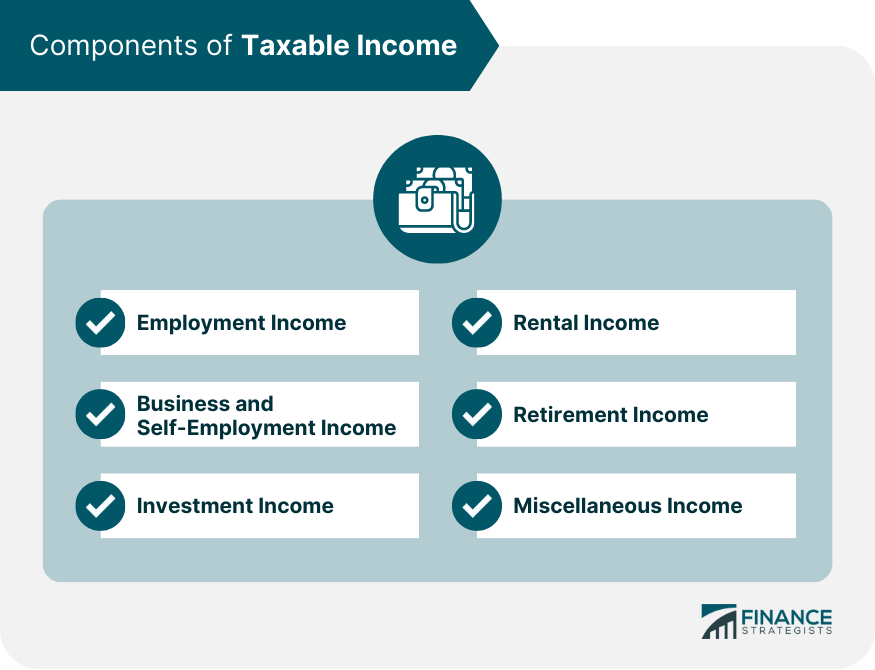

Taxable income refers to the portion of an individual's or a business's income that is subject to taxation by the government. It includes various types of earnings, such as wages, salaries, and investment income, minus allowable deductions and credits. There are various types of income that are subject to taxation, including employment income, business and self-employment income, investment income, rental income, retirement income, and miscellaneous income. Each type of income has specific tax rules and reporting requirements, which may vary depending on the tax jurisdiction. Tax jurisdictions refer to the governing bodies responsible for imposing and regulating taxes on income. These may include federal, state, and local governments, each with their specific tax regulations and rates. Taxpayers must understand the rules that apply to them based on their residency and the source of their income. Salaries and wages are the most common form of employment income and include regular compensation received for work performed. This income is usually subject to income tax withholding by employers, who deduct a portion of the employee's pay to cover their tax liability. Bonuses and commissions are additional forms of employment income typically received as performance-based incentives. These earnings are subject to taxation and are often taxed at a different rate than regular wages, depending on the tax jurisdiction and the amount received. Employee benefits, such as health insurance, retirement contributions, and fringe benefits, may also be considered taxable income, depending on the specific benefit and the applicable tax regulations. Certain benefits, however, may be excluded from taxable income or receive preferential tax treatment. Profits from business activities refer to the earnings generated by a business owner or a self-employed individual. These earnings are subject to taxation and must be reported on the taxpayer's income tax return, with the appropriate deductions and expenses accounted for. Freelance income is earned by individuals who provide services to clients on a project-by-project basis. This income is considered self-employment income and is subject to taxation. Freelancers must report their earnings and expenses on their tax returns and may be required to make estimated tax payments throughout the year. Gig economy income is generated through platforms that connect individuals with short-term work opportunities, such as ridesharing or food delivery apps. This income is also considered self-employment income and is subject to taxation, with the taxpayer responsible for reporting their earnings and expenses on their tax returns. Interest income is earned from investments, such as savings accounts, bonds, or certificates of deposit. This income is generally subject to taxation and must be reported on the taxpayer's income tax return. Some types of interest income, however, may be tax-exempt or taxed at a reduced rate. Dividend income is paid to shareholders as a distribution of a company's earnings. This income is typically subject to taxation, with specific tax rates and reporting requirements depending on the type of dividend received and the tax jurisdiction. Capital gains represent the profit earned from the sale of assets, such as stocks, real estate, or other investments. These gains are subject to taxation, with different tax rates and reporting requirements applying based on the type of asset, the holding period, and the tax jurisdiction. Rental income is the money received by property owners for the use of their real estate. This income is subject to taxation and must be reported on the taxpayer's income tax return. Property owners can also deduct certain expenses related to the rental property, such as maintenance, repairs, and depreciation. Pensions are a form of retirement income paid to individuals who have contributed to a pension plan during their working years. Pension income is generally subject to taxation, although some pension plans may provide tax-exempt or partially tax-exempt benefits depending on the plan's structure and the tax jurisdiction. Social Security benefits are government-provided retirement income for eligible individuals. These benefits may be subject to taxation depending on the recipient's total income and tax filing status. Specific rules and thresholds apply to determine the taxable portion of Social Security benefits. Retirement account distributions are withdrawals from retirement savings plans, such as 401(k)s or IRAs. The tax treatment of these distributions depends on the type of retirement account, the taxpayer's age, and other factors. Some distributions may be tax-free, while others are subject to income tax. Gambling winnings, such as those from casinos, lotteries, or sports betting, are considered taxable income. Taxpayers must report their winnings on their income tax returns, and in some cases, they may be required to pay taxes on these earnings through withholding or estimated tax payments. Royalties are payments received for the use of intellectual property, such as copyrighted works, patents, or trademarks. This income is subject to taxation and must be reported on the taxpayer's income tax return. Certain expenses related to the production of the intellectual property may be deductible. Legal settlements are payments received as a result of a lawsuit or legal claim. The tax treatment of these payments depends on the nature of the settlement and the underlying claim. Some settlements may be tax-free, while others are considered taxable income and must be reported on the taxpayer's tax return. The standard deduction is a fixed amount that taxpayers can subtract from their taxable income to reduce their tax liability. The amount of the standard deduction varies based on filing status, age, and other factors. Most taxpayers choose to take the standard deduction rather than itemizing their deductions. Medical expenses are the costs incurred for the diagnosis, treatment, or prevention of a medical condition. Taxpayers can deduct qualifying medical expenses that exceed a certain percentage of their AGI. To claim this deduction, taxpayers must itemize their deductions on their tax return. State and local taxes, also known as SALT, include income taxes, sales taxes, and property taxes. Taxpayers can deduct a limited amount of these taxes as an itemized deduction on their federal income tax return, subject to specific rules and limitations. Mortgage interest is the interest paid on a loan secured by a primary or secondary residence. Taxpayers can deduct a portion of their mortgage interest as an itemized deduction, subject to specific rules and limits. This deduction can help homeowners reduce their taxable income and lower their overall tax liability. Charitable contributions are donations made to qualified nonprofit organizations. Taxpayers can deduct these contributions as an itemized deduction on their tax return, subject to specific rules and limitations. This deduction encourages philanthropy and can help taxpayers lower their taxable income. Educational expenses include costs related to attending a college, university, or other eligible educational institution. Some of these expenses, such as tuition, fees, and course materials, may be deductible as an itemized deduction or eligible for tax credits, depending on the taxpayer's situation and the specific tax provisions. The Child Tax Credit is a credit designed to help families offset the costs of raising children. Eligible taxpayers can claim a credit for each qualifying child, subject to income limitations and other criteria. This credit is partially refundable, meaning taxpayers may receive a refund even if their tax liability is reduced to zero. The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and families. The credit amount depends on the taxpayer's income, filing status, and the number of qualifying children. The EITC helps to reduce the tax burden on eligible taxpayers and may result in a refund. Education credits are tax credits available to help offset the costs of higher education for eligible students and their families. The two main education credits are the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Each credit has specific eligibility requirements, income limits, and credit amounts. Energy credits are tax incentives designed to promote energy efficiency and the use of renewable energy sources. These credits may be available to taxpayers who make qualifying energy-efficient home improvements or purchase eligible renewable energy systems. The credits can help offset the costs of these investments and reduce the taxpayer's tax liability. Gross income is the total amount of income earned by an individual or a business before deductions, credits, or adjustments are applied. It includes various types of income, such as wages, salaries, interest, dividends, and rental income. Understanding gross income is the first step in determining taxable income. Adjusted gross income is a taxpayer's gross income minus specific adjustments allowed by the tax code. These adjustments may include contributions to retirement accounts, alimony payments, and certain education expenses. AGI is a critical figure in the tax calculation process, as it is used to determine eligibility for deductions and credits. Where AGI stands for Adjusted Gross Income and represents the taxpayer's total income from all sources minus specific deductions allowed by the IRS. Deductions are either the standard deduction or itemized deductions claimed by the taxpayer. The resulting taxable income is used to calculate the taxpayer's tax liability based on their applicable tax rate. Tax brackets and rates are the specific thresholds and percentages used to calculate a taxpayer's tax liability. Tax systems often use progressive tax rates, meaning the rate increases as taxable income increases. Taxpayers should understand their tax bracket and rate to estimate their tax liability and plan for potential changes in income or tax laws. Retirement accounts, such as 401(k)s and IRAs, provide tax benefits that can help individuals save for retirement. Contributions to these accounts may be tax-deductible or made with pre-tax dollars, reducing taxable income. Earnings within the account typically grow tax-deferred, and withdrawals may be taxed at a lower rate in retirement. Health savings accounts are tax-advantaged accounts designed to help individuals save for medical expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs can be an effective way to reduce taxable income and save for future healthcare costs. Education savings accounts, such as 529 plans and Coverdell Education Savings Accounts (ESAs), offer tax benefits for saving for education expenses. Contributions to these accounts grow tax-deferred, and withdrawals for qualified education expenses are tax-free. Utilizing these accounts can help families save for education while reducing their taxable income. Income shifting strategies involve reallocating income or deductions among family members or tax years to minimize overall tax liability. Common techniques include transferring income-producing assets to lower-income family members or deferring income to a future tax year when the taxpayer expects to be in a lower tax bracket. Tax-loss harvesting is a strategy used to offset capital gains by realizing capital losses on underperforming investments. By selling these investments and realizing a capital loss, taxpayers can offset capital gains and potentially reduce their tax liability. This strategy can be particularly useful in years with significant capital gains. Charitable giving strategies involve making donations to qualified nonprofit organizations to reduce taxable income and support philanthropic causes. Techniques may include donating appreciated assets, making qualified charitable distributions from retirement accounts, or utilizing donor-advised funds. These strategies can provide tax benefits while supporting important causes. Maintaining accurate records and documentation of income, expenses, deductions, and credits is essential for tax planning and compliance. Proper record keeping can help taxpayers identify potential tax savings opportunities and ensure they have the necessary documentation to support their tax return in case of an audit. Tax forms and schedules are the documents used to report income, deductions, credits, and other tax-related information to the Internal Revenue Service (IRS). The primary form used to report individual income tax is Form 1040, which may have additional schedules depending on the taxpayer's situation. Taxpayers must accurately complete these forms and schedules to avoid errors and potential penalties. Filing deadlines for federal income tax returns vary depending on the taxpayer's filing status, income level, and other factors. For most taxpayers, the deadline to file and pay any taxes owed is April 15th of each year. However, certain situations, such as extensions or amended returns, may have different deadlines. Taxpayers have various options for paying their tax liability, including electronic payments, credit or debit card payments, and mailing a check or money order. Taxpayers who cannot pay their full tax liability may be able to set up a payment plan or request an offer in compromise to settle their debt for less than the full amount owed. Penalties and interest may be assessed for late or incomplete tax filings or payments. The IRS charges interest on unpaid taxes, and penalties may be assessed for failure to file, failure to pay, or accuracy-related issues. Taxpayers should be aware of these potential penalties and take steps to avoid them. In some cases, the IRS may conduct an audit or dispute a taxpayer's return, resulting in additional taxes, penalties, or interest. Taxpayers have the right to challenge the IRS's findings and may appeal their case to the Tax Court or other appropriate venue. Seeking professional advice and maintaining accurate records can help taxpayers minimize the risk of an audit or dispute. Managing taxable income is an essential part of personal finance and financial planning. Understanding the components of taxable income, deductions, and credits can help individuals and families minimize their tax liability and maximize their financial well-being. By staying informed about changes in tax laws and utilizing tax planning strategies, taxpayers can better manage their tax burden. Tax laws and regulations are subject to frequent changes, making it essential for taxpayers to stay informed about updates and new provisions. Taxpayers should seek professional advice and regularly review their tax situation to ensure they are taking advantage of all available tax benefits. For complex tax situations, or for those who are unsure of their tax status, consulting with a tax professional can be beneficial. Tax professionals can provide guidance on tax planning, preparation, and compliance, and can help taxpayers navigate audits and disputes with the IRS. Seeking professional advice can help ensure that taxpayers are in compliance with tax laws and are maximizing their tax benefits.What Is Taxable Income?

Have a question about taxes? Click here.Components of Taxable Income

Employment Income

Salaries and Wages

Bonuses and Commissions

Employee Benefits

Business and Self-Employment Income

Profits from Business Activities

Freelance Income

Gig Economy Income

Investment Income

Interest Income

Dividend Income

Capital Gains

Rental Income

Retirement Income

Pensions

Social Security Benefits

Retirement Account Distributions

Miscellaneous Income

Gambling Winnings

Royalties

Legal Settlements

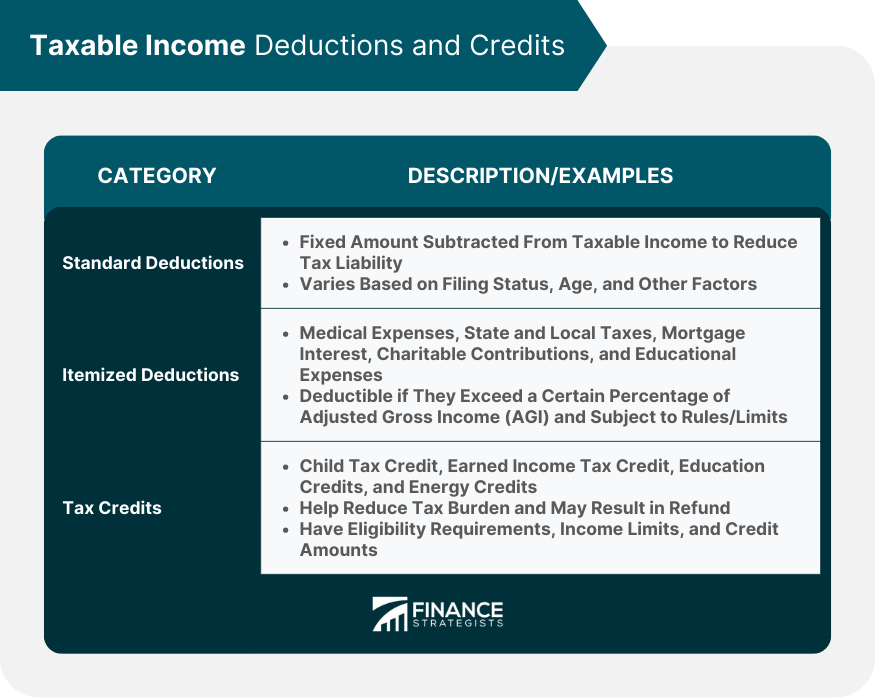

Taxable Income Deductions and Credits

Standard Deductions

Itemized Deductions

Medical Expenses

State and Local Taxes

Mortgage Interest

Charitable Contributions

Educational Expenses

Tax Credits

Child Tax Credit

Earned Income Tax Credit

Education Credits

Energy Credits

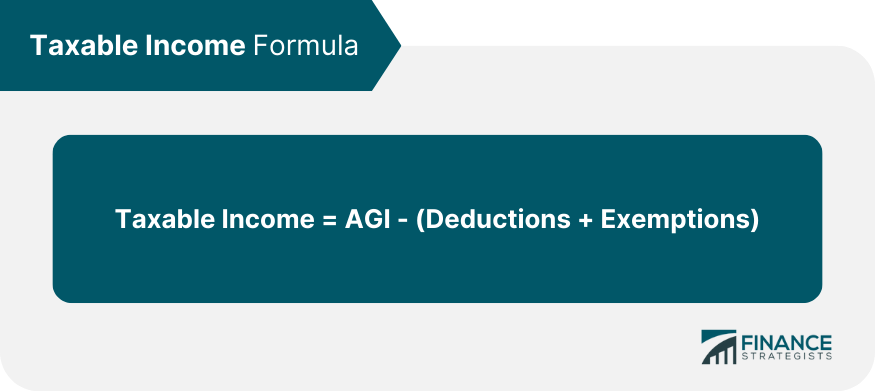

Calculating Taxable Income

Gross Income

Adjusted Gross Income (AGI)

Taxable Income Formula

Tax Brackets and Rates

Tax Planning and Strategies

Tax-Advantaged Accounts

Retirement Accounts

Health Savings Accounts (HSAs)

Education Savings Accounts

Income Shifting Strategies

Tax-Loss Harvesting

Charitable Giving Strategies

Record Keeping and Documentation

Filing and Paying Taxes

Tax Forms and Schedules

Filing Deadlines

Tax Payment Options

Penalties and Interest

Audits and Tax Disputes

Final Thoughts

Taxable Income FAQs

Taxable income is the amount of income subject to taxation by the government. It includes various types of income, such as wages, salaries, interest, dividends, rental income, and more.

Taxable income is calculated by subtracting deductions and exemptions from adjusted gross income (AGI). Taxpayers can claim the standard deduction or itemize their deductions, depending on which option provides the greatest tax benefit.

Tax planning strategies to minimize taxable income may include utilizing tax-advantaged accounts such as retirement accounts, health savings accounts, and education savings accounts. Other strategies may include income shifting, tax-loss harvesting, and charitable giving.

Tax brackets and rates are specific thresholds and percentages used to calculate a taxpayer's tax liability. Tax systems often use progressive tax rates, meaning the rate increases as taxable income increases. Taxpayers should understand their tax bracket and rate to estimate their tax liability and plan for potential changes in income or tax laws.

Managing taxable income is important for personal finance and financial planning. Understanding the components of taxable income, deductions, and credits can help individuals and families minimize their tax liability and maximize their financial well-being. By staying informed about changes in tax laws and utilizing tax planning strategies, taxpayers can better manage their tax burden.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.