Risk tolerance is a fundamental concept in the field of finance that determines an individual's or an organization's ability and willingness to take on financial risks in pursuit of their financial goals. It is a psychological trait that varies from person to person and is influenced by a combination of factors, including personality, financial situation, investment goals, and past experiences. This assessment helps investors and financial advisors to understand the level of risk that a person or entity is comfortable with, allowing them to create an investment strategy that aligns with their risk tolerance level. Understanding an individual's or organization's risk tolerance is essential for successful financial planning and investment. It ensures that investment strategies align with the person's or entity's financial goals and emotional comfort with risk. Furthermore, knowing one's risk tolerance helps to create a balanced investment portfolio, which can better manage market fluctuations and provide long-term financial growth. Several factors influence an individual's or organization's risk tolerance, including age, financial capacity, investment experience, emotional and psychological factors, and personal circumstances. By considering these factors, financial advisors can develop a comprehensive risk tolerance assessment that guides their clients towards informed investment decisions. Investors with conservative risk tolerance prioritize the preservation of capital over significant financial gains. They prefer investments with minimal risk, such as bonds, certificates of deposit (CDs), and money market funds. These investors are more comfortable with lower returns to ensure the safety of their principal investment. Moderate risk-tolerant investors are willing to take on some level of risk to achieve higher returns, but they still prioritize capital preservation. They often invest in a mix of low- and medium-risk assets, such as bonds, dividend-paying stocks, and some equity funds. This balanced approach allows for growth potential while maintaining a level of security. Aggressive risk-tolerant investors are willing to accept higher levels of risk in pursuit of potentially higher returns. They often invest in high-risk assets like stocks, options, and high-yield bonds. These investors understand that their investments might experience significant fluctuations in value, but they are comfortable with this level of risk in exchange for the potential for substantial gains. A person's appropriate risk tolerance level depends on various factors, including their financial goals, time horizon, and emotional comfort with risk. It is essential to conduct a thorough risk tolerance assessment to ensure that an investor's portfolio aligns with their overall financial strategy. The first step in the risk tolerance assessment process is to identify an individual's or organization's financial goals and objectives. These goals may include saving for retirement, funding education, or generating passive income. By understanding these objectives, financial advisors can develop a tailored investment strategy that aligns with the client's risk tolerance level. Financial advisors gather information about their clients' financial situation, including their income, assets, liabilities, and expenses. This information helps advisors understand their clients' financial capacity, which is a critical factor in determining their risk tolerance. By analyzing the client's current financial situation, financial advisors can gain insights into their clients' investment experience, financial knowledge, and existing investment portfolio. This information helps advisors determine if the client's current investment strategy aligns with their risk tolerance level and financial goals. Financial advisors often use questionnaires and interviews to assess their clients' risk tolerance. These tools help advisors gauge the clients' emotional and psychological comfort with risk, as well as their understanding of investment concepts and strategies. By discussing various investment scenarios and risk levels, advisors can develop a clearer picture of their clients' risk tolerance. Risk tolerance is not a static concept; it can change over time due to various factors, such as changes in financial circumstances, personal experiences, or market conditions. Regularly reviewing and adjusting an individual's or organization's risk tolerance is essential to ensure their investment strategy remains aligned with their financial goals and overall risk profile. Age and time horizon play a significant role in determining an individual's risk tolerance. Younger investors generally have a longer time horizon, which allows them to take on more risk in pursuit of higher returns, as they have more time to recover from potential losses. Older investors, with shorter time horizons, may have a lower risk tolerance, as they need to preserve their capital for imminent financial goals, such as retirement. An individual's financial capacity, which includes their income, assets, and liabilities, influences their risk tolerance. Investors with more substantial financial resources can typically afford to take on more risk, as they have a larger financial cushion to absorb potential losses. Conversely, those with limited financial capacity may have a lower risk tolerance, as they cannot afford significant financial setbacks. Investors with more experience and knowledge in investment strategies and financial markets tend to have a higher risk tolerance, as they better understand the potential risks and rewards associated with various investment options. In contrast, less experienced investors may be more risk-averse due to their limited understanding of investment risks and strategies. Emotional and psychological factors, such as an individual's personality, stress tolerance, and overall emotional well-being, can significantly impact their risk tolerance. Some investors may be more comfortable with risk and uncertainty, while others may prefer more stable and predictable investments. Family and personal circumstances, such as marital status, number of dependents, and overall financial stability, can also affect an individual's risk tolerance. Those with more financial responsibilities may be more risk-averse to protect their family's financial well-being, while those with fewer financial obligations may be more willing to take on higher levels of risk. A well-diversified portfolio helps investors manage risk by spreading investments across various asset classes, industries, and geographic regions. Diversification reduces the impact of a single underperforming investment on the overall portfolio, which can help investors achieve more consistent returns over time. A balanced portfolio acknowledges the risk-reward trade-off, which states that the potential for higher returns often comes with increased risk. By allocating assets based on an individual's risk tolerance, financial advisors can help clients achieve their financial goals while managing their exposure to risk. Asset allocation strategies involve dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, to balance risk and potential returns. These strategies consider an individual's risk tolerance, time horizon, and financial goals to create a well-diversified portfolio that aligns with their overall financial strategy. Regularly monitoring and rebalancing the investment portfolio is crucial to maintaining a balanced and diversified asset allocation. As market conditions change, some investments may outperform or underperform, causing the portfolio's asset allocation to shift. Rebalancing ensures that the portfolio remains aligned with the individual's risk tolerance and financial goals by adjusting the asset allocation to its target levels. Financial advisors should educate their clients on the importance of understanding and assessing risk tolerance. By explaining the role of risk tolerance in financial planning and investment, advisors can help clients make more informed decisions about their investment strategies. Advisors should discuss various investment strategies that align with their clients' risk tolerance levels. This conversation should cover the potential risks and rewards associated with different investment options, helping clients better understand the implications of their investment choices. Open communication between financial advisors and clients is essential for maintaining an investment strategy that aligns with the client's risk tolerance. Clients should feel comfortable discussing their concerns about risk and any changes in their financial circumstances that could affect their risk tolerance. One of the challenges of risk tolerance assessments is the subjectivity of measuring an individual's emotional and psychological comfort with risk. As a result, risk tolerance assessments may not always accurately reflect a person's true risk tolerance level, which could lead to inappropriate investment strategies. Biases in self-assessment can also impact the accuracy of risk tolerance assessments. Investors may overestimate their risk tolerance due to overconfidence or underestimate it due to fear or past negative experiences. Financial advisors should be aware of these biases and address them when conducting risk tolerance assessments. Risk tolerance can change over time, as individuals' financial circumstances, goals, and personal experiences evolve. Regularly reassessing risk tolerance is essential to ensure that an individual's investment strategy remains aligned with their current risk profile and financial objectives. Market conditions can also impact an individual's risk tolerance. For example, during periods of market stability and growth, investors may feel more comfortable taking on risk, whereas during periods of market volatility and decline, they may become more risk-averse. Financial advisors should consider the potential impact of market conditions on risk tolerance when developing investment strategies for their clients. Risk tolerance assessments play a crucial role in financial planning and investment, helping individuals and organizations make informed decisions about their investment strategies. By understanding their risk tolerance, investors can create a balanced and diversified portfolio that aligns with their financial goals and emotional comfort with risk. Risk tolerance is not a static concept, and it can change over time due to various factors. Regularly reviewing and adjusting an individual's risk tolerance ensures that their investment strategy remains aligned with their financial goals and overall risk profile. By educating clients about the importance of risk tolerance and discussing investment strategies that align with their risk profile, financial advisors can help their clients make more informed decisions about their investment choices. Open communication and ongoing evaluation are essential for maintaining an investment strategy that reflects an individual's or organization's risk tolerance and supports their long-term financial success.Definition of Risk Tolerance

Importance of Understanding Risk Tolerance in Financial Planning and Investment

Factors Influencing Risk Tolerance

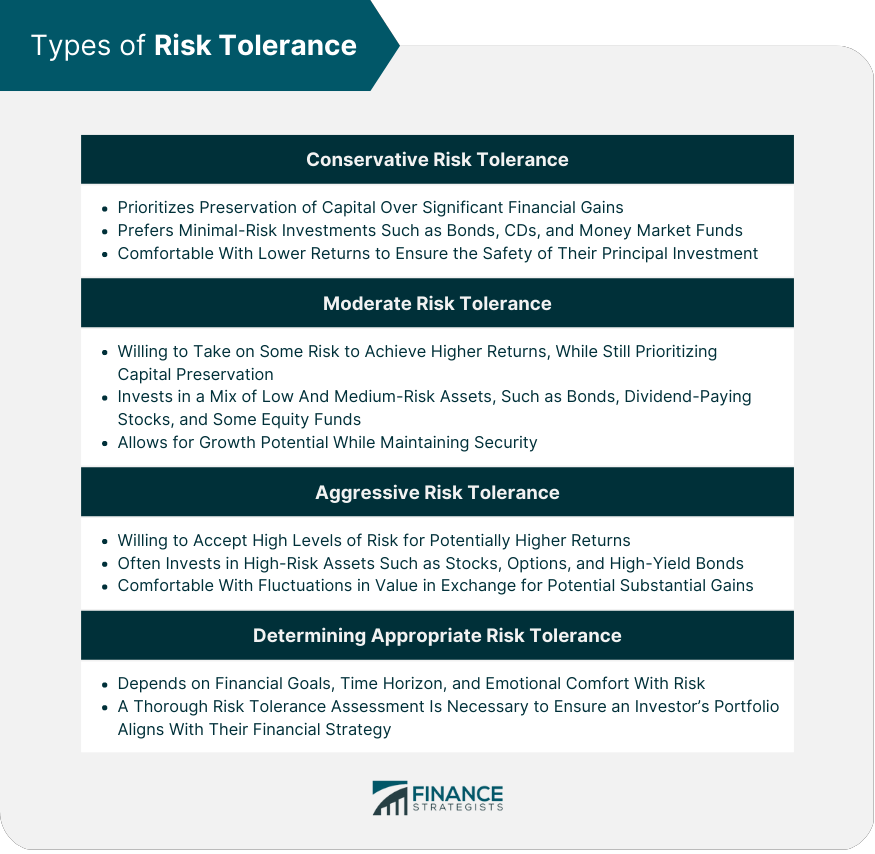

Types of Risk Tolerance

Conservative Risk Tolerance

Moderate Risk Tolerance

Aggressive Risk Tolerance

Determining the Appropriate Risk Tolerance for Individuals

Risk Tolerance Assessment Process

Identifying Financial Goals and Objectives

Gathering Client Information

Analyzing the Current Financial Situation

Determining Risk Tolerance Through Questionnaires and Interviews

Reviewing and Adjusting Risk Tolerance Over Time

Key Factors Affecting Risk Tolerance

Age and Time Horizon

Financial Capacity

Investment Experience and Knowledge

Emotional and Psychological Factors

Family and Personal Circumstances

Importance of a Balanced Portfolio

Diversification Benefits

Risk-Reward Trade-off

Asset Allocation Strategies

Monitoring and Rebalancing the Portfolio

Communicating Risk Tolerance to Clients

Educating Clients on the Importance of Risk Tolerance

Discussing Investment Strategies Based on Risk Tolerance

Encouraging Open Communication About Risk Concerns and Changes in Financial Circumstances

Challenges and Limitations of Risk Tolerance Assessments

Subjectivity of Risk Tolerance Measurement

Biases in Self-Assessment

Dynamic Nature of Risk Tolerance

Impact of Market Conditions on Risk Tolerance

Conclusion

The Critical Role of Risk Tolerance Assessments in Financial Planning

The Importance of Ongoing Evaluation and Adjustment

Encouraging Informed Decision-Making in Investment Strategies Based on Risk Tolerance

Risk Tolerance Assessment FAQs

A risk tolerance assessment is a process that helps investors determine their comfort level with investment risk by evaluating their financial goals, investment experience, and emotional temperament.

A risk tolerance assessment is important because it helps investors make informed decisions about their investment portfolios. It ensures that the investment strategy aligns with their risk appetite and investment goals.

A risk tolerance assessment is typically conducted through a questionnaire that asks investors about their financial goals, investment experience, and comfort level with investment risk. The results are used to determine the appropriate asset allocation for their portfolio.

The benefits of a risk tolerance assessment include helping investors make informed decisions about their investment portfolios, reducing the risk of losses, and maximizing returns.

Anyone who is considering investing in the market should conduct a risk tolerance assessment to ensure that their investment strategy aligns with their risk appetite and investment goals. It is especially important for new investors and those with limited investment experience.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.