Hard call protection is a provision in the agreement of a callable bond that prevents the issuer from exercising their right to buy back, or "call," the bond for a specified period. This is usually for a period equal to half the bond's life. During this period, investors are protected from having their bonds called, which would disrupt their income from interest payments. The main purpose of hard call protection is to provide security for bondholders. It gives them assurance that they can collect coupon payments over a fixed period without the issuer calling the bond. This is particularly important when interest rates are falling, as the issuer might be motivated to call the bond and reissue it at a lower interest rate. Therefore, hard call protection offers a degree of predictability for the investor. The duration of hard call protection is usually determined at issuance and often lasts until the bond is halfway to its maturity date. After this period, the issuer has the right to call the bond, subject to any applicable soft call protection. Hard call protection benefits bondholders by providing certainty over their investment. During the protection period, they can count on receiving the stipulated interest payments without worrying about the bond being called. This makes the bond more attractive to those seeking a predictable income stream. Hard call protection provides an absolute restriction period during which a bond cannot be called, providing certainty to the bondholder. On the other hand, soft call protection provides a relative restriction by allowing the issuer to call the bond, but at a premium. While hard call protection provides a guaranteed income stream for a period, soft call protection can potentially provide a higher return if the bond is called due to the call premium. The choice between the two will depend on the investor's risk tolerance and income needs. Some investors might prefer hard call protection because of its certainty, while others might prefer soft call protection because of the potential for a higher return. It's crucial for investors to understand their own risk tolerance and investment goals when choosing between these two. By providing a predictable income stream, hard call protection contributes to the stability of the bond market. It encourages investment in bonds by reducing the risks associated with callable bonds, thereby increasing the liquidity in the market. Hard call protection influences investment strategies by providing a guaranteed return for a period. Investors can use this feature to match their income needs, particularly in a retirement portfolio where a predictable income stream is desirable. By preventing the issuer from calling bonds during a defined period, hard call protection enhances market predictability. This helps both issuers and investors plan their financial strategies more effectively. Hard call protection is governed by the terms of the bond agreement, which is regulated by securities laws. The Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) are two regulatory bodies overseeing these practices in the United States. Issuers must adhere to the hard call protection terms stipulated in the bond agreement. Non-compliance can result in legal consequences and damage the issuer's reputation in the bond market. Violating the terms of hard call protection can lead to lawsuits from bondholders and enforcement action by regulatory bodies. This could result in financial penalties and negatively impact the issuer's ability to raise funds. Hard Call Protection plays a significant role in the callable bond market, serving as a linchpin that offers bondholders guaranteed returns over a specified period. This mechanism brings about stability in the bond market by promoting liquidity, ensuring a reliable income stream, and subsequently shaping investment strategies. It's crucial in financial planning, particularly for retirement portfolios. The comparison between Hard Call and Soft Call Protection provides a clear distinction that helps investors align their choices with risk tolerance and financial goals. Additionally, regulatory adherence to Hard Call Protection provisions, overseen by bodies like the SEC and FINRA, is non-negotiable, as violations can lead to legal repercussions and reputation damage. The understanding of Hard Call Protection, thus, underscores its impact on investment decisions, market stability, and regulatory compliance, marking its significance in the financial market.Definition of Hard Call Protection

How Hard Call Protection Works

Timing and Maturity of Hard Call Protection

How Hard Call Protection Benefits Bondholders

Comparison Between Hard Call and Soft Call Protection

Detailed Contrast and Comparison

Situational Benefits of Hard Call vs Soft Call Protection

Investor Preference - Hard Call vs Soft Call Protection

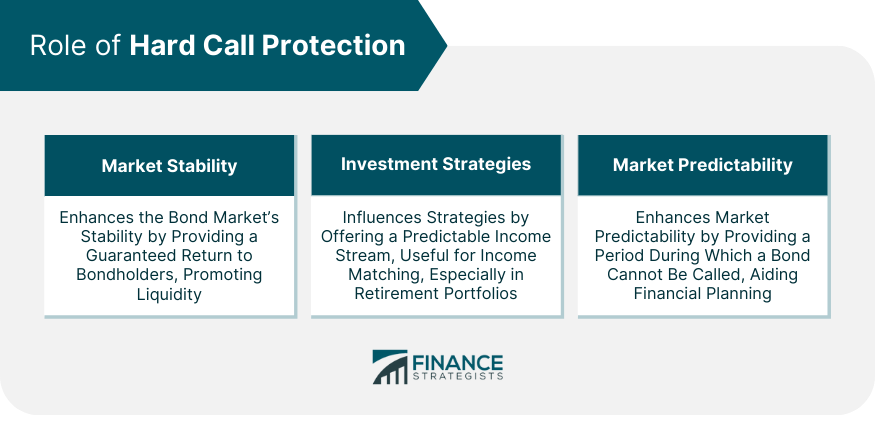

Role of Hard Call Protection in the Financial Market

Hard Call Protection and Bond Market Stability

Influence of Hard Call Protection on Investment Strategies

Importance of Hard Call Protection in Market Predictability

Legal and Regulatory Considerations for Hard Call Protection

Laws and Regulations Surrounding Hard Call Protection

Compliance With Hard Call Protection Requirements

Legal Repercussions for Violations

Final Thoughts

Hard Call Protection FAQs

Hard call protection is a provision in the agreement of a callable bond that prevents the issuer from buying back, or "calling," the bond for a specified period, often half the life of the bond. It serves to protect investors from having their bonds called prematurely, which could disrupt their income from interest payments.

Hard call protection benefits bondholders by providing them with certainty and predictability for their investment. During the hard call protection period, bondholders can rely on receiving the stipulated interest payments without worrying about the issuer calling the bond.

While both hard call and soft call protection offer security for investors, they function differently. Hard call protection defines a period during which the bond cannot be called under any circumstance. In contrast, soft call protection allows the issuer to call the bond before the hard call period but at a premium price.

Hard call protection influences yield-to-call (YTC) because it establishes the time frame during which the bond cannot be called. During the hard call protection period, the calculation for YTC is the same as the yield-to-maturity calculation. After this period, if the bond isn't called, the YTC will usually be lower than the yield-to-maturity.

Failing to adhere to hard call protection provisions can result in legal repercussions for the bond issuer. This could lead to lawsuits from bondholders, enforcement action by regulatory bodies like the Securities and Exchange Commission (SEC), financial penalties, and could damage the issuer's reputation in the bond market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.