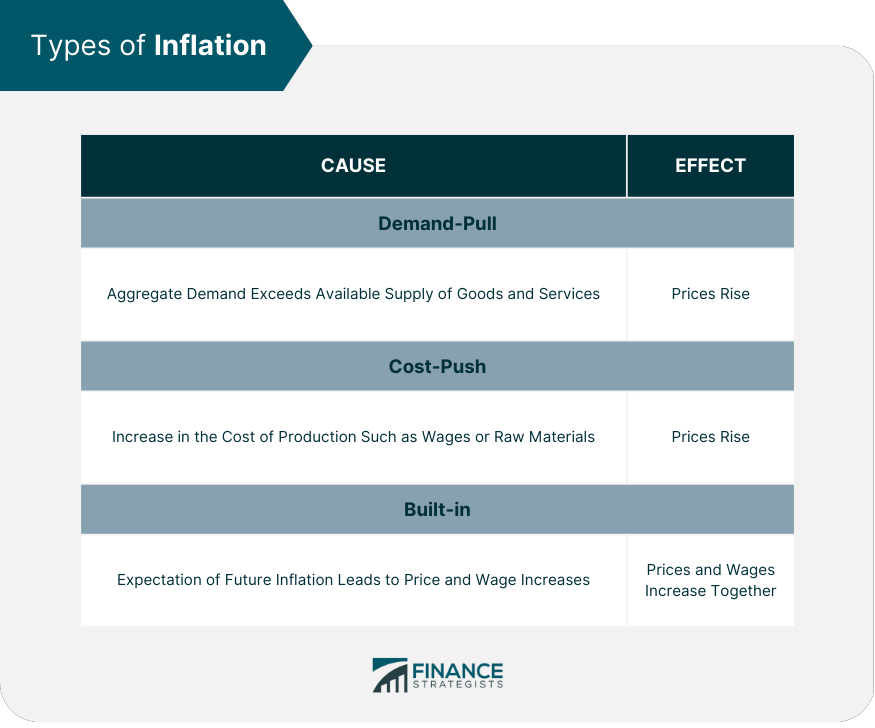

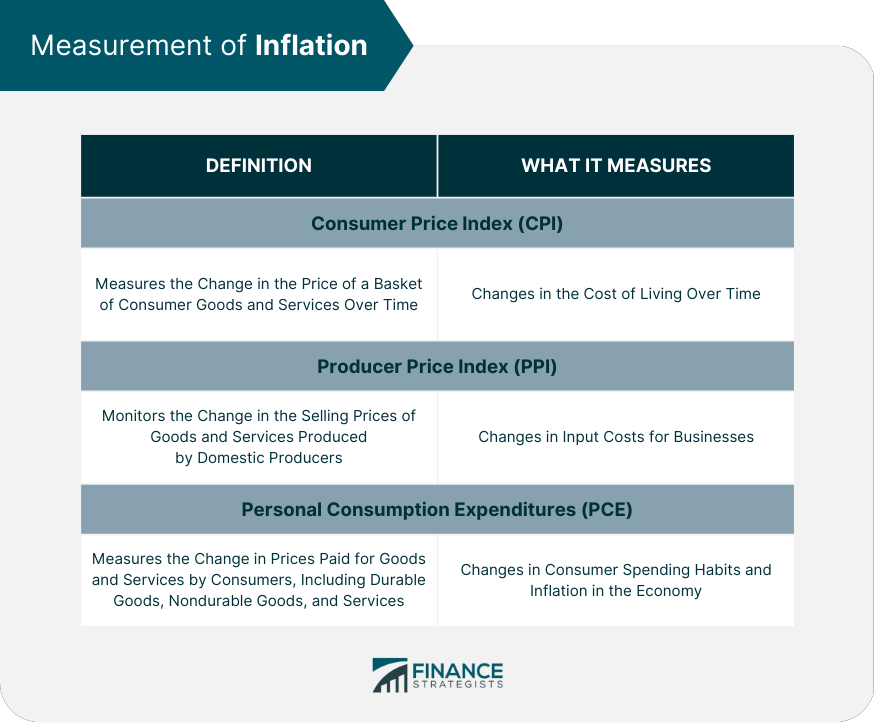

Inflation protection strategies are financial techniques that aim to protect an individual's investments from the negative effects of inflation. These strategies may include investing in assets that appreciate in value, investing in inflation-protected securities, and diversifying investments across different asset classes to hedge against inflation. By incorporating these strategies, investors can help offset the impact of rising prices on their investments and avoid the erosion of their purchasing power. Inflation protection strategies are designed to help investors maintain the value of their wealth and preserve their purchasing power over time. Inflation can erode the value of cash and other traditional investments, making it important to incorporate strategies that can provide a hedge against inflation. Demand-Pull Inflation: Occurs when the aggregate demand for goods and services exceeds the available supply, causing prices to rise. Cost-Push Inflation: Results from an increase in the cost of production, such as wages or raw materials, which then leads to higher prices for consumers. Built-In Inflation: Arises from the expectation of future inflation, causing businesses to increase prices and workers to demand higher wages. Consumer Price Index (CPI): Measures the change in the price of a basket of consumer goods and services over time. Producer Price Index (PPI): Monitors the change in the selling prices of goods and services produced by domestic producers. Personal Consumption Expenditures (PCE): Measures the change in prices paid for goods and services by consumers, including durable goods, nondurable goods, and services. Inflation can erode purchasing power, reduce the value of savings, increase the cost of living, and create uncertainty in financial planning. For businesses, it can lead to higher production costs, reduced profits, and increased difficulty in forecasting future expenses. A diversified portfolio helps spread risk across various asset classes, reducing the impact of inflation on an individual's overall financial position. Strategic allocation of assets, such as stocks, bonds, and cash, can provide a balance of growth, income, and capital preservation, helping to protect against inflation. Investing in assets from different countries can offer protection from country-specific inflationary risks and economic events. TIPS are government-issued bonds that provide protection against inflation by adjusting the principal amount based on changes in the CPI. REITs offer exposure to real estate, which often performs well during inflationary periods due to rising property values and rental income. These bonds adjust coupon payments according to changes in the inflation rate, providing investors with a hedge against inflation. Investing in commodities, such as gold or oil, can serve as a hedge against inflation, as their prices often rise with inflation. Companies that consistently pay dividends can help offset the impact of inflation, providing a steady stream of income. Investing in companies with strong growth prospects can lead to capital appreciation, outpacing inflation over time. Some sectors, such as utilities, healthcare, and consumer staples, tend to perform better during inflationary periods due to their essential nature and pricing power. These annuities provide periodic payments that are adjusted for inflation, helping to maintain purchasing power over time. Pensions with cost-of-living adjustments ensure that payments increase in line with inflation, providing retirees with a more stable income during inflationary periods. During inflationary periods, it's important to prioritize essential expenses, such as housing, food, and healthcare, to maintain financial stability. Having an emergency fund can help provide a financial cushion during times of inflation, covering unexpected expenses and mitigating financial stress. Inflation may require individuals to reassess and adjust their savings and investment goals to ensure they remain on track to achieve their financial objectives. Refinancing high-interest debt to secure lower interest rates can help reduce the burden of debt repayment during inflationary periods. Fixed-rate loans offer predictable payments, providing stability and protection from rising interest rates that often accompany inflation. Minimizing debt accumulation during inflationary periods can help preserve financial stability and reduce the negative impact of rising prices on personal finances. Periodic portfolio reviews allow investors to assess their investments' performance, ensuring that their inflation protection strategies remain effective. Being flexible and adapting investment strategies to changing economic conditions can help individuals stay ahead of inflation and protect their wealth. A financial advisor can provide expert guidance on adjusting investment strategies and managing personal finances during inflationary periods, ensuring that individuals remain on track to achieve their financial goals. Inflation protection strategies are vital for safeguarding wealth and maintaining financial stability in an ever-changing economy. By employing a combination of strategies, such as diversification, investing in inflation-protected assets, and effective personal finance management, individuals can minimize the impact of inflation on their financial well-being. Staying informed and proactive in managing finances is essential for navigating the challenges posed by inflation and ensuring long-term financial success.What Are Inflation Protection Strategies?

Understanding Inflation

Types of Inflation

Measurement of Inflation

Effects of Inflation on Individuals and Businesses

Inflation Protection Strategies

Diversification

Importance of a Diversified Portfolio

Asset Allocation

Geographic Diversification

Investing in Inflation-Protected Assets

Treasury Inflation-Protected Securities (TIPS)

Real Estate Investment Trusts (REITs)

Inflation-Linked Bonds

Commodities and Natural Resources

Investment in Stocks

Dividend-Paying Stocks

Growth Stocks

Inflation-Resistant Sectors

Annuities and Pensions

Inflation-Adjusted Annuities

Cost-Of-Living Adjustments in Pensions

Tips for Managing Personal Finances During Inflation

Budgeting and Financial Planning

Prioritizing Essential Expenses

Building an Emergency Fund

Adjusting Savings and Investment Goals

Debt Management

Refinancing High-Interest Debt

Using Fixed-Rate Loans Over Variable-Rate Loans

Avoiding Unnecessary Debt

Monitoring and Adjusting Strategies

Regularly Reviewing Your Portfolio

Adapting to Changing Economic Conditions

Consulting With a Financial Advisor

Conclusion

Inflation Protection Strategies FAQs

Inflation protection strategies are financial techniques that aim to protect an individual's investments from the negative effects of inflation. They can include investing in assets that appreciate in value, investing in inflation-protected securities, and diversifying investments across different asset classes.

Inflation erodes the purchasing power of money over time, so having inflation protection strategies can help investors maintain the value of their wealth. By incorporating these strategies, investors can help offset the impact of rising prices on their investments and avoid the erosion of their purchasing power.

Popular inflation protection strategies include investing in real estate, commodities, and inflation-protected securities such as TIPS (Treasury Inflation-Protected Securities). Additionally, investors can diversify their portfolio to include a mix of stocks, bonds, and other assets to hedge against inflation.

While traditional investment strategies focus on maximizing returns, inflation protection strategies aim to preserve the value of an investor's assets. Traditional investments may not always take into account the impact of inflation on an investor's returns, whereas inflation protection strategies are specifically designed to combat the negative effects of rising prices.

Anyone who wants to protect their investments from the impact of inflation can benefit from using inflation protection strategies. However, these strategies may be particularly important for retirees and others who are living off their investments, as they may be more vulnerable to the effects of inflation over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.