A Federal Housing Administration (FHA) loan is a mortgage insured by the FHA. It is viable for people who might not qualify for traditional mortgages because FHA loans have a lower credit score and down payment requirements. The federal government does not provide FHA loans, but it guarantees them. This insurance policy from the government protects lenders in case of any unforeseen defaults on payments. For this reason, FHA-approved banks, credit unions, and online lenders are willing to give more favorable terms for borrowers who might ordinarily not qualify for a conventional home loan. Have questions about FHA Loans? Click here. FHA loans are designed to help people who may not qualify for conventional mortgages to become homeowners. Here is how it works: Loan Term: FHA loans are available in 15-year and 30-year terms with fixed interest rates. Interest Rate: FHA loans have fixed interest rates applicable for the entire loan duration. Mortgage Insurance Premium (MIP): FHA mortgage insurance protects the lender from loss in case of borrower default. This insurance is mandatory for most loans where borrowers put down less than 20%. FHA loans also require two mortgage insurance premiums: Upfront Premium of 1.75% of the loan amount Annual Premium ranging from 0.45% to 1.05% of the loan amount, depending on loan terms FHA mortgage insurance premiums can be canceled if the borrower has financed 90% or less of the property's value. During the Great Depression in 1934, the U.S. housing industry faced a crisis. Default and foreclosure rates had surged, demanding a whopping 50% down payment, and mortgage terms were unaffordable for ordinary wage earners. Consequently, most households in the country were renters. To address this issue, Congress established the FHA, which aimed to decrease the risk to lenders and simplify the loan qualification process for borrowers, thereby encouraging more people to buy homes. According to the Federal Reserve Bank of St. Louis, home ownership steadily increased until it hit an all-time high in 2004 at 69.2%, even though there was a slight decrease by the first quarter of 2023 when it reached 66%. Several types of FHA loans are available to assist potential homebuyers. These include: A traditional mortgage is a type of loan used to purchase a home. The payments are made up of principal and interest. Traditional mortgages also require a down payment, usually 20% of the home's purchase price. Senior citizens aged 62 and above can tap into their home equity through the reverse mortgage program while remaining property owners. They may receive the funds as monthly payments or a line of credit. The loan features a fixed interest rate and a specified loan term, allowing borrowers to have a predetermined monthly payment and interest rate throughout their mortgage repayment. An adjustable-rate mortgage, or ARM, is a loan with an interest rate that may vary over time. It typically has a fixed rate for an initial period. This may rise or fall, resulting in possible changes to monthly payments. Section 245(a) is a home loan known as a graduated payment mortgage (GPM) or growing equity mortgage. It is designed for borrowers anticipating an increase in their income over time. It allows them to obtain a single-family home mortgage with a graduated monthly payment. This type of loan is ideal for anyone looking to purchase a property requiring renovations, as the borrowed amount covers all expenses related to repairs and upgrades. This program is comparable to the FHA 203(k) improvement loan program. Specifically, it focuses on upgrades that can result in energy conservation, such as installing solar or wind energy systems or adding new insulation. The following are the basic eligibility requirements for obtaining an FHA loan: The minimum required down payment for an FHA loan is 3.5% of the purchase price or appraised value of the home, whichever is less. However, borrowers can pay higher down to lower their monthly mortgage payments. The minimum credit score required for an FHA loan is typically 580 or higher. However, some lenders may require a higher score, and borrowers with lower credit scores may still be eligible for an FHA loan but may be required to make a higher down payment. FHA lenders will review the borrower's credit history to ensure that they have a good track record of paying their bills on time and not defaulting on previous loans. Borrowers with a history of bankruptcy or foreclosure may still be eligible for an FHA loan but may be required to wait a certain amount before applying. FHA lenders will verify the borrower's employment history to ensure that they have a stable income and can make monthly payments. Borrowers who are self-employed may be required to provide additional documentation to verify their income. Borrowers must have sufficient income to cover their monthly mortgage payments and other expenses. FHA lenders typically use a debt-to-income ratio (DTI) to determine if a borrower has enough income to qualify for a loan. The maximum DTI ratio for an FHA loan is 43%. FHA loans require borrowers to pay mortgage insurance premiums, which protect the lender in case the borrower defaults on the loan. The mortgage insurance premium can be paid upfront or added to the loan amount, and the amount depends on the size of the down payment and the loan term. Borrowers must pay the mortgage insurance premium for the life of the loan. The FHA sets loan limits that are adjusted annually, starting every January 1st. The FHA loan limits are adjusted across all metropolitan areas. As of 2024, if your home is located in an area with higher housing costs, such as Hawaii and Alaska, you will be eligible for up to $1,149,825 through an FHA loan. However, those residing in locations where real estate prices have not surged quite as significantly may qualify for a maximum amount of $498,257. Ultimately, what applies to your situation depends on the locality in which you reside. An FHA loan approval is valid for 90 days from the date of issuance. This means that the loan approval will expire within 90 days. The borrower must close the loan within the validity period, otherwise, he will need to reapply. The FHA loan approval may entail other requirements, such as a satisfactory home appraisal. Home appraisals, on the other hand, are valid for 180 days from the effective date of the appraisal report. Homeowners with FHA loans who have encountered a genuine financial hardship, such as an income loss or increased living expenses, may qualify for loan relief. The FHA Home Affordable Modification Program (HAMP) can help reduce your mortgage payment to a more manageable amount. To become fully enrolled in this program and secure modified payments permanently, you must first make three consecutive trial payments at the reduced amount. There are several advantages of obtaining an FHA loan, including: Low Down Payment: FHA loans require a lower down payment than conventional loans. Borrowers can put down as little as 3.5% of the purchase price, making it easier for first-time homebuyers or those with limited funds to purchase a home. Lenient Credit Requirements: FHA loans have more lenient credit requirements than conventional loans. Borrowers with a lower credit score or limited credit history may still be eligible for an FHA loan. Assumable: FHA loans are assumable, which means that if the borrower decides to sell the home, the buyer can assume the existing FHA loan. This can be a valuable feature if interest rates have increased since the original loan was obtained. Fixed Interest Rates: FHA loans offer fixed interest rates, which means that the interest rate will not change over the life of the loan. This can provide peace of mind for borrowers concerned about interest rate fluctuations. Low Debt-To-Income Requirement: The DTI compares monthly debt payments to gross income. To calculate, divide total monthly debt payments by monthly gross income. FHA mortgages offer a 43% DTI that can be negotiated based on other factors. While there are advantages to obtaining an FHA loan, there are also some potential drawbacks to consider, including: Mortgage Insurance Premiums: FHA loans require borrowers to pay a mortgage insurance premium for the duration of the loan. This can add to the overall cost of the loan and make monthly payments higher than a conventional loan. Limits on Loan Amounts: FHA loans limit the amount that can be borrowed, which can vary based on the location and property type. This may limit the options for borrowers looking to purchase a higher-priced home. Additional Fees: FHA loans may have additional fees and costs aside from the upfront and annual MIP fees. Other closing costs may also be incurred. These costs can add up and increase the overall cost of the loan. Limited Loan Options: FHA offers a 15-year or 30-year fixed mortgage. There may be situations where borrowers would benefit from other loan options like interest-only loans. The Federal Housing Administration loan is a type of mortgage insured by the government and designed for borrowers who may not qualify for conventional loans. FHA loans are available in 15-year and 30-year terms with fixed interest rates. They require mortgage insurance premiums that may be canceled if the borrower has financed 90% or less of the property’s value. Various types of FHA loans are available, including traditional mortgages, home equity conversion mortgages, fixed-rate FHA, Section 245(a) loans or graduated payment mortgages, FHA 203(k) improvement loans, and FHA energy efficient mortgages. The eligibility requirements for obtaining an FHA loan include a minimum required down payment of 3.5% of the purchase price or appraised value, a minimum of 580 credit score, and a debt-to-income ratio of 43%. Homeowners with FHA loans who may have suffered a genuine economic hardship, including an income drop or extra costs of living, are eligible to receive loan relief. Approval for such assistance is valid for 90 days upon application.What Is a Federal Housing Administration (FHA) Loan?

How the Federal Housing Administration (FHA) Loan Works

History of the Federal Housing Administration (FHA) Loan

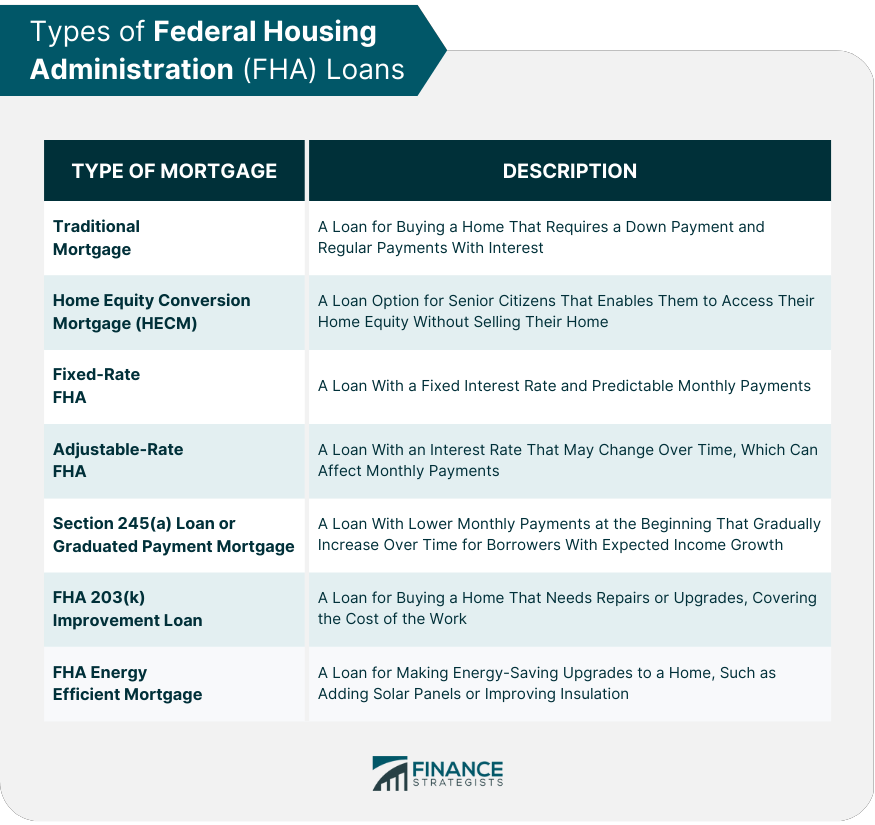

Types of Federal Housing Administration (FHA) Loans

Traditional Mortgage

Home Equity Conversion Mortgage (HECM)

Fixed-Rate FHA

Adjustable-Rate FHA

Section 245(a) Loan or Graduated Payment Mortgage

FHA 203(k) Improvement Loan

FHA Energy Efficient Mortgage

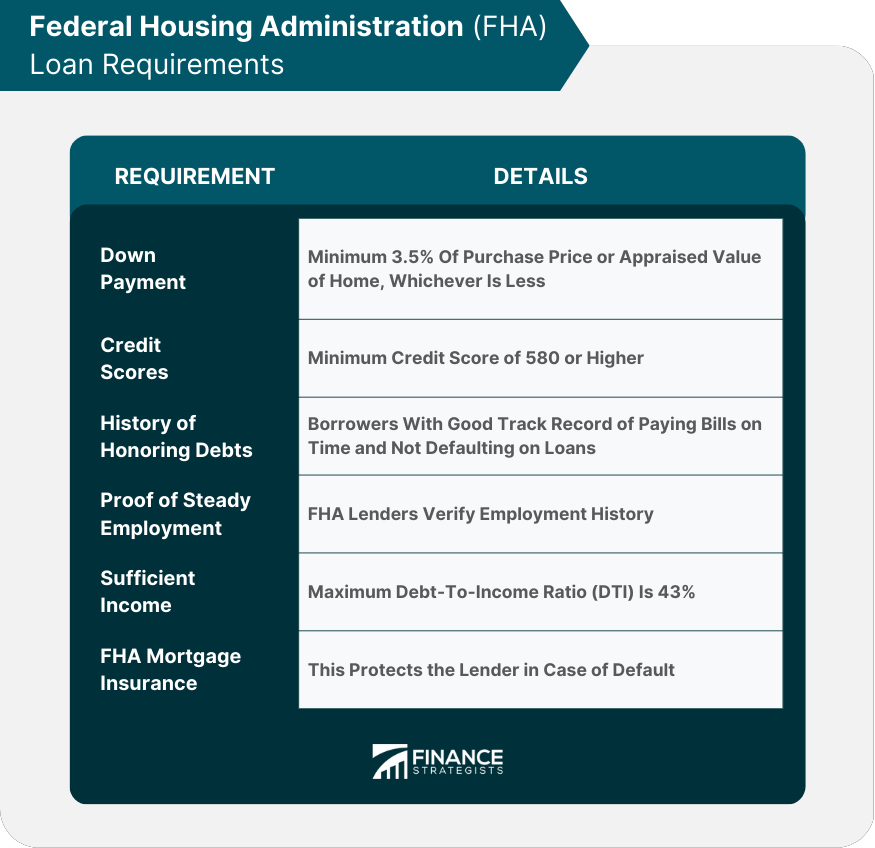

Requirements for Federal Housing Administration (FHA) Loan

Down Payments

Credit Scores

History of Honoring Debts

Proof of Steady Employment

Sufficient Income

FHA Mortgage Insurance

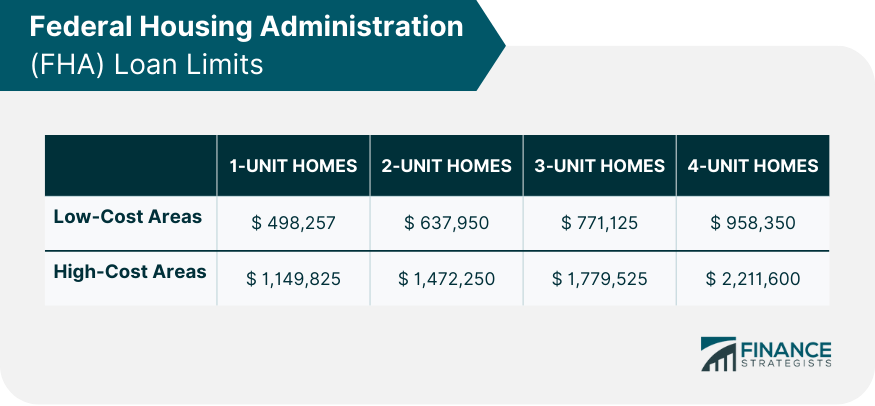

Federal Housing Administration (FHA) Loan Limits

Federal Housing Administration (FHA) Loan Approval

Federal Housing Administration (FHA) Loan Relief

Advantages of Federal Housing Administration (FHA) Loans

Disadvantages of Federal Housing Administration (FHA) Loans

Final Thoughts

Federal Housing Administration (FHA) Loan FAQs

To apply for an FHA loan, you must provide the necessary financial documents to your chosen lender. The lender will prepare the comprehensive loan estimate.

A person who can meet the eligibility requirements may qualify for an FHA loan. These are the requirements: (1) a minimum required down payment of 3.5% of the purchase price or appraised value, (2) a minimum of 580 credit score, and (3) a debt-to-income ratio of 43%.

FHA has set loan limits depending on the home purchase type and the property's area or location. This can range from $472,030 (1-unit property at a low-cost area) to $2,095,200 (4-unit property at a high-cost area).

The drawbacks of FHA are (1) mortgage insurance premiums which can be considered as additional costs, (2) there are limits on the loan amounts, (3) additional closing fees may be incurred, and (4) there are limited loan options available.

An FHA Approval is valid for 90 days from the issuance date. The borrower must complete the loan process within 90 days, otherwise he will need to reapply.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.