A negative covenant, also known as a restrictive covenant, is a promise in a contract that prohibits the borrower from doing specific actions. It forms a critical part of many financial and legal agreements. Its primary purpose is to protect the interests of the lender or the bondholder by restricting the borrower's activities that may jeopardize the borrower's ability to repay the loan or bond. Negative covenants often stipulate limitations on tangible aspects such as selling assets, merging with other entities, or incurring additional debt. Violation of a negative covenant may trigger a default, leading to severe consequences including possible foreclosure or financial penalties. Financial ratio covenants place limits on key financial ratios that the borrower must maintain, such as the debt-to-equity ratio, current ratio, and interest coverage ratio. These covenants ensure that the borrower maintains a healthy financial state, which is crucial to the lender as it reduces the risk of default. Some covenants restrict or limit the amount of dividends that a company can pay to its shareholders. This is to ensure that the company does not deplete its cash reserves required for debt repayment. These covenants restrict the borrower from selling assets without the lender's approval. This provision safeguards the lender's interests by ensuring that the borrower retains its revenue-generating assets, which are necessary for debt repayment. Such covenants limit the borrower's ability to take on additional debt. This restricts the borrower's debt level, thus reducing the risk to the existing lenders or bondholders. In the context of bonds, negative covenants protect bondholders by limiting the issuer's activities that may affect the issuer's ability to make interest payments or repay the principal. In loans, negative covenants are designed to protect the lender by ensuring that the borrower maintains a certain level of financial health and stability. They also limit activities that may affect the borrower's ability to repay the loan. In lease agreements, negative covenants may restrict the lessee from subleasing the property or making significant modifications without the lessor's consent. Negative covenants may impose certain restrictions on the borrower's operational and financial activities, potentially limiting the company's strategic options. With the restrictions posed by negative covenants, companies may need to adjust their strategic planning and management. Companies must consider these covenants when making major financial decisions. Breach of negative covenants can result in severe penalties, including the acceleration of debt repayment or even a demand for immediate full repayment. Negative covenants provide a layer of protection for the lenders, ensuring that the borrower maintains the ability to repay the debt. These covenants give lenders some level of control and monitoring over the borrower's activities, which can be vital in ensuring the borrower's financial stability. In case of a covenant breach, lenders can take several actions, including calling the loan, changing the loan terms, or even taking legal action. In Mergers and Acquisitions (M&A), negative covenants can restrict a company from merging or acquiring another company without the lender's approval. They ensure that the M&A activity does not negatively impact the borrower's ability to repay its debt. During corporate restructuring, negative covenants may prohibit certain actions, such as the sale of significant assets, ensuring that the restructuring process does not jeopardize the company's ability to meet its debt obligations. Negative covenants can impact shareholders and other stakeholders. The restrictions can limit the company's activities, affecting the company's growth prospects and shareholder returns. Economic and market conditions can significantly impact the structuring of negative covenants. In tougher economic times, lenders may impose more stringent covenants. Regulatory changes can also influence the practices around negative covenants. For instance, increased regulatory scrutiny on lending practices can result in changes to how covenants are structured and enforced. With the increasing complexity of financial markets and products, negative covenants are expected to evolve to address new types of risks. It may see the introduction of more sophisticated covenants that cover areas such as environmental, social, and governance (ESG) risks. Critics argue that overly restrictive covenants can stifle a company's growth by limiting its ability to invest in new projects or take strategic risks. This can impact the company's long-term prospects. There is an ongoing debate over the fairness and transparency of negative covenants. Some argue that they favor lenders excessively and lack transparency, which can lead to disputes and litigation. Negative covenants have also been scrutinized for their role in financial crises. In the 2008 financial crisis, for example, covenant breaches by several large corporations accelerated the financial turmoil. Negative covenants, integral to financial agreements, protect lender interests by curbing borrower actions potentially hindering debt repayment. Varying in scope, these covenants encompass financial ratio, dividend payment, asset disposal, and additional debt restrictions. They serve to maintain borrower financial health, assure steady asset retention, and control debt levels. Amid controversies of over-restriction and lack of transparency, these covenants remain essential in corporate finance, especially in Mergers & Acquisitions and restructuring processes. The evolving financial landscape, shaped by economic conditions and regulatory changes, is leading to more sophisticated negative covenants, potentially including areas like ESG risks. While these covenants pose challenges to borrowers, a thorough understanding is key to crafting mutually beneficial contracts, ensuring financial stability, and mitigating default risk.What Is a Negative Covenant?

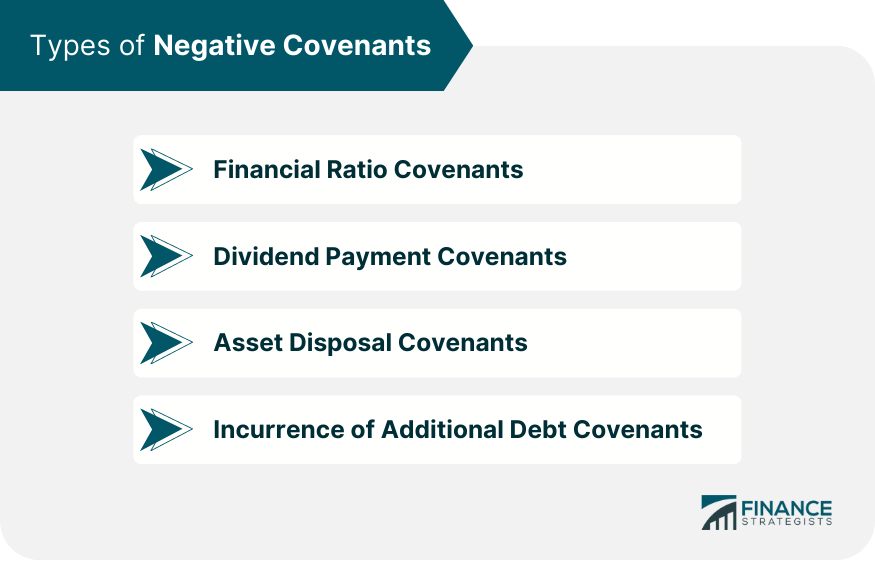

Different Types of Negative Covenants

Financial Ratio Covenants

Dividend Payment Covenants

Asset Disposal Covenants

Incurrence of Additional Debt Covenants

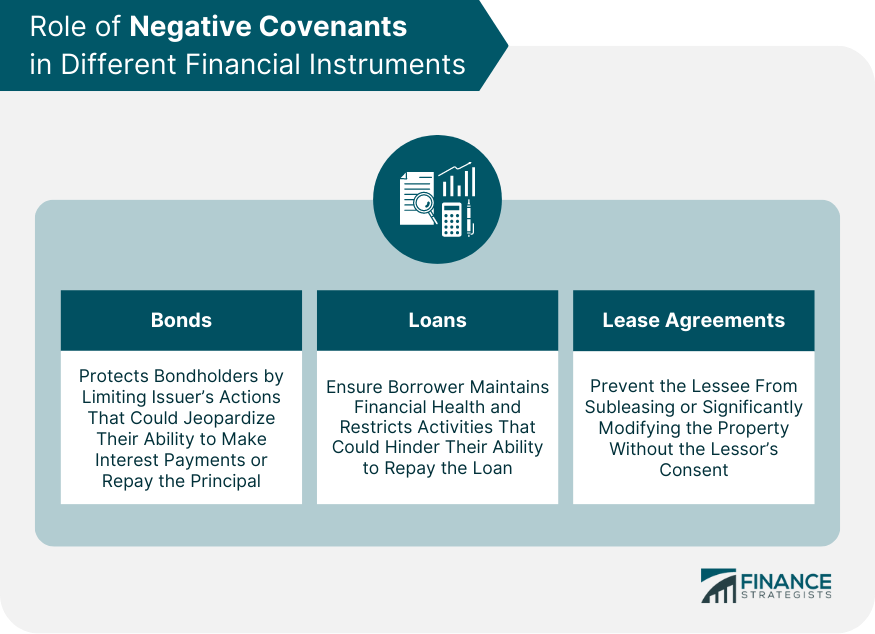

Negative Covenants in Different Financial Instruments

Bonds

Loans

Lease Agreements

Impact of Negative Covenants on Borrowers

Constraints on Operational and Financial Activities

Implications for Strategic Planning and Management

Potential Penalties for Breach of Negative Covenants

Impact of Negative Covenants on Lenders

Protection of Investment

Monitoring and Control Over Borrower's Activities

Remedies and Actions in Case of Covenant Breach

Negative Covenants in Corporate Finance

Role in Mergers and Acquisitions

Role in Corporate Restructuring

Implications for Shareholders and Stakeholders

Trends and Evolving Practices in Negative Covenants

Impact of Economic and Market Conditions

Regulatory Changes and Implications

Future Perspectives on Negative Covenants

Criticisms and Controversies Surrounding Negative Covenants

Overly Restrictive Covenants and Their Impact on Businesses

Debate Over Fairness and Transparency

Role of Negative Covenants in Financial Crises

Bottom Line

Negative Covenant FAQs

Negative covenants are promises made by a borrower in a financial agreement, stating that they will refrain from specific actions that might jeopardize their ability to repay the debt. These actions might include taking on additional debt, selling significant assets, or paying excessive dividends.

Negative covenants protect lenders by putting restrictions on borrowers that aim to maintain their financial stability. These covenants can limit the borrower's operational and financial activities, thus reducing the risk of default. If the borrower breaches a covenant, the lender may have the right to demand immediate repayment or alter the terms of the loan.

Negative covenants can constrain borrowers' operational and financial activities. For example, they can limit a company's ability to invest in new projects, take on additional debt, or pay dividends. Breaching a negative covenant can lead to severe penalties, including immediate full repayment of the debt.

Negative covenants play a significant role in corporate finance, particularly in the context of mergers and acquisitions (M&A) and corporate restructuring. They can limit a company's ability to merge or acquire other companies without the lender's approval or prohibit the sale of significant assets during restructuring. This ensures the activities do not adversely affect the borrower's ability to repay their debt.

Some controversies surrounding negative covenants include the argument that they can be overly restrictive, potentially stifling a company's growth. There is also a debate over the fairness and transparency of these covenants, with some critics arguing that they favor lenders excessively. Negative covenants have also been scrutinized for their role in exacerbating financial crises, as covenant breaches can accelerate financial instability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.