A savings bond is a type of government-issued investment security designed to help fund government expenditures and raise capital. It is a debt instrument where an individual lends money to the government in exchange for a fixed or variable interest rate over a specified period. Savings bonds are typically considered low-risk investments because they are backed by the full faith and credit of the issuing government. These bonds can be purchased directly from government agencies or through financial institutions. They are available in different denominations and can have various features, such as fixed interest rates or inflation-adjusted returns. The interest earned on savings bonds is generally subject to federal income tax, but it may be exempt from state and local taxes. Savings bonds are known for their long-term nature, as they often have maturity periods of several years. Upon maturity, the bondholder can redeem the bond for its face value, which includes the original investment amount plus any accumulated interest. Savings bonds work by allowing individuals to lend money to the government in exchange for a fixed or variable interest rate. Here's how the process typically works: Individuals can buy savings bonds directly from government agencies, such as the U.S. Department of the Treasury, or through financial institutions authorized to sell them. Bonds are available in different denominations, such as $25, $50, $100, and so on. Savings bonds have a fixed term during which they earn interest. The length of this period varies depending on the type of bond. For example, U.S. Series EE bonds have a term of 20 years, while Series I bonds have a term of 30 years. During this time, the bond accrues interest based on the bond's interest rate and the principal amount. The interest rates for savings bonds can be fixed or variable. Fixed-rate bonds have a predetermined interest rate that remains the same for the bond's entire term. Variable-rate bonds, on the other hand, have interest rates that adjust periodically based on market conditions or inflation rates. The bond earns interest based on its interest rate and the principal amount. The interest may compound semiannually, annually, or in the case of Series I bonds, both. The interest is added to the bond's value and increases over time. Once the bond reaches its maturity date, which is typically the end of the bond's term, it can be redeemed. Bondholders can redeem the bond by presenting it to the issuing authority, such as the Treasury Department, and receive the face value of the bond, which includes the original investment amount and any accumulated interest. The interest earned on savings bonds is generally subject to federal income tax. However, it may be exempt from state and local taxes if used for qualifying educational expenses. Additionally, interest income from savings bonds may be excluded from federal taxes if used for education and certain income limits are met. Series EE bonds, issued by the U.S. Treasury, are a type of savings bond offering a fixed interest rate over a long-term period, typically up to 30 years. They are purchased at face value, meaning if you buy a $50 EE bond, you pay $50. One of the primary advantages of Series EE bonds is that the U.S. Treasury guarantees they will at least double in value after 20 years from their issue date. This feature ensures a minimum return on your investment. If the bond doesn't double in value due to applying the fixed interest rate over 20 years, the Treasury will make a one-time adjustment to make up the difference. Therefore, the bondholder is assured that their investment will yield a significant return over a 20-year period. This safety makes EE bonds an attractive long-term investment choice for those seeking a low-risk savings option. Series I bonds are another type of U.S. savings bond, uniquely designed to guard against inflation over time. These bonds come with two different interest rates: a fixed rate that stays constant over the bond's life and an inflation rate that adjusts semi-annually based on changes in the Consumer Price Index for All Urban Consumers (CPI-U). This dual-rate structure offers protection against rising inflation. When inflation rates increase, the earnings on I bonds increase. When inflation falls, earnings decrease. However, an I bond's earnings rate can never go below zero, nor can the bond's value. This feature provides assurance that your investment will retain its value, regardless of economic fluctuations. H/HH Bonds were savings bonds offered by the U.S. Treasury until they stopped issuing them in 2004. Unlike Series EE and I Bonds, which accrue interest over time, H/HH bonds pay interest directly to their owners every six months. Although H/HH bonds are no longer available for purchase, many people still own them, paying interest until maturity or being redeemed. Notably, HH bonds had a maturity period of up to 20 years. If you have matured H/HH bonds, it's a good idea to redeem them, as they no longer earn interest. Par value is a financial term that refers to a bond or stock's face value or nominal value. Regarding savings bonds, the par value is the amount that the federal government agrees to pay the bondholder upon the bond's maturity. For Series EE bonds, the par value is the same as the purchase price, meaning a $50 bond will grow to a guaranteed $100 after 20 years, which is its par value. The bond's maturity period is when the bondholder receives the bond's par value from the issuer. For Series EE bonds, the maturity period is typically 20 years, at which point the U.S. Treasury guarantees the bond will at least double in value. However, the bonds continue earning interest for up to 30 years. The interest earned on savings bonds typically combines fixed and inflation rates. Series EE bonds offer a fixed interest rate, meaning the rate doesn't change over the bond's life. The U.S. Treasury determines this fixed rate at the time of purchase. Series I bonds, however, have a unique interest structure. They have a fixed rate and an inflation rate that is adjusted semiannually based on changes in the Consumer Price Index for All Urban Consumers (CPI-U). This structure ensures the value of Series I bonds keeps pace with inflation. With the advent of technology, purchasing savings bonds has become a much more streamlined process. Digital savings bonds can be purchased online directly from the U.S. Treasury through their TreasuryDirect website. After creating an account, you can buy, manage, and redeem your savings bonds at your convenience. While you can no longer purchase paper savings bonds, those who have previously purchased them can still redeem them. Most financial institutions can facilitate the redemption process, making it easy for bondholders to cash in their investments. Accrued interest is the interest that a bond earns but has yet to be paid. It accumulates between the regular interest payment intervals of a bond, or in the case of savings bonds, from the time of issuance or the last compounding date. Savings bonds accrue interest every month, and this interest is compounded semiannually. Compounding means that the interest earned in one period is added to the principal amount, and in the next period, interest is earned on this new total. This process can significantly increase the value of a savings bond over time, especially when held until maturity. Inflation plays a vital role in determining the earnings of Series I savings bonds, which are designed to protect investors against the eroding effects of inflation on the value of their investments. The U.S. Bureau of Labor Statistics' Consumer Price Index for All Urban Consumers (CPI-U) influences the semiannual inflation rate applied to these bonds. When combined with the fixed rate of Series I bonds, this inflation rate results in a composite rate that adjusts to economic changes. When inflation rises, so does the composite rate, allowing the bond's earnings to keep pace with the cost of living. Conversely, when inflation decreases, the composite rate also drops. This dual-rate structure ensures that the value of your investment does not diminish due to inflation over time. There are several key advantages to investing in savings bonds: Safety and Reliability: Savings bonds are considered one of the safest investments because the U.S. government backs them. Investors can rest assured knowing they will receive the bond's face value and accumulated interest when they redeem. Long-Term Savings: Savings bonds are designed for long-term savings, with a lifespan that extends as long as 30 years. This makes them ideal for goals that are decades away, like retirement or college education for a newborn. Tax Advantages: The interest earned on savings bonds is often exempt from state and local income taxes, potentially increasing the net returns for investors. Further, federal taxes can be deferred until redemption or maturity, providing a tax planning advantage. While savings bonds are generally safe investments, there are a few potential risks to keep in mind: Low-Interest Rates: Savings bonds usually offer lower interest rates than other investments. While they guarantee a return, it may not keep pace with inflation over time, potentially eroding purchasing power. Lack of Early Redemption: Savings bonds are designed for long-term investments. If you redeem them within the first five years, you'll forfeit the last three months' worth of interest, which could impact your overall return. Liquidity Constraints: While savings bonds can be cashed in after a year of ownership, they don’t offer the same level of liquidity as some other investment vehicles, such as stocks or mutual funds. Savings bonds can play a crucial role in retirement planning. Given their safety and predictability, they provide a steady, albeit modest, source of income that can supplement Social Security, pensions, and other retirement savings. As savings bonds are not subject to market fluctuations, they can serve as a reliable, conservative component in a diversified retirement portfolio. With their guaranteed return, savings bonds offer a sense of financial security, particularly beneficial during retirement when a stable income is crucial. Savings bonds also offer unique benefits when used for education funding. The Education Savings Bond Program, initiated by the U.S. government, allows for the interest earned from Series EE and Series I savings bonds to be excluded from federal income tax when the bond proceeds are used for qualified higher education expenses. These expenses can include tuition and fees at eligible institutions. This tax advantage can make savings bonds attractive for parents and students looking to finance education costs. Finally, savings bonds can play a significant role in estate planning. They can be reissued to a trust, included in a will, or bequeathed to heirs, making them a flexible tool for transferring wealth. Furthermore, savings bonds' safety, reliability, and long-term growth potential can provide peace of mind to individuals looking to leave a financial legacy. Despite their relatively modest returns compared to riskier assets, the low-risk nature of savings bonds makes them a valuable tool in estate planning, providing a stable foundation to preserve wealth for future generations. Savings bonds offer flexibility in terms of when they can be cashed in. After a mandatory holding period of one year, savings bond owners can redeem their bonds anytime. However, it's important to note that if you choose to redeem your bonds within the first five years, you will incur a penalty in the form of forfeiting the last three months' worth of interest. While early redemption is an option, it may only sometimes be the most financially beneficial decision depending on your circumstances. Savings bonds mature at different times based on their series and the terms set at the time of issuance. For most savings bonds, the final maturity date—when they stop earning interest—occurs 30 years after issuance. Once a bond has reached its final maturity, it no longer earns any additional interest, so keeping a bond beyond this point means losing out on potential earnings. Therefore, bondholders are generally recommended to promptly redeem their matured savings bonds to maximize their investment return. The U.S. Treasury sends out notifications of upcoming bond maturities to help investors stay informed and take appropriate action. Savings bonds come with certain federal tax implications. The interest earned on savings bonds is subject to federal income tax. However, investors can defer this tax until the bonds are redeemed or reach final maturity. This means you do not have to report the interest earned each year as taxable income on your federal tax return. Instead, you can choose to report all the accumulated interest in the year you cash the bond, or it matures, providing a measure of control over your tax planning. One of the significant advantages of savings bonds is their favorable treatment concerning state and local income taxes. The interest earned on savings bonds is exempt from state and local income taxes, making them more attractive to investors in high-tax states. Additional tax benefits exist for those using savings bonds to finance higher education expenses. Under the Education Savings Bond Program, if Series EE or Series I savings bonds are used to pay for qualified higher education expenses at an eligible institution, it's possible to exclude the interest earned from federal income tax. This tax benefit encourages investors to use savings bonds to save for higher education expenses, adding to their utility as a versatile financial tool. Savings bonds play a crucial role in personal finance and offer various advantages. In retirement planning, they provide a steady income source and serve as a reliable component in a diversified portfolio. Savings bonds are also beneficial for education funding, as the interest earned from Series EE and Series I bonds can be excluded from federal income tax when used for qualified higher education expenses. Additionally, savings bonds can be a valuable tool in estate planning, allowing for flexible wealth transfer and providing stability for future generations. When it comes to redemption, savings bonds offer flexibility. They can be redeemed after a one-year holding period, although redeeming them within the first five years results in a penalty of forfeiting the last three months' worth of interest. After maturity, which typically occurs 30 years after issuance, it is recommended to promptly redeem the bonds to maximize returns. Regarding tax implications, savings bond interest is subject to federal income tax, but it can be deferred until redemption or maturity. Furthermore, the interest is often exempt from state and local income taxes, making savings bonds attractive for investors in high-tax states. Definition of Savings Bonds

How Does Savings Bonds Work?

Purchase

Investment Period

Interest Rates

Interest Accrual

Redemption

Tax Considerations

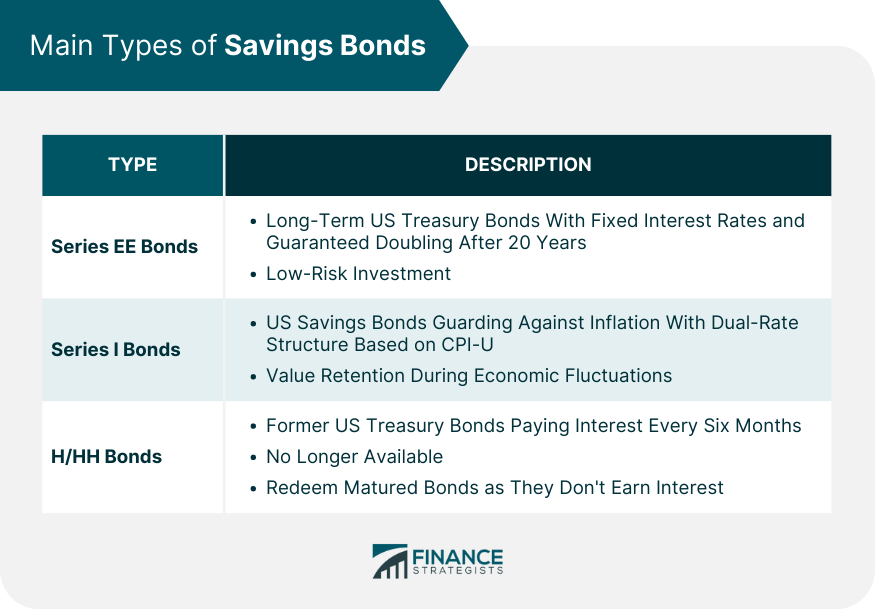

Main Types of Savings Bonds

Series EE Bonds

Series I Bonds

H/HH Bonds

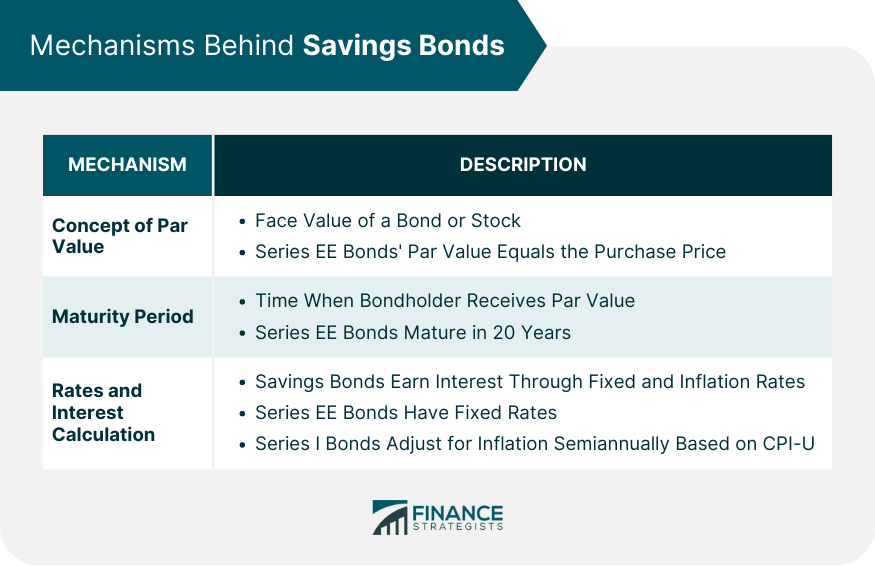

Mechanism Behind Savings Bonds

Concept of Par Value

Maturity Period

Rates and Interest Calculation

Purchasing Process

Online Purchasing Method

Traditional Paper-Based Purchasing Method

How Savings Bonds Earn Interest

Accrued Interest

Role of Inflation

Savings Bonds as a Financial Investment

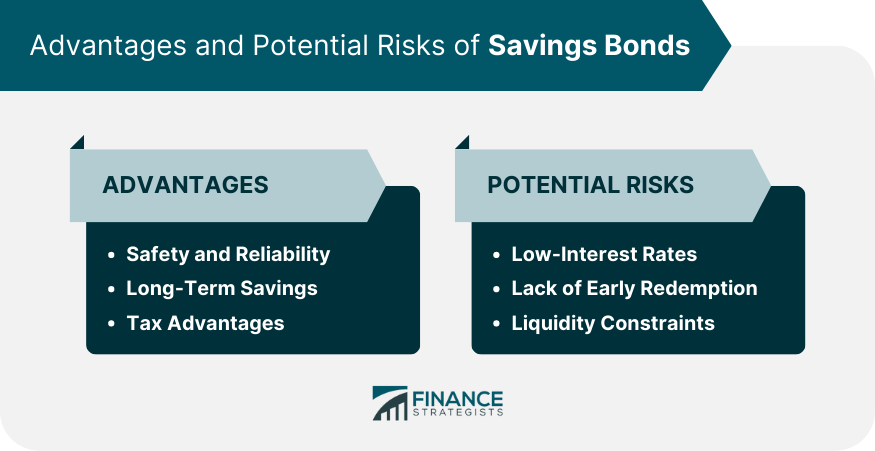

Advantages of Savings Bonds

Potential Risks

This could pose a challenge if you need access to your investment quickly.

Role of Savings Bonds in Personal Finance

Retirement Planning

Education Funding

Estate Planning

Redemption of Savings Bonds

Redemption Prior to Maturity

Redemption After Maturity

Tax Implications of Savings Bonds

Federal Tax

State and Local Tax

Tax Benefits for Education

Conclusion

How Savings Bonds Work FAQs

In the event of a lost, stolen, or destroyed paper savings bond, FS Form 1048 can be submitted to the Treasury. This will facilitate the replacement of the missing bond.

Indeed, savings bonds can be given as gifts. When procuring a bond on TreasuryDirect, simply select the option "This is a gift" during the purchase process.

While savings bonds do not have an expiry date, they stop accruing interest at final maturity, typically 30 years from the issuance date.

The worth of a savings bond can be calculated using the Savings Bond Calculator available on the TreasuryDirect website.

Since 2012, paper savings bonds are no longer available for purchase through banks or other financial institutions. However, digital savings bonds can be purchased online via the TreasuryDirect website.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.