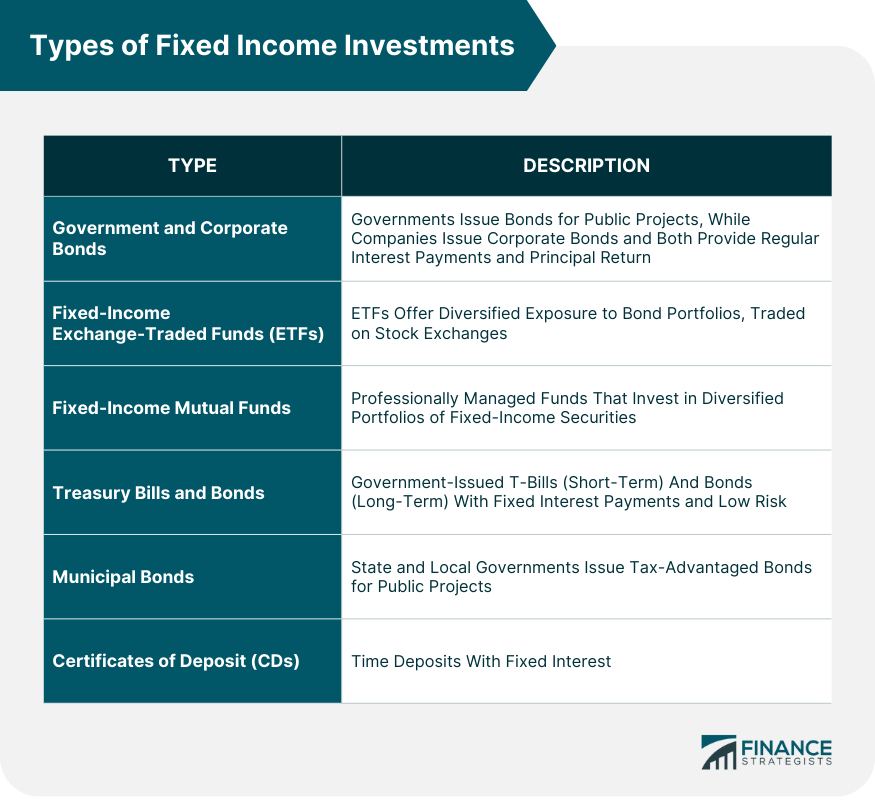

Fixed income investments are financial vehicles that provide a predictable stream of income to investors. Echoing the value of such investments, financial advisor Matt Williamson notes, "Fixed income forms the bedrock of stability in a diversified portfolio, offering security and steady income." "They embody a prudent choice for investors aiming to safeguard their capital while ensuring a steady income flow." These investments typically involve purchasing fixed income securities such as bonds, Treasury bills, or certificates of deposit (CDs). They are favored by investors seeking a steady income stream, capital preservation, and diversification within their investment portfolios. A fixed-income security is an investment vehicle that pays investors unchanging interest or dividend payments until its maturity date. Upon maturity, investors are repaid the principal amount invested. The purpose of fixed-income securities is to provide a steady income stream that is more stable than stocks. Additionally, fixed-income investors are paid before common stockholders in the event that a company goes bankrupt. Some common types of fixed-interest products are: Government bonds are issued by governments to fund public projects, while corporate bonds are issued by companies to raise capital. Both types provide regular interest payments and the return of the principal amount upon maturity. Fixed-income exchange-traded funds (ETFs) offer diversified exposure to a portfolio of bonds. These funds trade on stock exchanges and provide investors with the opportunity to invest in a variety of fixed-income securities. Fixed-income mutual funds pool money from multiple investors to invest in a diversified portfolio of fixed-income securities. These funds are managed by professional fund managers who select and manage the bond investments. Fixed-income mutual funds are suitable for investors seeking professional management and a diversified approach to fixed-income investing. Treasury bills (T-bills) and bonds are issued by the government to finance its operations. T-bills have a maturity of less than one year, while bonds have longer maturities, typically ranging from 2 to 30 years. These investments are considered low-risk and are backed by the government. Treasury securities provide a fixed interest payment to investors. Municipal bonds, also known as munis, are issued by state and local governments to fund public projects, such as schools, roads, and hospitals. These bonds offer tax advantages to investors, as the interest earned is often exempt from federal income tax. Municipal bonds are suitable for investors seeking tax-efficient fixed-income investments. Certificates of deposit (CDs) are time deposits offered by banks and credit unions. Investors deposit a specific amount of money for a fixed period, and in return, they receive a fixed interest rate. CDs have a specified maturity date and are insured by the Federal Deposit Insurance Corporation (FDIC) up to certain limits. CDs are considered low-risk investments with predictable returns. For most investors, fixed-income investments are a common component of a well-diversified portfolio. Depending on their investment style, the percent of their portfolio dedicated to fixed-income securities may vary. For example, a risk-averse investor may choose to invest 60% in fixed-income products and 40% in equities, while a more aggressive investor may have 20% in fixed-income securities and 80% in equities. One strategy for maximizing the return on investment from fixed-income investments such that of fixed-income securities is called laddering. This is where an investor purchases a portfolio of bonds with staggered maturities. For example, say an investor has $100,000 to invest in fixed-income securities. Instead of buying $100,000 of one-year bonds, they may split the money into fifths and invest $20,000 each into one, two, three, four, and five-year securities. When the one-year bonds mature, instead of buying more one-year securities, the investor will reinvest in five-year securities. This way, the investor sees cash flow from their investments each year. Assessing your risk tolerance is a crucial step in choosing a fixed income investment. Risk tolerance refers to your ability and willingness to withstand potential fluctuations in the value of your investment. Consider factors such as your financial goals, investment knowledge, and comfort level with market volatility. If you have a low tolerance for risk, you may prefer more conservative fixed income options with lower potential returns but greater stability. Clearly defining your investment objectives is essential when selecting a fixed income investment. Ask yourself what you hope to achieve with your investment. Your objectives will help you identify the type of fixed income investment that aligns with your financial goals. For example, if you prioritize income generation, you may focus on bonds with higher coupon rates. The investment time horizon refers to the duration for which you plan to hold your fixed income investment. It can range from short-term (less than a year) to medium-term (1-5 years) or long-term (5 years or more). Shorter time horizons may be better suited to investments like Treasury bills or shorter-term bonds, while longer time horizons can accommodate longer-term bonds with potentially higher yields. When choosing a fixed income investment, it is important to evaluate the yield and return potential it offers. Yield refers to the income generated by an investment relative to its price, expressed as a percentage. Consider the current yield, yield to maturity, or coupon rate, depending on the specific type of fixed income investment. Assess the historical performance and projected returns to determine if they meet your financial objectives. Keep in mind that higher returns often come with increased risk, so it's essential to find a balance that suits your risk tolerance and investment goals. Fixed income investments are financial instruments that offer a fixed return or income stream over a specified period. They provide stability, regular income, and capital preservation. Common types include government and corporate bonds, fixed-income ETFs, mutual funds, Treasury bills and bonds, municipal bonds, and certificates of deposit (CDs). When choosing a fixed income investment, consider your risk tolerance, investment objectives, and time horizon. Assess your comfort with market fluctuations, define your financial goals, and determine whether you prioritize income, preservation, or growth. Understand the duration you plan to hold the investment and evaluate the yield and return potential of different options. Carefully selecting the right fixed income investment can help meet your financial objectives while managing risk effectively.Overview Of Fixed Income Investments

Types of Fixed Income Investments

Government And Corporate Bonds

Fixed-Income ETFs

Fixed-Income Mutual Funds

Treasury Bills And Bonds

Municipal Bonds

Certificates Of Deposit (CDs)

Diversifying Portfolio With Fixed-Income Investments

Utilizing Fixed Income

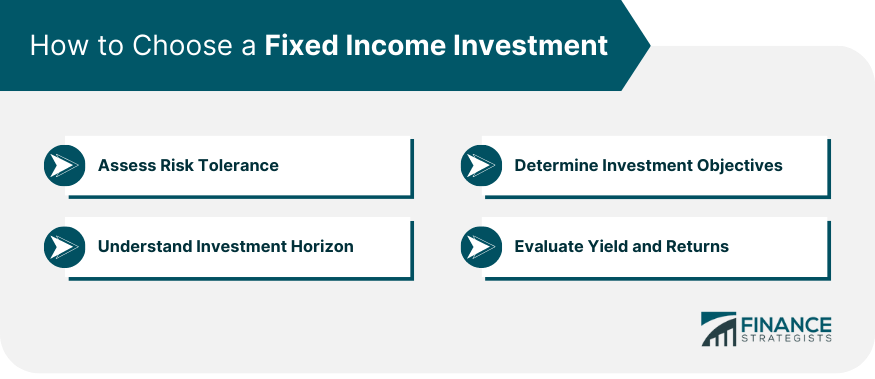

How to Choose a Fixed Income Investment

Assess Risk Tolerance

Determine Investment Objectives

Understand Investment Time Horizon

Evaluate the Yield and Return Potential

Bottom Line

Types of Fixed Income Investments FAQs

Some common types of fixed income investments are Government and corporate bonds, Fixed-Income ETFs, Fixed-Income mutual funds, Treasury bills and bonds, Municipal bonds, and Certificates of Deposit (CDs).

Fixed income investments provide stability and income generation potential, which can balance the volatility of equities in a portfolio. They offer regular income payments and lower risk compared to stocks, helping to diversify risk and provide a more balanced investment approach.

Laddering involves purchasing a portfolio of bonds with staggered maturities. By spreading investments across different maturities, investors can ensure a steady cash flow as bonds mature and are reinvested. This strategy helps manage interest rate risk and provides liquidity.

Factors to consider include assessing your risk tolerance, defining your investment objectives, understanding your time horizon, and evaluating the yield and return potential. By aligning these factors with your financial goals, you can choose a fixed income investment that suits your needs.

Fixed income investments can be suitable for a wide range of investors, depending on their risk tolerance, investment goals, and time horizon. Conservative investors seeking stable income may find fixed income investments appealing, while others with a higher risk tolerance may use them to diversify their portfolios. It's important to consider personal circumstances and consult with a financial advisor before making investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.