Capital preservation is a strategy for managing investments with the goal of protecting the initial investment or capital from losses and preserving its value over time. The primary objective of capital preservation is to minimize the risk of losing money, rather than seeking high returns or maximizing gains. Investors who prioritize capital preservation may choose to invest in low-risk assets such as bonds, cash, and money market funds, which offer relatively stable returns and have a lower risk of losing value compared to riskier assets such as stocks or real estate. They may also opt for investments with fixed income or guaranteed principal, such as certificates of deposit (CDs) or annuities. Capital preservation is often favored by investors who are close to retirement or those who have a low risk tolerance. It can also be a viable strategy during times of economic uncertainty or market volatility, as it aims to minimize losses during market downturns. Diversification is a cornerstone of any capital preservation strategy. Spreading investments across various assets, sectors, and geographies can reduce risk and protect capital. By allocating investments across different asset classes, such as stocks, bonds, and cash equivalents, investors can reduce the impact of a poor-performing asset on their overall portfolio. Investing across multiple sectors can protect against sector-specific risks, as various industries often perform differently under different economic conditions. Investing in different countries or regions can help mitigate the risks associated with local economic or political events. Conservative investments typically carry lower risks and are more likely to preserve capital than more aggressive investments. Investing in bonds or other fixed-income securities can provide a steady income stream with a lower risk than equities. Dividend-paying stocks can provide a source of income while offering some potential for capital appreciation. These conservative investments offer relatively low returns but provide a high degree of capital preservation. Proactive risk management is essential for preserving capital. Implementing stop-loss orders can help limit potential losses by automatically selling an investment if its price falls below a predetermined level. Hedging involves taking an offsetting position to protect against potential losses in another investment. Managing the size of individual investments can limit the potential impact of any single investment on overall portfolio performance. For young investors, balancing risk and reward is crucial, as they typically have a longer investment horizon and can potentially recover from short-term market fluctuations. As investors approach retirement, shifting the focus to capital preservation becomes increasingly important. Reducing risk exposure can help protect retirement savings from market downturns. For retirees, ensuring a stable income stream while preserving capital is essential. Managing withdrawal rates can help prevent depleting their nest egg too quickly. Comparing performance to relevant benchmarks and indices can provide valuable insights into how well a capital preservation strategy is performing. Selecting an appropriate benchmark for comparison is crucial to accurately assess portfolio performance. It is essential to recognize that benchmarks have limitations and may not account for specific investor circumstances or goals. Risk-adjusted returns take both return and risk into consideration, providing a more comprehensive view of performance. The Sharpe ratio measures risk-adjusted performance by comparing an investment's return to its volatility. The Sortino ratio is similar to the Sharpe ratio but only considers downside volatility. Various other metrics can help assess risk-adjusted performance, such as the Treynor ratio and the information ratio. Inflation can erode purchasing power over time, making it essential for capital preservation strategies to account for this risk. Inflation can reduce the value of money over time, which means that the purchasing power of an investment may decline even if its nominal value remains unchanged. Investing in assets that have historically outpaced inflation, such as stocks or inflation-protected securities, can help preserve purchasing power. Interest rate changes can impact bond prices and, subsequently, capital preservation strategies focused on fixed-income investments. When interest rates rise, bond prices typically fall, potentially eroding the value of a fixed-income portfolio. Investors can manage interest rate risk by diversifying their bond holdings, investing in short-term bonds, or using bond ladders. Market volatility and economic events can pose challenges to capital preservation strategies. Market fluctuations can lead to short-term losses in investment portfolios, making it crucial for investors to remain focused on their long-term capital preservation goals. Diversification and proactive risk management can help protect capital against market and economic risks. Capital preservation plays a vital role in achieving long-term financial success and protecting one's wealth. It is essential for investors to strike a balance between risk and reward, consistently adapt their capital preservation strategies to align with their personal circumstances and financial goals, and remain focused on proactive risk management. By embracing a capital preservation mindset and employing effective strategies, investors can navigate the complex world of investing with greater confidence and a stronger foundation for a secure financial future. As investors move through different life stages, their approach to capital preservation should evolve to meet their changing needs and priorities. Diversification, conservative investments, and risk management techniques are key components of any capital preservation strategy, helping to safeguard wealth in the face of market volatility, inflation, and interest rate risks. By understanding and addressing these challenges, investors can build resilient portfolios that stand the test of time and maximize their chances of achieving financial success.What Is Capital Preservation?

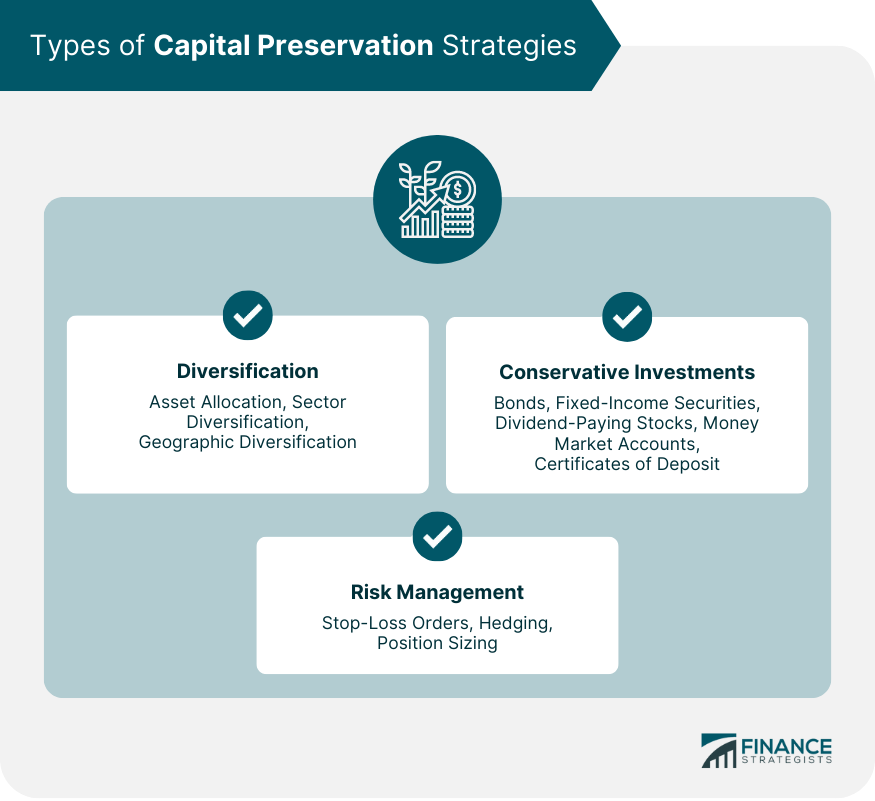

Types of Capital Preservation Strategies

Diversification

Asset Allocation

Sector Diversification

Geographic Diversification

Conservative Investments

Bonds and Fixed-Income Securities

Dividend-Paying Stocks

Money Market Accounts and Certificates of Deposit

Risk Management

Stop-Loss Orders

Hedging Strategies

Position Sizing

Role of Capital Preservation in Different Life Stages

Young Investors

Pre-retirement Investors

Retirees

Evaluating Capital Preservation Performance

Benchmarks and Indices

Comparing Performance to Relevant Benchmarks

Understanding the Limitations of Benchmark Comparisons

Risk-Adjusted Returns

Sharpe Ratio

Sortino Ratio

Other Risk-Adjusted Performance Metrics

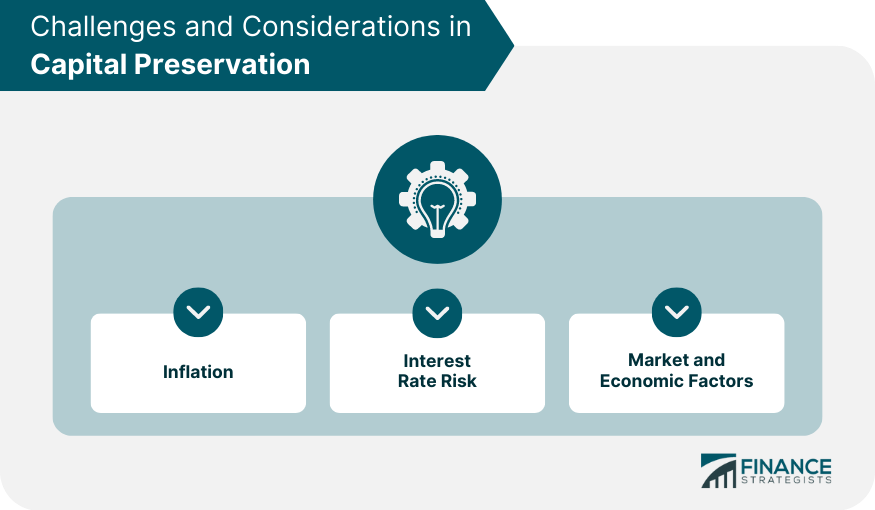

Challenges and Considerations in Capital Preservation

Inflation

Impact of Inflation on Purchasing Power

Strategies for Preserving Purchasing Power

Interest Rate Risk

Effects of Interest Rate Changes on Bond Prices

Managing Interest Rate Risk

Market and Economic Factors

Impact of Market Volatility on Capital Preservation

Diversification and Risk Management Techniques

Final Thoughts

Capital Preservation FAQs

Capital preservation in investment refers to a strategy aimed at protecting an investor's initial investment from any significant losses. It involves investing in assets that have a low risk of losing value, such as high-quality bonds or cash. The goal is to ensure that the investor's principal is protected, even if the returns are low.

Capital preservation focuses on protecting the initial investment from any significant loss, while capital growth seeks to increase the initial investment's value over time. Capital growth typically involves taking on more risk, investing in assets with the potential for higher returns, such as stocks or alternative investments.

Common capital preservation strategies include investing in high-quality bonds, cash or cash equivalents, and conservative mutual funds or ETFs. Some investors may also use a laddered bond strategy or invest in Treasury Inflation-Protected Securities (TIPS) to protect against inflation.

Investors who are close to retirement age or who have a low tolerance for risk often use a capital preservation strategy. It may also be used by investors who have accumulated a significant amount of wealth and want to protect their capital while generating modest returns.

One potential drawback of a capital preservation strategy is the possibility of not keeping pace with inflation. Because these strategies typically involve investing in assets with low returns, the returns may not be enough to keep up with the rising cost of goods and services. Additionally, in a low-interest-rate environment, capital preservation strategies may not generate enough returns to meet an investor's long-term financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.