Treasury Inflation-Protected Securities (TIPS) are a unique type of government-issued bonds designed to help investors protect their investments against inflation. Issued by the U.S. Department of the Treasury, TIPS offer an effective means for investors to safeguard their purchasing power in the face of rising prices. The following are the features of Treasury Inflation-Protected Securities: TIPS are designed to have their principal amount adjusted in accordance with changes in the Consumer Price Index (CPI), a widely used measure of inflation. When inflation occurs, the principal amount of TIPS increases, whereas in deflationary periods, the principal amount decreases. TIPS pays interest semi-annually, with the interest rate determined by the U.S. Treasury during the initial auction. The interest payment is calculated by multiplying the adjusted principal amount by the fixed interest rate. This means that if the principal amount increases due to inflation, the interest payment will also increase, providing additional protection against inflation. TIPS are available in various maturity periods, including 5-year, 10-year, and 30-year terms. Investors can choose the maturity period that best suits their investment horizon and risk tolerance. Interest earned from TIPS is subject to federal income tax, but it is exempt from state and local income taxes. Additionally, the adjustments made to the principal amount due to inflation are considered taxable income, even though the investor does not receive the adjustment until the bond matures or is sold. There are different points that must be considered when investing in Treasury Inflation-Protected Securities. There are multiple methods for purchasing TIPS, including directly from the U.S. Department of the Treasury via TreasuryDirect, through banks and brokers, or on the secondary market. Investors who prefer diversification can invest in TIPS mutual funds or Exchange-Traded Funds (ETFs), which hold a basket of TIPS with varying maturities. These funds may charge management fees, but they offer an easy way to gain exposure to TIPS without having to manage individual bonds. There are benefits and risks to investing in Treasury Inflation-Protected Securities: TIPS offers several benefits for investors, including inflation protection, a guarantee backed by the U.S. government, and a low-risk investment profile. Despite their benefits, TIPS also come with certain risks. These include the possibility of deflation, interest rate risk, liquidity risk, and the tax implications of inflation adjustments. TIPs can be compared and contrasted with other fixed-income investments. When compared to traditional Treasury bonds, TIPS offers additional protection against inflation. However, the interest rates on TIPS are generally lower than those of traditional Treasury bonds. Corporate bonds typically offer higher yields than TIPS, but they come with a higher level of credit risk, as they are not backed by the U.S. government. Municipal bonds provide tax advantages, as their interest income is usually exempt from federal income tax and, in some cases, state and local taxes. However, their credit quality can vary significantly depending on the issuer. Below are some points that are associated with TIPS in a diversified investment portfolio. TIPS can play a vital role in a diversified investment portfolio, providing a hedge against inflation and a source of low-risk, fixed-income investments. By including TIPS in a portfolio, investors can protect their purchasing power from eroding due to inflation. A well-diversified portfolio may include a mix of TIPS and other fixed-income investments, such as corporate bonds, municipal bonds, or traditional Treasury bonds. This can help investors balance the benefits of inflation protection with the potential for higher yields and tax advantages offered by other fixed-income securities. TIPS may be more suitable for certain investor profiles, such as those who prioritize capital preservation, have a long-term investment horizon, or are more sensitive to the effects of inflation. As with any investment decision, it is important for investors to evaluate their individual goals, risk tolerance, and financial situation before incorporating TIPS into their portfolios. Understanding Treasury Inflation-Protected Securities is essential for investors looking to protect their investments from the negative effects of inflation. By evaluating the features, risks, and benefits of TIPS, as well as comparing them to other fixed-income investments, investors can make more informed decisions about incorporating TIPS into their diversified investment portfolios. Ultimately, the decision to invest in TIPS should be based on an investor's specific financial goals, risk tolerance, and investment horizon.Definition of Treasury Inflation-Protected Securities (TIPS)

Features of TIPS

Principal Adjusted With Inflation

Semi-annual Interest Payments

Maturity Periods

Tax Implications

Investing in TIPS

Purchasing Methods

TIPS Mutual Funds and ETFs

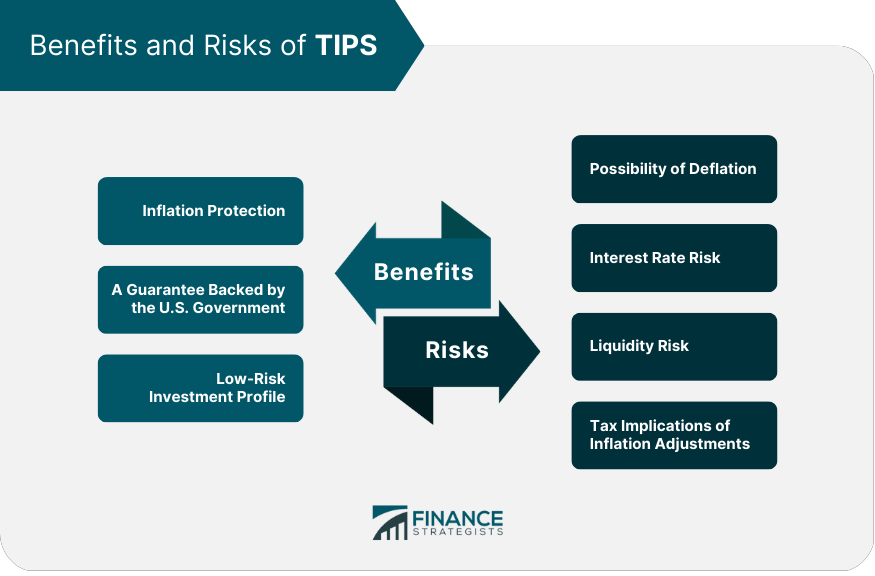

Benefits and Risks of TIPS

Benefits

Risks

Comparing TIPS to Other Fixed-Income Investments

Traditional Treasury Bonds

Corporate Bonds

Municipal Bonds

TIPS in a Diversified Investment Portfolio

Role in Asset Allocation

Hedging Against Inflation

Combining With Other Fixed-Income Investments

Considerations for Different Investor Profiles

Conclusion

Treasury Inflation-Protected Securities (TIPS) FAQs

Treasury Inflation-Protected Securities (TIPS) are government-issued bonds designed to protect investors from inflation. They offer a safeguard for investors' purchasing power by having their principal adjusted with changes in the Consumer Price Index (CPI), ensuring that interest payments increase with inflation.

TIPS adjust their principal based on changes in the Consumer Price Index (CPI), a widely used measure of inflation. When the CPI rises, the principal amount of TIPS increases, and when the CPI falls, the principal amount decreases. This adjustment ensures that the bond's value is protected against the effects of inflation.

There are several ways to purchase TIPS, including directly from the U.S. Department of the Treasury via TreasuryDirect, through banks and brokers, or on the secondary market. Alternatively, you can invest in TIPS mutual funds or exchange-traded funds (ETFs) for a more diversified exposure to TIPS.

Interest earned from TIPS is subject to federal income tax but is exempt from state and local income taxes. Additionally, the adjustments made to the principal amount due to inflation are considered taxable income, even though the investor does not receive the adjustment until the bond matures or is sold.

TIPS offer inflation protection, which traditional Treasury bonds do not provide. However, TIPS generally have lower interest rates compared to traditional Treasury bonds. Corporate bonds typically offer higher yields than TIPS but come with higher credit risk. Municipal bonds provide tax advantages but may have varying credit quality. Including TIPS in a diversified investment portfolio can help balance inflation protection with the potential for higher yields and tax advantages offered by other fixed-income securities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.