A gift tax is a levy imposed by the federal government on individuals who transfer large amounts of money or property to others without payment or commensurate value. It applies to all gifts made during a person's lifetime. Gift tax is demanded to prevent individuals from avoiding estate taxes by transferring their wealth during life rather than at death. The tax is typically imposed on the donor, depending on the gift amount and the recipient. Generally, the Internal Revenue Service (IRS) requires taxpayers to declare and pay taxes on any gifts they bestow that exceed the exclusion amount. Gift tax can range from 18% to 40% of the gift value. Have questions about gift taxes? Click here.

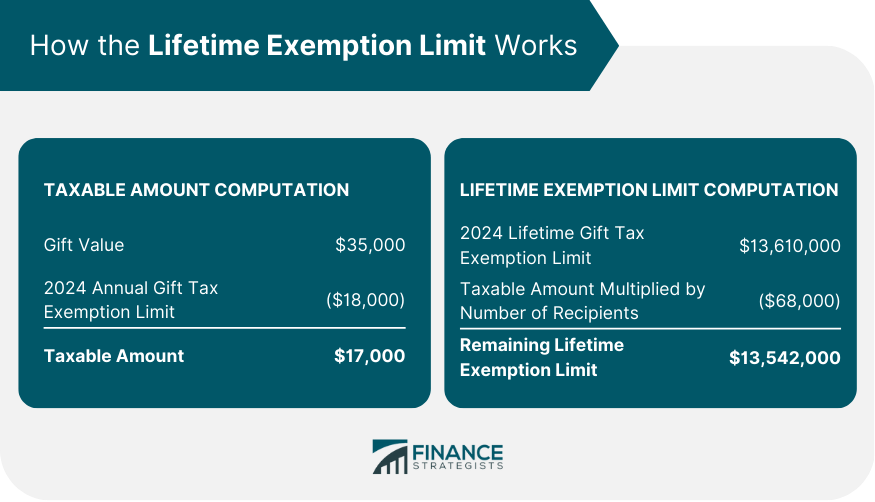

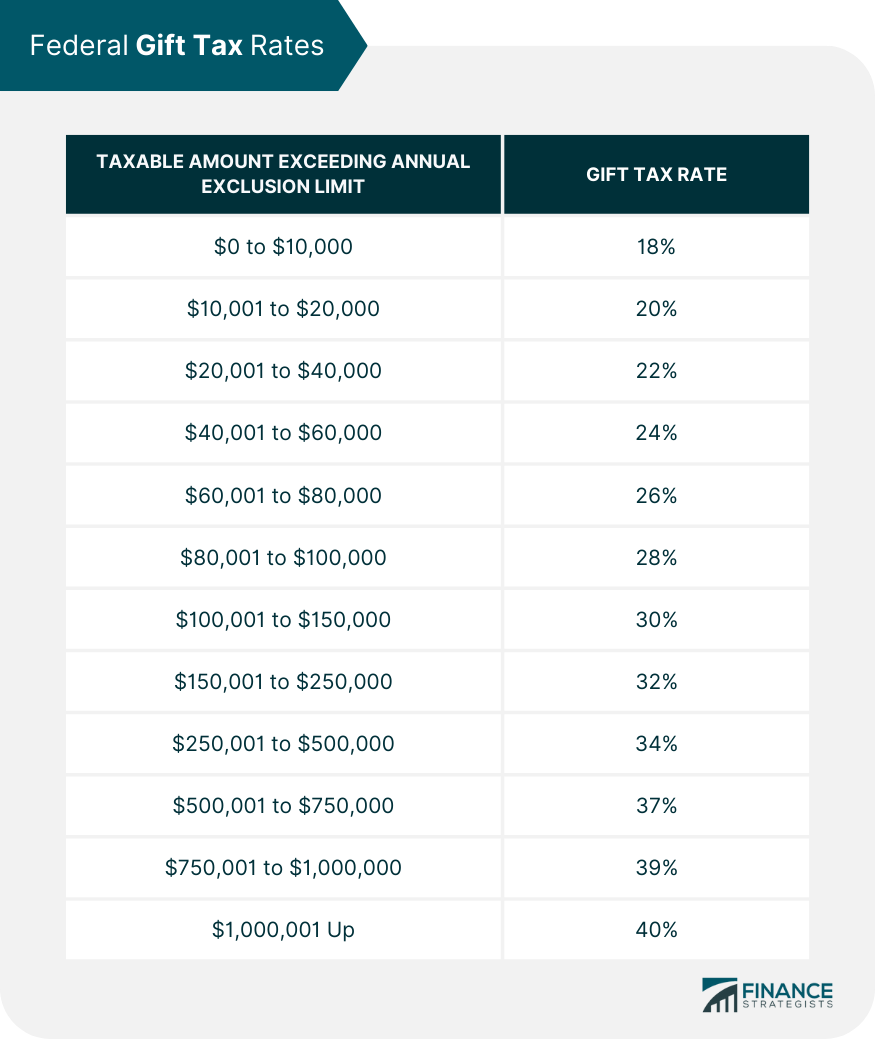

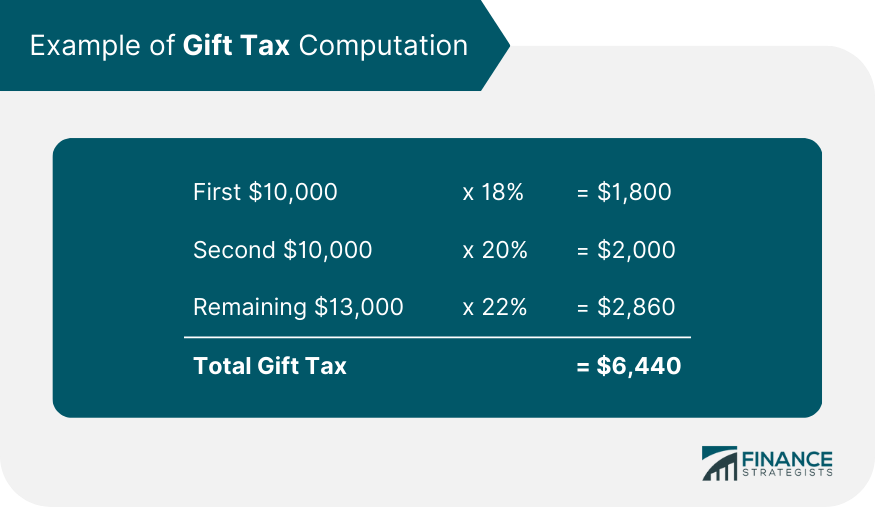

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I had the opportunity to assist a couple approaching retirement in navigating the intricacies of capital gains tax on their investment property. Utilizing a Section 1031 exchange allowed them to reinvest the proceeds from their sale into a similar property, thereby deferring capital gains taxes. This approach protected their savings and made it easier for them to move to a property that better suited their needs, improving their financial situation for retirement. If you are considering selling an investment property, I can guide you through the process and help you make the most out of your investments. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Anything considered of value can constitute a gift, including cash, checks, stocks, real estate, cars, jewelry, art, or antiques, as long as it is given for free or paid at less than the fair market value. Gift tax is levied depending on the item's value, use, and the recipient. However, there are some recipients or instances of gifts that are exempt from gift tax. These include anything given to a spouse, as long as they are a U.S. citizen, gifts to dependents, charitable or religious donations, and gifts to political organizations. Gifts for educational purposes are exempt if they are used for tuition expenses paid directly to the school or university. It does not include miscellaneous costs like books, uniforms, or dorms. Funds paid directly to medical providers on behalf of someone else are also excluded. The IRS uses two measures to determine whether your gifts are taxed and by how much: the annual and the lifetime gift tax limits. The annual gift tax limit specifies the amount you can give per person per year. Exceeding it does not automatically trigger taxes. Anything over that amount must first be reported to the IRS and then considered against your lifetime limit. The gift tax is levied after considering the two limits combined. You will only be charged the additional tax when the lifetime limit is exhausted. The gift tax is calculated based on the surplus amount. Remember that the donor or giver is typically responsible for the gift tax. However, recipients may volunteer to pay the taxes, depending on their agreement with the donor. Recipients may also pay other taxes based on capital gains if they sell the gift later. The IRS annual gift tax limit is $17,000 for 2023 and $18,000 for 2024. It covers both cash and non-cash items as long as they are not considered taxable income for the recipient. Gifts within these amounts will not be taxed. For example, if a grandfather gave $15,000 each to his four grandchildren on their birthdays in 2024, he would not need to pay gift taxes since those are below the $18,000 annual limit per recipient. Suppose he bought a $35,000 car for each of his grandchildren in 2024. He may be charged gift taxes because he eclipsed the $18,000 exemption per recipient. The excess $68,000 ($17,000 x 4 grandchildren) must be reported to the IRS and considered against his lifetime gift tax limit. All amounts over the annual limit are juxtaposed against the lifetime limit. The 2023 limit is $12.92 million, while in 2024, the lifetime limit is $13.61 million. Take the 2024 example above. The grandfather exceeded the annual limit by $17,000 for each of his grandchildren. Suppose further that this was his first time giving anything to anyone. The combined $68,000 is considered against the lifetime limit of $13.61 million. He will not need to pay gift taxes. Instead, the $68,000 is subtracted from the lifetime gift tax limit, meaning the grandfather has approximately $13.54 million left in his gift tax exemption. The amount of taxes a donor pays depends on the value of their gifts and the applicable tax rate. If you are a donor, it is easy to compute how much you need to pay when you exceed the IRS gift tax limits. These marginal rates range from as low as 18% to a maximum of 40% of the excess amount. Suppose you have exhausted the lifetime tax exemption of $12.92 million in 2023. You give a nephew $50,000 for his wedding. To calculate your gift tax liability, use the following tax bracket: Subtract the $17,000 annual gift tax exemption allowed per recipient from the $50,000 you gave your nephew. The $33,000 in excess will be taxed as follows: the first $10,000 will be subject to an 18% rate, the second $10,000 at 20%, and the remaining $13,000 will be charged 22%. You will need to pay a total gift tax of $6,440. By understanding the intricacies of the gift tax, you can lessen liability or avoid them altogether by using the following techniques: Gift splitting allows married couples to split gifts between them and double their annual exclusion amount. You can split gifts over your yearly limit with your spouse to reduce or avoid a potential gift tax liability. Remember that each person has an annual gift tax limit, meaning you have $17,000 to give per recipient in 2023. Your spouse also has $17,000 to bestow, raising your yearly limit to $34,000 per recipient. A gift in trust is a financial arrangement wherein the donor transfers assets to a third party—called a trustee—who holds and manages the assets on behalf of another person, called the beneficiary. For example, parents typically use a Crummey trust to provide children with lifetime gifts and avoid gift tax responsibility by limiting the amount the children can access based on the annual gift tax limits set by the IRS. Gifts in trust allow beneficiaries to withdraw assets within a limited period, giving them what the IRS calls a present interest in the trust. This distribution type qualifies as a non-taxable gift. You can use this trust to give assets without exceeding your annual exclusion amount. This strategy revolves around the annual gift tax limit. Since the IRS resets the limit yearly, you can make gifts up to your annual limit in successive years. Timing your gifts according to the reset of annual limits is essential. For instance, if you want to give a considerable amount to a person but do not want it to be taxable, you can spread out your gifting over several years. This way, the total amount of all the gifts would be within what is allowed for any given year. The gift tax is a way the government taxes citizens by levying on any transfer of assets to an individual that is free or paid below fair market value. It is affected by limits set by the IRS, which updates the amounts yearly. For 2024, the annual gift tax limit is $18,000, while the lifetime limit is $13.61 million. Understanding how gift tax works and using strategies such as gift splitting, giving in trust, and structuring your gifts can help you lower or avoid any potential liabilities that come with gifting large amounts of money. Remember your annual and lifetime limits when making your next gift to ensure that it will not be taxed. Speak to a financial advisor or tax accountant for further guidance on relevant tax services and what steps you can take to reduce or avoid tax liability.What Is a Gift Tax?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

What Gifts Are Exempted From Taxes?

How a Gift Tax Works

Annual Gift Tax Limits

Lifetime Gift Tax Limit

Gift Tax Calculation

Strategies to Avoid Gift Tax

Gift Splitting

Gift in Trust

Structuring Gifts

Final Thoughts

Gift Tax FAQs

A gift tax is a type of federal tax levied on gifts made to specific individuals. It applies to money and other property given as presents, including real estate. The Internal Revenue Service (IRS) imposes gift taxes on the donor based on annual and lifetime limits.

The amount of gift tax owed depends on the value of the gift and the annual and lifetime limits. Exceeding such limits can trigger the gift tax. Rates vary from 18% to 40%.

The donor, or giver of the gift, is typically responsible for paying the gift tax.

No, you are not usually responsible for paying taxes on a gift. The donor must pay the associated tax if either annual or lifetime limits are exceeded, unless you volunteer to pay it on their behalf. You may also pay capital gains tax if you sell the gift later.

You can avoid the gift tax by not exceeding the annual and lifetime limits. Additionally, some gifts are not included in the calculation of gift taxes, such as those made to a spouse or qualified charities. Some strategies may also allow you to reduce your potential liability for gift taxes, like splitting with a spouse, structuring gifts, and gifts in trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.