Interest rates and bond prices exhibit an inverse relationship: when interest rates increase, bond prices decrease, and when rates decrease, bond prices increase. This occurs because newly issued bonds offer higher yields as interest rates rise, making existing lower-yield bonds less attractive and reducing their market price. Conversely, when interest rates fall, existing higher-yield bonds become more appealing, increasing prices. This dynamic is crucial for bond investors, as it introduces interest rate risk - the potential for investment losses due to changing interest rates. For ordinary citizens, these fluctuations can impact the return on their investment portfolios, retirement funds, or any financial product tied to bonds. Therefore, it's essential to understand this relationship before investing in bonds. Whether you're an investor or simply planning for retirement, changes in interest rates could significantly impact your financial future. The effect of interest rates on bonds can be summarized as follows: When interest rates rise, bond prices generally fall. This is because newly issued bonds will offer higher yields, making existing bonds with lower yields less attractive to investors. Conversely, when interest rates decline, bond prices tend to rise, as existing bonds with higher yields become more desirable. As interest rates rise, bond yields increase. This is because new bonds will offer higher coupon rates to match the prevailing interest rates. On the other hand, when interest rates decrease, bond yields tend to decline, as new bonds will offer lower coupon rates. Bonds with longer durations are more sensitive to changes in interest rates. This means that when interest rates rise, the prices of longer-term bonds will typically experience larger declines compared to shorter-term bonds. Overall, interest rate movements have a significant impact on the value and yields of bonds. Investors need to consider the relationship between interest rates and bond prices when making investment decisions in the bond market. The face value, or the par value or principal, is a fundamental bond component. It represents the amount of money the bond issuer, such as a government or a corporation, promises to return to the bondholder upon the bond's maturity. The coupon rate, another vital bond component, is the interest rate that the bond issuer agrees to pay the bondholder annually. It is expressed as a percentage of the face value. For instance, a bond with a face value of $1,000 and a coupon rate of 5% would pay the bondholder $50 per year. Usually, the coupon rate remains fixed for the bond's life, leading to predictable and steady income for bondholders. Some bonds carry variable coupon rates that can adjust over time based on certain benchmarks, providing a degree of interest rate risk and potential upside to bondholders. The bond's maturity date refers to the specific future date when the bond issuer must repay the face value of the bond to the bondholder. The time to maturity can vary widely among different bonds, from short-term bonds that mature in a few months or years to long-term bonds that may not mature for several decades. The maturity date is significant because it denotes the length of time over which the bondholder will receive interest payments. It plays a role in the bond's sensitivity to interest rate changes. Generally, the longer a bond's time to maturity, the more its price will fluctuate in response to changes in interest rates. Government bonds, also known as sovereign bonds, are debt securities issued by national governments to finance their budget deficits. They come with various maturity periods, ranging from a few months (known as treasury bills) to 30 years or more (long-term treasury bonds). Government bonds are considered among the safest investments as the full faith and credit of the issuing government back them. This means the government promises to honor its debt obligations, even if it has to raise taxes or print money to do so. However, this safety comes at a cost – government bonds typically offer lower yields than other bonds. On the other side of the spectrum are corporate bonds companies issue to raise capital for various business needs, such as expanding operations, purchasing equipment, or funding research and development. Corporate bonds usually offer higher yields compared to government bonds. This is because they carry higher risk – the risk that the company could default on its debt obligations. The creditworthiness of the issuing company plays a crucial role in determining the risk and, consequently, the bond yield. Corporate bonds of companies with excellent credit ratings are referred to as investment-grade bonds, while those of companies with lower credit ratings are known as high-yield or junk bonds. Municipal bonds, or "munis," are issued by states, cities, counties, or other local government entities to finance public projects such as building schools, highways, hospitals, and sewer systems. One key feature of many municipal bonds is that the interest income they generate is exempt from federal income tax and, in some cases, state and local taxes as well. This tax-exempt status can make munis especially attractive to investors in higher tax brackets. However, similar to government bonds, they usually offer lower yields than corporate bonds. Fixed interest rates remain the same throughout the duration of the loan. This type of rate provides predictability for both the lender and the borrower. Variable or floating interest rates can change over the loan period. The changes are usually based on an underlying interest rate index. Inflation is the rate at which the general level of prices for goods and services is rising. When inflation is high, the purchasing power of money decreases. Consequently, lenders demand higher interest rates to compensate for the decreased purchasing power of the money they will be repaid. Interest rates are closely tied to the overall health of an economy. When an economy grows robustly, demand for credit usually increases, pushing up interest rates. During periods of economic downturn or slowdown, demand for credit decreases, leading to lower interest rates. Government policy, particularly monetary policy set by central banks, significantly impacts interest rates. Central banks adjust the money supply to control inflation and stabilize the economy. For example, by lowering the policy rate, a central bank can decrease borrowing costs to stimulate economic growth, leading to lower interest rates. Duration measures a bond's price sensitivity to changes in interest rates. It takes into consideration both the immediate interest payments and the future ones. The higher the duration, the more sensitive the bond price is to changes in interest rates. Duration can be calculated using various formulas, the most common being the Macaulay duration. A bond with a higher duration carries more risk in a changing interest rate environment. If interest rates rise, the price of a high-duration bond will fall more than that of a lower-duration bond. Investors can use duration to manage interest rate risk in their bond portfolios. If they expect interest rates to rise, they may reduce the average duration of their portfolios to limit price volatility. If they expect interest rates to fall, they may increase the duration to maximize price appreciation. Yield to Maturity (YTM) is the total return an investor can expect if they hold the bond until maturity. It factors in the bond's current market price and coupon payments. YTM can be calculated using a complex formula that equates the present value of a bond's future cash flows to its current market price. When interest rates rise, the market price of a bond falls, and since YTM is inversely related to the bond's price, its YTM rises. Conversely, when interest rates fall, the bond's price increases, decreasing YTM. Investors can use YTM to compare bonds with different maturities and coupon rates. The bond with the highest YTM offers the best return, assuming that the investor holds the bond until maturity and the issuer doesn't default. In the buy-and-hold strategy, investors purchase bonds and hold them until they mature. This strategy is most beneficial when interest rates are expected to fall, as the bond's fixed coupon rate will provide a better return than new bonds issued in the lower interest rate environment. Active traders buy and sell bonds to capitalize on price changes resulting from fluctuating interest rates. This strategy requires a thorough understanding of interest rate trends and their impact on bond prices. An investor allocates funds across bonds with different maturity dates in a ladder strategy. As each bond matures, the funds are reinvested in a new bond at the longest duration of the ladder. This strategy provides a balance of reinvestment risk and interest rate risk. The barbell strategy involves investing in short-term and long-term bonds but avoids intermediate-term bonds. This strategy can maximize returns when short-term and long-term interest rates move in opposite directions. Government bonds are highly sensitive to changes in interest rates. When rates increase, the prices of existing government bonds decrease because they may offer lower returns than new bonds. Conversely, when rates decrease, government bond prices increase. Interest rate changes also significantly impact corporate bonds. However, these bonds also face risks such as credit risk, which can influence their prices independently of interest rate changes. Municipal bonds are affected by interest rates similarly to other bonds. However, their interest payments are often tax-free, so their prices may be less sensitive to interest rate changes than taxable bonds. Understanding the relationship between interest rates and bonds is crucial for investors and individuals planning for their financial future. When interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with higher yields. Conversely, when interest rates decline, bond prices tend to rise as existing bonds with higher yields become more desirable. This inverse relationship between interest rates and bond prices introduce interest rate risk, which can impact investment portfolios and retirement funds tied to bonds. Factors such as inflation, economic growth, and government policy influence interest rates. Duration, yield to maturity, and different bond investment strategies can help manage interest rate risk. The impact of interest rates on bonds varies across types, including government, corporate, and municipal bonds. Understanding these dynamics is essential for making informed investment decisions and navigating the bond market effectively.Overview of the Effect of Interest Rates and Bonds

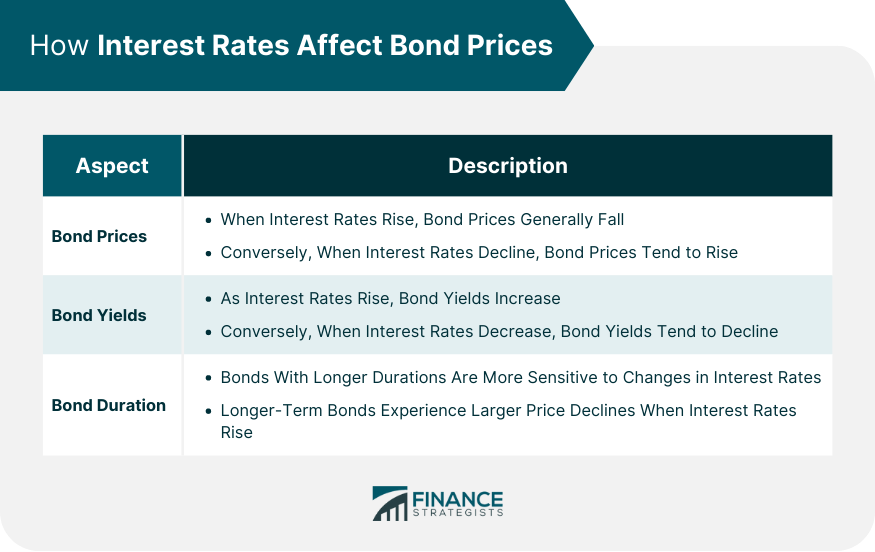

How Interest Rates Affect Bond Prices

Bond Prices

Bond Yields

Bond Duration

Understanding Bonds

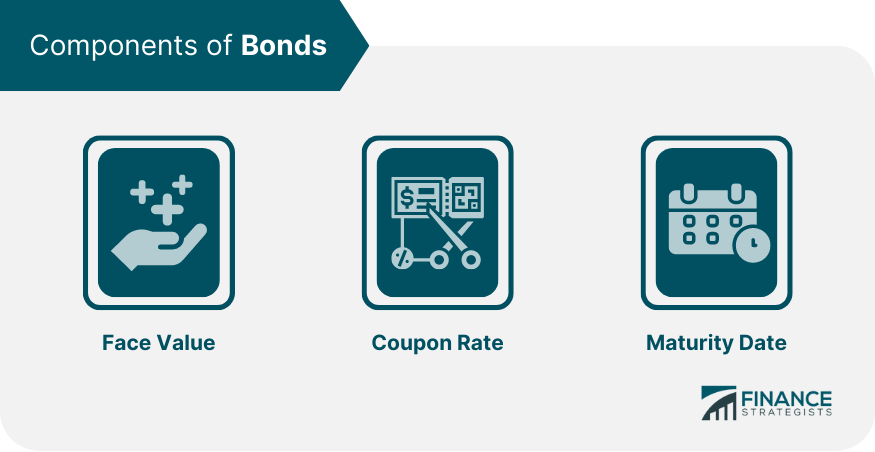

Components of Bonds

Face Value

Coupon Rate

Maturity Date

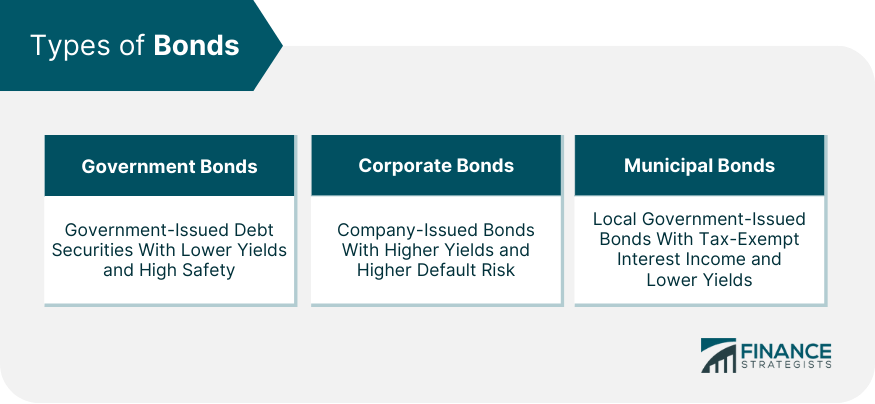

Types of Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Understanding Interest Rates

Types of Interest Rates

Fixed Interest Rates

Variable Interest Rates

Factors Affecting Interest Rates

Inflation

Economic Growth

Government Policy

Concept of Duration in Bonds and Its Relation to Interest Rates

Definition and Calculation of Duration

Duration's Implication for Interest Rate Risk

Strategies for Using Duration in Investment Decisions

Yield to Maturity (YTM) and Its Relation to Interest Rates

Definition and Calculation of YTM

Impact of Interest Rates Changes on YTM

Using YTM in Bond Investment Decisions

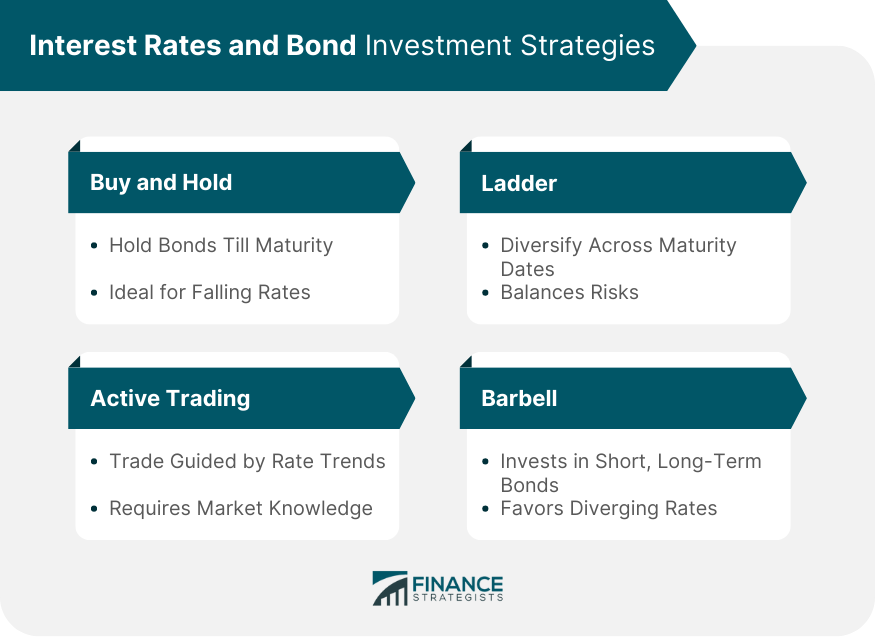

Interest Rates and Bond Investment Strategies

Buy and Hold Strategy

Active Trading Strategy

Ladder Strategy

Barbell Strategy

Impact of Interest Rates on Different Types of Bonds

Effect on Government Bonds

Effect on Corporate Bonds

Effect on Municipal Bonds

Conclusion

Effect of Interest Rates on Bonds FAQs

Interest rates and bond prices have an inverse relationship, meaning that bond prices tend to fall when interest rates rise and vice versa.

Rising interest rates make newly issued bonds more attractive with higher yields, reducing the demand for existing bonds and causing their prices to decrease.

Falling interest rates generally increase bond prices as existing bonds with higher yields become more desirable than newly issued bonds with lower yields.

Yes, changes in interest rates can impact various types of bonds differently depending on factors such as bond duration, credit quality, and market conditions.

Investors can employ strategies such as diversification, adjusting bond durations, and monitoring market conditions to effectively manage interest rate risk in their bond portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.