Investment horizon refers to the total length of time an individual expects to hold an investment before liquidating it. Depending on the investor's financial goals and risk tolerance, it could range from a few days or weeks (short-term), several months or years (medium-term), to decades or even a lifetime (long-term). On the other hand, returns represent the gain or loss made on an investment. This could be in the form of capital gains, interest, dividends, or any investment-generated income. They are usually expressed as a percentage and are considered a measure of an investment's success or failure. The relationship between the investment horizon and returns is usually positive and direct. Simply put, the longer the investment horizon, the higher the potential for returns, provided the risks are well managed. This is primarily due to factors such as the time value of money, the power of compounding, and the ability to weather market cycles. Understanding this relationship requires an examination of two fundamental financial concepts: the time value of money and the compounding effect. This principle asserts that a dollar in hand today is worth more than a dollar to be received in the future. This is primarily due to the potential earning capacity of money, which gives rise to the concepts of future and present value of an investment. The future value (FV) of an investment refers to the amount an investment is expected to be worth at some point in the future. The FV is determined by the initial investment amount, the rate of return, and the duration of the investment. For example, if you invest $1000 today in a savings account that yields an annual interest rate of 5%, the future value of your investment after one year would be $1050. Extend that to five years, the investment would grow to approximately $1276. This simple calculation underscores the positive effect of the length of time on investment. The longer the investment horizon, the greater the future value, given a constant interest rate. Conversely, the present value (PV) represents the current worth of a future sum of money or cash flow, given a specified rate of return. This is where the concept of discounting comes into play. For instance, what would be the value of $1050 to be received a year from now if the discount rate is 5%? The present value, in this case, would be the $1000 that you initially invested. This might lead you to question, why is a dollar today worth more than a dollar in the future? This is due to several factors: inflation, which reduces purchasing power over time, risk factors associated with future returns, and the potential earning capacity of money if it were invested or saved. Compounding is the process where the value of an investment increases because the earnings on an investment, both capital gains and interest, earn interest as time passes. In the early years of an investment, the compounding effect might seem insignificant. But as time goes on, the growth becomes more exponential because you're effectively earning returns on your returns. For example, if you invested $1,000 at an annual interest rate of 5% compounded annually, in the first year, you'd earn $50. However, in the second year, you'd earn $52.5 because the interest is computed on the initial principal and the accumulated interest ($1,000 + $50). Moreover, the frequency of compounding (how many times interest is added to the investment per time period) also affects the returns. Suppose you invest $5,000 in a savings account for two years. If your bank compounds interest annually at a rate of 5%, you'd have $5,512.50 at the end of two years. However, if the bank compounds semi-annually, you would have $5,520.63. While the difference might seem trivial for a short period and a small principal, over a longer investment horizon and a larger principal, the difference becomes quite substantial. Therefore, a long-term investment with frequent compounding can dramatically boost returns. Investors with a higher risk tolerance are generally willing to invest over a longer period. This is because the value of investments can fluctuate over the short term, but trends tend to smooth out over longer timeframes. For instance, an investor saving for retirement may be looking at an investment horizon spanning decades, allowing for long-term investments that can weather market cycles. Conversely, if an investor's goal is to save for a down payment on a house within a few years, they would prefer a shorter investment horizon with investments that are less risky and more liquid. Generally, younger investors have the advantage of time, enabling them to opt for a longer investment horizon. They have more years to recover from potential market downturns, which allows them to take on more risk for potentially higher returns. In contrast, older investors nearing retirement might favor a shorter investment horizon to preserve their capital and maintain a steady income. Those who have a stable income and financial position can afford to take on riskier, long-term investments. However, those facing financial uncertainty may opt for a shorter investment horizon, ensuring they have quick access to their investment if needed, thus maintaining liquidity. During a bull market, when prices are rising, investors might be inclined to extend their investment horizons, hoping for continued strong performance. Conversely, investors might prefer to shorten their investment horizons to protect themselves from further losses when prices are falling. Equities and mutual funds, which often fluctuate in the short term but have historically provided strong long-term returns, typically require a longer investment horizon. In contrast, bonds or fixed-income investments, which provide regular returns over a defined period, usually involve shorter investment horizons. Seasoned investors, aware of market cycles and confident in their investment choices, may be willing to stick with a long-term investment horizon. On the other hand, novice investors, uncertain about market dynamics, may prefer a shorter investment horizon to mitigate potential losses. Return volatility is a statistical measure of the dispersion of returns for a given security or market index. In simpler terms, it represents the degree of variation of a financial instrument's price over time. Understanding the relationship between return volatility and investment horizon can help investors better manage their investment portfolios. In the short-term, investments can be subject to significant volatility. This can lead to fluctuations in the returns an investor sees over a brief period. Factors contributing to this short-term volatility may include sudden market changes, economic news, geopolitical events, or company-specific information. These short-term changes can cause investors to react, often emotionally, which can exacerbate price swings. Therefore, investments with shorter horizons are often perceived as riskier because there's less time to recover from any downturns. On the other hand, when considering a longer investment horizon, these short-term fluctuations tend to even out, leading to more stable returns. Over the long term, investments often have the opportunity to recover from downturns, and the effect of positive years can offset negative ones. Thus, long-term investing can often help reduce the impact of price volatility and offer a higher probability of positive returns. Investors with a longer investment horizon can generally afford to take on more risk, as they have more time to recover from potential losses. For instance, a downturn in the stock market may not be as concerning for an investor who doesn't plan on touching their investment for 20 years compared to someone nearing retirement. It's also worth noting that a longer investment horizon provides the flexibility to adjust the investment strategy based on changes in financial goals, market conditions, or personal circumstances. This could involve rebalancing the portfolio or adjusting the asset allocation to align with changing risk tolerance or financial needs. Strategic asset allocation refers to setting a target allocation for various asset classes, such as stocks, bonds, and cash equivalents, and regularly rebalancing the portfolio to maintain these allocations. This strategy is based on the investor's risk tolerance, financial goals, and investment horizon. For instance, if you have a longer investment horizon and a higher risk tolerance, you might choose a more aggressive allocation, such as 70% stocks and 30% bonds. On the other hand, if you have a shorter investment horizon and a lower risk tolerance, you might opt for a more conservative allocation, such as 40% stocks and 60% bonds. Dollar-cost averaging (DCA) is an investment technique that involves consistently investing a fixed amount of money in a particular investment at regular intervals, regardless of the investment's price. This approach can mitigate the impact of volatility and reduce the risk of making a large investment at the wrong time. By investing a fixed dollar amount on a regular basis, you buy more shares when prices are low and fewer shares when prices are high, which can result in a lower average cost per share over time. This strategy is especially beneficial for long-term investors who are looking to build wealth gradually and reduce the impact of short-term market fluctuations. Diversification is a strategy that involves spreading your investments across various asset classes and within different sectors to minimize risk. The goal of diversification is not necessarily to boost performance but to balance the risk and reward in your portfolio by investing in different areas that would each react differently to the same event. While it's unlikely that all investments will perform poorly at the same time, it's also rare that they'll all perform well. In a well-diversified portfolio, any losses incurred by some investments should be mitigated by gains in others. Therefore, diversification can potentially lead to more stable returns over the long run. Lastly, risk management is essential in investing. This can involve setting stop-loss orders, regularly rebalancing your portfolio to maintain your target asset allocation, and adjusting your investment strategy based on changes in your financial circumstances or risk tolerance. Investment horizon and returns are closely linked, with longer investment horizons generally offering greater potential for higher returns. Factors such as the time value of money and the compounding effect contribute to this relationship. The time value of money highlights the worth of a dollar today compared to the future, considering factors like inflation and potential earning capacity. Meanwhile, the compounding effect demonstrates how returns can grow exponentially over time, particularly when investments are held for longer periods. Various factors influence the choice of investment horizon, including risk tolerance, investment goals, age, financial stability, market conditions, and the type of investment. Investors with higher risk tolerance, long-term goals, and stable financial positions are more likely to opt for longer investment horizons. Conversely, those with shorter-term goals, lower risk tolerance, financial uncertainty, or limited experience may prefer shorter investment horizons. Understanding the impact of investment horizon on return volatility is crucial, as short-term investments tend to be more volatile while longer-term investments offer more stability. Employing techniques such as strategic asset allocation, dollar-cost averaging, diversification, and risk management can help maximize returns based on the investment horizon.Investment Horizon and Return: Overview

Direct Relationship Between Investment Horizon and Returns

The Time Value of Money

Future Value of Investment

Present Value of Investment

The Compounding Effect

Power of Compounding in the Long-Term

Impact of Frequency of Compounding

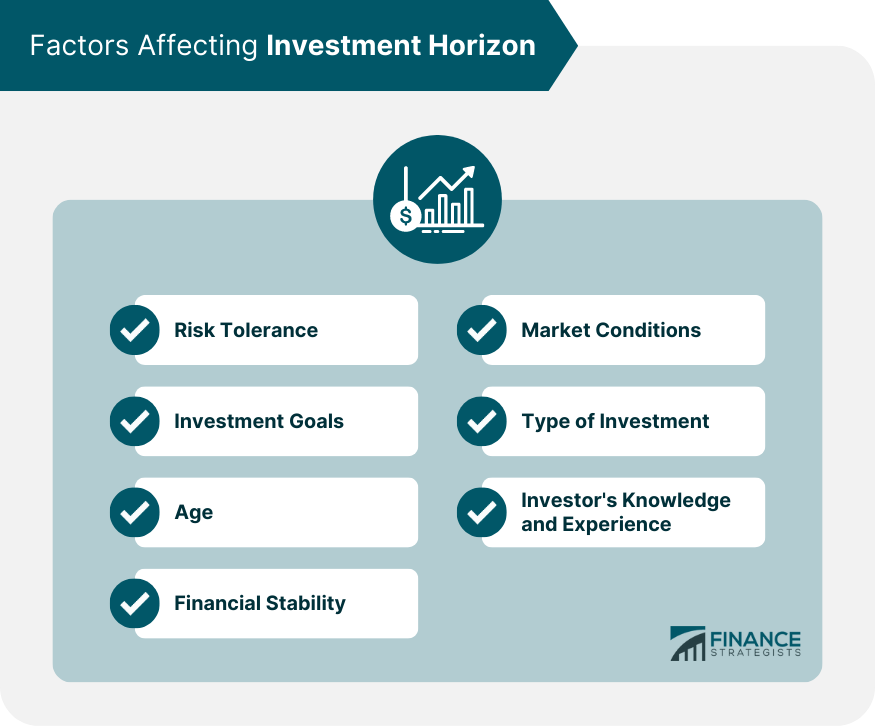

Factors Affecting Investment Horizon

Risk Tolerance

Investment Goals

Age

Financial Stability

Market Conditions

Type of Investment

Investor's Knowledge and Experience

Effect of Investment Horizon on Return Volatility

Short-Term Volatility vs Long-Term Stability

Mitigation of Short-Term Market Risks in Long-Term Investment

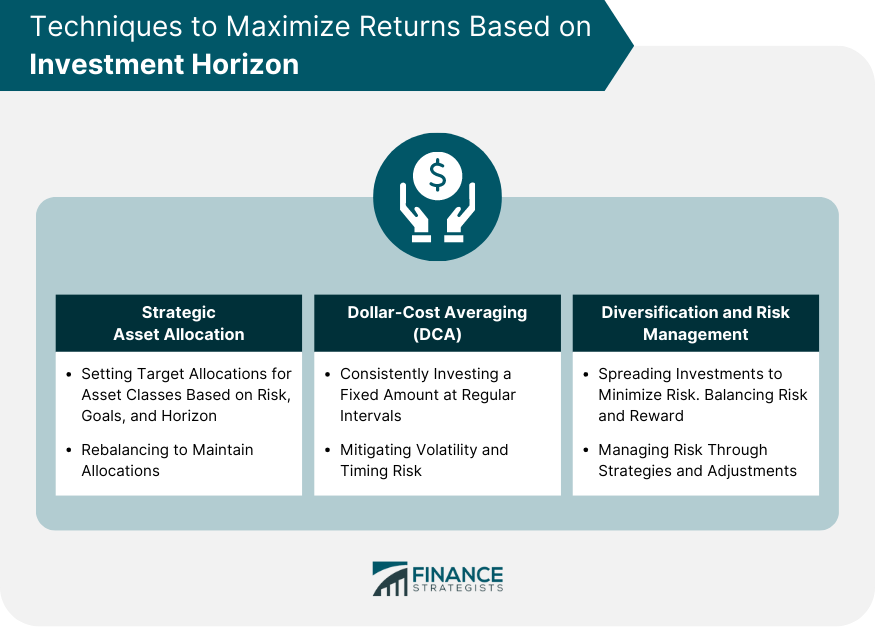

Techniques to Maximize Returns Based on Investment Horizon

Strategic Asset Allocation

Dollar-Cost Averaging (DCA)

Diversification and Risk Management

Final Thoughts

What Is the Relation Between Investment Horizon and Returns? FAQs

The investment horizon and returns have a positive relationship. Generally, a longer investment horizon allows for the potential of higher returns. This is because longer time frames provide opportunities for the power of compounding and the ability to ride out market cycles, resulting in potentially increased investment gains.

While there is no guarantee of higher returns based solely on the investment horizon, a longer investment horizon often provides more time for investments to grow and recover from market downturns. However, it is crucial to consider factors such as risk tolerance, investment strategy, and the specific investment itself when aiming for optimal returns.

Diversification is vital regardless of the investment horizon as it helps mitigate risk. However, it becomes particularly important for longer investment horizons. By spreading investments across different asset classes and sectors, investors can reduce the impact of market volatility and increase the likelihood of achieving more stable returns over the long term.

While longer investment horizons generally have the potential for higher returns, shorter investment horizons can still yield significant gains depending on various factors. Short-term investments may focus on specific market opportunities or strategies, leveraging market volatility for potential profits within a limited timeframe.

While a longer investment horizon increases the potential for positive returns, it does not guarantee them. Investments are subject to market fluctuations and various risks. Proper diversification, risk management, and diligent investment selection are important considerations regardless of the investment horizon to enhance the chances of achieving positive returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.