Inflationary risk refers to the potential for rising prices in an economy to erode the value of money over time. In other words, it is the risk that inflation will reduce the purchasing power of money. Inflationary risk can be particularly harmful to those with limited financial resources, as rising prices can make it more difficult to afford basic goods and services. Inflationary risk can have a variety of causes, including changes in the money supply, changes in demand, and cost-push factors. Understanding inflationary risk is important for individuals, investors, economists, financial analysts, and policymakers, as it can have a significant impact on the economy, individuals, and investments. Inflation is the sustained increase in the general price level of goods and services in an economy over time. It is the rate at which the purchasing power of a currency is falling. It is measured as an annual percentage increase in the Consumer Price Index (CPI), a basket of goods and services commonly purchased by consumers. While it is a usual feature of most modern economies, excessive inflation harms economic growth and stability. Inflation can be categorized as demand-pull inflation and cost-push inflation. Demand-pull inflation arises from an upsurge in demand for goods and services, resulting in an increase in prices, typically observed during a period of low unemployment, increased consumer spending, and a thriving economy. Cost-push inflation happens when production costs increase, such as labor or raw material expenses, leading to a rise in prices, and is generally linked to supply-side shocks such as oil price surges, conflicts, or natural disasters. Inflation can be a result of a variety of factors, including an increase in money supply, an increase in demand, or cost-push factors. When there is an increase in the supply of money in an economy, consumers have more to spend, which can cause prices to rise. Conversely, if there is a rise in demand for goods and services, price increases can happen due to heightened consumer competition for access to scarce resources. Lastly, when there is an increase in the cost of production, such as labor or raw materials, prices can also blow up as producers pass on the increased costs to consumers. There are two main types of inflationary risk: anticipated inflationary risk and unanticipated inflationary risk. It occurs when inflation is expected and is therefore built into the pricing of goods and services. In other words, it is the risk that prices will rise as anticipated, reducing the purchasing power of money over time. It can be managed through strategies such as indexing or hedging. It happens when inflation is unexpected and is therefore not built into the pricing of goods and services. This type of inflationary risk can be particularly harmful as it can lead to a sudden and significant loss of purchasing power. To effectively manage inflation risk, investors must first understand how it is measured. This section will discuss the most common measurements of inflation, including the Consumer Price Index (CPI), Producer Price Index (PPI), GDP Deflator, and Personal Consumption Expenditures (PCE). The Consumer Price Index is a widely used measure of inflation. It tracks the changes in the prices of a basket of consumer goods and services over time, representing the cost of living for households. CPI is calculated by comparing the price of a specific basket of goods and services in a given period to the price of the same basket in a base period. The Producer Price Index (PPI) measures the changes in the prices that producers receive for their goods and services. It is an important indicator of inflation because it reflects the costs faced by businesses, which can ultimately be passed on to consumers. By monitoring the PPI, investors can gain insights into potential inflationary pressures in the economy. Higher PPI values may indicate that businesses are facing increased costs, which could lead to higher consumer prices and inflation risk. Inflation risk can be influenced by several factors, including government policies, supply and demand factors, and global economic conditions. Government policies, such as fiscal and monetary policies, can have a significant impact on inflation risk. Fiscal policy refers to government spending and taxation decisions, while monetary policy involves the management of money supply and interest rates by a central bank. Expansionary fiscal and monetary policies can lead to higher inflation risk, as they increase demand and money supply in the economy. Conversely, contractionary policies can help control inflation risk by reducing demand and tightening the money supply. Supply and demand factors can also affect inflation risk. Demand-pull inflation occurs when strong demand for goods and services exceeds supply, causing prices to rise. Cost-push inflation, on the other hand, results from higher production costs, such as increased labor or raw material prices, leading to higher prices for consumers. Both demand-pull and cost-push inflation can contribute to increased inflation risk. By understanding the dynamics of supply and demand in the economy, investors can better anticipate changes in inflation risk and make more informed investment decisions. Global economic conditions, such as exchange rates and commodity prices, can influence inflation risk. Changes in exchange rates can affect the prices of imported goods and services, while fluctuations in commodity prices can impact production costs for businesses. A depreciation in a country's currency can lead to higher inflation risk, as it makes imported goods more expensive. Conversely, a stronger currency can help lower inflation risk by making imports cheaper. Similarly, rising commodity prices can contribute to higher inflation risk, while falling prices can help mitigate it. Inflationary risk is a complex issue that can be caused by various factors, including: Fiscal policy refers to the decisions made by governments regarding taxation and spending. When governments engage in deficit spending, meaning they spend more money than they collect in taxes, it can lead to an increase in the money supply and inflationary risk. It is because deficit spending often leads to increased government borrowing, which can raise the supply of money in the economy. In addition, expansionary fiscal policies such as tax cuts or increased government spending can also lead to inflationary risk by increasing demand for goods and services. Monetary policy refers to the actions central banks take to manage the money supply and interest rates in an economy. When central banks engage in expansionary monetary policies, such as lowering interest rates or increasing the money supply, it can lead to inflationary risk. Lower interest rates can stimulate borrowing by individuals and businesses, leading to increased demand for goods and services. Similarly, increasing the money supply can lead to an increase in demand and prices for goods and services. Non-economic events can also lead to inflationary risk. For example, natural disasters or conflicts can disrupt supply chains and cause prices to rise. Likewise, changes in international trade agreements or tariffs can impact the prices of goods and services and lead to inflation. In some cases, inflation can be driven by psychological factors, such as expectations about future inflation rates. If consumers or businesses expect inflation to rise, they may adjust their behavior in ways that can lead to increased inflation. Inflationary risk can have a significant impact on the economy, individuals, and investments. Excessive inflation can have negative effects on the economy. When prices rise too quickly, it can lead to a decrease in consumer spending as people struggle to afford basic goods and services. It can, in turn, lead to decreased demand for goods and services, which can harm businesses and lead to unemployment. In addition, inflation can make it more difficult for businesses to plan for the future, as they are uncertain about future prices and demand for their products. Inflationary pressures can significantly affect individuals, especially those with set incomes or restricted financial reserves. As prices increase, it becomes more challenging to afford essential goods and services such as food, housing, and healthcare. It can result in a decline in the quality of life as individuals grapple with meeting their basic needs. Additionally, inflation can diminish the value of savings and investments, making it more challenging to plan for the future. Rising prices can make it more difficult for businesses to operate as they face increased costs for labor, raw materials, and other inputs. Inflation can lead to decreased demand for some goods and services, particularly those that are considered luxury items. In terms of investments, inflation can erode the value of savings and investments, particularly for fixed-income investments, such as bonds, as rising prices can lead to decreased purchasing power. Inflation can also lead to higher interest rates, harming bond prices. Several strategies can be used to handle inflationary risk. Consider the following: It involves adjusting prices or wages to reduce the impact of inflation. By indexing prices or wages, individuals and businesses can ensure that their income keeps pace with inflation, thus maintaining their purchasing power. Indexing can take different forms, such as cost-of-living adjustments (COLAs), inflation-indexed bonds, or price indexing. In the case of COLAs, workers' salaries are adjusted to keep up with inflation, ensuring that the real value of their income remains constant over time. Governments can also issue inflation-indexed bonds with a fixed interest rate, where the principal value is adjusted for inflation. It means that investors can be confident that they will receive a return that keeps pace with inflation, thus maintaining the value of their investment. Lastly, an example of price indexing involves adjusting the price of goods and services to keep up with inflation, like a restaurant increasing its menu prices to keep up with rising food costs. It is a risk management strategy that involves investing in assets or taking positions that offset potential losses in other investments. In the context of inflationary risk, hedging is a strategy used to manage the impact of inflation on investments. There are several ways to hedge against inflation. One common way is to invest in commodities such as gold or oil. When inflation occurs, the value of these commodities tends to rise, helping to offset the impact of inflation on investments. Another way to hedge is to invest in real estate or real estate investment trusts (REITs). As the cost of goods and services increases, so does the value of the real estate, helping to protect investors from inflationary risk. Furthermore, investors may also choose to invest in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). These securities are designed to adjust the principal value of the security in response to changes in the CPI. It can involve strategies such as paying off existing debts as quickly as possible, avoiding high-interest loans, and living within one's means. By avoiding excessive debt, individuals and businesses can reduce their exposure to inflationary risk and ensure that they can better weather economic fluctuations. However, it is important to note that avoiding debt entirely may not always be feasible or desirable, particularly for businesses that require financing to grow and expand. In some cases, borrowing money may be necessary to take advantage of business opportunities or to invest in the future. It is important to consider the risks and benefits of borrowing carefully, and to ensure that debt levels remain manageable and sustainable. It involves spreading investments across a variety of asset classes, such as stocks, bonds, and real estate. The purpose of diversification is to reduce the impact of inflation on investments by ensuring that any losses in one asset class are offset by gains in another. Inflation can erode the value of investments over time, particularly in asset classes such as cash or fixed-income securities. However, by diversifying investments across a range of asset classes, investors can reduce the impact of inflation on their overall portfolio. For example, while inflation may reduce the value of cash or fixed-income securities, it may also increase the value of real estate or commodities such as gold. By investing in a range of asset classes, investors can ensure that their portfolios can withstand the impact of inflation over time. Individuals and businesses may also choose to diversify within asset classes by investing in a range of companies or industries. This can help to reduce the impact of inflation on individual stocks or sectors, and can provide greater protection against market fluctuations. One way is to monitor indicators such as the CPI, a key measure of inflation by governments and central banks worldwide. Tracking changes in the CPI can provide valuable insights into inflationary trends in the economy. It is also important to stay informed about economic and political developments that may impact inflation. For example, changes in government policies, shifts in global commodity prices, or geopolitical events such as conflicts or natural disasters can all impact inflationary pressures. By staying informed about inflation trends, individuals and businesses can make informed decisions about their investments, spending, and borrowing. Governments can help manage inflationary risk by using fiscal and monetary policies. Fiscal policy can be used to manage inflationary risk by adjusting taxation and government spending in response to economic changes. For example, if the economy is experiencing inflationary pressures, the government may choose to increase taxes or reduce spending to slow down demand and reduce inflation. Central banks handle monetary policy. They can control the money supply and interest rates in an economy. For example, the central bank may choose to increase interest rates to reduce the money supply, resulting in decreased demand and slowing down inflation. Fiscal and monetary policy can also be combined to manage inflationary risk. This coordinated approach can effectively manage inflationary risk by targeting both the demand and supply sides of the economy. Inflation-protected investments, such as Treasury Inflation-Protected Securities (TIPS) and inflation-linked bonds, can help investors manage inflation risk. These securities are designed to adjust their principal and interest payments for changes in inflation, ensuring that the real value of the investment remains relatively stable. By including inflation-protected investments in their portfolios, investors can help protect their assets from the eroding effects of inflation, while still benefiting from the potential returns offered by fixed-income securities. Inflation risk can have significant implications for retirement planning, as it affects the purchasing power of retirement savings and income. This section will discuss the impact of inflation risk on retirement savings, strategies for generating inflation-adjusted retirement income, and portfolio management approaches for retirees. Inflation risk can erode the purchasing power of retirement savings, making it more difficult for retirees to maintain their desired standard of living. To counteract this risk, investors should consider incorporating investments that offer some protection against inflation into their retirement portfolios. By including a mix of asset classes, such as stocks, bonds, real estate, and commodities, retirees can help protect their savings from the effects of inflation and maintain their purchasing power over time. Generating inflation-adjusted retirement income is essential for maintaining a retiree's standard of living during their retirement years. Strategies for achieving this can include investing in inflation-protected securities, dividend-paying stocks, and real estate investment trusts (REITs). These investments can help provide retirees with a steady income stream that adjusts for inflation, ensuring that their purchasing power remains relatively stable even as the cost of living increases. Retirement portfolio management should take inflation risk into account. By employing strategies such as rebalancing and dollar-cost averaging, retirees can help protect their portfolios from the effects of inflation while still pursuing long-term growth. Rebalancing involves periodically adjusting a portfolio's asset allocation to maintain the desired level of risk and return. This can help ensure that retirees maintain an appropriate mix of inflation-protected and growth-oriented investments. Dollar-cost averaging involves consistently investing a fixed amount of money at regular intervals, which can help smooth out the effects of market fluctuations and reduce the impact of inflation on investment returns. Inflationary risk is a concept that refers to the potential for rising prices to erode the value of money over time. Inflationary risk can have a variety of causes, including changes in the money supply, changes in demand, and cost-push factors. Inflationary risk can have a significant impact on the economy, individuals, businesses, and investments. However, some strategies can be used to manage inflationary risk, including indexing, hedging, and fiscal and monetary policy. By understanding inflationary risk and implementing strategies to manage it, individuals, businesses, and governments can protect themselves from the negative impacts of inflation. Consult a wealth management professional or qualified financial advisor for further information and guidance regarding inflationary risk. While inflation is a common feature of most contemporary economies, these professionals can help manage its effects.What Is Inflationary Risk?

Understanding Inflation

Types of Inflation

Causes of Inflation

Types of Inflationary Risk

Anticipated Inflationary Risk

Unanticipated Inflationary Risk

Measurement of Inflation Risk

Consumer Price Index (CPI)

The CPI is then used to determine the rate of inflation, which helps investors and policymakers make informed decisions about their investments and policies.Producer Price Index (PPI)

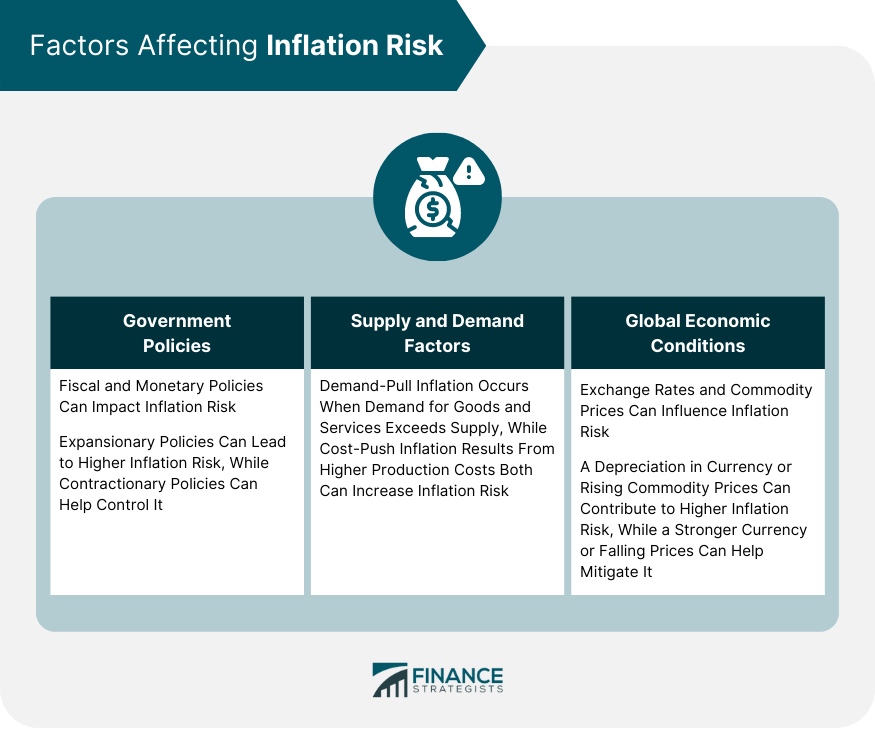

Factors Affecting Inflation Risk

Government Policies

Supply and Demand Factors

Global Economic Conditions

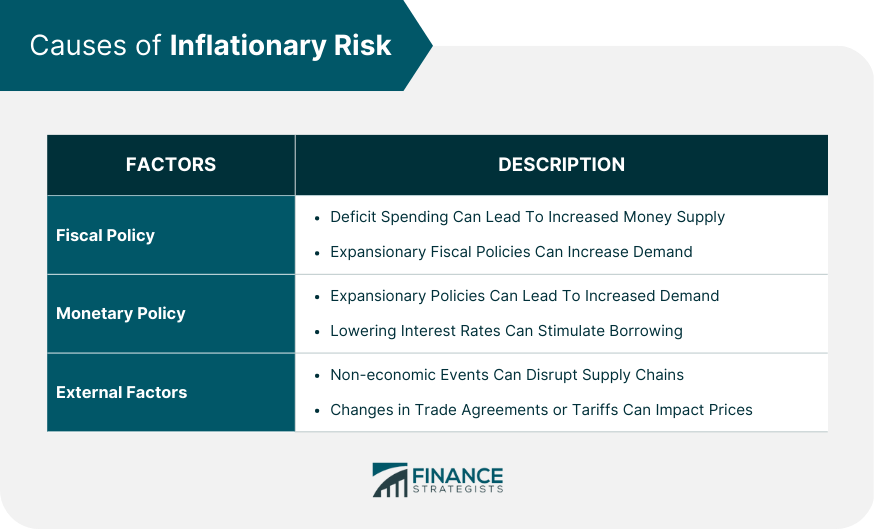

Causes of Inflationary Risk

Fiscal Policy

Monetary Policy

External Factors

Impact of Inflationary Risk

Economic Effects

Effects on Individuals

Effects on Businesses

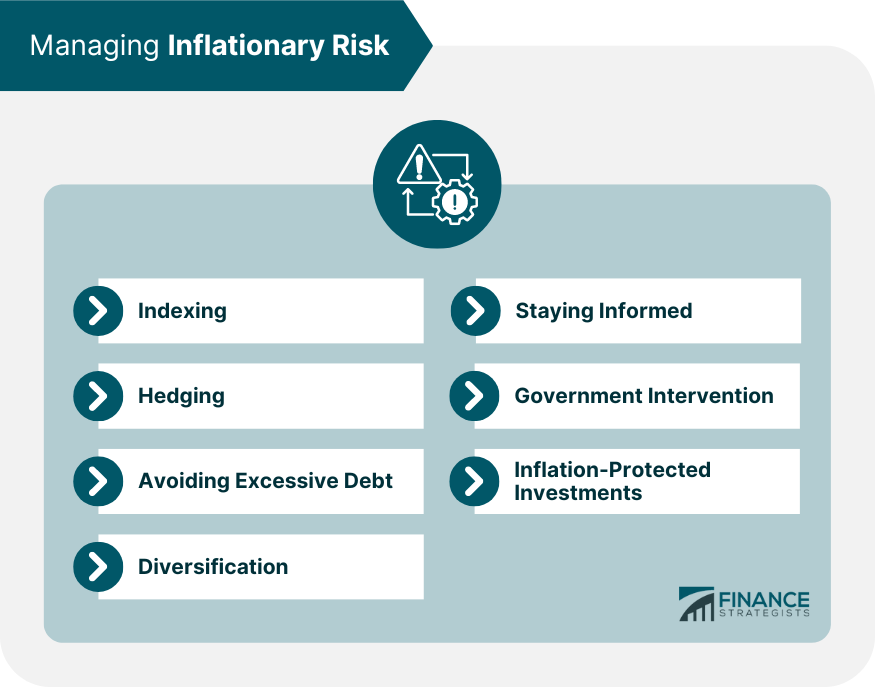

Managing Inflationary Risk

Indexing

Hedging

Avoiding Excessive Debt

Diversification

Staying Informed

Government Intervention

Inflation-Protected Investments

Inflation Risk and Retirement Planning

Impact on Retirement Savings

Inflation-Adjusted Retirement Income

Strategies for Retirement Portfolio Management

Final Thoughts

Inflationary Risk FAQs

It is the risk that the general level of prices in an economy will increase, reducing the purchasing power of money over time.

Inflationary risk can make it more difficult for individuals to afford basic goods and services, erode the value of savings and investments, and lead to a decrease in quality of life.

Inflationary risk can impact businesses by increasing the cost of production, reducing profits, and making it more difficult to plan for the future. Businesses may need to adjust prices or wages to keep up with inflation, and may also need to invest in strategies such as hedging to manage inflationary risk.

Strategies for managing inflationary risk include indexing, hedging, diversification, avoiding debt, and staying informed about inflation trends.

Governments manage inflationary risk through fiscal and monetary policy, which can involve adjusting taxation, government spending, interest rates, and the money supply to manage inflationary pressures in the economy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.