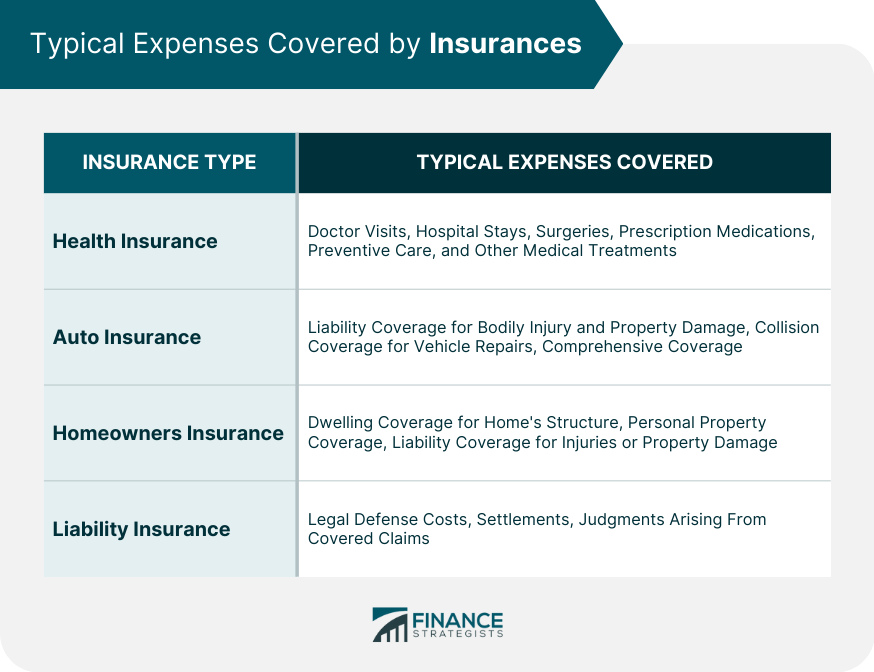

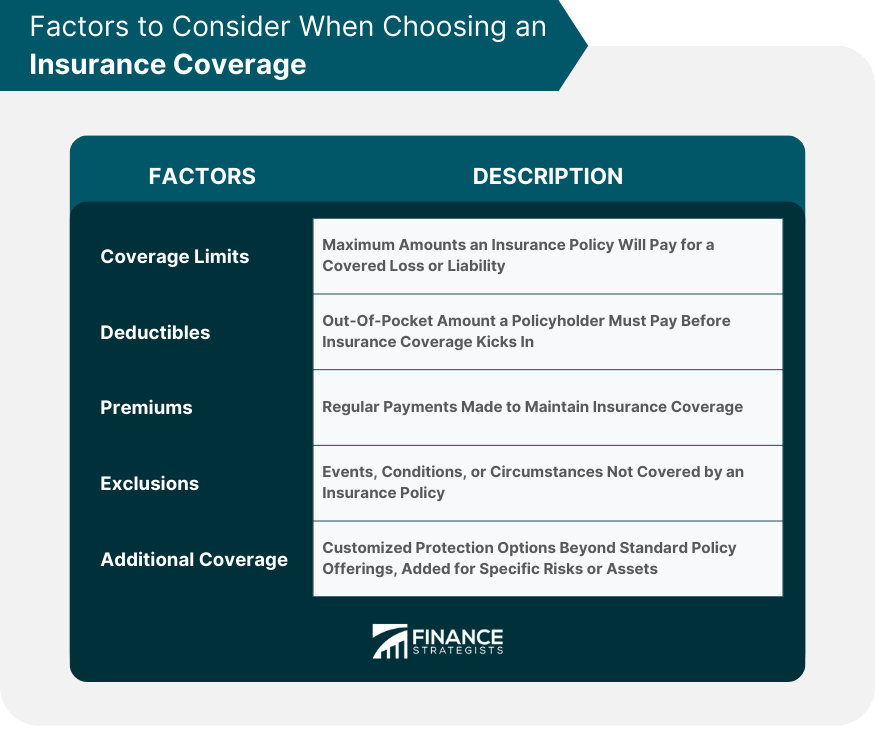

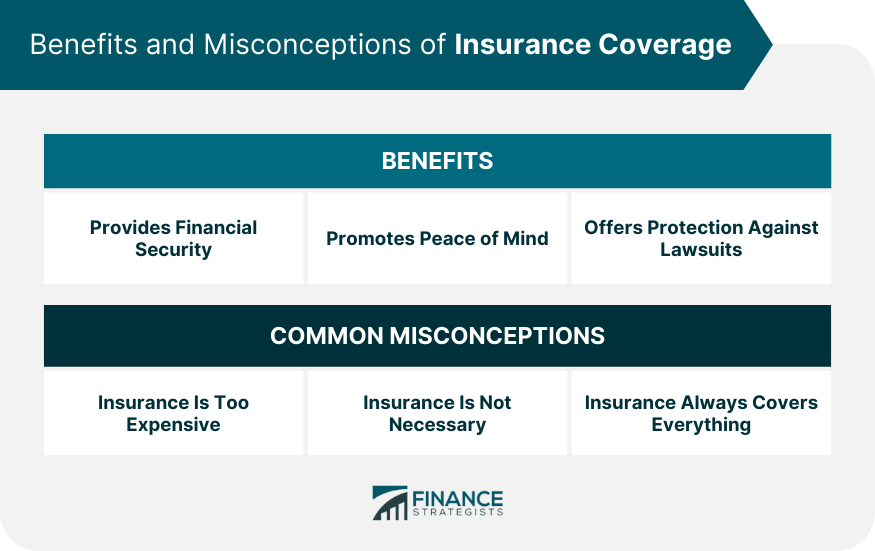

Insurance coverage is a contract between an individual or entity (the policyholder) and an insurance company, wherein the insurer agrees to provide financial protection or reimbursement for specific losses, damages, or liabilities in exchange for regular premium payments from the policyholder. The insurance coverage is outlined in the insurance policy, which details the terms, conditions, and specific protections provided by the insurer. By transferring the financial risk from the policyholder to the insurer, insurance coverage helps individuals and businesses manage potential risks and minimize the financial impact of accidents, illnesses, natural disasters, or legal liabilities. Health insurance coverage provides policyholders with financial protection for medical expenses resulting from illness, injury, or preventive care. These expenses can include doctor visits, hospital stays, surgeries, prescription medications, and other medical treatments. Health insurance coverage is often offered through employer-sponsored plans or government programs, but individuals can also purchase private health insurance policies. Auto insurance coverage is designed to provide financial protection for policyholders in the event of vehicle-related accidents or damages. This type of coverage typically includes liability coverage for bodily injury and property damage, collision coverage for vehicle repairs or replacement, and comprehensive coverage for non-collision-related damages such as theft, vandalism, or weather-related damage. Auto insurance is required by law in most jurisdictions, with minimum coverage levels mandated by each state or country. Homeowners insurance coverage offers financial protection for policyholders in the event their home or personal property is damaged or destroyed by a covered peril, such as fire, windstorms, or theft. This type of coverage typically includes dwelling coverage for the home's structure, personal property coverage for belongings inside the home, and liability coverage for injuries or property damage caused by the policyholder or their family members. Liability insurance coverage protects policyholders from financial losses resulting from legal liabilities or claims made against them. This type of coverage is often included in auto and homeowners insurance policies but can also be purchased as standalone policies, such as general liability insurance for businesses or professional liability insurance for specific professions. Liability insurance provides coverage for legal defense costs, settlements, and judgments arising from covered claims. Coverage limits are the maximum amounts an insurance policy will pay for a covered loss or liability. When choosing insurance coverage, policyholders should consider the potential financial risks they face and select coverage limits that adequately protect their assets and financial well-being. Insufficient coverage limits can leave policyholders vulnerable to significant out-of-pocket expenses in the event of a loss. A deductible is the amount a policyholder must pay out-of-pocket before the insurance coverage kicks in. Deductibles can vary widely depending on the type of insurance and the specific policy terms. When selecting insurance coverage, policyholders should consider their ability to pay the deductible in the event of a claim and choose a deductible amount that balances affordability with the desired level of coverage. Premiums are the regular payments policyholders make to maintain their insurance coverage. Premium amounts are determined by various factors, including the type and amount of coverage, the policyholder's risk profile, and the insurer's underwriting guidelines. When choosing insurance coverage, policyholders should compare premium costs and consider the overall value of the coverage provided relative to the cost. Exclusions are specific events, conditions, or circumstances that are not covered by an insurance policy. It is essential for policyholders to understand the exclusions in their insurance coverage to avoid surprises in the event of a claim. When comparing insurance policies, policyholders should carefully review the exclusions and consider whether additional coverage options are needed to address any potential gaps in protection. In some cases, policyholders may want or need additional coverage beyond the standard protections offered by their insurance policy. These additional coverage options, often referred to as riders or endorsements, can be added to an existing policy to provide customized protection for specific risks or assets. When choosing insurance coverage, policyholders should evaluate their unique needs and consider any additional coverage options that may be appropriate for their situation. By entrusting the potential burdensome consequences of losses or liabilities to insurers, insurance coverage facilitates effective management of unforeseen circumstances for individuals and businesses alike. This proactive approach mitigates the dire financial impact that accidents, illnesses, or legal liabilities can impose, affording policyholders peace of mind and a safeguard against potential financial ruin. Through the transfer of risk, insurance coverage ensures that policyholders can navigate the uncertain terrain of life with greater confidence, knowing that they have a reliable and robust safety net to rely upon when unexpected events transpire. Knowing that they have financial protection in place in the event of unforeseen events or losses can reduce stress and anxiety, allowing individuals and businesses to focus on their daily lives and operations with greater confidence and security. Insurance coverage, particularly liability insurance, provides policyholders with protection against potential lawsuits and legal claims. This protection can be invaluable in today's litigious society, as legal defense costs, settlements, and judgments can be financially devastating for individuals and businesses alike. Insurance coverage helps mitigate this risk by providing financial resources and support in the event of a covered claim. One common misconception about insurance coverage is that it is too expensive and not worth the cost. However, the cost of insurance premiums is often significantly less than the potential financial losses resulting from accidents, illnesses, or legal liabilities. By investing in insurance coverage, policyholders can achieve greater financial security and protect their assets in the long run. Another misconception is that insurance coverage is not necessary, particularly for individuals or businesses who believe they are at low risk for accidents or losses. However, unexpected events can happen to anyone, and the financial consequences of being uninsured can be severe. Insurance coverage provides a safety net and financial protection that can be invaluable in times of need. A third misconception is that insurance coverage always covers everything, regardless of the circumstances. In reality, insurance policies have specific terms, conditions, and exclusions that determine the extent of the coverage provided. Policyholders should carefully review their insurance policies to understand the coverage limitations and ensure they have adequate protection for their needs. Insurance coverage is a contract between a policyholder and an insurance company, providing financial protection or reimbursement for specific losses, damages, or liabilities in exchange for regular premium payments. When selecting insurance coverage, policyholders should consider factors such as coverage limits, deductibles, premiums, exclusions, and additional coverage options. These factors can help ensure that the chosen coverage adequately meets the policyholder's needs and provides the desired level of protection. Insurance coverage offers numerous benefits, including financial security, peace of mind, and protection against lawsuits. However, there are also common misconceptions about insurance coverage, such as the belief that insurance is too expensive, not necessary, or always covers everything. By understanding the true nature and value of insurance coverage, policyholders can make informed decisions about their insurance needs and ensure that they have the right protection in place for their unique circumstances.What Is Insurance Coverage?

Types of Insurance Coverage

Health Insurance Coverage

Auto Insurance Coverage

Homeowners Insurance Coverage

Liability Insurance Coverage

Factors to Consider When Choosing Insurance Coverage

Coverage Limits

Deductibles

Premiums

Exclusions

Additional Coverage Options

Benefits of Insurance Coverage

Financial Security

Peace of Mind

Protection Against Lawsuits

Common Misconceptions About Insurance Coverage

Insurance Is Too Expensive

Insurance Is Not Necessary

Insurance Always Covers Everything

The Bottom Line

Insurance Coverage FAQs

Insurance coverage refers to the protection provided by an insurance policy against potential financial losses, damages, or liabilities.

The most common types of insurance coverage include health, auto, homeowners, and liability coverage, each designed to protect against different types of risks.

You should consider coverage limits, deductibles, premiums, exclusions, and additional coverage options when choosing insurance coverage.

Insurance coverage provides financial security, peace of mind, and protection against lawsuits, among other benefits.

Common misconceptions include that insurance is too expensive, not necessary, and always covers everything, when in fact, insurance can be affordable, necessary, and subject to limitations and exclusions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.