An asset class is a category of investments that exhibit similar characteristics, behave similarly in the marketplace, and are subject to the same laws and regulations. Asset classes play a critical role in investment and portfolio management, as they provide the building blocks for diversification, risk management, and return enhancement. Understanding and selecting the appropriate asset classes is essential for investors seeking to construct well-diversified portfolios, manage risk, and achieve their financial goals. The main asset classes include equities, fixed income, cash and cash equivalents, real estate, commodities, and alternative investments. Each asset class offers different levels of risk, return potential, and correlation with other asset classes. Domestic stocks represent ownership in companies based in the investor's home country. They provide investors with the opportunity to participate in the growth of the domestic economy. International stocks represent ownership in companies based outside the investor's home country. Investing in international stocks can help diversify a portfolio and gain exposure to different economic and market conditions. Small-cap, mid-cap, and large-cap stocks refer to companies of different market capitalizations, with small-cap being the smallest and large-cap being the largest. Each category offers different risk-return characteristics and growth potential. Growth stocks are companies with higher-than-average earnings growth potential, while value stocks are companies that are considered undervalued in the market. Each investment style offers different risk-return profiles and opportunities for capital appreciation. Government bonds are debt securities issued by national governments, typically with a promise to pay periodic interest and repay the principal at maturity. They are generally considered lower risk investments, providing income and capital preservation. Corporate bonds are debt securities issued by companies, with a promise to pay periodic interest and repay the principal at maturity. They offer higher yields compared to government bonds but also carry higher credit risk. Municipal bonds are debt securities issued by state and local governments, typically for public projects and infrastructure. They may offer tax advantages for investors and provide income with relatively low credit risk. Inflation-protected securities are government-issued bonds designed to provide protection against inflation by adjusting their principal and interest payments based on changes in the consumer price index. Savings accounts are interest-bearing accounts offered by banks and credit unions, providing a safe and liquid place to store cash for short-term needs. Money market funds are mutual funds that invest in short-term, high-quality debt securities, offering investors liquidity and capital preservation with a modest yield. Certificates of deposit (CDs) are time deposits offered by banks, providing a fixed interest rate for a specified term. They offer higher interest rates than savings accounts but require the investor to commit their funds for the duration of the term. Treasury bills are short-term debt securities issued by the U.S. government, offering low-risk, low-yield investment options with high liquidity. Residential real estate includes properties such as single-family homes, townhouses, and condominiums, offering investors the opportunity to generate income through rent or capital appreciation. Commercial real estate includes properties such as office buildings, retail centers, and industrial properties, providing investors with income potential and capital appreciation. Real estate investment trusts (REITs) are companies that own, operate, or finance income-producing real estate properties. They provide investors with a way to gain exposure to real estate without directly owning or managing properties, offering income and diversification benefits. Precious metals, such as gold, silver, and platinum, are tangible assets that can act as a store of value, provide a hedge against inflation, and add diversification to a portfolio. Energy commodities, such as oil, natural gas, and coal, offer investors exposure to the energy sector and can be a useful hedge against inflation. Agricultural commodities, such as corn, soybeans, and wheat, provide investors with exposure to the agricultural sector and can help diversify a portfolio. Livestock commodities, such as cattle and hogs, represent investments in the meat production industry and can provide diversification benefits. Private equity investments involve investing in privately-held companies, offering the potential for high returns but also higher risk and illiquidity. Hedge funds are pooled investment vehicles that employ a range of strategies to generate returns, often involving higher risk and fees compared to traditional investments. Venture capital investments focus on providing early-stage financing to startup companies with high growth potential, offering the possibility of significant returns but also high risk and illiquidity. Cryptocurrencies and digital assets, such as Bitcoin and Ethereum, are decentralized digital currencies that can provide investors with diversification, potential for high returns, and exposure to emerging technology. Investing in a mix of asset classes can help reduce portfolio risk by spreading investments across different sectors, industries, and geographic regions, reducing the impact of any single investment's poor performance. Allocating investments across various asset classes with different risk profiles can help investors manage their overall portfolio risk, aligning it with their risk tolerance and investment objectives. A well-diversified portfolio that includes investments from various asset classes can potentially enhance overall performance by capturing returns from different market segments. Including income-generating asset classes, such as fixed income and dividend-paying equities, can provide investors with a steady stream of income to meet their financial needs. Investing in asset classes with a history of outpacing inflation, such as stocks and real estate, can help protect an investor's purchasing power over time. Strategic asset allocation is a long-term investment strategy that involves determining an investor's target asset allocation based on their risk tolerance, investment objectives, and time horizon, and periodically rebalancing the portfolio to maintain the desired allocation. Tactical asset allocation is a more active investment strategy that involves adjusting an investor's asset allocation based on short-term market conditions and opportunities, seeking to enhance returns or manage risk. Dynamic asset allocation is an investment strategy that involves adjusting an investor's asset allocation in response to changing market conditions, economic factors, or investor needs, aiming to optimize portfolio performance and manage risk. Constant-weighted asset allocation is a passive investment strategy that involves maintaining a fixed percentage allocation to each asset class, requiring periodic rebalancing to maintain the desired allocation. Age-based asset allocation is an investment strategy that involves adjusting an investor's asset allocation based on their age, typically reducing exposure to riskier asset classes and increasing exposure to more conservative investments as the investor approaches retirement. Every investor has a different level of risk tolerance. Some are willing to take high risks for high returns, while others prefer lower risks and modest returns. An investor's risk tolerance will play a significant role in deciding the asset classes to invest in. For example, investors with a low-risk tolerance may prefer fixed-income securities such as bonds, while those with a higher risk tolerance may invest in equities or alternative investments such as real estate or commodities. An investor's investment objectives also play a crucial role in asset class selection. For example, an investor with a short-term investment objective may prefer to invest in low-risk assets such as cash or money market securities, while an investor with a long-term investment objective may prefer to invest in higher-risk assets such as equities, real estate, or commodities. An investor's time horizon is another important factor in asset class selection. An investor with a long time horizon can take on more risk and invest in higher-risk assets that have the potential for higher returns. Conversely, an investor with a short time horizon may prefer low-risk assets that provide a steady income stream and preserve capital. Market conditions such as economic growth, inflation, and interest rates can also influence asset class selection. For example, during periods of high inflation, investors may prefer to invest in assets such as real estate or commodities that can provide a hedge against inflation. Tax considerations such as tax rates, tax deductions, and tax credits can also influence asset class selection. For example, an investor in a high tax bracket may prefer tax-efficient investments such as municipal bonds or tax-advantaged retirement accounts. Benchmarking involves comparing the performance of a portfolio to a benchmark index that represents the performance of a particular asset class or market. This allows investors to evaluate the performance of their portfolio relative to the market or asset class. Risk-adjusted returns take into account the level of risk taken by a portfolio to generate returns. This allows investors to compare the performance of portfolios with different levels of risk. Portfolio rebalancing involves adjusting the asset allocation of a portfolio to maintain the desired level of risk and return. This is important because the performance of different asset classes can vary over time, and rebalancing ensures that the portfolio remains aligned with the investor's investment objectives. Periodic reviews of the portfolio allow investors to assess whether the portfolio is performing as expected and whether any adjustments need to be made. This can include reviewing the asset allocation, investment objectives, risk tolerance, and market conditions. Asset classes are crucial in investment and portfolio management because they offer a way for investors to diversify their portfolios and manage risk. Different asset classes have different risk and return characteristics, which allows investors to build a well-rounded portfolio that balances risk and return. Diversification and asset allocation can help investors achieve better risk-adjusted returns and reduce the impact of market volatility on their portfolios. Asset classes play a critical role in helping investors achieve their financial goals. By diversifying across different asset classes, investors can build a diversified portfolio that aligns with their financial goals and risk tolerance.What Is an Asset Class?

Types of Asset Classes

Equities

Domestic Stocks

International Stocks

Small-Cap, Mid-Cap, and Large-Cap Stocks

Growth and Value Stocks

Fixed Income

Government Bonds

Corporate Bonds

Municipal Bonds

Inflation-Protected Securities

Cash and Cash Equivalents

Savings Accounts

Money Market Funds

Certificates of Deposit

Treasury Bills

Real Estate

Residential Real Estate

Commercial Real Estate

Real Estate Investment Trusts (REITs)

Commodities

Precious Metals

Energy

Agricultural Products

Livestock

Alternative Investments

Private Equity

Hedge Funds

Venture Capital

Cryptocurrencies and Digital Assets

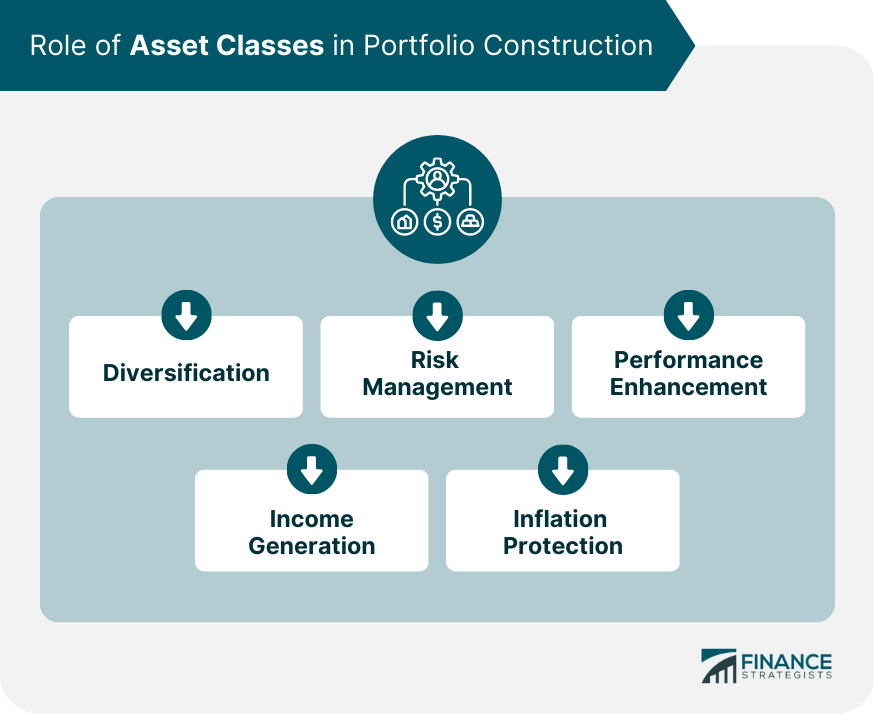

Role of Asset Classes in Portfolio Construction

Diversification

Risk Management

Performance Enhancement

Income Generation

Inflation Protection

Asset Allocation Strategies

Strategic Asset Allocation

Tactical Asset Allocation

Dynamic Asset Allocation

Constant-Weighted Asset Allocation

Age-Based Asset Allocation

Factors Influencing Asset Class Selection

Risk Tolerance

Investment Objectives

Time Horizon

Market Conditions

Tax Considerations

Performance Evaluation and Monitoring

Benchmarking

Risk-Adjusted Returns

Portfolio Rebalancing

Periodic Reviews

Final Thoughts

Asset Class FAQs

An asset class is a group of financial instruments that have similar characteristics and behave similarly in the market. Examples of asset classes include stocks, bonds, real estate, commodities, and cash.

Asset class diversification is important in investing because it helps to spread risk and reduce exposure to any one particular asset class. By investing in a variety of asset classes, investors can minimize the impact of market fluctuations on their portfolio.

Investors choose the right asset classes for their portfolio based on their risk tolerance, investment goals, and time horizon. For example, a young investor with a long time horizon and high risk tolerance may choose to invest more heavily in equities, while an older investor with a shorter time horizon and lower risk tolerance may choose to invest more heavily in fixed income securities.

Alternative asset classes, such as private equity, hedge funds, and real estate, can offer investors diversification benefits and potentially higher returns than traditional asset classes. However, these asset classes also tend to be more illiquid and have higher fees and minimum investment requirements.

Changes in interest rates can affect different asset classes in different ways. For example, higher interest rates can lead to lower bond prices and higher yields, while stocks may experience increased volatility as investors re-evaluate their investment strategies. Real estate and other alternative asset classes may also be impacted by changes in interest rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.