Bonds, integral to the global financial system, are loans made by investors to issuers like governments or corporations, offering periodic interest payments and principal returns upon maturity. They range from government and municipal bonds to corporate bonds, each carrying unique risk-return profiles. Bonds are favored by conservative investors, especially those nearing retirement, for their consistent income and portfolio stabilizing effects. Retirement marks a cessation of full-time work, requiring a reliable income source and strategic planning to avoid financial insecurity. Retirement planning involves various components like savings, investments, social security, pensions, and annuities. In this context, fixed-income investments like bonds play a pivotal role. They offer retirees a steady income stream and stability, safeguarding their principal amount—crucial for those who cannot withstand substantial losses in their retirement years. Bonds play a pivotal role in income generation during retirement. The regular interest payments from bonds can provide a consistent income stream, supplementing other retirement income such as social security or pension payments. This can provide retirees with the financial stability they need to maintain their lifestyle and meet their expenses in retirement. The stability and low-risk nature of bonds makes them particularly suited for retirement portfolios. While bonds may offer lower returns compared to stocks, they are generally less volatile and provide a safer store of value. This stability can help to preserve capital and reduce the risk of significant losses, crucial considerations for those in or nearing retirement. A well-balanced retirement portfolio should include a mix of different assets to diversify risk. Here, bonds serve an essential role by counterbalancing the risks associated with stocks. When stock prices fall, bond prices often increase, providing a hedge against equity market downturns. This risk-diversification feature of bonds is particularly valuable for retirement planning, where preserving capital is as crucial as generating returns. One way to invest in bonds is by purchasing them directly from the government. Treasury bonds, notes, and bills can be bought directly from the U.S. Department of the Treasury through the TreasuryDirect program. Similarly, I-Bonds, a type of inflation-protected security, can also be purchased directly from the government. Investors can also buy corporate or municipal bonds directly. Corporate bonds can typically be purchased through a broker, while municipal bonds can often be bought through public offerings or on the secondary market. However, these bonds carry higher risk compared to government bonds, so investors must carefully assess the creditworthiness of the issuer. Bond mutual funds and exchange-traded funds (ETFs) offer another route to invest in bonds. These funds pool money from many investors to buy a diversified portfolio of bonds, providing instant diversification. They are managed by professional fund managers and can be a more convenient and accessible way for individual investors to invest in bonds. Investing in bonds can be complex, and many investors choose to work with a broker or financial advisor. These professionals can provide advice on which bonds to invest in, based on the investor's risk tolerance and retirement goals. They can also handle the practicalities of buying and selling bonds, making the process easier for the investor. Interest rate risk refers to the potential for bond prices to decrease as interest rates rise. Since bond prices move inversely to interest rates, a spike in rates can negatively impact the value of existing bonds. This risk is particularly acute for long-term bonds, which are more sensitive to interest rate changes. Credit or default risk is the chance that the bond issuer will fail to make timely interest or principal payments. This risk is highest for corporate and municipal bonds, which lack the government backing of treasuries. Therefore, understanding the creditworthiness of the bond issuer is crucial before making an investment. Inflation risk is the risk that rising prices will erode the purchasing power of bond income. Inflation can be especially harmful to fixed-income investors, as the income from bonds may not keep pace with the increasing cost of living. Reinvestment risk is the risk that interest income from a bond will have to be reinvested at a lower rate in the future. This risk arises when interest rates fall, and it's particularly relevant to investors who depend on bond income for their living expenses. Bond ratings are grades assigned to bonds that represent the credit quality of a bond issuer. Ratings agencies like Standard & Poor’s, Moody's, and Fitch issue these ratings. They range from AAA or Aaa (the highest quality) to D or C (in default). Understanding these ratings is vital for assessing the level of credit risk involved in a bond investment. Diversification involves spreading investments across different types of bonds to reduce risk. This can be achieved by investing in a mix of government, corporate, and municipal bonds and bonds with varying maturities and credit ratings. The ladder strategy involves buying bonds with different maturity dates. As each bond matures, the funds are reinvested in new bonds at the longest end of the ladder. This strategy can provide a balance between higher yield and the flexibility to reinvest as interest rates change. Duration is a measure of a bond's sensitivity to interest rate changes, while yield to maturity is the total return an investor can expect if they hold the bond until maturity. Understanding these concepts can help investors make more informed decisions about which bonds to include in their portfolios. Bonds should be balanced with other assets, such as stocks and real estate, to create a diversified portfolio. The right mix will depend on an individual's risk tolerance, income needs, and time horizon. Some bonds, like municipal bonds, can be tax-exempt, meaning the interest income is not subject to federal income tax and in some cases, state and local taxes. Taxable bonds, such as corporate and government bonds, are subject to federal income tax. Understanding the tax implications can help investors make more informed decisions about which bonds to buy. Interest income from bonds is typically taxable in the year it's received. For those in higher tax brackets, this can significantly reduce the net return on bond investments. Strategies for minimizing tax liability include investing in tax-advantaged accounts, such as IRAs or 401(k)s, and considering tax-exempt bonds for a portion of the bond portfolio. Investors should regularly review their bond portfolio's performance and rebalance it as needed to maintain their desired asset allocation. Changes in interest rates, economic conditions, and credit market trends can impact the performance of bond investments. Investors must stay informed about these changes and adjust their strategies as necessary. Financial advisors can provide valuable guidance on bond investing, including advice on diversification, risk management, and tax strategies. Working with a financial advisor can help investors make the most of their bond investments and navigate the complexities of retirement planning. Bonds offer vital income, stability, and risk mitigation in retirement planning. Investment methods include direct government purchases, corporate or municipal bonds, bond mutual funds, ETFs, or employing a broker or financial advisor. However, mindful evaluation of risks - interest rate fluctuations, credit/default, inflation, and reinvestment rates - is key, as is understanding bond ratings. Implement strategies such as diversification, bond laddering, and assessing duration and yield to maturity for well-rounded planning. Balancing bond investments with other assets contributes to a diversified portfolio suited to individual needs. Understanding tax implications, taking advantage of tax benefits, and regularly reviewing your portfolio helps optimize returns. The bond investment process may seem intricate, but with well-planned strategies and professional help, bonds can solidify your retirement security. To navigate these complexities and maximize your wealth, consider seeking wealth management services for personalized guidance and strategies.Overview of Bonds and Retirement

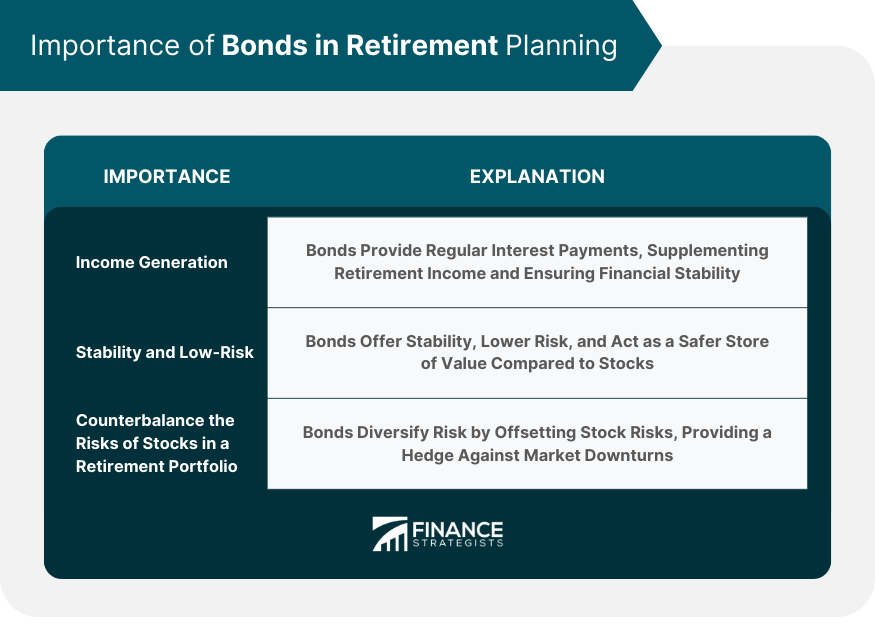

Importance of Bonds in Retirement Planning

Income Generation

Stability and Low-Risk

Counterbalance the Risks of Stocks in a Retirement Portfolio

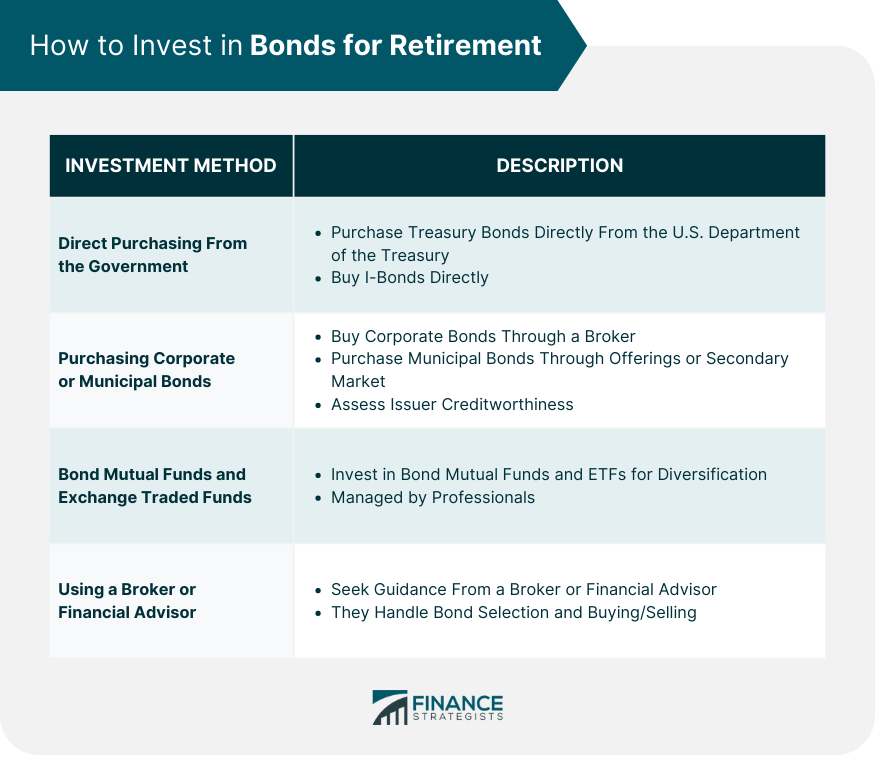

How to Invest in Bonds for Retirement

Direct Purchasing From the Government: Treasuries, I-Bonds, and Others

Purchasing Corporate or Municipal Bonds

Bond Mutual Funds and Exchange Traded Funds (ETFs)

Using a Broker or Financial Advisor for Bond Investments

Risks and Considerations in Bond Investments for Retirement

Interest Rate Risk

Credit/Default Risk

Inflation Risk

Reinvestment Risk

Understanding and Evaluating Bond Ratings

Strategies for Bond Investing for Retirement

Diversification in Bond Investments

Ladder Strategy for Bond Investment

Assessing Duration and Yield to Maturity

Balancing Bond Investments With Other Retirement Assets

Tax Considerations for Bond Investments

Tax-Exempt Versus Taxable Bonds

Understanding the Impact of Bond Interest on Taxable Income

Strategies for Minimizing Tax Liability

Review and Monitoring of Bond Investments

Bottom Line

Bonds for Retirement FAQs

Bonds are essential for retirement planning because they provide a steady income stream and stability. They serve as a counterbalance to the volatility of riskier investments like stocks, ensuring a diversified retirement portfolio.

You can invest in bonds for retirement by purchasing them directly from the government or through a broker. Additionally, you can invest in bond mutual funds or ETFs for diversified exposure.

When investing in bonds for retirement, you should consider interest rate risk, credit/default risk, inflation risk, and reinvestment risk. It's also crucial to understand and evaluate bond ratings before investing.

Some strategies include diversification in bond investments, using a ladder strategy, assessing duration and yield to maturity, and balancing bond investments with other retirement assets.

Wealth management services can provide valuable guidance on diversification, risk management, tax strategies, and ongoing portfolio review, helping you optimize your bond investments for retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.