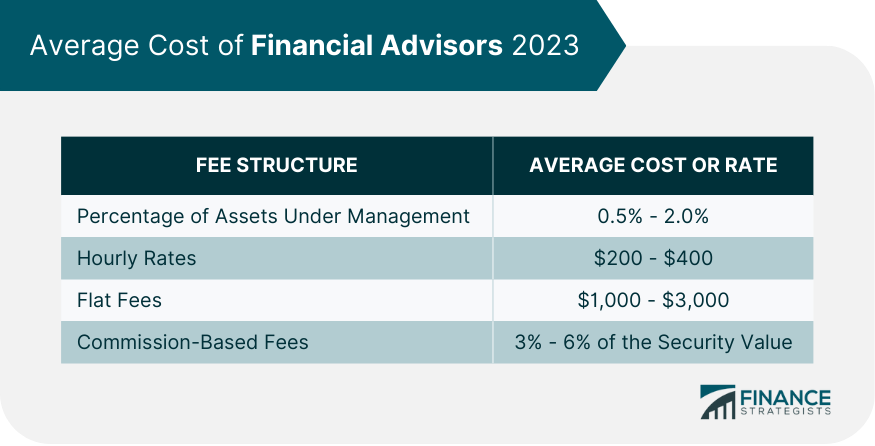

Financial advisors assist clients in developing long-term plans for increasing wealth, controlling risk, and various other financial decisions and challenges. To do so, they have differing services and fee structures. We analyzed all 19,490 Form ADV filings registered with the SEC as of 2023. Below is a table of what percentage of firms offered that fee structure: This fee structure charges a percentage of the assets under management by the firm. Fee structures are often tiered based on the amount of assets managed, with higher AUM often charged a lower rate. Typical Cost: Between 0.50% and 2.00% of assets under management (annually), often lower for a robo-advisor. Fees are typically charged quarterly by the firm and will show on your investment statement. How Common: ~96% of registered firms offer this fee structure Example: If you have $1 million managed by a firm at a 1% management fee, you would be charged $10,000 / year to manage your assets (or $2,500 per quarter). This would be automatically deducted from your investment portfolio. Similar to an attorney, a financial consultant might charge fees based on hourly rates. This fee structure can be advantageous when seeking specific or ad hoc advice. Typical Cost: Charges generally span from $150 to $400 per hour, depending on the extent of the services required. How Common: ~33% of registered firms offer this fee structure Example: If you needed hourly consulting to sell a business or transfer your estate to your children but did not want your assets managed by a firm, you could consult a firm at an hourly rate to answer any questions you may have. Fixed fees are a one-time, lump-sum payment rendered for a specific service, such as creating a financial plan without ongoing management or implementation. This option is beneficial if you solely require guidance for a particular objective rather than a long-term consultancy or asset management. Typical Cost: Fixed fees for creating a financial plan often range from $1,000 to $3,000. How Common: ~49% of registered firms offer this fee structure Example: If you did not want a firm to manage your assets but needed to create a retirement plan, life transition plan such as divorce or loss of a spouse, estate transition plan, business financial plan, or any other financial planning, you could consult with an RIA firm to help you with the creation of that plan. Occasionally, advisors are compensated through commissions by selling certain financial products, such as mutual funds or life insurance policies, or as a broker-dealer by facilitating the buying and selling of securities. Advisors who receive commissions may be incentivized to make specific suggestions to clients in order to secure a commission. Advisors who operate on a fee-only basis do not earn commissions, whereas fee-based advisors may do so. Typical Cost: Often 3% - 6% of the value of the security How Common: Only ~3% of registered firms say they offer this fee structure, but other advisors may receive “soft dollars.” Many mutual funds charge 12b-1 fees to cover the promoting and selling of the fund’s shares. While your advisor does not charge these fees, they may receive a kickback for recommending the investment. Example: An advisor selling their client on a life insurance policy and receiving a commission on the sale of that policy, or recommending a specific investment and receiving a kickback for that recommendation. Advisors typically obtain performance-based fees if a portfolio surpasses a predefined benchmark. This fee is determined through various methods, but is most commonly assessed as a percentage of investment gains. Performance-based fees may incentivize advisors to undertake riskier decisions in pursuit of generating higher returns. Typical Cost: “Two and Twenty” is common among hedge funds with a 2% management fee and a 20% incentive fee above the “hurdle rate,” or performance threshold the fund is compared against. How Common: 32% of registered firms offer this fee structure Example: A hedge fund earns a 15% return with a 20% performance fee in above the performance of the S&P 500, which grew 7% that same year. 20% of fund growth in excess of S&P 500’s 7% growth for that year = 15% hedge fund growth - 7% S&P 500 growth = 8% difference x 20% = 2% performance fee (in addition to the management fee) Firms charge this fee for offering educational resources, such as a monthly periodical. This arrangement is helpful if you aspire to independently learn about investing or financial management. Typical Cost: Anywhere from $10 - $800 per month depending on the level of educational resources offered by the firm. Firms often include financial education as a benefit to clients whose assets they manage. How Common: <1% of registered firms offer this fee structure Example: For $50 per month, a client can subscribe to an educational periodical that teaches the fundamentals of investing. Firms occasionally offer unconventional fee structures when charging clients. For more detailed information about a firm’s specific fee structures, please refer to their Form ADV and Part 2 Brochure. The average cost of working with a financial advisor in 2023 is 0.5% to 2.0% of the assets they manage, $200 to $400 hourly consultation, a flat fee of $1,000 to $3,000 for a one-time service, a 3% to 6% commission fee on the products that they sell. These estimates vary widely by firm and service offering. There are ways to lower the cost regardless of your financial advisor's fee structure. Here is some advice: The fee structure should align with your financial needs. Consider the type of advice you seek, the number of times you will be consulting them, and the complexity of your financial situation. You can use negotiating tactics such as asking for a lower rate or including additional services in the agreement. Feel free to ask for a better deal. It is essential to research and compare different advisors' fees thoroughly. Be sure to read the fine print for details on any additional costs that are not in their base fee. When you monitor your investments regularly, you can identify potential problems before they become costly. In this way, you can keep your financial advisor fees in check. The choice of advisor depends on the type of assistance you require and your financial resources. Traditional advisors are often more expensive than online alternatives. For simple investment goals, Robo-advisors may be a cost-effective option. They charge lower fees than conventional advisors and provide an automated, algorithmic approach to managing your investments. On the other hand, if you have more complicated investment goals or require advice about non-investment-related matters, then a traditional financial advisor may be the better option. They provide personalized advice. Both advisors offer portfolio management, but only conventional financial advisors cater to services related to estate, insurance, and retirement planning. Make sure to know what services you need. Traditional advisors usually charge higher fees. Their average AUM percentage is 0.5% to 2.0%, while Robo-advisors are less than 0.5%. Working with a financial advisor is a sensible option for anyone who wants to organize their money and establish long-term goals; they are not just for the wealthy. To locate the ideal financial advisor for your requirements, follow these steps. It is essential to understand the services you require from a financial advisor before deciding. Consider your current financial goals and needs to define the advice you are looking for. Financial advisors can have different specializations, from those offering retirement planning to those focusing on estate planning or tax advice. Choose an advisor that can meet your needs and has the experience and qualifications you are looking for. The cost of financial advice varies greatly depending on the type of services you need, the advisor's experience, and the advisor's fee structure. Make sure you understand the costs associated with each service. Your capacity to pay is an essential consideration before deciding. Once you have a list of potential advisors, research their credentials and experience. Ask friends or family members for recommendations. Explore their websites to see their services, read reviews, and learn more about their background. Interviewing multiple advisors is essential to ensure you find the right fit. Ask questions about their experience and services, fees, and any other information you feel is necessary. Pay attention to how they communicate with you and get references from past clients. Financial advisors are professionals who offer an extensive range of services to help manage your finances. The cost of hiring an advisor depends on the services you agree to. Financial advisors' most common fee structures include AUM percentage, hourly rates, flat fees, and performance-based fees. In 2023, the average cost of getting financial advisor services is expected to be 0.5% to 2% of your AUM. Consultation with them would cost $200 to $400 per hour. Financial advisors charge a flat fee of $1,000 to $3,000 for a one-time service. They impose a 3% to 6% fee on the products they sell for commission based. It is essential to carefully research and compares fees before selecting a financial advisor. You may also negotiate and ask for a lower fee or additional services included in the agreement to make the most of your money. To select the right financial advisor, you need to understand what services you need and research potential advisors. Consider the amount you can afford to pay and thoroughly interview multiple financial advisors before selecting one. By following these tips, you can guarantee that you make the most out of your financial advisor at the best possible rates. Understanding your options and using negotiation strategies will help minimize the cost of working with a financial advisor.Fee Structures of Financial Advisors

Percentage of Assets Under Management

96%

Fixed Fees

49%

Hourly

33%

Performance-Based Fees

32%

Other

14%

Commissions

3%

Subscription (Newsletter or Periodical)

1%

Have questions about advisor costs? Click here.Percentage of Assets Under Management (AUM)

Hourly

Fixed Rate

Commissions

Performance-Based

Subscription

Miscellaneous

Average Cost of Financial Advisors

Ways to Minimize Financial Advisor Fees

Choose an Appropriate Fee Structure

Research and Compare Fees

Monitor Your Investments Regularly

Robo-Advisor Fees vs Traditional Advisor Fees: Which Is For You?

How to Choose a Financial Advisor

Step 1: Understand What Financial Services You Need

Step 2: Select Which Type of Financial Advisor You Need

Step 3: Consider How Much You Can Pay

Step 4: Research Financial Advisors

Step 5: Interview Multiple Financial Advisors

Final Thoughts

Financial Advisor Cost FAQs

The average cost of working with a financial advisor in 2023 is 0.5% to 2.0% of the assets they manage, $200 to $400 hourly consultation, a flat fee of $1,000 to $3,000 for a one-time service, a 3% to 6% commission fee on the products that they sell.

In addition to the average cost of working with a financial advisor, additional costs may be associated with their services. These can include performance-based fees, account set-up fees, annual maintenance fees, research and analysis fees, and other miscellaneous or management fees. It is essential to understand all the costs of hiring a financial advisor before making a decision.

It is helpful to compare fees and services offered by different advisors to make an informed decision. Negotiating with your potential advisor can also minimize the costs associated with their services in the long run. Additionally, researching any promotions or discounts available can be a great way to save money.

Financial advisors' most common fee structures are AUM percentage, hourly rates, flat fees, and commission-based. It is helpful to understand what type of fee structure your advisor uses so you can be sure that their services align with the cost.

Robo-advisors typically charge a lower fee than traditional financial advisors. They usually charge between 0.25% and 0.50% of assets under management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.