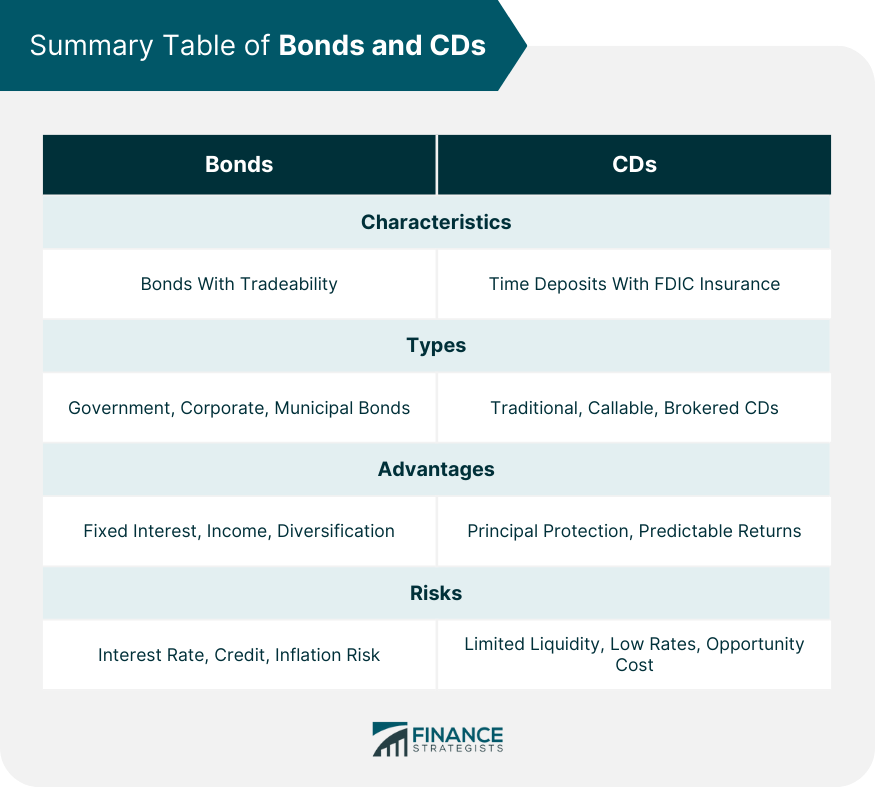

Bonds and CDs (Certificates of Deposit) are both fixed income investments that offer predictable returns to investors. They are popular investment options in wealth management. There are some key differences between the two. Bonds are debt instruments issued by governments, corporations, or municipalities to raise capital. CDs are time deposits offered by banks and credit unions. Bonds have a wider variety of types and risk levels, while CDs are generally considered low-risk. Bonds can be bought and sold on the secondary market, while CDs have a fixed maturity period. Understanding the characteristics and differences between bonds and CDs is essential for investors to make informed investment decisions. Bonds are fixed income securities that represent a loan made by an investor to a borrower, such as a corporation or government entity. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount upon maturity. Bonds have several key characteristics that make them unique investment instruments. Firstly, bonds have a predetermined face value, which is the amount the investor will receive when the bond matures. Secondly, bonds have a specified maturity date, at which point the issuer is obligated to repay the face value to the investor. Additionally, bonds have a coupon rate, which is the fixed interest rate that the issuer pays to the investor at regular intervals, typically semiannually or annually. The coupon rate is calculated based on the face value of the bond. Another important characteristic of bonds is their credit rating, which indicates the issuer's creditworthiness and the likelihood of default. Bonds with higher credit ratings are considered less risky and often have lower interest rates. Lastly, bonds can be traded on the secondary market, allowing investors to buy and sell bonds before their maturity date. This secondary market provides liquidity to bond investors. Government bonds, also known as sovereign bonds, are issued by national governments to fund their operations and projects. These bonds are considered one of the safest investment options as governments have the power to tax and print money to meet their obligations. Government bonds can be further categorized into Treasury bonds, Treasury notes, and Treasury bills, depending on their maturity periods. Corporate bonds are issued by companies to raise capital for various purposes, such as expanding operations, financing acquisitions, or investing in research and development. These bonds offer higher yields compared to government bonds to compensate for the increased risk associated with corporate issuers. Corporate bonds can be categorized based on the creditworthiness of the issuer, with investment-grade bonds having higher credit ratings and lower risk, while high-yield or junk bonds have lower credit ratings and higher risk. Municipal bonds, or munis, are issued by state and local governments or related agencies to fund public projects, such as building schools, highways, or infrastructure. These bonds are often exempt from federal income tax, and in some cases, state and local taxes, making them attractive to investors seeking tax advantages. Municipal bonds can be further classified into general obligation bonds, which are backed by the issuer's full faith and credit, and revenue bonds, which are backed by the revenue generated by a specific project. One of the primary advantages of bonds is the fixed interest payments they provide. Investors know in advance the amount they will receive as interest income, allowing for more predictable cash flows. Investors seeking a stable income stream, such as retirees or those looking to meet specific financial obligations may take advantage of this. The regular coupon payments can be reinvested or used to supplement one's income. This income can be especially valuable during periods of economic uncertainty or market volatility when other investments may experience fluctuations. Bonds tend to have a lower correlation with stocks and other asset classes, meaning that they may perform differently under various market conditions. By diversifying across different asset classes, investors can potentially reduce the overall risk of their portfolio and achieve a more balanced investment strategy. When interest rates rise, the value of existing bonds in the market typically decreases, as newer bonds with higher coupon rates become more attractive. Conversely, when interest rates fall, the value of existing bonds tends to increase. This inverse relationship between bond prices and interest rates is known as interest rate risk. Investors who need to sell their bonds before maturity may experience capital losses if interest rates have risen since the bond's purchase. Credit risk refers to the risk that the issuer may default on its financial obligations, leading to a loss for bondholders. Bonds with higher credit ratings are generally considered to have lower credit risk, as the issuer's ability to repay the bond's principal and interest is deemed stronger. On the other hand, bonds with lower credit ratings or those issued by financially unstable entities carry a higher risk of default. Inflation risk is the risk that the purchasing power of future interest and principal payments will be eroded by inflation. When inflation rises, the fixed coupon payments and face value of a bond may have less purchasing power in the future. Investors who hold bonds with low coupon rates may be particularly vulnerable to inflation risk, as the real return on their investment may be diminished. Certificates of Deposit, or CDs, are time deposits offered by banks and other financial institutions. When an investor purchases a CD, they agree to deposit a specific amount of money for a predetermined period, known as the maturity period. In return, the bank pays the investor interest on the deposit. At the end of the maturity period, the investor receives the initial deposit plus the accumulated interest. CDs offer a fixed interest rate, which is predetermined at the time of purchase and remains constant throughout the maturity period. They have a specific maturity period, which can range from a few months to several years. During this period, investors typically cannot withdraw their funds without incurring penalties. However, at the end of the maturity period, the investor receives the full amount of their initial deposit, along with the accumulated interest. Lastly, CDs are considered to be low-risk investments, as they are typically insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per bank. Traditional CDs are the most common type of CD. They offer a fixed interest rate and a specific maturity period, typically ranging from a few months to several years. Investors agree to lock in their funds for the entire duration of the CD and are rewarded with a higher interest rate compared to more accessible savings accounts. Callable CDs provide the issuer with the option to redeem the CD before its maturity date. This feature allows the issuer to take advantage of declining interest rates by calling back the CD and reissuing a new CD at a lower interest rate. While callable CDs may offer higher initial interest rates compared to traditional CDs, investors face the risk of having their CDs called back, potentially leading to reinvestment at a lower rate. Brokered CDs are CDs that are bought and sold through brokerage firms rather than directly from banks. Brokered CDs offer a wider range of issuers and maturities compared to traditional bank CDs. They also allow investors to purchase CDs from multiple banks in one brokerage account, providing diversification opportunities. One of the primary advantages of CDs is principal protection. When investing in a CD, the investor's initial deposit is generally secured and guaranteed by the issuing bank, up to the FDIC-insured limit. This provides peace of mind to investors, knowing that their principal amount is safe even in the event of a bank failure. CDs offer predictable returns due to their fixed interest rates. Investors know in advance the amount of interest they will earn over the CD's maturity period. The predictability can be beneficial for those seeking stable income or looking to match specific financial goals and obligations. CDs are typically insured by the FDIC, which means that even in the unlikely event of a bank failure, the investor's deposits, including the interest earned, are protected up to the FDIC-insured limit. This insurance coverage provides an added layer of security, particularly for risk-averse investors who prioritize the safety of their investments. CDs are designed to be held until maturity, and withdrawing funds before the maturity date can result in penalties and forfeiting a portion of the accrued interest. This limited liquidity can be a disadvantage for investors who may need access to their funds before the CD's maturity period. Therefore, it's crucial to carefully consider the investment horizon and liquidity needs before investing in CDs. CDs generally offer lower interest rates compared to other investment options, such as stocks or bonds. While the fixed interest rate provides stability, it may not keep pace with inflation over the long term. The real return on investment (adjusted for inflation) may be relatively low, limiting the potential for significant wealth accumulation. If interest rates rise significantly after purchasing a CD, the investor may find themselves locked into a lower interest rate, missing out on the potential for higher returns in other investments. It's essential to consider the prevailing interest rate environment and compare CD rates to alternative investment options before committing to a CD. Bonds generally carry higher risk compared to CDs, especially corporate bonds or bonds with lower credit ratings. This higher risk is accompanied by the potential for higher returns. CDs, on the other hand, are considered low-risk investments, offering more stable but relatively lower returns compared to bonds. Investors need to assess their risk tolerance and investment objectives to determine which option aligns best with their needs. Bonds, especially those traded on the secondary market, offer greater liquidity compared to CDs. Investors can buy and sell bonds before their maturity date, allowing for flexibility and the potential to capitalize on market opportunities. In contrast, CDs typically have limited liquidity, and early withdrawals may result in penalties or loss of interest. Investors should consider their liquidity needs and investment time horizons when choosing between bonds and CDs. Bonds have the potential to generate higher income compared to CDs, especially corporate bonds or those with higher coupon rates. The regular coupon payments from bonds can provide a consistent income stream for investors. CDs, although offering fixed interest payments, generally provide lower income compared to bonds. The income generation potential should be considered in light of the investor's income needs and objectives. The investment horizon and goals of investors play a crucial role in determining whether bonds or CDs are more suitable. Bonds typically have longer maturity periods, making them better suited for long-term investment goals or income generation over an extended period. CDs, with their fixed maturity periods, are often favored for shorter-term goals or as a means to preserve capital within a specific timeframe. Both bonds and CDs have potential tax implications that investors should consider. Bond interest payments are generally taxable at the federal level, although certain types of municipal bonds may offer tax advantages. CDs, similarly, generate taxable interest income. Investors should evaluate their tax situation and consult with a tax advisor to understand the tax implications of investing in bonds or CDs. Bonds and CDs are both fixed income investment options that offer distinct advantages and risks. Bonds provide the potential for higher returns, income generation, and diversification benefits but carry risks such as interest rate and credit risk. CDs, on the other hand, provide principal protection, predictable returns, and FDIC insurance but may have limited liquidity and lower interest rates. The choice between bonds and CDs depends on various factors, including risk tolerance, investment goals, liquidity needs, and time horizons. Investors should carefully evaluate their individual circumstances and consider a balanced portfolio approach that incorporates both bonds and CDs to achieve their financial objectives. By understanding the characteristics, advantages, and risks associated with bonds and CDs, investors can make informed decisions and build a diversified investment strategy that aligns with their needs and preferences.Overview of Bonds and CDs

What Are Bonds?

Types of Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Advantages of Bonds

Fixed Interest Payments

Income Generation

Diversification Benefits

Risks Associated With Bonds

Interest Rate Risk

Credit Risk

Inflation Risk

What Are CDs (Certificates of Deposit)?

Types of CDs

Traditional CDs

Callable CDs

Brokered CDs

Advantages of CDs

Principal Protection

Predictable Returns

FDIC Insurance

Risks Associated With CDs

Limited Liquidity

Low Interest Rates

Opportunity Cost

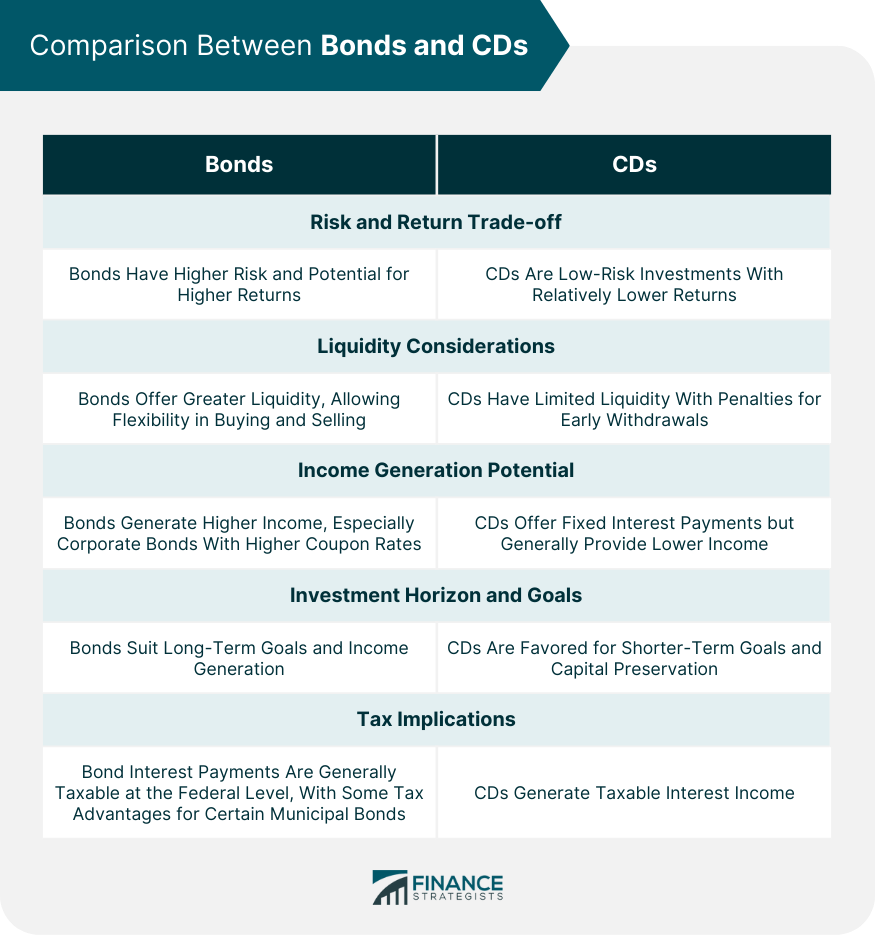

Comparison Between Bonds and CDs

Risk and Return Trade-off

Liquidity Considerations

Income Generation Potential

Investment Horizon and Goals

Tax Implications

Conclusion

Bonds vs CDs FAQs

Bonds represent a loan made by an investor to a borrower, typically a corporation or government entity, while CDs are time deposits offered by banks. Bonds have a wider variety of types and risk levels, and their prices can fluctuate in the secondary market. CDs offer fixed interest rates, principal protection, and FDIC insurance.

Bonds generally carry higher risk compared to CDs, as they are subject to interest rate risk, credit risk, and inflation risk. CDs are considered low-risk investments, offering principal protection and predictable returns.

Yes, bonds can be bought and sold on the secondary market before they mature. The price at which a bond is sold in the secondary market may be higher or lower than the face value, depending on market conditions and changes in interest rates.

Withdrawing funds from a CD before its maturity date can result in penalties and loss of interest. CDs are designed to be held until maturity, and early withdrawals are generally discouraged. It's important to consider the maturity period and liquidity needs before investing in a CD.

Bonds generally offer higher income generation potential compared to CDs, especially those with higher coupon rates. The regular coupon payments from bonds can provide a consistent income stream. CDs, although offering fixed interest payments, generally provide lower income. The choice between bonds and CDs for income generation depends on an investor's income needs and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.