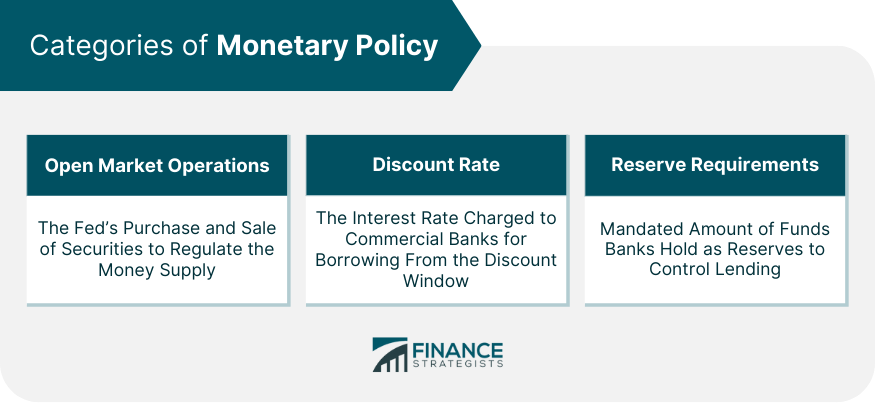

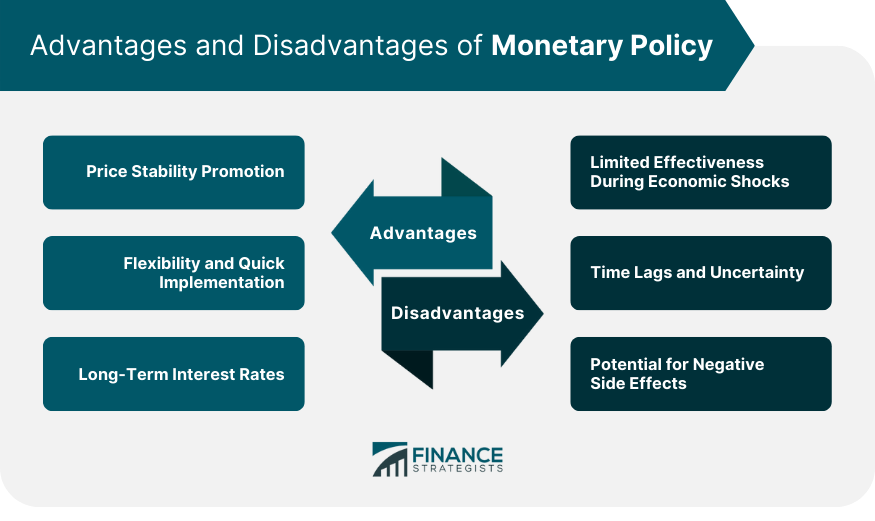

To define monetary policy, it refers to the financial policies adopted by the monetary authority of a country, such as the Federal Reserve, to achieve the country's economic goals. The primary goal of monetary policy is to achieve specific economic objectives, such as promoting price stability, supporting sustainable economic growth, and maintaining low levels of unemployment. These goals are often a combination of economic growth, price stability and credit availability. Central banks utilize tools like interest rate changes, open market operations, and quantitative easing to control money supply and interest rates, affecting economic activities. These actions influence borrowing, spending, and investment, shaping overall economic conditions and results. Monetary policies are generally categorized as either expansionary or contractionary. Expansionary policies are used to accelerate the economy by making capital easily accessible. Contractionary policies are used to fight inflation and slow economic growth when necessary. While expansionary policy may seem more intuitive, both expansionary and contractionary policies are needed for the long-term health of an economy. For example, expansionary policy's low interest rates can result in harmful levels of inflation and undisciplined investments, forming economic bubbles. Unlike fiscal policy, which pertains to policies on government taxation and spending, monetary policy is independent from the political process. The Federal Reserve operates autonomously in order to shield it from short-term political pressures, such as a presidential election. This ensures that the Federal Reserve may make the best decisions for the long-term health of the economy. According to federalreserve.gov, "Congress has directed the Fed to conduct the nation's monetary policy to support three specific goals: 1. Maximum Sustainable Employment Central banks aim to achieve the highest level of employment that an economy can sustain over the long term. By implementing accommodative monetary policies, such as lowering interest rates or engaging in quantitative easing, central banks encourage borrowing and investment, which can stimulate economic activity and lead to job creation. Conversely, tightening monetary policy by raising interest rates can help prevent excessive inflation and maintain a balance between economic growth and employment. 2. Stable Prices Maintaining stable prices is a core objective of monetary policy. Central banks strive to keep inflation in check to prevent rapid and unpredictable price increases, which can erode purchasing power and disrupt economic planning. Through various policy measures, central banks manage the money supply and credit availability to control inflation. By keeping inflation at a moderate and predictable level, they aim to create a favorable environment for economic growth and financial stability. 3. Moderate Long-Term Interest Rates Central banks also seek to maintain moderate and stable long-term interest rates. By influencing short-term interest rates through their policy tools, central banks impact the broader interest rate environment. Moderate long-term interest rates are essential for encouraging borrowing and investment, which contribute to economic growth. Additionally, stable long-term rates help businesses and individuals make informed financial decisions, as sudden interest rate fluctuations can introduce uncertainty into economic activities. To achieve these goals, the Federal Reserve institutes three categories of monetary policy: Open Market Operations The Fed's purchase and sale of securities in the open market in order to regulate the money supply. Open market operations involve central banks buying or selling government securities in the open market. When central banks buy securities, they inject money into the banking system, increasing the money supply and potentially lowering short-term interest rates. Conversely, selling securities absorbs money from the system, reducing the money supply and potentially raising interest rates. These actions influence the overall availability of credit and money in the economy, affecting borrowing costs and economic activity. Discount Rate The Discount Rate is the interest rate charged to commercial banks on debt borrowed from "the discount window," or the Federal Reserve Bank's lending facility. By changing the discount rate, central banks can influence the cost of borrowing for banks, which in turn affects the rates at which banks lend to businesses and consumers. Lowering the discount rate encourages banks to borrow more and lend at lower rates, promoting economic activity. Conversely, raising the discount rate makes borrowing from the central bank more expensive, which can lead to tighter lending conditions and slower economic growth. Reserve Requirements The amount of funds banks are required to hold in its reserves in order to meet its liabilities. Central banks often mandate that commercial banks hold a certain percentage of their deposits as reserves. By adjusting these reserve requirements, central banks control the amount of money that banks can lend out relative to their deposits. Lowering reserve requirements allows banks to lend more of their deposits, increasing the money supply and stimulating economic activity. Conversely, raising reserve requirements reduces the amount of money banks can lend, which can help control inflation and prevent excessive risk-taking in the financial system. Monetary policy, when effectively implemented, is a pivotal tool in maintaining price stability within an economy. Central banks, such as the Federal Reserve in the U.S., utilize various instruments, like open market operations, to influence the level of money and credit in the economy. By doing so, they aim to keep inflation at a target rate, preventing both hyperinflation and deflation. Price stability ensures that purchasing power is maintained, giving consumers and businesses the confidence to spend and invest. This, in turn, helps in fostering sustainable economic growth, ensuring that economies neither overheat nor fall into prolonged recessions. One of the inherent strengths of monetary policy lies in its ability to be adjusted swiftly in response to changing economic conditions. Unlike fiscal policy, which often requires lengthy legislative processes and can be mired in political disputes, monetary policy can be enacted relatively quickly. Central banks can decide on interest rate changes or engage in quantitative easing in a timely manner, allowing them to respond proactively to emerging economic challenges or shifts in the economic landscape. Additionally, this flexibility means central banks can reverse decisions if they see unintended consequences or if the economic situation changes again. While central banks typically have a more direct influence on short-term interest rates, their actions undeniably affect long-term rates as well. By setting expectations about the future course of inflation and monetary policy, they can indirectly sway long-term interest rates. These long-term rates, in turn, influence decisions related to big-ticket items such as mortgages, business loans, and infrastructure projects. Lower long-term interest rates can stimulate borrowing and investment, potentially leading to economic expansion. Conversely, when the central bank signals concerns about inflation, and the expectation is that tighter monetary policy will follow, long-term rates might increase, thereby cooling down excessive borrowing and spending. During a liquidity trap – where interest rates are near zero and the demand for money becomes highly elastic – traditional tools like rate cuts might not stimulate borrowing and spending as intended. In such situations, people and businesses might choose to hoard cash, anticipating further economic downturns. Even with low or zero interest rates, the demand for loans might remain subdued, making the central bank's policy tools less potent. Implementing changes in monetary policy doesn't produce immediate results. There's often a lag between when a policy change is made and when its effects are felt in the broader economy. This delay can make it challenging for central banks to respond effectively to rapidly changing economic conditions. Additionally, the exact duration and potency of these lags can be uncertain, making it difficult for policymakers to predict the precise impact of their decisions. In some cases, by the time the effects are realized, the economic situation might have changed, requiring a different policy response. Maintaining low interest rates for extended periods can lead to asset bubbles as investors search for higher yields in riskier assets. Such bubbles, when they burst, can lead to economic downturns. Furthermore, while low rates can encourage borrowing and investment, they can also discourage savings. Overreliance on monetary easing can lead to misallocation of resources, with businesses investing in less-than-optimal projects due to the cheap availability of credit. Monetary policy is the financial strategy adopted by a country's central bank, and plays a crucial role in achieving economic objectives. These goals include ensuring maximum sustainable employment, stable prices, and moderate long-term interest rates. By utilizing tools such as interest rate adjustments, open market operations, and quantitative easing, central banks influence economic activities and outcomes. This policy's advantages lie in its ability to promote price stability, offer flexibility for quick adjustments, and indirectly impact long-term interest rates. However, its effectiveness can be limited during economic shocks, hampered by time lags and uncertainty in outcomes, and prone to potential negative side effects such as asset bubbles and resource misallocation. What Is Monetary Policy?

What Are the Types of Monetary Policy?

What Is the Objective of U.S. Monetary Policy?

Categories of Monetary Policy

Advantages of Monetary Policy

Price Stability Promotion

Flexibility and Quick Implementation

Long-Term Interest Rates

Disadvantages of Monetary Policy

Limited Effectiveness During Economic Shocks

Time Lags and Uncertainty

Potential for Negative Side Effects

Conclusion

Monetary Policy FAQs

Monetary policy refers to the financial policies adopted by the monetary authority of a country, such as the Federal Reserve, to achieve the country’s economic goals.

Monetary policies are generally categorized as either expansionary or contractionary.

Unlike fiscal policy, which pertains to policies on government taxation and spending, monetary policy is independent from the political process.

The goals of different monetary policies are often a combination of economic growth, price stability, and credit availability.

Congress has directed the Fed to achieve the following specific goals: maximize sustainable employment; stabilize prices; moderate long-term interest rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.