For Single Filers

For Married Filing Jointly

For Married Filing Separately

For Head of Household

Tax Planning Strategies

Maximize Deductions and Credits

Time Income and Deductions

Invest in Tax-Advantaged Accounts

Tax Bracket Changes

Adjustments for Inflation

Legislative Changes

Impact on Taxpayers

Conclusion

Tax Brackets FAQs

Tax bracket is a range of income levels used to determine how much tax an individual or business owes based on their taxable income.

As your taxable income increases, you move into higher tax brackets where you pay a higher percentage of tax on the portion of income in that bracket.

There are three types of tax brackets: progressive, flat, and regressive. Progressive tax brackets are most common in the US.

Maximizing deductions and credits, timing income and deductions, and investing in tax-advantaged accounts are all effective tax planning strategies.

Tax brackets can change due to inflation, legislative changes, or other factors. It's important to stay up-to-date on current tax laws and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.