Income sources refer to the various ways individuals and households earn money to support their lifestyles, save for the future, and achieve their financial goals. Understanding the different income sources is crucial for effective financial planning, budgeting, and risk management. Employment income is the most common income source and typically includes: Regular compensation received for work performed as an employee, usually paid weekly, biweekly, or monthly. Additional compensation for working beyond the standard work hours or days typically calculated at a higher rate than the regular pay. Financial incentives are paid for achieving specific performance goals or milestones, often used in sales or executive positions. Service industry workers, such as waitstaff or hotel staff, receive extra income as a reward for good service. Self-employment income comes from running a business or working independently, and may involve: Income is earned by individuals who operate their own businesses without formal legal structures, such as freelancers or consultants. Income is generated through a shared business venture between two or more individuals who agree to distribute profits and losses according to their ownership interests. Income earned by members of an Limited Liability Company (LLC), a hybrid business structure that combines a partnership's tax flexibility with a corporation's limited liability protection. Income derived from owning shares in a corporation, either through salary or dividends, depends on the shareholder's involvement in the company. Income earned by providing services on a per-project or short-term basis, often facilitated by digital platforms like Uber, Airbnb, or Upwork. Government assistance programs provide financial support to individuals who meet specific eligibility criteria: Temporary income assistance for individuals who have lost their jobs and are actively seeking new employment. The federal government provides retirement, disability, and survivor benefits to eligible individuals and their families. Income support for individuals with qualifying disabilities that prevent them from working. Various income-based programs, such as food stamps or housing assistance, are designed to help low-income individuals and families meet basic needs. Investments are income sources that involve placing capital into assets with the expectation of generating returns over time: Income earned from interest-bearing accounts and fixed-income securities: Savings Accounts: Interest earned on deposits held in savings accounts at banks or credit unions. Bonds: Interest income is paid by the issuer of a bond, usually semiannually, until the bond's maturity date. Income received from owning shares in dividend-paying companies or investment funds: Stocks: Dividends are paid to shareholders as a portion of a company's profits. Mutual Funds: Dividends are distributed to investors who own shares in a mutual fund. Exchange-Traded Funds (ETFs): Dividends are paid to investors who own shares in an Exchange-Traded Fund (ETF), which typically tracks an index or a specific sector. Income earned from the increase in the value of an asset, such as real estate, stocks, or bonds. Passive income is money earned with little or no active involvement in the income-generating activity: Income received from renting out residential or commercial real estate. Income earned from the use or sale of intellectual property or natural resource rights: Intellectual Property (Books, Music, Patents): Royalties paid to authors, musicians, inventors, and other creators for the use, sale, or licensing of their copyrighted or patented works. Oil, Gas, and Mineral Rights: Royalties are received for granting access to natural resources on one's property, such as oil, gas, or minerals. Income earned as a limited partner in a partnership, where the limited partner provides capital but does not participate in business management. Retirement income sources provide financial support during retirement years: Pensions that pay a predetermined amount to retirees, typically based on years of service and salary history. Retirement savings plans in which contributions are invested, and retirement income depends on the performance of the investments. Insurance products that provide a steady stream of income in exchange for a lump-sum payment or series of payments made during the accumulation phase. Income raised through online platforms, such as Kickstarter or GoFundMe, to fund projects, businesses, or personal needs. Income in the form of goods or services received in exchange for other goods or services, rather than money. Income generated through digital assets or transactions: Digital currencies, such as Bitcoin or Ethereum, which can be used for online transactions or converted to traditional currencies. Unique digital assets, such as artwork or collectibles, that can be bought, sold, or traded for profit. Income earned from work outside one's primary job or business, often to supplement primary income or pursue personal interests. Understanding the tax implications of different income sources is crucial for effective financial planning: Taxes levied by the federal government on various types of income, with rates depending on the individual's filing status and income level. Taxes imposed by state and local governments on income, with rates and rules varying by jurisdiction. Taxes withheld from employment income to fund the Social Security and Medicare programs. Financial incentives that reduce the amount of income subject to taxation, such as the Earned Income Tax Credit or deductions for retirement contributions. Proactive approaches to managing tax liabilities include tax-loss harvesting or maximizing deductions. To maximize financial success, individuals should consider the following strategies: Maintaining multiple sources of income reduces reliance on any single source and increase financial resilience. Assessing the potential risks and rewards of various income sources to develop a balanced financial strategy. Creating a long-term financial plan with specific goals, such as saving for retirement or building an emergency fund. Monitoring income sources and expenses to maintain a healthy financial outlook and make informed decisions. Consulting with financial advisors or tax professionals to develop tailored strategies for optimizing income sources. In today's fast-paced and dynamic economy, having a single source of income can be risky and unsustainable. Understanding and managing multiple income sources is crucial for achieving financial success and security. By diversifying their income streams, individuals can mitigate risks associated with market fluctuations, job loss, or unexpected expenses. Effective management of income sources involves balancing risk and reward, which means seeking high potential returns while minimizing exposure to potential losses. It also requires engaging in proactive financial planning, including setting financial goals, creating a budget, and regularly reviewing and adjusting financial strategies. Financial literacy, lifelong learning, and adaptation are essential components of this process. Individuals must continually educate themselves on financial matters, stay informed of market trends, and be prepared to adapt to changing circumstances. With the right knowledge and strategies, anyone can build a strong foundation for their financial future and achieve long-term financial stability.Definition of Income Sources

Primary Income Sources

Employment Income

Salaries and Wages

Overtime Pay

Bonuses and Commissions

Tips and Gratuities

Self-Employment Income

Sole Proprietorship

Partnerships

Limited Liability Companies (LLCs)

Corporations

Freelance and Gig Economy Work

Government Assistance Programs

Unemployment Benefits

Social Security Benefits

Disability Benefits

Public Assistance Programs

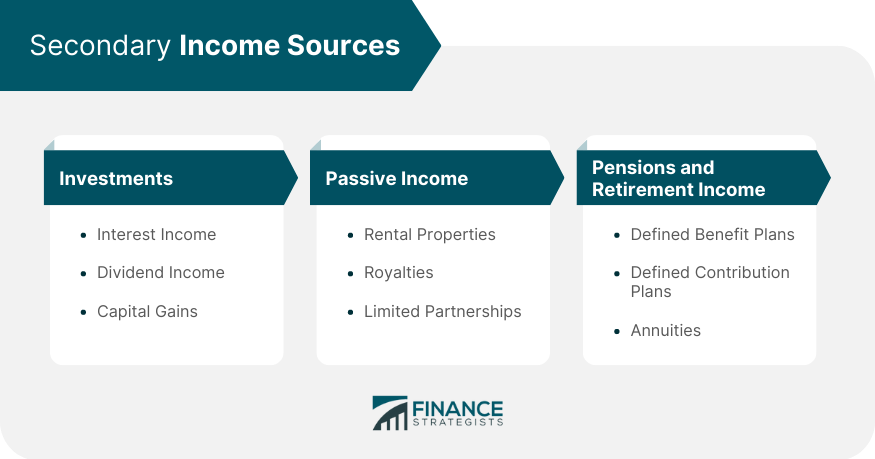

Secondary Income Sources

Investments

Interest Income

Dividend Income

Capital Gains

Passive Income

Rental Properties

Royalties

Limited Partnerships

Pensions and Retirement Income

Defined Benefit Plans

Defined Contribution Plans (401(k), 403(b), IRA)

Annuities

Alternative Income Sources

Crowdfunding and Donations

Bartering and Trade

Digital Currencies and Assets

Cryptocurrencies

Non-Fungible Tokens (NFTs)

Side Hustles and Part-Time Jobs

Tax Implications of Income Sources

Federal Income Tax

State and Local Income Taxes

Social Security and Medicare Taxes

Tax Credits and Deductions

Tax Planning Strategies

Optimizing Income Sources

Diversifying Income Streams

Balancing Risk and Reward

Financial Planning and Goal Setting

Budgeting and Tracking Income

Seeking Professional Advice

Conclusion

Income Sources FAQs

Income sources are the various channels through which individuals or businesses earn money. These may include employment, investments, rental income, and royalties, among others.

Passive income sources include rental income, dividends from investments, interest on savings accounts, and royalties from intellectual property.

Yes, it is common for individuals to have multiple income sources. This can provide greater financial stability and flexibility.

Yes, having multiple income sources may result in a more complex tax situation, as each income source may be subject to different tax rates and regulations.

One way to increase income sources is to invest in assets that generate passive income, such as stocks, rental properties, and intellectual property. Another option is to start a side business or take on freelance work in addition to your primary source of income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.