The term Alternative Investments refers to the types of investments that do not fall in the traditional categories of: Unlike these conventional assets which are typically readily available to the general public, alternative investments often have restrictions in terms of accessibility and liquidity. The allure of alternative investments lies in their potential to provide investors with returns that aren't closely correlated with mainstream investments. This means they can offer unique diversification benefits within a broader investment portfolio. These investments offer a buffer against market uncertainties, and their growth is a testament to the evolving nature of the investment world, reflecting a more sophisticated and diverse marketplace. A few drawbacks to Alternative Investments include that they often require a lot of capital to invest (such as the case with venture capital) and that they are often unregulated. Because Alternative Investments are often unregulated, there is more room for fraudulent financial reporting and misappropriation of assets. The Chartered Alternative Investment Analyst Association was privately developed in the United States in 2002 for the furthering of research and ethics within the profession. It represents an early attempt to bring regulation to this field. Here are examples of Alternative Investments: Hedge Funds are pooled investment vehicles that employ a wide array of strategies to achieve returns for their investors. Unlike traditional mutual funds, hedge funds are less regulated, which gives them the flexibility to pursue aggressive investment strategies, including short selling, derivatives trading, and leverage. This potential for high returns, however, comes with increased risks. Managed by hedge fund managers who are often seen as industry experts, these funds cater primarily to institutional investors and high-net-worth individuals due to their high minimum investment thresholds. Private Equity refers to a type of investment that involves purchasing shares in private companies – those not listed on public exchanges. The goal of private equity firms is to acquire undervalued or underperforming companies, improve their operations and profitability, and eventually sell them for a profit. This process can span several years. There are different strategies within private equity, including leveraged buyouts, growth capital, and distressed asset acquisitions. Investors in private equity are usually institutional entities, like pension funds or university endowments, and high-net-worth individuals. The allure of private equity lies in the potential for high returns, but it's also accompanied by increased illiquidity and longer investment horizons. Venture Capital is a subset of private equity, with a focus on investing in startups and small companies with strong growth potential. Venture capitalists provide the necessary capital to these fledgling businesses in exchange for equity, hoping that one or more of these enterprises will become successful and deliver substantial returns. For example, if an investor made an investment in a venture capital fund that focuses on research startups, and one of the investments recently developed a cure for the common cold, then that investor would experience a significant return on investment even if the stock market was declining. The ultimate goal for venture capitalists is to exit their investment through means like an initial public offering (IPO) or a buyout, realizing a significant profit in the process. Commodities encompass a broad range of raw materials and primary agricultural products that can be bought and sold. These are typically divided into two main categories: hard and soft commodities. Hard commodities include natural resources like oil, gold, and metals, which are mined or extracted. Soft commodities, on the other hand, refer to agricultural products such as wheat, coffee, and cotton. Investing in commodities offers a unique diversification advantage. Since their prices are often driven by supply and demand dynamics distinct from stock and bond markets, commodities can act as a hedge against inflation and currency fluctuations. Investors can gain exposure to commodities through various means, including futures contracts, commodity-focused mutual funds, or exchange-traded funds (ETFs). In a similar way, an investor who invests in oil, which is a relatively volatile commodity, may experience returns that contradict the stock market because oil's value is largely due to geopolitical issues. Many Alternative Investments are not actively traded on public markets, making them harder to acquire for the average investor. These assets often require a different approach compared to traditional investments like stocks and bonds. Alternative Investments encompass a wide range of options such as private equity, real estate, hedge funds, and more. Due to their unique nature, they can offer distinct advantages but also come with their own set of challenges. However, these investments also have weaker or no correlation to the public markets, therefore, they can be a viable strategy for diversifying a portfolio. Portfolio diversification is a fundamental principle in investment management. By adding assets with low or negative correlation to traditional stocks and bonds, investors can potentially reduce overall portfolio risk. This is where alternative investments come into play. Their performance often operates independently from the broader market trends, offering a potential hedge against market volatility. Diversification, at its heart, involves the spreading of investments across various asset classes to reduce exposure to any single asset's potential loss. Because alternative investments usually don't move in tandem with traditional equity and bond markets, they can provide a buffer against the latter's volatilities. For instance, during periods when stocks may be underperforming, investments in commodities or real estate might be experiencing growth, thereby balancing out the portfolio's overall performance. Alternative investments, due to their unique nature and strategies, often present the allure of higher potential returns compared to traditional assets. Take, for instance, venture capital. Investing in a startup in its early stages can be risky, but if the company flourishes and becomes a significant player in its industry, the returns can be astronomical. Similarly, private equity firms often acquire underperforming companies, revamp their operations, and later sell them at a premium, aiming to deliver substantial profits to their investors. Alternative investments can play a vital role in this regard. Many alternative assets, such as hedge funds, employ strategies specifically designed to hedge against market downturns. These strategies might involve short-selling, derivatives trading, or other methods to counterbalance potential losses in other parts of the portfolio. By providing a counterweight against adverse market movements, alternative investments can help reduce the overall risk of an investment portfolio. The returns from alternative investments are often driven by different factors than traditional assets. For instance, while stock market performance might be influenced by corporate earnings, interest rates, and macroeconomic factors, the value of a real estate property might depend on local market conditions, rental incomes, or development prospects. This difference in driving factors means that alternative assets often have a low correlation with traditional investments. Low correlation is advantageous because it means the performance of alternative investments is not tightly tied to that of stocks or bonds. So, when traditional markets face downturns, alternative assets might remain unaffected or even thrive. Unlike stocks or bonds that can be easily sold in financial markets, assets like real estate, private equity, or art can take a considerable amount of time to convert into cash. This illiquidity can be a double-edged sword. While it may protect investors from short-term market fluctuations, it also means they might have difficulty accessing their money when needed. Moreover, this lack of liquidity can sometimes result in assets being sold at a discount, especially if there's an urgent need for funds. For long-term investors, this might not be a pressing concern, but it's a crucial factor to consider for those who might require liquidity in the foreseeable future. Understanding the intricacies of a hedge fund's strategy or the specifics of a private equity deal requires a level of expertise and due diligence. This complexity means that potential investors need to be well-versed with the asset in question or rely heavily on experts, adding another layer of cost and potential risk. Furthermore, the complexity can also translate into a lack of transparency. Without a clear understanding of the investment, gauging its performance, risks, and potential returns can become challenging, potentially leading to unforeseen pitfalls. Unlike traditional investments, which are often subject to strict regulatory reporting requirements, alternative investments can sometimes operate in a more opaque environment. The lack of clarity regarding fees, performance metrics, or underlying strategies can pose challenges for investors. This lack of transparency can sometimes mask underlying risks or costs associated with an investment. It underscores the importance of thorough due diligence and possibly seeking expert guidance before venturing into the realm of alternative assets. Alternative investments can sometimes fall into a regulatory gray area. While there's oversight, the level of scrutiny might not be as stringent as that for traditional assets. This softer regulatory environment can pose both opportunities and risks. On the one hand, it allows for more flexibility in terms of investment strategies. On the other hand, it could lead to potential malpractices or even fraud. Moreover, as the world of finance evolves, regulatory frameworks are continually adapting. Staying compliant requires vigilance, and any lapses can result in hefty penalties or legal repercussions. Alternative Investments encompass a diverse array of non-traditional assets, offering distinctive avenues for portfolio diversification. Defined by their deviation from the conventional categories of income, equity, and cash, these investments often entail varying degrees of liquidity and accessibility restrictions. The allure of Alternative Investments stems from their potential to deliver returns independent of mainstream market trends, effectively mitigating overall portfolio risk. These assets have the capacity to balance market uncertainties due to their inherent lack of correlation with traditional investments. However, challenges such as illiquidity, complexity, lack of transparency, and regulatory intricacies underscore the importance of careful due diligence and expertise. The realm of Alternative Investments showcases a dynamic landscape that provides investors with opportunities for potentially enhanced returns and risk management in an ever-evolving financial environment. Have a financial question? Click here.Alternative Investment Definition

Alternative Investment History

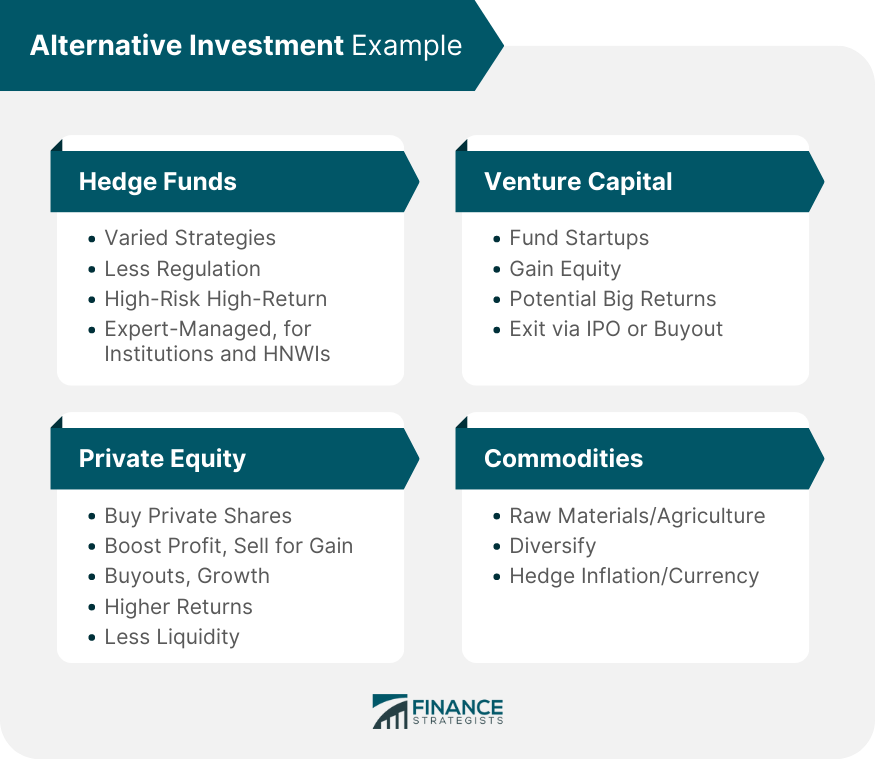

Alternative Investment Example

Hedge Funds

Private Equity

Venture Capital

Commodities

Investing in Alternative Investments

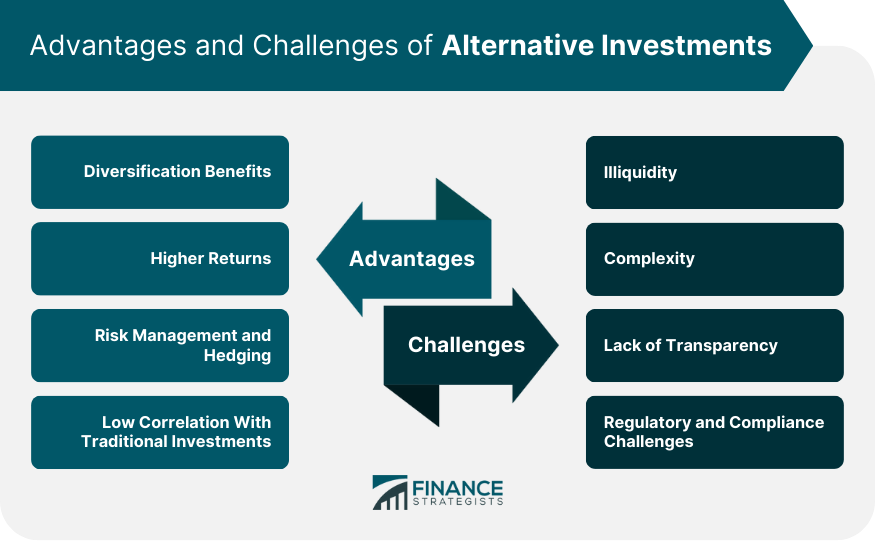

Advantages of Alternative Investments

Diversification Benefits

Higher Returns

Risk Management and Hedging

Low Correlation With Traditional Investments

Challenges of Alternative Investments

Illiquidity

Complexity

Lack of Transparency

Regulatory and Compliance Challenges

Conclusion

Alternative Investment FAQs

The term alternative investment refers to the types of investments that do not fall in the traditional categories of investments, equity, and cash.

Examples of alternative investments include hedge funds, commodities, private equity, and venture capital.

Many alternative investments are not actively traded on public markets, making them harder to acquire for the average investor.

The Chartered Alternative Investment Analyst Association was privately developed in the United States in 2002 for the furthering of research and ethics within the profession.

A few drawbacks to alternative investments are that they often require a lot of capital to invest and that, despite the existence of the association mentioned in question #4, are often unregulated.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.