A government bond, also called sovereign debt, is a form of debt security that is sold to investors to support government activities. Unlike other investments that have a market risk premium built in, these bonds are low-risk because they are backed by the full faith and authority of the issuing government and its ability to print money. Explore Investment Options with a Vetted Financial Advisor. Click here. Some government bonds pay periodic interest called coupon payments. These payments are based on the interest rate established by the Federal Reserve. Others do not pay coupons and are sold at a discount instead. US government bonds are sold by the US Treasury Department at auctions throughout the year. These bonds can also be traded in the secondary market through a broker as pooled investments or exchange-traded funds (ETFs) where they may sell at a discount or premium of their principal. U.S. government bonds are close to risk-free; however other government issuers, particularly those in emerging markets, may carry additional risk. The risk associated with government bonds is based on the economic strength of the country, its political outlook, and the stability of its central bank. In addition, it is important to note the difference between government and municipal bonds. Unlike government bonds, municipal bonds are issued by cities, states, and counties to local governments to finance local projects and carry certain tax advantages for investors. Treasury bonds, often called "T-Bonds," are long-term investment instruments issued by the federal government. With maturity periods generally ranging from 20 to 30 years, these bonds offer semi-annual interest payments to the bondholder. T-Bonds are considered some of the safest investments since they are backed by the full faith and credit of the U.S. government. Upon maturity, the bondholder receives the face value of the bond. However, it's worth noting that the price and yield of T-Bonds can fluctuate in the secondary market, where bonds are traded after their initial issuance. While similar to Treasury bonds, Treasury notes—or "T-Notes"—tend to have shorter maturity periods, usually between 2 to 10 years. Like T-Bonds, T-Notes also pay semi-annual interest and return the face value upon maturity. The key difference lies in the duration of the investment and, as a result, the potential yield over time. As T-Notes have shorter maturity periods, their prices are typically less susceptible to interest rate fluctuations than longer-term bonds. This feature can make them more appealing to investors looking for a slightly safer, shorter-term investment. Treasury bills, or "T-Bills," are the shortest-term government securities, with maturities ranging from a few days to 52 weeks. Unlike their longer-term counterparts, T-Bills don't provide regular interest payments. Instead, they are sold at a discount to their face value, and upon maturity, the government pays the full face value. For instance, you might buy a T-Bill with a face value of $1,000 for $950. At the end of the term, you would receive the full $1,000, thereby earning $50 in interest. The yield of a T-Bill is the difference between the purchase price and the amount you receive at maturity. Municipal bonds are issued by state and local governments, rather than the federal government. These bonds help finance public projects like building schools, highways, and other infrastructure. One of the main attractions of municipal bonds is that their interest payments are often exempt from federal income tax, and sometimes state or local tax as well. However, municipal bonds may carry a bit more risk than federal government bonds. The default risk, although still relatively low, is higher because state and local governments, unlike the federal government, can go bankrupt. For our readers outside of the United States, provincial bonds can be a viable investment option. Similar to the way U.S. states issue municipal bonds, provinces in countries such as Canada issue provincial bonds. Just like other government bonds, provincial bonds are used to finance government projects and services. Their risk level and tax treatment vary depending on the regulations of the specific country, so investors should do their research before diving in. International government bonds offer exposure to foreign markets, which can provide additional diversification for an investment portfolio. These bonds are issued by foreign governments and can be denominated in the issuer's currency or another currency, such as the U.S. dollar. Investing in international bonds introduces additional risks, including foreign exchange risk and country risk. However, these bonds can offer higher yields compared to domestic bonds, which can be attractive for some investors. Government bonds, regardless of type, share certain features and characteristics. The maturity date of a bond is the date when the bond issuer must repay the bond's face value to the bondholder. Maturities for government bonds can range from a few days (in the case of T-Bills) to as long as 30 years (for T-Bonds). Bonds with longer maturities usually offer higher yields to compensate investors for the increased risk associated with a longer investment period. Investors should consider their investment horizon when choosing bonds. For instance, if you know you'll need your investment back in five years, you wouldn't want to buy a bond that matures in ten years. The face value, or par value, is the amount of money the bondholder will receive from the issuer when the bond matures. Most bonds, including government bonds, have a face value of $1,000. However, in the secondary market, a bond's price may fluctuate and deviate from its face value. These fluctuations are influenced by factors such as changes in interest rates, the issuer's creditworthiness, and time remaining until maturity. The coupon rate is the annual interest rate that the bond issuer promises to pay the bondholder. This rate is typically fixed for the life of the bond. For example, a $1,000 bond with a coupon rate of 5% will pay $50 in interest each year. Government bonds usually pay interest semi-annually, which means the annual interest is split into two equal payments. It's important to note that not all bonds come with coupon payments; T-Bills, for instance, are sold at a discount and don't pay regular interest. Yield is a measure of the return on your bond investment. It's calculated as the annual interest payments divided by the bond's current market price. Unlike the coupon rate, the yield of a bond changes as the market price of the bond fluctuates. When a bond's price rises above its face value, it's said to be selling at a premium, and its yield is lower than the coupon rate. Conversely, when a bond's price falls below its face value (selling at a discount), its yield is higher than the coupon rate. Credit rating agencies assess the creditworthiness of bond issuers, including governments. These ratings help investors understand the risk of the issuer defaulting on its debt obligations. U.S. Treasury securities are considered to have virtually no credit risk, as they're backed by the full faith and credit of the U.S. government. However, municipal and international bonds can have varying degrees of credit risk, which is reflected in their credit ratings. Liquidity refers to how quickly and easily an investment can be converted into cash without significantly affecting its price. Treasury securities are known for their high liquidity—there's a large market of buyers and sellers, so you can generally sell these securities easily if you need to. However, not all government bonds have high liquidity. Municipal bonds, for instance, are often less liquid than Treasury securities. If you need to sell a less liquid bond before it matures, you may have to sell it at a discount to its current value. The interest income from most government bonds is subject to federal income tax. However, some bonds have tax advantages. For instance, interest on municipal bonds is often exempt from federal income tax and may also be exempt from state and local taxes if you live in the state where the bond was issued. However, even though the interest may be tax-free, any capital gains from selling a municipal bond on the secondary market are subject to federal capital gains tax. The specific tax treatment will depend on your individual circumstances and may be subject to change, so it's always a good idea to consult a tax advisor. Government bonds can play a vital role in a diversified portfolio. Here are some of the key benefits that these investment vehicles offer. When it comes to the spectrum of investment risk, government bonds are usually found at the lower end. They are considered safe investments because they are backed by the issuing government. U.S. Treasury securities, for example, are backed by the full faith and credit of the U.S. government, making them one of the safest investments around. For risk-averse investors, these bonds can be an attractive choice. Even during periods of economic uncertainty or market volatility, government bonds typically maintain their value and continue to pay interest. Government bonds are a reliable source of regular income. They typically pay interest semi-annually, providing a steady income stream for investors. This makes them particularly appealing to retirees and other investors who need to supplement their income. The interest rate is usually fixed, meaning the income you receive won't change over the life of the bond. You can calculate the income you'll receive each year by multiplying the bond's face value by its interest rate. Adding government bonds to your portfolio can provide much-needed balance and diversification. As bonds typically have a low correlation with equities, they can help smooth out returns and reduce portfolio risk. In other words, when the stock market is performing poorly, bonds often perform well, and vice versa. This counterbalancing act can lead to less volatility in the overall portfolio. Capital preservation is a strategy aimed at preventing losses in an investment portfolio. For investors whose main goal is to maintain the original amount of their investment, government bonds are an attractive option. Given their safety and the predictable income stream, bonds can effectively preserve capital. Even though they may not offer high returns, you're likely to get back your initial investment plus the interest you've earned over the term of the bond. Despite their numerous advantages, government bonds are not without their drawbacks. It's essential to be aware of these disadvantages before investing. Government bonds are secure, but they come at a cost: lower returns. Compared to stocks and other higher-risk investments, the yield on government bonds is relatively low. Investors willing to take on more risk can often find investments with a higher potential for return. This lower return might not keep up with inflation, especially in an environment with high inflation rates. In such cases, the purchasing power of the bond's interest payments could decrease over time. While the interest rate on a bond is fixed, market interest rates are not. When market interest rates rise, the prices of existing bonds fall. This is because new bonds are issued at the higher interest rates, making existing bonds with lower rates less attractive. If you need to sell a bond before it matures in a market where interest rates have risen, you may have to sell it at a lower price than what you paid for it, potentially resulting in a loss. Inflation risk, or purchasing power risk, is the risk that inflation will reduce the value of the bond's interest payments and principal. In other words, the cash you receive in the future will be worth less than it is today. This is a particular concern for long-term bonds. If inflation rises significantly over the bond's term, your real return (the return after accounting for inflation) could be lower than expected, or even negative. While U.S. Treasury securities are considered virtually risk-free, the same is not true for all government bonds. International bonds carry the risk that the foreign government will default on its debt payments. Credit ratings can help you assess this risk, but keep in mind that economic conditions can change, and a government that is creditworthy now might not be in the future. If you're interested in adding government bonds to your portfolio, here are some ways to do it. The U.S. Treasury sells T-Bills, T-Notes, and T-Bonds through regular auctions. You can participate in these auctions by setting up an account on the Treasury Direct website. There are no fees or commissions for buying bonds this way, but you'll need to do your own research to decide which bonds to buy. Purchasing directly from the government guarantees that you'll pay no more than face value for the bond, and for T-Bills, you'll pay less than face value. After the auction, the bond is deposited into your Treasury Direct account. Government bonds are also traded on the secondary market, where you can buy and sell them just like stocks. Many brokerage firms offer bond trading. This gives you the opportunity to buy bonds at market prices, which can be above or below face value. One advantage of buying on the secondary market is that you can find bonds with a variety of maturity dates, not just new issues. However, brokers usually charge fees or commissions on trades, which can reduce your returns. Another way to invest in government bonds is through bond funds. These are mutual funds or exchange-traded funds (ETFs) that invest in a diversified portfolio of bonds. The advantage of bond funds is that you get exposure to a wide variety of bonds for a relatively low investment. The fund manager takes care of the research and makes the decisions about which bonds to buy and sell. However, bond funds charge management fees, which can eat into your returns. Government bonds, also known as sovereign debt, are fixed-income securities issued by a national government to raise funds and finance its activities. These bonds are a form of debt financing, where the government borrows money from investors and agrees to pay periodic interest (coupon payments) or return the principal amount (face value) upon maturity. Backed by the issuing government's full faith and credit, these bonds are considered safe investments, providing regular interest payments or returning the face value upon maturity. Government bonds come in various types, including Treasury Bonds, Treasury Notes, and Treasury Bills, each with distinct features and maturity periods. Advantages of investing in government bonds include safety, regular income, diversification, and capital preservation. However, they may yield lower returns compared to riskier investments and are susceptible to interest rate and inflation risks. International bonds also entail credit risk. Investors can access government bonds through auctions, brokerage firms, or bond funds, each method having its benefits and drawbacks.Government Bond Definition

Functions of Government Bonds

Why Bonds?

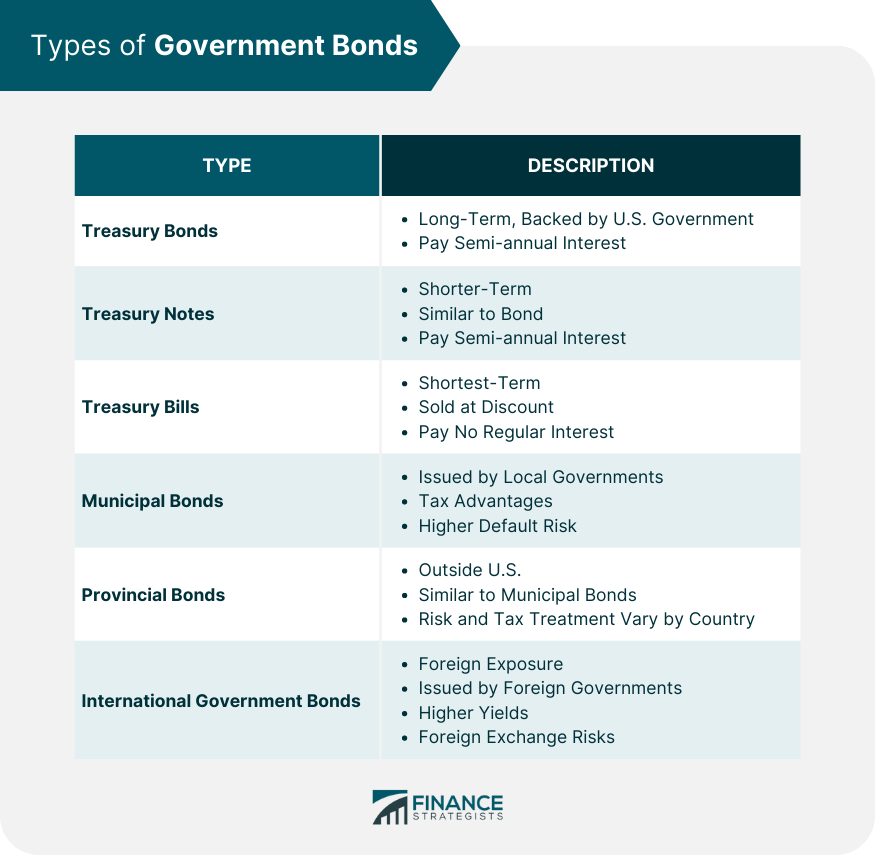

Types of Government Bonds

Treasury Bonds

Treasury Notes

Treasury Bills

Municipal Bonds

Provincial Bonds

International Government Bonds

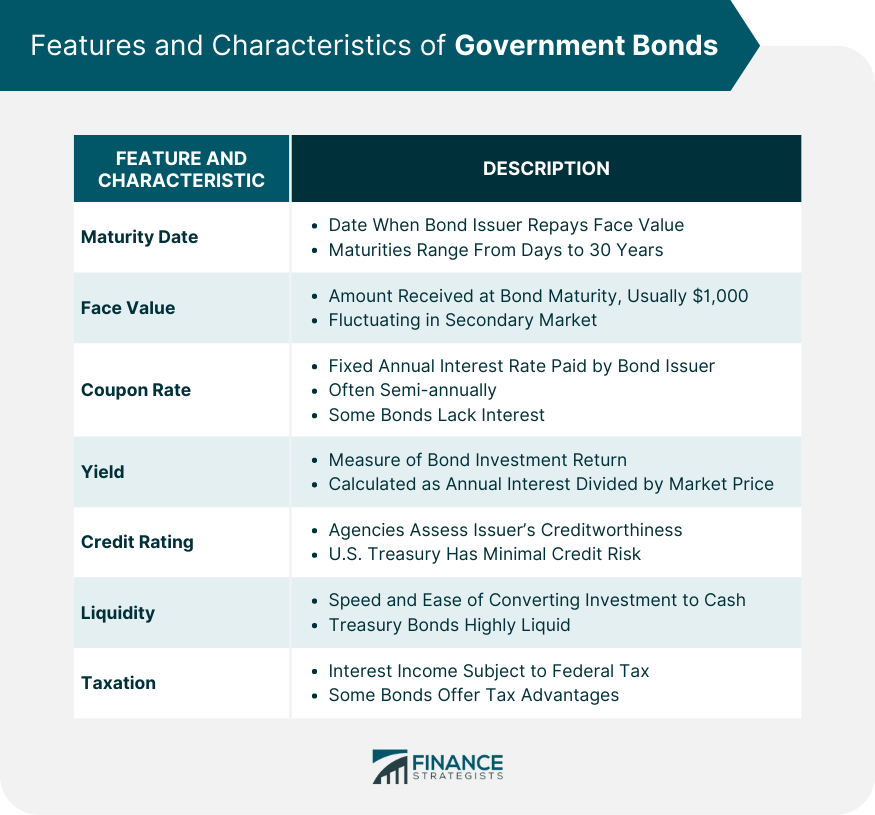

Features and Characteristics of Government Bonds

Maturity Date

Face Value

Coupon Rate

Yield

Credit Rating

Liquidity

Taxation

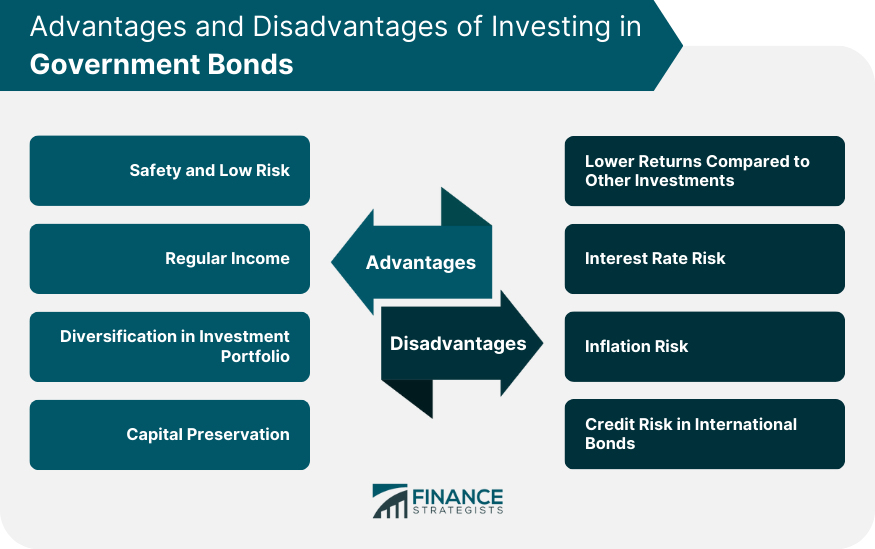

Advantages of Investing in Government Bonds

Safety and Low Risk

Regular Income

Diversification in Investment Portfolio

Capital Preservation

Disadvantages of Investing in Government Bonds

Lower Returns Compared to Other Investments

Interest Rate Risk

Inflation Risk

Credit Risk in International Bonds

How to Invest in Government Bonds

Purchase Through Government Auctions

Buy From Brokerage Firms

Invest in Bond Funds

Conclusion

Government Bond FAQs

A government bond, also called sovereign debt, is a form of debt security that is sold to investors to support government activities.

U.S. government bonds are sold by the US Treasury Department at auctions throughout the year.

U.S. government bonds are close to risk-free; however other government issuers, particularly those in emerging markets, may carry additional risk.

Unlike other investments that have a market risk premium built in, these bonds are low-risk because they are backed by the full faith and authority of the issuing government and its ability to print money.

Unlike government bonds, municipal bonds are issued by cities, states, and counties to local governments to finance local projects and carry certain tax advantages for investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.