When comparing Certificates of Deposit (CDs) and Treasury Bonds, several factors come into play. CDs are deposit accounts offered by banks with a fixed term and interest rate, insured by the FDIC, making them a secure choice. However, their liquidity is limited, with penalties for early withdrawal, and the interest earned is subject to federal, state, and local taxes. On the other hand, Treasury Bonds are long-term securities issued by the U.S. government, offering higher yields and excellent liquidity as they can be bought or sold on the open market. Although subject to federal tax, the interest earned is exempt from state and local taxes. Both investment options are considered safe, but Treasury Bonds may offer higher returns and tax benefits, while CDs may be more suitable for those seeking a guaranteed return and with no intention of early withdrawal. A certificate of deposit, or CD, is a type of savings account offered by banks and credit unions. When you purchase a CD, you agree to deposit a fixed sum of money for a set period. In return, the bank promises to pay a fixed rate of interest over the term. When the CD matures, you get back the amount you originally deposited, along with any accrued interest. Traditional CDs are the most common type. When you open a traditional CD, you agree to deposit a specific amount of money for a predetermined period, known as the term. In return, the bank guarantees a fixed interest rate for the duration of the term. Terms can range from a few months to several years. At the end of the term, you receive your initial deposit plus the accrued interest. Bump-up CDs allow you to take advantage of rising interest rates. If the bank's interest rates increase during your CD term, you can request a 'bump-up' to the higher rate. However, these CDs often start with a lower interest rate than traditional CDs. Liquid CDs offer more flexibility than most other types. They allow you to withdraw a portion of your deposit without paying a penalty. This can be beneficial if you need access to your money before the end of the term. However, these CDs usually provide a lower interest rate to offset the increased flexibility. Jumbo CDs are for large investments, typically $100,000 or more. They often offer a higher interest rate than standard CDs due to the large deposit size. If you have a significant amount to invest and want a secure, low-risk option, a jumbo CD might be the right choice. Zero-coupon CDs are purchased at a substantial discount to their face value. Instead of paying out annual interest, these CDs accumulate interest over the term and pay the total amount at maturity. They are similar to zero-coupon bonds and are ideal for long-term savers who don't need immediate income. Callable CDs come with a risk that the bank may 'call' or terminate the CD before its maturity date. Banks do this when interest rates fall and they can borrow money more cheaply. While they often offer higher initial rates, the possibility of being called makes them a bit risky. One of the key benefits of investing in CDs is the guaranteed return. When you invest in a CD, the bank promises to pay a fixed interest rate over a specified period. This allows you to know exactly how much you will earn from the CD at the end of the term. CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed by law—currently $250,000 per depositor per bank. This means that even if the bank fails, your money is safe. CDs are considered low-risk investments because they offer a fixed, predictable return. They are particularly suitable for risk-averse investors or those who are nearing retirement and want to protect their capital. CDs typically come with a predetermined term during which your money is locked in. If you need to withdraw your money before the term ends, you may have to pay a penalty. This makes CDs less liquid than other investment options, like savings accounts or money market funds. Compared to riskier asset classes like stocks or bonds, CDs usually offer lower returns. While your capital is safe in a CD, the growth potential is limited, and the returns may not keep up with inflation. CDs come with reinvestment risk, which is the risk that you might have to reinvest your money at a lower rate once the CD matures. This can happen if interest rates fall during the term of your CD. Treasury bonds, or T-bonds, are government-issued securities with a maturity of more than ten years. When you buy a treasury bond, you are lending money to the government. In return, the government promises to pay you a fixed rate of interest every six months until the bond matures. At maturity, you receive the face value of the bond. Regular Treasury Bonds, also known simply as T-Bonds, are long-term securities issued with maturities of 20 to 30 years. Investors receive semi-annual interest payments at a fixed rate throughout the duration of the bond. When the bond matures, the investor is paid the face value of the bond. These bonds can be purchased directly from the U.S. Treasury or on the secondary market. TIPS are treasury securities designed to help protect investors from inflation. Unlike regular treasury bonds, the principal of a TIPS increases with inflation (as measured by the Consumer Price Index), and decreases with deflation. Interest is paid semi-annually at a fixed rate, but the amount of interest paid varies because it is calculated based on the adjusted principal. At maturity, the investor is paid the greater of the adjusted principal or the original principal. Savings Bonds come in two types: Series EE and Series I bonds. Series EE bonds are sold at face value and will double in value if held for 20 years. Series I bonds are inflation-protected savings bonds that offer a fixed rate plus an inflation-adjusted rate. Both types of savings bonds stop earning interest after 30 years. One of the key advantages of Treasury bonds is their safety. Since they're backed by the full faith and credit of the U.S. government, the risk of default is virtually nonexistent. This makes Treasury bonds a highly secure investment. Treasury bonds pay interest every six months until they mature. This regular income stream can be a beneficial feature for those looking for consistent returns, such as retirees or other income-focused investors. Interest earned from Treasury bonds is exempt from state and local income taxes. Although it's still subject to federal tax, this can offer significant tax savings, especially for those living in states with high income tax rates. Although Treasury bonds have long maturity periods (more than 10 years), they're highly liquid. This means you can easily buy or sell them on the open market if you need to access your investment before the bond reaches maturity. In comparison to other investments such as stocks or corporate bonds, Treasury bonds typically offer lower yields. Therefore, while they're low in risk, they may not provide high enough returns for those aiming for aggressive growth. While the interest rate on a Treasury bond remains fixed for its entire duration, market interest rates can fluctuate. If market rates increase after you've purchased your bond, the resale value of your bond could decrease. This won't matter if you hold onto your bond until maturity, but it could result in a loss if you need to sell it beforehand. Inflation is a risk for long-term investments like Treasury bonds. If inflation rates rise significantly over the bond's duration, it could erode the purchasing power of your interest payments and principal, leading to lower real returns. The return on CDs is typically lower than treasury bonds. CDs are considered safer than corporate bonds but less safe than government bonds, resulting in a return that is somewhere in between. Treasury bonds, on the other hand, tend to offer higher yields, especially for longer-term bonds. However, the actual return depends on the prevailing market conditions at the time of investment. CDs are less liquid than Treasury bonds. With a CD, your money is tied up until the CD matures, and early withdrawals can result in penalties. Treasury bonds can be bought and sold in the secondary market, offering more liquidity. Both CDs and Treasury bonds offer a high level of safety. CDs are insured by the FDIC, while Treasury bonds are backed by the full faith and credit of the U.S. government. However, treasury bonds have a slight edge as they are considered virtually risk-free. Credit risk, or the risk of default, is virtually nonexistent in both CDs and Treasury bonds. CDs are insured by the FDIC, which means even if the bank fails, your deposit is protected. Treasury bonds are backed by the U.S. government, which has never defaulted on its debt obligations. Both CDs and Treasury bonds are subject to interest rate risk. When interest rates rise, the value of existing bonds and CDs can decrease. However, unless you plan to sell your bond or CD before it matures, changes in market interest rates will not affect your initial investment. Reinvestment risk, the risk that interest income won't be able to be reinvested at the same rate, is present in both CDs and Treasury bonds. This risk is higher when interest rates are declining. For CDs, this risk is felt most acutely at maturity, while for Treasury bonds, it is felt semi-annually when coupon payments are made. Both CDs and Treasury bonds are subject to federal income tax. The interest earned on CDs is taxed as ordinary income. Similarly, the interest on Treasury bonds is also taxable at the federal level. Here lies a key difference between CDs and Treasury bonds. The interest earned on CDs is subject to state and local taxes. In contrast, interest earned on Treasury bonds is exempt from state and local income taxes, potentially offering significant savings for investors in high-tax states. Conservative investors, such as retirees or those nearing retirement, may find CDs and Treasury bonds appealing due to their low risk and stable returns. These investment vehicles offer the safety of principal and a reliable income stream. Moderate investors, who can tolerate a bit more risk for potentially higher returns, may use CDs and Treasury bonds as part of a diversified portfolio. The stable returns from these investments can help balance out the volatility of riskier assets like stocks. Aggressive investors may not find CDs or Treasury bonds as appealing due to their low returns. However, they could still play a role in their portfolio as a hedge against volatility and a source of steady income. You can purchase CDs directly from banks or credit unions. The process is straightforward: choose the term and amount, and deposit the money. It's important to compare rates across different institutions to get the best deal. Treasury bonds can be purchased directly from the U.S. Treasury through the TreasuryDirect website. They can also be bought and sold through brokers. When buying treasury bonds, pay attention to the bond's yield, maturity, and price. CDs and Treasury Bonds are both secure investment vehicles, offering different benefits. CDs provide a fixed return and are insured by the FDIC, making them an attractive choice for conservative investors. However, their liquidity is constrained by early withdrawal penalties. Treasury Bonds, backed by the U.S. government's full faith and credit, yield higher returns and offer greater liquidity. Their interest earnings are exempt from state and local taxes, providing a notable advantage. Both CDs and Treasury Bonds face reinvestment and interest rate risks, and both are subjected to federal taxes. Ultimately, the choice between the two depends on the individual investor's risk tolerance, liquidity needs, and tax situation. Regardless of the choice, both investment options can serve as a stable component in a diversified portfolio.CDs vs Treasury Bonds Overview

How CDs Work

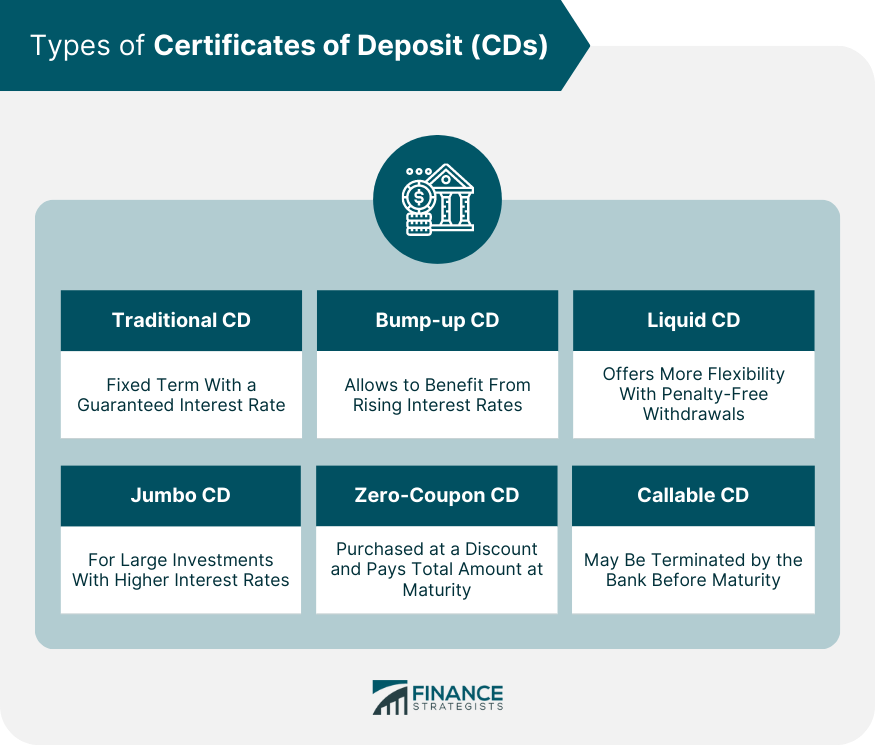

Types of CDs

Traditional CDs

Bump-up CDs

Liquid CDs

Jumbo CDs

Zero-Coupon CDs

Callable CDs

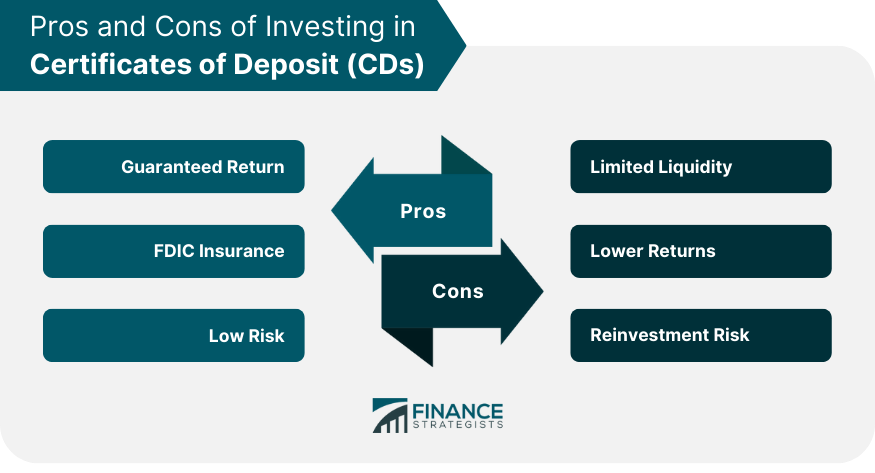

Pros of Investing in CDs

Guaranteed Return

FDIC Insurance

Low Risk

Cons of Investing in CDs

Limited Liquidity

Lower Returns

Reinvestment Risk

How Treasury Bonds Work

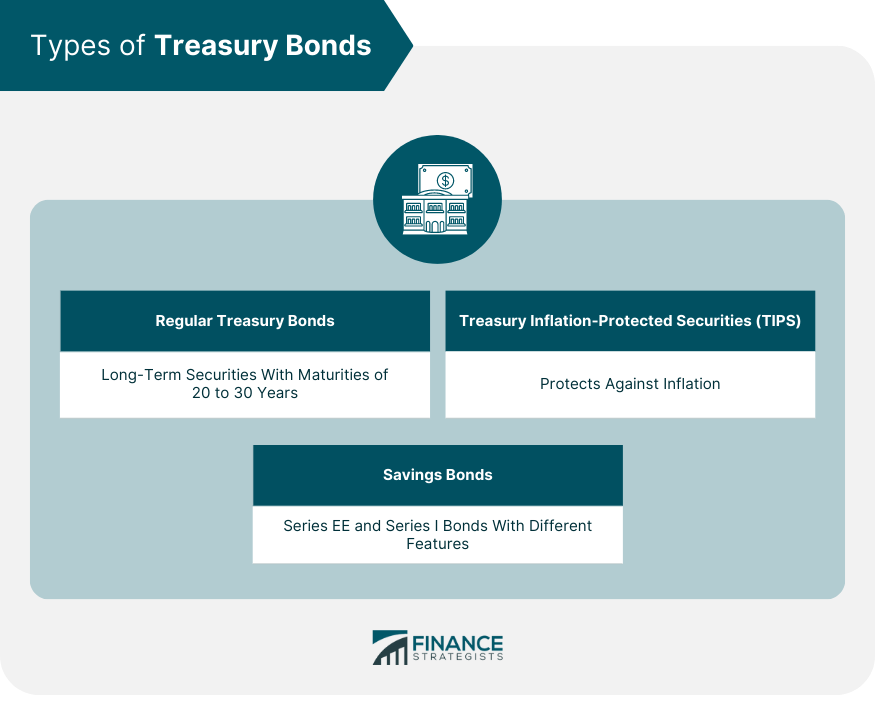

Types of Treasury Bonds

Regular Treasury Bonds

Treasury Inflation-Protected Securities (TIPS)

Savings Bonds

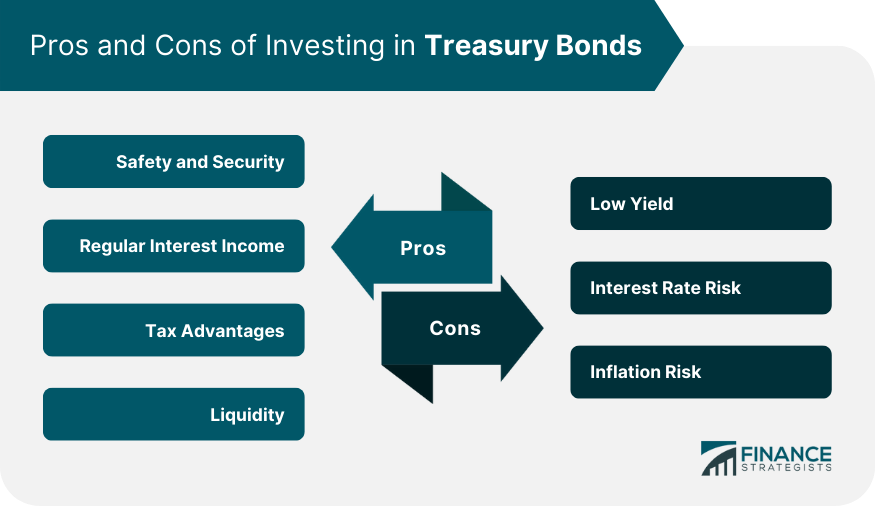

Pros of Investing in Treasury Bonds

Safety and Security

Regular Interest Income

Tax Advantages

Liquidity

Cons of Investing in Treasury Bonds

Low Yield

Interest Rate Risk

Inflation Risk

Key Differences Between CDs and Treasury Bonds

Return on Investment

Liquidity

Safety

Risk Assessment: CDs vs Treasury Bonds

Credit Risk

Interest Rate Risk

Reinvestment Risk

Tax Implications: CDs vs Treasury Bonds

Federal Taxes

State and Local Taxes

Suitability for Different Investor Profiles

Conservative Investors

Moderate Investors

Aggressive Investors

How to Buy CDs and Treasury Bonds

Purchasing CDs

Purchasing Treasury Bonds

Conclusion

CDs vs Treasury Bonds FAQs

CDs and Treasury Bonds are both safe investment options, but they differ in terms of liquidity, taxation, and return. CDs offer less liquidity as premature withdrawal can lead to penalties. Interest from CDs is also subject to state and local taxes. Treasury Bonds, on the other hand, provide higher liquidity and their interest is exempt from state and local taxes.

Both CDs and Treasury Bonds are considered safe investments. CDs are insured by the FDIC up to $250,000 per depositor per bank. Treasury Bonds are backed by the full faith and credit of the U.S. government, which has never defaulted on its debt, making them virtually risk-free.

The return varies depending on the specific CD or Treasury Bond and the prevailing market conditions. Typically, Treasury Bonds tend to offer higher yields than CDs, especially for longer-term bonds. However, it's important to consider other factors like risk and tax implications when comparing returns.

Inflation can erode the purchasing power of the returns from CDs and Treasury Bonds. If the rate of inflation surpasses the interest rate you're receiving on your CD or Treasury Bond, your real return can be negative. However, Treasury Inflation-Protected Securities (TIPS) offer some protection against inflation.

Both CDs and Treasury Bonds can play a role in a retirement portfolio, depending on the individual's risk tolerance, income needs, and tax situation. They both provide steady, reliable returns and low risk. Treasury Bonds offer the added benefits of state and local tax exemption and greater liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.