The Consumer Price Index (CPI) is an economic measure that gauges the average alteration in prices of goods and services bought by households over a period of time. The CPI is widely used by economists, policymakers, and investors to gauge the health of an economy and make informed decisions. The CPI is determined by collecting price data for a basket of goods and services that represent the spending habits of households in a specific region or country. The basket of goods and services includes food, housing, transportation, healthcare, and entertainment. The items in the basket are assigned different weights based on their relative importance to consumers, and the prices of these items are then tracked over time. The weighting system used in calculating the CPI is based on consumer expenditure surveys. These surveys are conducted periodically by national statistical agencies to collect data on the spending patterns of households. The weights assigned to each item in the basket are based on the percentage of total household spending that is allocated to that item. Tracking the prices of the items in the basket over time involves collecting data on the prices of these items from a variety of sources, such as retailers, service providers, and government agencies. The prices are then weighted and combined to calculate the CPI for a specific period. The Consumer Price Index holds significant importance as an economic indicator due to its ability to measure inflation and provide valuable information to policymakers, businesses, and investors. The Consumer Price Index is an important economic indicator because it measures inflation, which is the rate at which the level of prices for goods and services is rising. Inflation can significantly affect an economy, as it can impact the stability of financial markets by influencing the purchasing power of consumers and the profitability of businesses. The CPI is used to measure inflation by tracking changes in the prices of a basket of goods and services over time. By comparing the CPI for different periods, economists can calculate the rate of inflation and track its trend. This information is used by policymakers, businesses, and investors to make informed decisions about economic policy, pricing, and investment strategies. In addition to measuring inflation, the CPI is used to adjust economic variables for inflation. For example, wages, taxes, and interest rates are often adjusted using the CPI to maintain their real value over time. When wages are adjusted for inflation using the CPI, workers can maintain their purchasing power even as prices rise. Similarly, when interest rates are adjusted for inflation, it can help to prevent economic instability by maintaining the real value of savings and investments. The CPI is used to calculate real GDP (Gross Domestic Product), which is GDP adjusted for inflation. This provides a more accurate measure of economic growth, as it reflects changes in output rather than changes in prices. Real GDP is measured by dividing nominal GDP (GDP measured in current prices) by the CPI for the same period and then multiplying the result by 100. This calculation removes the impact of inflation on GDP and provides a clearer picture of the economy's performance. The CPI has a wide range of uses, including: The CPI is used to adjust wages, taxes, and interest rates for inflation. This helps to maintain the purchasing power of workers and investors and to prevent economic instability caused by inflation. The CPI is used by policymakers to inform decisions on interest rates, taxes, and other economic policies. By tracking changes in the CPI, policymakers can make informed decisions on how to manage the economy. Investors use the CPI to identify potential opportunities and risks in various industries. For example, industries that are highly sensitive to changes in the CPI, such as healthcare and housing, may present opportunities or risks depending on the direction of inflation. Businesses use the CPI to help them make pricing decisions and adjust their business strategies in response to changes in the economy. For example, if the CPI is rising rapidly, businesses may need to raise prices to maintain profitability. Consumers use the CPI to understand how inflation affects their purchasing power. By tracking changes in the CPI, consumers can make informed decisions about managing finances. While the CPI is a useful economic indicator, it has some limitations that should be taken into account when interpreting its meaning and significance. Some of the limitations of the CPI include: The CPI is computed based on the spending patterns of households as a whole, and may not accurately reflect the spending patterns of individual households. For example, if a household spends a higher percentage of its income on healthcare than the average household, the impact of healthcare price changes on that household may not be accurately reflected in the CPI. The CPI only measures changes in the prices of goods and services, and may not accurately capture the impact of technological advances or changes in quality. For instance, if the price of a computer stays the same, but the computer's processing power doubles, the CPI may not accurately reflect the increased value of the computer. The Consumer Price Index is a widely recognized and utilized economic metric that tracks the average fluctuations in prices of goods and services acquired by households over a given period of time. The CPI is used to adjust many economic variables for inflation, such as wages, taxes, and interest rates, and is also used to calculate real GDP. The CPI has a wide range of uses, including informing economic policy-making, identifying investment opportunities and risks, and helping businesses make pricing and business strategy decisions. However, the CPI also has some limitations, such as its potential to not reflect individual circumstances or preferences, and to not accurately capture the impact of technological advances or changes in quality. Overall, the CPI is a valuable tool for understanding the economy and making informed decisions, but it should be used together with other economic indicators and contextual information. The Consumer Price Index is an important economic indicator that is widely used to measure inflation and inform decision-making by policymakers, businesses, investors, and consumers. While it has some limitations, the CPI remains a valuable tool for understanding the economy and making informed decisions. To stay informed about changes in the CPI and other economic indicators, it is encouraged to regularly check reputable sources of economic news and analysis. By staying informed, we can better understand the economic trends that affect us all and make more informed wealth management decisions in our personal and professional lives.What Is Consumer Price Index (CPI)?

Calculation of Consumer Price Index

Significance of the Consumer Price Index

Measuring Inflation

Adjusting for Inflation in Economic Variables

Calculating Real GDP

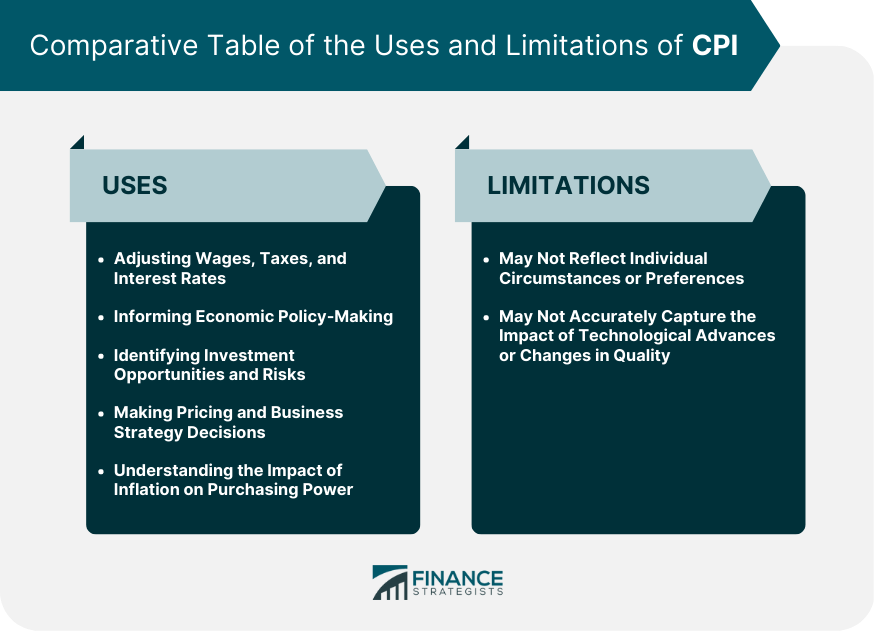

Uses of Consumer Price Index

Adjusting Wages, Taxes, and Interest Rates

Informing Economic Policy-Making

Identifying Investment Opportunities and Risks

Making Pricing and Business Strategy Decisions

Understanding the Impact of Inflation on Purchasing Power

Limitations of Consumer Price Index

May Not Reflect Individual Circumstances or Preferences

May Not Accurately Capture the Impact of Technological Advances or Changes in Quality

Final Thoughts

Consumer Price Index (CPI) FAQs

The Consumer Price Index (CPI) is an economic measure of the average change in prices of goods and services purchased by households over a certain period of time.

To calculate the CPI, data is collected on the prices of a set of goods and services that reflect the typical spending patterns of households in a given region or country. These items in the basket are assigned different weights based on their significance to consumers, and their prices are tracked over time.

The CPI is an economic indicator because it measures inflation, which is the rate at which the general level of prices for goods and services is rising. Inflation can have a significant impact on an economy. It affects the purchasing power and the stability of financial markets.

The CPI has a wide range of uses, including adjusting wages, taxes, and interest rates for inflation; informing economic policy-making; identifying investment opportunities and risks; making pricing and business strategy decisions; and understanding the impact of inflation on purchasing power.

While the CPI is a useful economic indicator, it has some limitations, such as its potential to not reflect individual circumstances or preferences, and to not accurately capture the impact of technological advances or changes in quality.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.