An investment strategy is a systematic approach to making investment decisions based on principles, guidelines, and rules. It involves selecting a portfolio of investments expected to meet the investor's financial goals while considering their risk tolerance, time horizon, and investment objectives. A good investment strategy considers various factors, such as economic trends, market conditions, and the investor's financial situation. It may involve diversifying the portfolio across different asset classes such as stocks, bonds, and real estate and using various investment vehicles such as mutual funds, exchange-traded funds (ETFs), or individual securities. An investment strategy can be either active or passive. An active strategy involves actively managing the portfolio, buying and selling assets in an attempt to outperform the market. A passive strategy, on the other hand, involves buying and holding a diversified portfolio of low-cost index funds that track the market. Having a well-defined investment strategy is crucial to enhance the likelihood of success, maintaining discipline in decision-making, and manage risks more effectively. Investment strategies are designed and implemented by individual investors, financial advisors, and institutional investors, such as mutual funds, pension funds, and endowments. Active investing involves actively selecting and managing individual securities to outperform the market. In contrast, passive investing focuses on replicating the performance of a market index through index funds or exchange-traded funds.. Growth investing aims to identify and invest in companies with high growth potential, often characterized by increasing revenues, earnings, and market share. Value investing involves seeking undervalued stocks with strong fundamentals based on the belief that the market will eventually recognize their true value. Income investing focuses on generating a steady stream of income through dividends, interest, or other distributions from investments, such as stocks, bonds, and real estate investment trusts (REITs). Momentum investing involves buying securities with strong recent price performance and selling those with weak performance based on the assumption that trends are likely to continue. Contrarian investing involves taking positions contrary to prevailing market sentiment, expecting market conditions to eventually change and lead to a reversal. Dollar-cost averaging is a strategy of regularly investing a fixed amount in a particular asset, regardless of its price, to reduce the impact of market volatility on the investment. Socially Responsible Investing (SRI) focuses on incorporating environmental, social, and governance (ESG) criteria into the investment process, aiming to generate both financial returns and positive societal impact. Tactical asset allocation is a dynamic strategy that adjusts the portfolio's asset allocation based on short-term market conditions and opportunities. A strategic asset allocation is a long-term approach that establishes a target asset allocation based on an investor's objectives, risk tolerance, and time horizon. Investment objectives vary depending on the investor's time horizon, which can be classified as short-term (1-3 years), medium-term (3-10 years), or long-term (10+ years). Investors should determine their risk tolerance and return expectations, considering factors such as age, income, financial goals, and investment experience. Investment strategies should take into account constraints and preferences, such as liquidity needs, tax considerations, and ethical or social considerations. Investment strategies should be tailored to the investor's life stage, with younger investors typically having a higher risk tolerance and longer time horizon. In comparison, older investors may prioritize capital preservation and income generation. The investment strategy process involves various stages that require careful consideration and analysis to make informed investment decisions. The first step in the investment strategy process is to assess the investor's investment objectives. Investors should determine their investment time horizon, risk tolerance, and financial objectives. Understanding investment goals helps in determining the appropriate asset allocation, risk tolerance, and investment options that align with the investor's needs. Once the investment objectives have been defined, investors need to determine the appropriate asset allocation for their portfolio. Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents, to achieve diversification and optimize returns. The appropriate asset allocation depends on an investor's investment objectives, risk tolerance, and time horizon. Investors need to select specific investment options to achieve their investment objectives and asset allocation. This involves evaluating various investment options, such as stocks, bonds, mutual funds, ETFs, and alternative investments, and assessing their potential returns, risks, and correlation with other investments in the portfolio. The selection of investment options should be based on thorough research and analysis. Investors need to manage risk to achieve their investment objectives. This involves assessing the potential risks associated with each investment option and determining the appropriate risk management strategies. For example, investors can use diversification, stop-loss orders, and hedging strategies to manage risk. Investment portfolios need to be regularly reviewed and rebalanced to ensure they remain aligned with the investor's investment objectives and asset allocation. Regular review and rebalancing help investors to manage risk, optimize returns, and adjust their investment strategy to changing market conditions. Different investment strategies can have varying tax implications, and investors should consider the tax efficiency of their investments. Tax-efficient investing involves selecting investments and strategies that minimize tax liabilities, such as investing in tax-exempt bonds or using tax-advantaged accounts like IRAs or 401(k)s. Tax-loss harvesting is a strategy that involves selling underperforming securities to offset capital gains tax liabilities and potentially improve the portfolio's after-tax returns. A well-defined investment strategy is essential for achieving financial goals, managing risks, and maintaining discipline in the face of market volatility. An effective investment strategy should be tailored to the investor's unique objectives, risk tolerance, and constraints and should evolve as their financial circumstances change. Regular monitoring and adjustments are necessary to ensure that the investment strategy remains aligned with the investor's goals and market conditions and to capitalize on new opportunities or manage emerging risks.What Is an Investment Strategy?

Types of Investment Strategies

Active vs. Passive Investing

Growth Investing

Value Investing

Income Investing

Momentum Investing

Contrarian Investing

Dollar-Cost Averaging

Socially Responsible Investing (SRI)

Tactical Asset Allocation

Strategic Asset Allocation

Factors to Consider When Choosing an Investment Strategy

Investment Objectives

Risk Tolerance

Investment Preferences

Life Stage Considerations

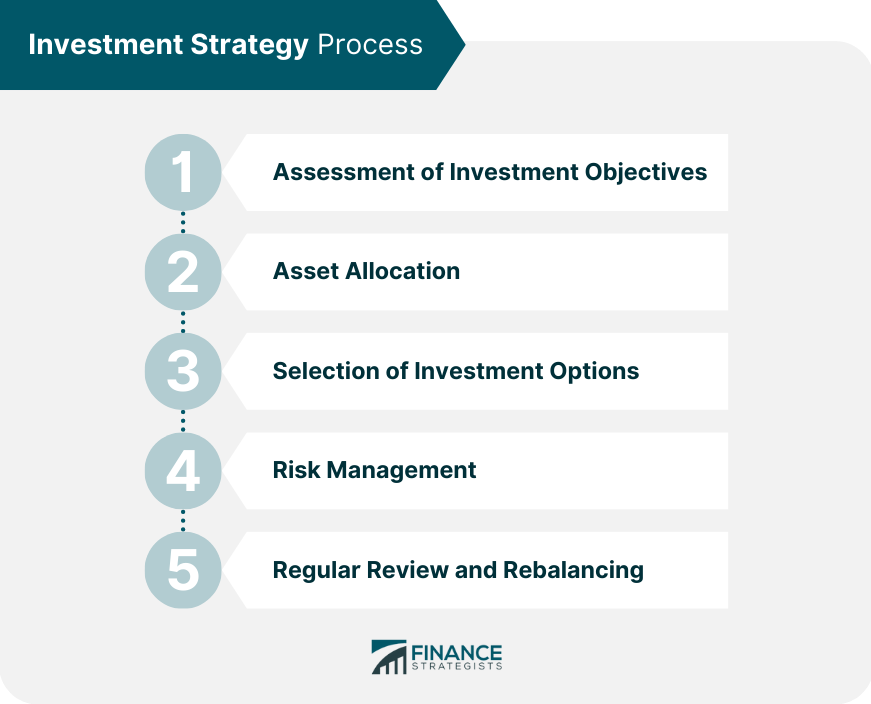

Investment Strategy Process

Assessment of Investment Objectives

Asset Allocation

Selection of Investment Options

Risk Management

Regular Review and Rebalancing

Tax Implications of Investment Strategies

Tax-Efficient Investing

Tax-Loss Harvesting

Conclusion

Investment Strategy FAQs

An investment strategy is a systematic approach to making investment decisions based on a set of principles and rules. It's essential because it helps investors make informed decisions about their investments while minimizing risks and maximizing returns.

To create an investment strategy, you must determine your financial goals, risk tolerance, and time horizon. Then, you can select a diversified portfolio of investments based on your preferences and goals. You can also seek the advice of a financial advisor to help you create a suitable investment strategy.

There are several types of investment strategies, including value investing, growth investing, dividend investing, index investing, and momentum investing. Each strategy has its unique approach to investing and is suitable for different types of investors.

The success of your investment strategy depends on your financial goals and the performance of your investments. You can regularly monitor your portfolio's performance and compare it to the market benchmarks to see if your strategy works.

Yes, an investment strategy can change over time. As your financial goals or personal circumstances change, you may need to adjust your investment strategy to reflect these changes. It's essential to regularly review and update your investment strategy to ensure it remains suitable for your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.