A financial advisor is a professional that helps individuals or businesses achieve their personal financial goals by providing guidance. Their job is to help people manage their money, with the ultimate goal of optimizing wealth over time. Financial advisors provide guidance to clients, usually on a fee basis. Generally, a client comes to a financial advisor with an issue involving the client's finances. For example, when there is major life change such as buying or selling of real estate property, planning for retirement, education planning for children and so on. The client may need help in managing his or her assets in order to meet future goals. Have a financial question? Click here. A financial advisor is important because they can help individuals and families make informed choices about their money. Advisors have the training and experience to assess a client's situation and recommend appropriate courses of action. Advisors can help clients save money, invest for the future, and avoid costly mistakes. There are several types of financial advisors according to the title. These include the following: CPAs are licensed by the state in which they work and must pass an exam in order to become certified. They specialize in accounting and tax planning. CPAs may also offer financial planning services, but they are not required to do so. CFPs are certified by the Certified Financial Planner Board of Standards, Inc. They specialize in comprehensive financial planning, which includes investment planning, retirement planning, tax planning, and estate planning. RIAs are licensed by the Securities and Exchange Commission (SEC) and must meet certain requirements in order to be registered. They specialize in investment planning and portfolio management. RIAs must act in the best interests of their clients, which is called a fiduciary duty. CFA is a member of the CFA Institute. They specialize in investment planning, particularly for portfolios that include investments other than stocks and bonds. They also provide asset management services for clients with large sums of investable assets. They specialize in life insurance planning and risk management for businesses. CLUs may also offer investment and retirement planning services depending on their education and licensing requirements. CMFCs are advisors who have been closely examined on their knowledge of mutual funds. They help clients choose a portfolio of mutual funds based on the client's needs and objectives. They specialize in risk management for businesses. FRMs are licensed by the insurance industry and have extensive training in derivatives, options, hedging strategies, swaps, futures contracts, credit risk analysis and other complex financial instruments. They specialize in providing financial planning and investment management services to high-net-worth clients. Choosing a financial advisor can be difficult, especially since there are so many types of advisors with various specialties. Before choosing an advisor, identify your needs and then select an advisor that meets those needs. Here are some tips when selecting a financial advisor: Make sure the professional you choose has been properly licensed and registered. It is important to verify that they have passed required examinations in order to do their job legally. There should not be any hidden fees, and he or she should fully disclose all costs and commissions associated with their services. Regardless of what kind of service agreement you sign, make sure it states clearly how much money you will be paying the advisor. If you don't know where to start, ask family and friends if they have a financial advisor they recommend. Advisors may be subject to disciplinary action by their state licensure board or the SEC. You can check with these agencies to see if any complaints have been filed against them. If you are thinking about hiring an advisor to help with investments, talk to an accountant, attorney or estate planner to get their opinion on the best person for the job. Advisors typically charge by the hour, by the amount of assets they manage, or a combination of the two. Make sure that you are on the same page with your advisor about your risk tolerance and investment goals. It is essential to realize the value of the services provided by financial advisors. If you're thinking about hiring one, read this article to learn how to ask better questions and choose the right advisor for you: Financial Advisor Fees Financial advisors can provide valuable services when it comes to financial planning and investment management. By taking the time to research and interview different professionals, you can find an advisor who is a good fit for your needs. Importance of a Financial Advisor

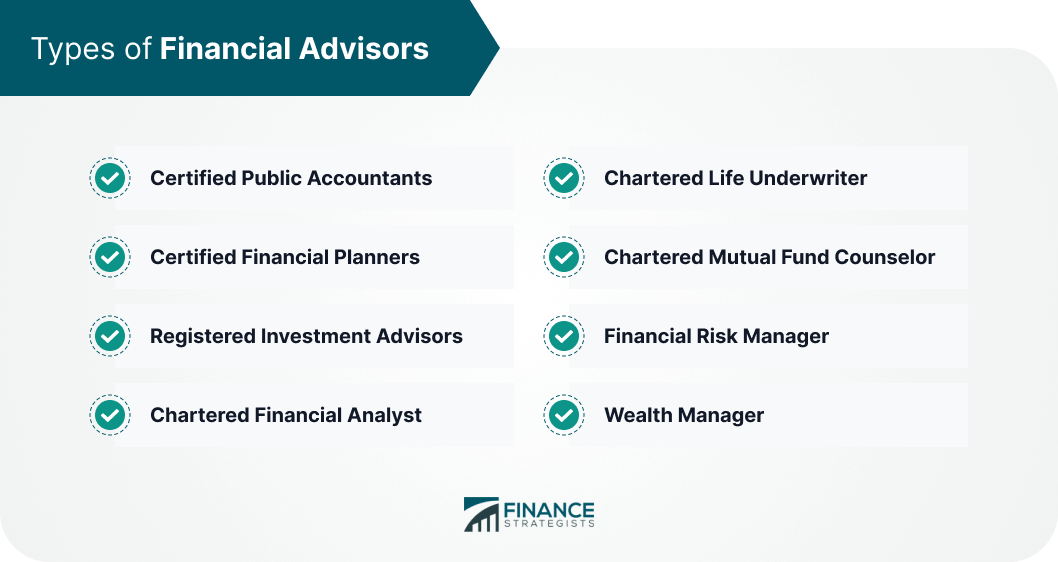

Types of Financial Advisors

Certified Public Accountants

Certified Financial Planners

Registered Investment Advisors

Chartered Financial Analyst

Chartered Life Underwriter

Chartered Mutual Fund Counselor

Financial Risk Manager

Wealth Manager

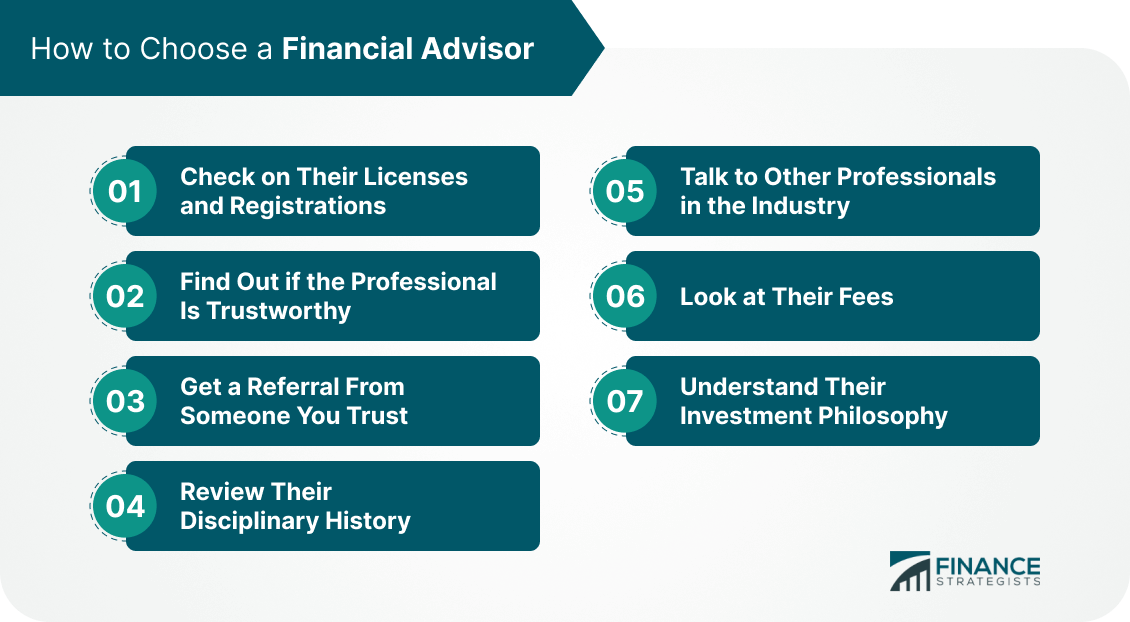

How to Choose a Financial Advisor

Check on their licenses and registrations.

Find out if the professional is trustworthy.

Get a referral from someone you trust.

Review their disciplinary history.

Talk to other professionals in the industry.

Look at their fees.

Understand their investment philosophy.

Final Thoughts

Understanding Financial Advisor Titles FAQs

A Financial Advisor typically provides advice on investments, insurance, and retirement accounts but may not be licensed or regulated. A Certified Financial Planner (CFP) has passed rigorous exams administered by the CFP Board of Standards and is required to adhere to certain ethical standards.

Investors should look for advisors who have the appropriate professional credentials, such as certifications or designations, to ensure they are qualified to provide competent advice. Additionally, investors can check with regulatory bodies such as FINRA and the SEC to verify an advisor's credentials.

A Registered Investment Advisor (RIA) is an individual or firm that has registered with the SEC or state securities regulators and provides advice on investments, tax planning, estate planning, and retirement planning. They are held to a fiduciary standard, meaning they must always act in their client's best interests.

A Financial Advisor typically provides advice on investments, insurance, and retirement accounts but may not be licensed or regulated. A Broker is an individual or firm that buys and sells securities such as stocks, bonds, and mutual funds for customers. Brokers often receive commission-based compensation and are not required to adhere to the same fiduciary standard expected of financial advisors.

It depends on an individual's specific needs and goals. Fee-Only Advisors typically do not receive any commission-based compensation but may charge a flat fee or an hourly rate for their services. Fee-Based Advisors, on the other hand, may receive both commissions and fees from clients; however, they are held to the same fiduciary standard as Fee-Only Advisors. Ultimately, it is important to understand how each type of advisor charges before deciding.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.