A fixed-income security is an investment with a fixed rate of return that is paid back at specific times throughout a given year. The most popular use of a fixed-income security is in the form of a bond, but other uses of fixed-income security also exist in the forms of CDs, money markets, and preferred shares. The distinguishing feature of FIS is the fixed interest rate, or coupon rate, which remains constant throughout the life of the security. These securities provide investors with a reliable income stream and are often sought for their stability and income-generation potential. Have questions about Fixed-Income Securities? Click here. Corporations and institutions of the government, in an effort to raise money for new projects or the maintenance of old ones, will allow interested buyers to purchase bonds. In other words, these large public entities, by selling bonds, are asking individual private citizens to loan them small sums of money. From the investor's point of view, the purpose of investing in a fixed-income security is to diversify one's portfolio in a safe way. Since fixed-income securities' rate of return is more stable than other investments, albeit with no potential for growth, investors will turn to securities during tough economic times or in an attempt to create a steady income because the fixed rate of return set by large corporations or the government is so dependable. Government bonds are issued by national governments to finance their operations and projects. They are considered one of the safest fixed-income investments, as they are backed by the full faith and credit of the issuing government. Government bonds often offer fixed interest payments and return the principal amount at maturity. Corporate bonds are issued by companies to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing. They offer investors the opportunity to earn interest income over a specified period. Corporate bonds carry varying levels of risk depending on the creditworthiness of the issuing company. Municipal bonds, also known as munis, are issued by state and local governments or their agencies to finance public infrastructure projects, such as schools, hospitals, or transportation systems. Municipal bonds offer tax advantages to investors, as the interest earned is often exempt from federal income tax and, in some cases, state and local taxes. Treasury securities are issued by the government to finance its operations and manage the national debt. They include Treasury bills (T-bills), Treasury notes, and Treasury bonds. T-bills have short-term maturities of one year or less, while Treasury notes and bonds have longer maturities, ranging from 2 to 30 years. Treasury securities are considered low-risk investments and are backed by the U.S. government. Mortgage-backed securities (MBS) represent an ownership interest in a pool of mortgage loans. These securities are created by pooling together individual mortgages and issuing securities backed by the cash flows generated from the underlying mortgage payments. MBS provides investors with exposure to the housing market and offers different risk profiles based on the quality of the underlying mortgages. Asset-backed securities (ABS) are created by pooling together various types of debt obligations, such as auto loans, credit card receivables, or student loans. These securities derive their value and income from the underlying assets. ABS can offer investors diversification and access to different types of consumer debt, but they also carry specific risks associated with the underlying assets. When purchased, a bond comes with two promises. The first is that the issuer of the bond will repay the interest on the loan at a fixed rate at fixed times of the year. The second is that after the bond has matured that the bond issuer will have repaid the amount of money originally invested by the purchaser of the bond. The rate at which the interest is paid on a bond varies from bond to bond. Bonds issued by large, stable corporations or government institutions typically have very low yields. But they make up for it by being particularly reliable when it comes to paying interest and the matured principle. Fixed-income securities provide a reliable and predictable income stream through regular interest payments. This makes them particularly attractive to income-focused investors who rely on consistent cash flow to meet their financial needs. One of the key advantages of fixed-income securities is their focus on preserving the invested capital. Government bonds, for example, are considered relatively safe investments with low default risk, making them suitable for risk-averse investors seeking to protect their principal. Including fixed-income securities in a well-diversified investment portfolio helps spread risk and reduce volatility. They typically have a lower correlation with equities, which means their prices may not move in tandem with the stock market. This diversification benefit can help cushion the overall portfolio during market downturns. While they may still experience fluctuations in value, the magnitude of these fluctuations is often lower. This lower volatility can provide stability to a portfolio and help investors manage their overall risk exposure. When interest rates rise, the value of existing fixed-rate bonds tends to decline as newer bonds with higher yields become more attractive. Conversely, when interest rates fall, existing bonds with higher coupon rates may become more valuable. Fixed-income securities carry the risk of default by the issuer, particularly in the case of corporate and lower-rated bonds. Credit risk refers to the possibility that the issuer may not be able to make timely interest payments or repay the principal amount at maturity. Investors need to assess the creditworthiness of issuers and consider the credit ratings assigned by rating agencies. Inflation erodes the purchasing power of future interest payments and principal repayments. Fixed-income securities with fixed coupon rates may not provide sufficient returns to keep pace with inflation, resulting in a decrease in the real value of investment returns over time. Certain fixed-income securities, such as callable bonds, give the issuer the right to redeem the bonds before their scheduled maturity dates. This introduces call risk to investors, as the issuer may choose to call the bond if prevailing interest rates are lower, resulting in the investor receiving the principal back earlier than expected and potentially missing out on future interest payments. Investors should assess the yield offered by fixed-income securities in relation to prevailing interest rates. Comparing the yield to the risk-free rate and considering the investment's risk profile will help determine whether the potential return adequately compensates for the associated risks. Credit ratings assigned by reputable rating agencies provide an indication of the issuer's creditworthiness and the likelihood of timely interest and principal payments. Higher-rated securities generally carry lower credit risk. Longer-term securities typically have greater interest rate risk than shorter-term ones. Investors should consider their investment horizon and tolerance for interest rate fluctuations when selecting securities with different maturities. Liquidity refers to the ease of buying or selling fixed-income securities in the secondary market without significantly impacting their prices. Investors should assess the liquidity of the securities they intend to invest in, considering factors such as trading volume and bid-ask spreads. Adequate liquidity ensures that investors can enter or exit positions as needed. Fixed-income securities is an investment that provides a fixed return or income stream over a specific period and includes government bonds, corporate bonds, municipal bonds, treasury securities, mortgage-backed securities, and asset-backed securities. The benefits of fixed-income securities include stable and predictable income, capital preservation, diversification, and lower volatility compared to equities. However, investors must consider factors such as interest rate risk, credit risk, inflation risk, and call risk. Yield, credit quality, maturity, and liquidity are important factors to evaluate when dealing with fixed-income securities. Careful consideration of these factors and consultation with a financial advisor can help investors navigate the fixed-income securities market successfully.Fixed-Income Security (FIS) Definition

Why Fixed-Income Securities?

Purpose of Investing in Fixed-Income Security

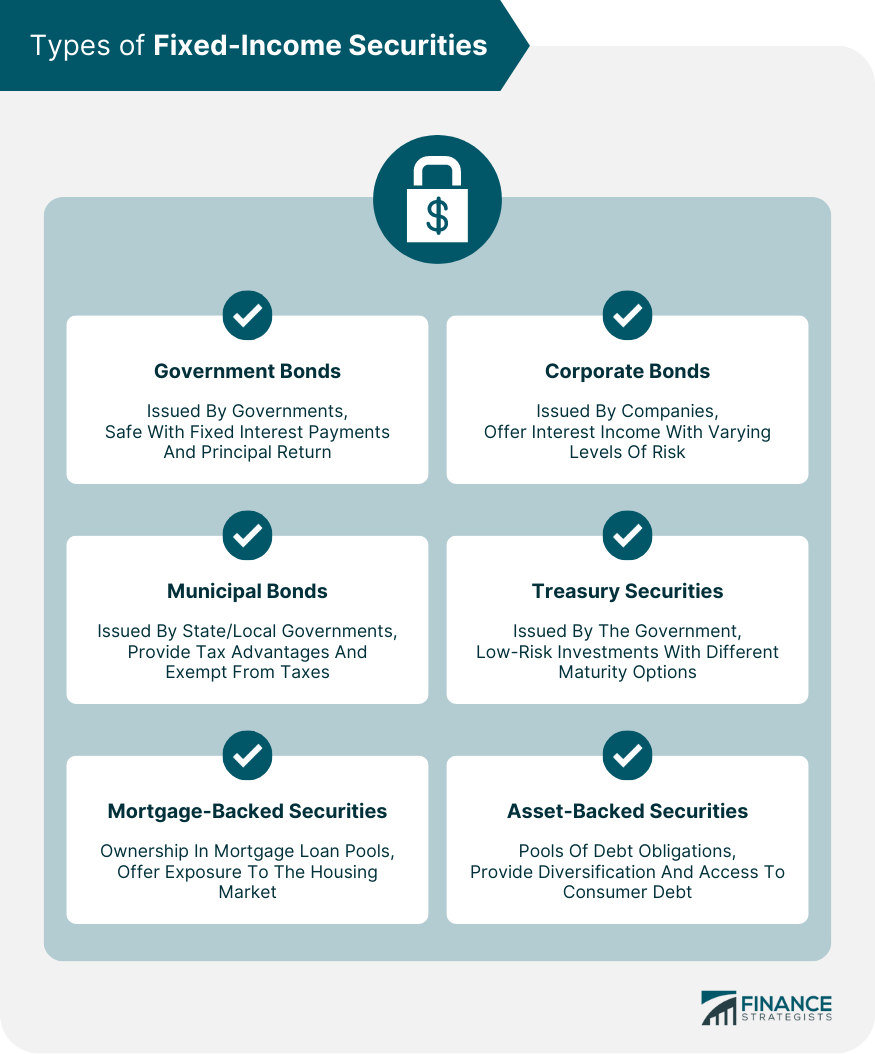

Types of Fixed-Income Securities

Government Bonds

Corporate Bonds

Municipal Bonds

Treasury Securities

Mortgage-Backed Securities

Asset-Backed Securities

Bond as a Popular Use of Fixed-Income Securities

Promises of a Bond

Interest Rate on Bonds

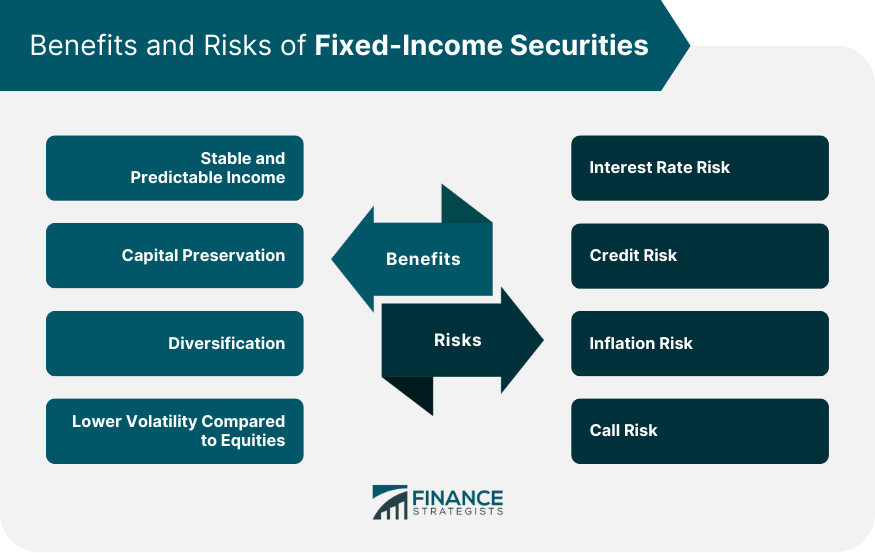

Benefits of Fixed-Income Securities

Stable and Predictable Income

Capital Preservation

Diversification

Lower Volatility Compared to Equities

Risks Associated With Fixed-Income Securities

Interest Rate Risk

Credit Risk

Inflation Risk

Call Risk

Factors to Consider When Investing in Fixed-Income Securities

Yield and Interest Rates

Credit Quality and Ratings

Maturity and Duration

Liquidity

Final Thoughts

Fixed-Income Security (FIS) FAQs

Fixed-income security is an investment with a fixed rate of return that is paid back at specific times throughout a given year.

The most popular use of a fixed-income security is in the form of a bond, but other uses of fixed-income security also exist in the forms of CDs, money markets, and preferred shares.

From the investor’s point of view, the purpose of investing in a fixed-income security is to diversify one’s portfolio in a safe way.

The rate at which the interest is paid varies, but those issued by large, stable corporations or government institutions typically have very low yields.

Investors should consider factors such as interest rate risk, credit risk, inflation risk, and call risk. Additionally, evaluating the yield, credit quality, maturity, and liquidity of fixed-income securities is important in making informed investment decisions. Consulting with a financial advisor can help navigate the complexities of the fixed-income securities market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.