Savings bonds are a type of government-issued investment instrument designed to provide individuals with a safe and low-risk way to save money. They offer a fixed interest rate over a specified period, typically ranging from 1 to 30 years. The purpose of savings bonds is to encourage individuals to save for the long term, whether it's for education expenses, retirement, or other financial goals. They are backed by the government, making them a reliable and secure investment option, although their returns may be modest compared to other investment vehicles. People misplace savings bonds due to various reasons, and the potential for them to be lost, forgotten, or misplaced in moves, safety deposit boxes, or among other documents highlights the importance of understanding and mitigating the associated risks. Begin by gathering all information related to the lost bond. This includes the bond's serial number, issue date, denomination, and social security number used during the bond purchase. If you purchased your bond through a financial institution, reaching out to them might yield useful information. They may have kept records that could aid in the retrieval process. Consulting family members or financial advisers could provide valuable leads for bonds received as gifts or as part of an inheritance. They might recall critical details or possess documentation related to the bond. The U.S. Bureau of Public Debt is a government agency that keeps records of all savings bonds. You can request a bond search if you believe you have a bond that isn't in your possession. TreasuryDirect is a website operated by the U.S. Department of the Treasury, providing comprehensive information about savings bonds. It also features tools to help you find your lost bonds. The Treasury Hunt tool, available on the TreasuryDirect website, allows you to search for matured, unredeemed savings bonds and savings notes. If your bond is matured and has yet to be redeemed, it should appear in this search. Savings bonds are secure investments that grow in value over time. They're popular for individuals looking to diversify their portfolios without significant risk. The type of savings bond you hold can impact its growth, interest rate, and redemption rules. Each type has its unique features, benefits, and considerations. Series EE bonds are commonly purchased and are sold at face value. They have a unique feature: they're guaranteed to double in value after 20 years. If the bond has yet to double at this point due to the set interest rate, a one-time adjustment is made to ensure it reaches its face value. Series I bonds are also popular. Like Series EE bonds, they're sold at face value. However, the interest they earn is based on a fixed rate and an inflation rate. This dual-factor interest calculation can make Series I bonds an attractive choice for investors looking to protect their money against inflation. A lost savings bond might result in a potential loss of value, especially if the bond has matured and is no longer accruing interest. This missed financial opportunity could result in significant losses, particularly for bonds that were purchased decades ago. While it's possible to reclaim a lost savings bond, the process can be complex and time-consuming, requiring accurate records and potentially lots of patience. While rare, there is a risk that someone else could fraudulently cash a lost savings bond. This risk underlines the importance of promptly addressing a lost savings bond. Properly storing savings bonds is crucial to prevent loss. Consider utilizing a secure location such as a safety deposit box at a bank. Additionally, investing in a fireproof and waterproof safe at home can provide an excellent storage option for these important documents. Creating a digital copy of your savings bond can be highly beneficial in case of loss. Take a clear picture or scan the bond and securely store the digital file. Ensure that all essential details, including the serial number, issue date, and face value, are included in the digital record. Conducting regular check-ups on your bond's status can help prevent loss. These routine checks provide updated information on the bond's maturity date, accrued interest, and other relevant details. By staying informed, you can actively monitor the status and ensure the security of your savings bond. To reclaim a lost savings bond, you must complete Form PD F 1048 - Claim for Lost, Stolen, or Destroyed United States Savings Bonds. This form requires essential information about the bond and the circumstances under which it was lost, stolen, or destroyed. Once completed, the form should be mailed to the Bureau of the Fiscal Service, a U.S. Department of the Treasury division. Ensure that all the provided information is accurate to avoid unnecessary delays or rejections. After submission, there's typically a waiting period while the claim is processed. You may need to answer additional queries from the Treasury Department during this time. Remember that this process can be complex and require some patience. Interest earned on savings bonds is subject to federal income tax, which can either be deferred until redemption, final maturity, or disposed of in an exchange or reported annually. Knowing the tax implications can help you plan your financial affairs more effectively. Over time, savings bonds can accrue significant interest, which is added to the bond's value. Be aware of the bond's earning conditions; some bonds stop accruing interest after a certain period. If a lost bond is discovered after the original owner's death, it could impact the distribution of the estate, particularly if the bond's value is substantial. With the move towards digitalization, electronic savings bonds are becoming increasingly popular. They're easier to manage, track and are less likely to be lost or stolen. There are also alternative low-risk investment vehicles to consider, such as certificates of deposit (CDs), money market accounts, or government-backed securities like Treasury notes, bills, and bonds. Finding a lost savings bond requires gathering known information, contacting the initial purchase institution, consulting family members and advisers, and utilizing government resources like the Bureau of Public Debt and TreasuryDirect's Treasury Hunt tool. Different types of savings bonds, including Series EE and Series I bonds, offer unique features and benefits. Misplacing a savings bond can lead to potential loss of value, difficulty in reclaiming, and the risk of fraudulent use. To prevent losing a savings bond, secure storage solutions, digital record keeping, and regular bond status checks are recommended. Filing a claim for a lost savings bond involves completing Form PD F 1048 and submitting it to the Bureau of Fiscal Service, with potential waiting periods and challenges. Financial implications of finding a lost bond include tax considerations, inflation, and interest accumulation, and potential impact on estate planning. Exploring alternatives like electronic savings bonds and other low-risk investment vehicles can be considered.Definition and Purpose of Savings Bonds

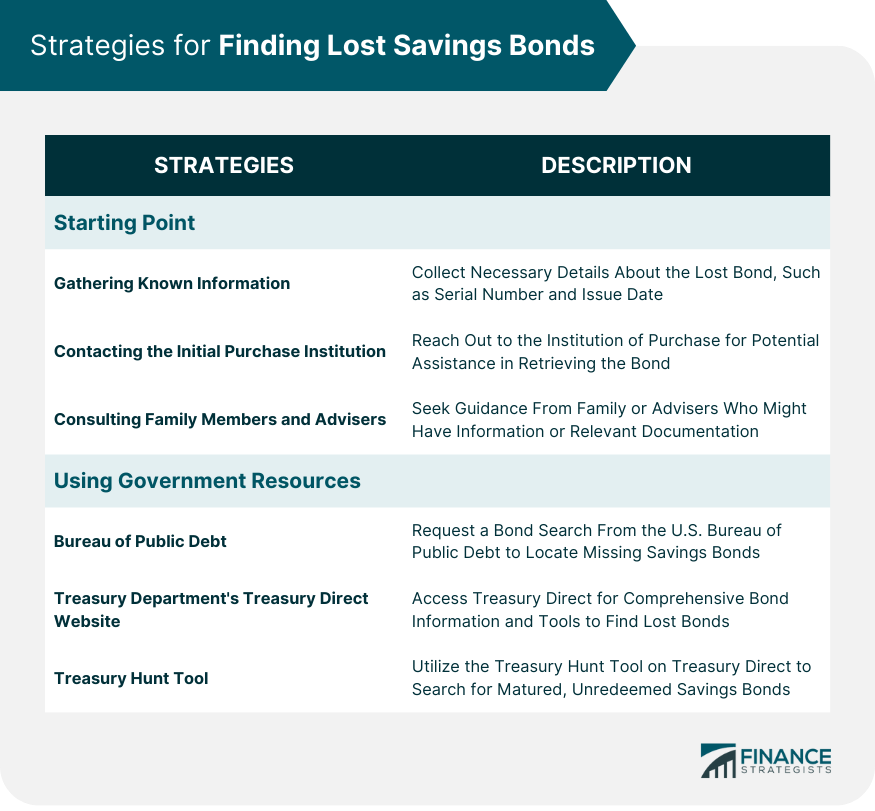

Finding a Lost Savings Bond: Starting Point

Gathering Known Information

Contacting the Initial Purchase Institution

Consulting Family Members and Advisers

Finding a Lost Savings Bond: Using Government Resources

Bureau of Public Debt

Treasury Department's TreasuryDirect Website

Treasury Hunt Tool

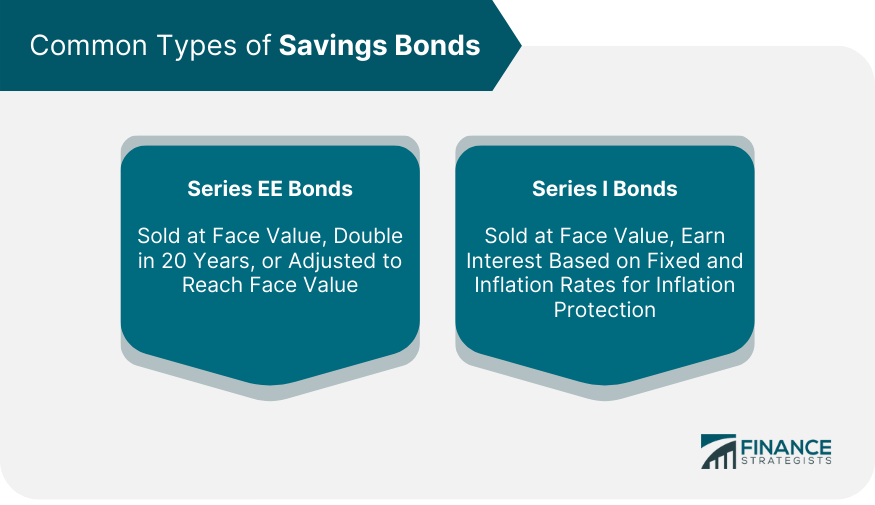

Common Types of Savings Bonds

Series EE Bonds

Series I Bonds

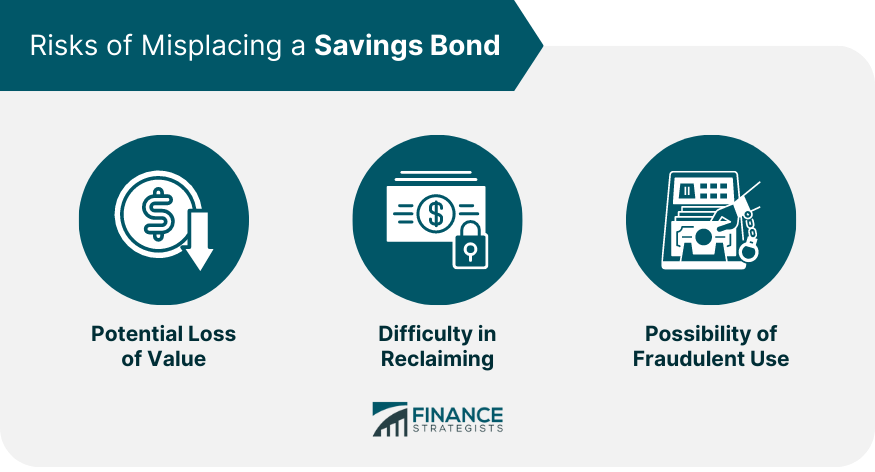

Risks of Misplacing a Savings Bond

Potential Loss of Value

Difficulty in Reclaiming

Possibility of Fraudulent Use

Prevention Measures to Avoid Losing a Savings Bond

Secure Storage Solutions

Digital Record Keeping

Regular Bond Status Checks

Filing a Claim for a Lost Savings Bond

Completing Form PD F 1048

Submitting the Form to the Bureau of Fiscal Service

Waiting Period and Potential Challenges

Financial Implications of Finding a Lost Savings Bond

Tax Considerations

Inflation and Interest Accumulation

Potential Impact on Estate Planning

Alternatives to Paper Savings Bonds

Electronic Savings Bonds

Other Low-Risk Investment Vehicles

Conclusion

How to Find a Lost Savings Bond FAQs

If you have lost a savings bond, start by gathering any information you have about the bond, such as the bond number, issue date, and purchase amount. Then, contact the institution where the bond was initially purchased. They may be able to assist you in locating the bond or provide guidance on the next steps to take.

Misplacing a savings bond can lead to a potential loss of value. Without proper documentation, it may be challenging to reclaim the bond or prove ownership. There is also a risk of fraudulent use if someone else finds the bond and tries to cash it.

To prevent losing a savings bond, it is recommended to store it securely in a safe place. Consider using a safe deposit box or a home safe. Additionally, keep digital records of your bonds, including scanned copies or photographs. Regularly check the status of your bonds to ensure they are accounted for.

If you believe your savings bond is lost, you can file a claim by completing Form PD F 1048. This form can be obtained from the Bureau of Fiscal Service. Once completed, submit the form to the Bureau of Fiscal Service, which will assist you in the process of reclaiming the bond. It's important to note that there may be waiting periods and challenges associated with filing a claim for a lost savings bond.

Yes, finding a lost savings bond can have financial implications. Firstly, there may be tax considerations, such as reporting interest earned on the bond. Additionally, if the bond was lost for an extended period, it might have accumulated interest and may be subject to inflation. Finally, finding a lost bond can also have implications for estate planning if it affects the distribution of assets. It is advisable to consult with financial advisers or tax professionals to understand the specific implications of your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.