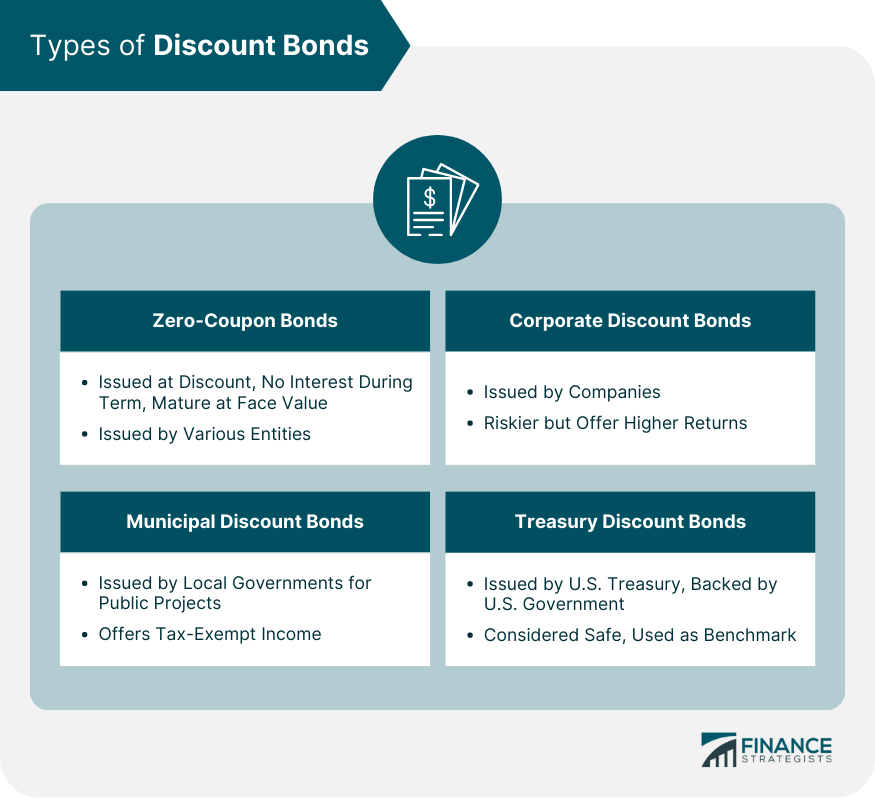

A discount bond is a debt security that is issued or traded for a price lower than its face or par value. This means that investors can purchase the bond at a discount to its face value, and when the bond reaches maturity, the issuer repays the bond's face value to the bondholder. Factors such as interest rates, credit quality, and time to maturity influence bond pricing. The price of a bond fluctuates in response to these factors. When interest rates rise, bond prices generally fall, while lower interest rates often result in higher bond prices. The same goes for credit quality – higher-quality bonds are priced higher than lower-quality bonds. The closer a bond is to its maturity date, the less its price will typically fluctuate. Discount bonds do not pay periodic interest or coupon payments to bondholders. Instead, they provide capital appreciation, which is the difference between the bond's purchase price and its face value at maturity. Investors earn a return on their investment by holding the bond until it matures or selling it at a higher price than they paid. Zero-coupon bonds are the most common type of discount bond. They are issued at a discount to their face value and do not pay any interest during their term. Upon maturity, the bondholder receives the bond's face value. Various entities, including governments, corporations, and financial institutions can issue zero-coupon bonds. State and local governments issue municipal discount bonds to fund public projects such as schools, highways, and infrastructure improvements. These bonds are attractive to investors seeking tax-exempt income, as the interest earned is typically exempt from federal income tax and, in some cases, state and local taxes as well. Companies issue corporate discount bonds to raise capital for various purposes, such as funding expansions, acquisitions, or refinancing debt. They are typically riskier than government-issued bonds due to the potential for default but offer higher potential returns to compensate investors for the increased risk. Treasury discount bonds are issued by the U.S. Department of the Treasury and are backed by the full faith and credit of the U.S. government, making them among the safest investments. These bonds are often used as a benchmark for other fixed-income investments due to their low risk and high liquidity. One of the primary reasons for issuing discount bonds is the fluctuation of interest rates in the market. When interest rates rise, the prices of existing bonds fall, making them less attractive to investors. Issuing bonds at a discount allows the issuer to attract investors despite the higher interest rates. Another reason for issuing discount bonds is the credit risk associated with the bond issuer. If an issuer is perceived to have a higher risk of default, investors may require a higher yield to compensate for the additional risk. Issuing the bond at a discount allows the issuer to provide a higher yield without increasing the bond's coupon rate. Issuers may also issue discount bonds in response to market demand. If there is strong demand for a particular bond or type of bond, issuers may issue bonds at a discount to capitalize on the market's appetite for the security. One of the main advantages of investing in discount bonds is the potential for capital appreciation. When a bond is purchased at a discount and held until maturity, the investor earns the difference between the purchase price and the face value, resulting in a profit. This capital appreciation can provide a significant return on investment, especially for long-term investors. Discount bonds require a lower initial investment than other bonds with similar face values. This lower cost of entry makes them accessible to a wider range of investors, including those with limited funds or seeking to diversify their portfolios. Investing in discount bonds can offer diversification benefits to an investment portfolio. Since they have different risk and return characteristics than other types of investments, such as stocks, adding discount bonds to a portfolio can help reduce overall risk and improve long-term returns. Certain types of discount bonds, such as municipal discount bonds, offer tax benefits to investors. The interest earned on these bonds is typically exempt from federal income tax. It may also be exempt from state and local taxes, making them an attractive option for investors seeking tax-advantaged income. The primary risk associated with discount bonds is interest rate risk. When interest rates rise, bond prices fall, which can result in a loss for investors who sell their bonds before maturity. Investors should carefully consider the potential impact of interest rate fluctuations on their investment before purchasing discount bonds. Another risk associated with discount bonds is credit risk. The possibility that the issuer may default on its debt obligations can lead to a loss of investment for bondholders. Investors should thoroughly research an issuer's creditworthiness before investing in discount bonds. Liquidity risk refers to the risk that an investor may not be able to sell their bond quickly or at a favorable price. Discount bonds, especially those issued by less creditworthy entities, may have lower liquidity than other types of bonds, making it more difficult for investors to sell their bonds when needed. Reinvestment risk is the risk that an investor will not be able to reinvest the proceeds from a matured bond at a similar rate of return. This risk is particularly relevant for zero-coupon bonds, as they do not provide regular income streams for reinvestment. Investors should consider their long-term investment goals and strategies when evaluating reinvestment risk. Yield to maturity is the total return an investor can expect if they hold a bond until it matures. It is calculated by considering the bond's purchase price, face value, time to maturity, and any coupon payments. Yield to Maturity is an important metric for evaluating the attractiveness of a discount bond investment. Current yield is the annual income a bond generates relative to its current market price. It is calculated by dividing the bond's annual interest payment by its current price. Current yield can help investors evaluate the income potential of a bond investment. Yield to call is the total return an investor can expect if they hold a callable bond until it is called or repurchased by the issuer. Callable bonds give the issuer the right to repurchase the bond before it reaches maturity, typically at a specified call price. Yield to Call helps investors assess the potential return of callable discount bonds. Yield to worst is the lowest possible yield an investor can expect from a bond, considering all possible call and maturity scenarios. It is a conservative estimate of a bond's potential return and can help investors evaluate the risk associated with a discount bond investment. The buy-and-hold strategy involves purchasing a discount bond and holding it until maturity. This strategy allows investors to benefit from the full capital appreciation potential of the bond and minimize interest rate and reinvestment risk. It is suitable for long-term investors seeking a predictable return on their investment. Bond laddering is a strategy that involves building a portfolio of bonds with staggered maturity dates. This approach allows investors to spread their investments across different interest rate environments and manage reinvestment risk more effectively. As bonds in the ladder mature, the proceeds are reinvested in new bonds, maintaining the ladder structure. Active trading involves buying and selling discount bonds frequently in an attempt to profit from short-term price fluctuations. This strategy requires a deep understanding of the bond market and the factors influencing bond prices. It is typically more suitable for experienced investors who are comfortable with the risks associated with frequent trading. Bond swapping is when an investor sells one bond and uses the proceeds to purchase another bond with similar characteristics but a more attractive yield or risk profile. This approach allows investors to improve the overall quality of their bond portfolio or take advantage of market inefficiencies without significantly altering their investment exposure. The primary market is where new bonds are issued and sold to investors. Investors can purchase discount bonds directly from the issuer or through a financial intermediary, such as a broker or investment bank. Primary market purchases often involve larger investment minimums and may require the assistance of a financial professional. The secondary market is where previously issued bonds are bought and sold among investors. Discount bonds can be purchased on the secondary market through brokers, online trading platforms, or financial advisors. Secondary market purchases typically offer more flexibility in terms of investment amounts and can be an attractive option for smaller investors or those seeking specific bond issues. Bond funds and exchange-traded funds (ETFs) are another way to invest in discount bonds. These funds pool investors' money and use it to purchase a diversified portfolio of bonds, including discount bonds. Investing in bond funds or ETFs can provide diversification benefits, professional management, and lower transaction costs than individual bond investments. The interest earned on discount bonds is generally subject to federal income tax. However, some types of discount bonds, such as municipal bonds, may be exempt from federal and, in some cases, state and local taxes. Investors should consult a tax professional to understand the specific tax implications of their discount bond investments. When a discount bond is sold or matures, the investor may realize a capital gain, which is the difference between the bond's purchase price and its sale or redemption price. Capital gains are generally subject to capital gains tax, with rates depending on the investor's income level and the holding period of the investment. Certain discount bonds, such as municipal bonds, may offer tax-exempt income, making them an attractive option for investors seeking tax-advantaged income. Tax-exempt bonds are generally exempt from federal income tax and may also be exempt from state and local taxes, depending on the investor's residence and the issuing municipality. A discount bond is a debt security sold at a price below its face value, offering capital appreciation upon maturity. Interest rate fluctuations and credit quality influence bond prices. Types of discount bonds include zero-coupon bonds, municipal discount bonds, corporate discount bonds, and treasury discount bonds. Investing in discount bonds offers capital appreciation potential, lower initial investment requirements, portfolio diversification, and potential tax benefits. Risks associated with discount bonds include interest rate risk, credit risk, liquidity risk, and reinvestment risk. Calculating yield involves metrics like yield to maturity, current yield, yield to call, and yield to worst. Discount bond trading strategies include buy and hold, bond laddering, active trading, and bond swapping. Discount bonds can be bought in the primary market, secondary market, or through bond funds and ETFs. Tax implications include taxation on interest, capital gains, and the availability of tax-exempt bonds.What Is a Discount Bond?

Types of Discount Bonds

Zero-Coupon Bonds

Municipal Discount Bonds

Corporate Discount Bonds

Treasury Discount Bonds

Reasons for Discount Bond Issuance

Interest Rate Fluctuations

Credit Risk

Market Demand

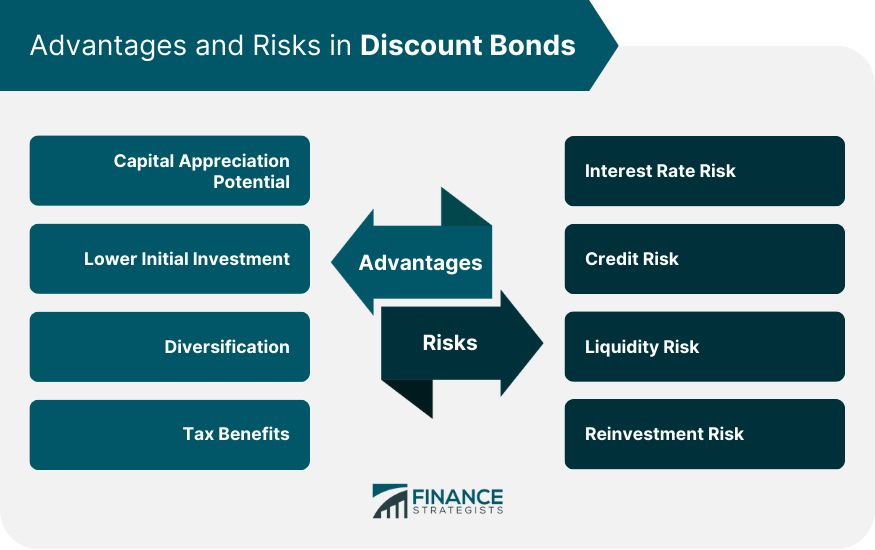

Advantages of Investing in Discount Bonds

Capital Appreciation Potential

Lower Initial Investment

Diversification

Tax Benefits

Risks Associated With Discount Bonds

Interest Rate Risk

Credit Risk

Liquidity Risk

Reinvestment Risk

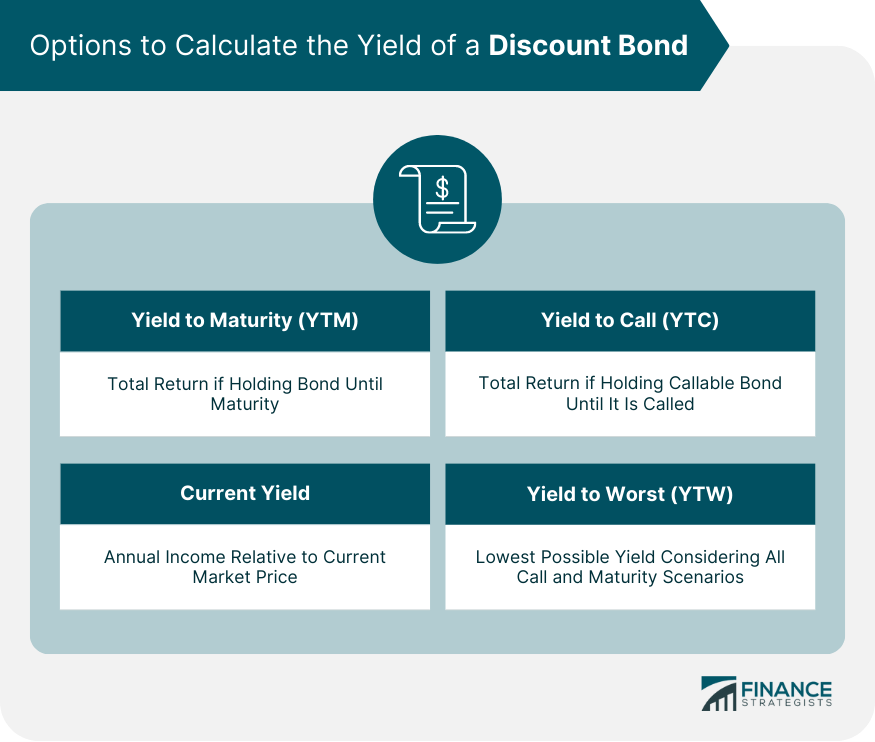

Calculating the Yield of a Discount Bond

Yield to Maturity (YTM)

Current Yield

Yield to Call (YTC)

Yield to Worst (YTW)

Discount Bond Trading Strategies

Buy and Hold

Bond Laddering

Active Trading

Bond Swapping

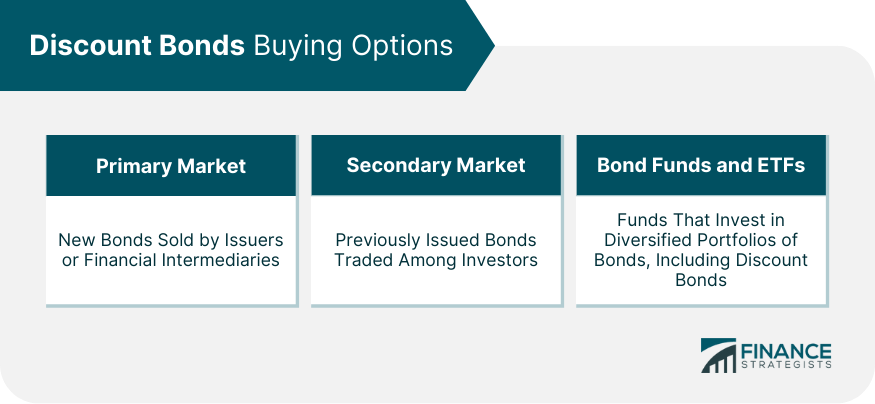

How to Buy Discount Bonds

Primary Market

Secondary Market

Bond Funds and ETFs

Tax Implications of Discount Bonds

Taxation on Interest

Taxation on Capital Gains

Tax-Exempt Bonds

Conclusion

Discount Bond FAQs

A discount bond is a type of bond that is sold at a price below its face value or par value.

A discount bond is initially sold at a discounted price, and the investor receives the bond's face value when it matures. The difference between the purchase price and the face value represents the investor's return or interest.

Discount bonds are sold below face value because their coupon rates are lower than prevailing market interest rates, making them less attractive to investors.

The yield of a discount bond is calculated by dividing the annual interest payment by the purchase price, and then multiplying by 100 to get a percentage.

Investing in discount bonds carries risks such as interest rate risk, where rising interest rates can reduce the bond's market value. Additionally, discount bonds may have a longer time horizon for investors to receive the full face value, which increases the risk of inflation eroding the purchasing power of future cash flows.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.