Revenue bonds is a type of municipal bond that is issued by government entities to finance public projects, such as infrastructure developments, utilities, or transportation systems. The principal and interest payments of these bonds are secured by the revenues generated from the project itself, rather than from general tax revenues. The primary purpose of revenue bonds is to provide financing for projects that generate income, thereby reducing the burden on taxpayers. They are considered a form of self-liquidating debt, as the income generated from the project should be sufficient to repay the bondholders. Revenue bonds often have a longer maturity than other types of municipal bonds and may be non-callable, which means that they cannot be redeemed before the maturity date. Revenue bonds differ from general obligation bonds, which are backed by the full faith and credit of the issuing government and its taxing authority. While general obligation bonds are repaid through taxes, revenue bonds rely on the income generated by the specific project being financed. Project revenue bonds are issued to finance specific projects, such as toll roads, airports, or public housing developments. The revenue generated from these projects is used to repay the bondholders. Lease revenue bonds are issued by a government entity to finance projects that will be leased to another public or private entity. The lessee makes lease payments to the issuer, which are then used to repay the bondholders. Special tax bonds are backed by a specific tax or revenue source, such as sales tax, hotel occupancy tax, or gasoline tax. These bonds are used to finance projects that have a clear relationship to the designated tax or revenue source. Industrial development revenue bonds are issued to finance the construction or improvement of facilities for private businesses. The businesses then lease or purchase the facilities, and their payments are used to repay the bondholders. Public utility revenue bonds are issued to finance the construction, expansion, or improvement of public utilities, such as water and sewer systems or electric power plants. The revenue generated from these utilities is used to repay the bondholders. Nonprofit revenue bonds are issued to finance the construction or improvement of facilities for nonprofit organizations, such as hospitals, schools, or cultural institutions. The revenue generated from these facilities is used to repay the bondholders. Underwriters and financial advisors play a crucial role in the issuance and sale of revenue bonds. They help structure the bond issue, price the bonds, and market them to potential investors. The pricing of revenue bonds is determined by the creditworthiness of the issuer, the interest rate environment, and the specifics of the project being financed. Interest rates on revenue bonds are generally higher than those on general obligation bonds, reflecting the higher risk associated with relying on project revenues for repayment. Credit rating agencies assign ratings to revenue bonds based on their assessment of the issuer's creditworthiness and the financial feasibility of the project being financed. Higher credit ratings typically result in lower interest rates, reducing the issuer's borrowing costs. Revenue bonds are initially sold in the primary market, where underwriters purchase the bonds from the issuer and resell them to investors. Once issued, revenue bonds can be bought and sold in the secondary market, where bond prices may fluctuate based on market conditions and changes in credit ratings. Revenue bonds provide an important source of funding for public projects that generate income, allowing governments to invest in infrastructure and other developments without increasing taxes. Since revenue bonds are repaid from project revenues rather than general tax revenues, they may not appear on a government's balance sheet as debt. This can help governments maintain a favorable debt-to-income ratio. By issuing revenue bonds, governments can access lower borrowing costs than they might through other forms of debt, such as bank loans or corporate bonds. Investments in public projects financed by revenue bonds can stimulate economic growth by creating jobs, boosting local industries, and improving the overall quality of life for residents. Credit risk refers to the possibility that the issuer may default on its principal or interest payments. This risk is generally higher for revenue bonds compared to general obligation bonds, as repayment relies on the success of the specific project being financed. Interest rate risk is the potential for bond prices to decrease as market interest rates rise. Since revenue bonds often have longer maturities than other types of municipal bonds, they may be more susceptible to interest rate fluctuations. Market risk refers to the possibility of bond prices declining due to changes in investor sentiment, economic conditions, or other factors affecting the broader bond market. Revenue bonds, like other fixed-income securities, are subject to this risk. Regulatory risk involves the potential for changes in government regulations or policies that may negatively impact the project being financed or the issuer's ability to repay bondholders. This risk is particularly relevant for projects that are heavily regulated, such as utilities or transportation systems. Although interest income from revenue bonds is generally exempt from federal income taxes, it may be subject to state and local taxes. Additionally, changes in tax laws or policies could affect the attractiveness of revenue bonds to investors. The risk of default is higher for revenue bonds compared to general obligation bonds, as their repayment is dependent on the success of the specific project being financed. This can make revenue bonds a riskier investment for bondholders. Issuing revenue bonds can create a moral hazard for governments, as they may be more inclined to undertake risky projects knowing that the bondholders, rather than taxpayers, will bear the financial consequences if the project fails. There may be concerns about the transparency and accountability of governments that issue revenue bonds, particularly when the financed projects involve partnerships with private entities. There is a risk that governments may use revenue bond proceeds for purposes other than the intended project, potentially leading to financial mismanagement and increased default risk. Examples of successful revenue bond projects can help illustrate the benefits and best practices associated with this financing mechanism. Examining failed revenue bond projects can provide valuable insights into the risks and challenges associated with this type of financing. By analyzing both successful and failed revenue bond projects, governments and investors can learn important lessons to improve the effectiveness and efficiency of future revenue bond financing. Emerging technologies, such as blockchain and digital currencies, may transform the issuance and trading of revenue bonds, potentially improving transparency, efficiency, and accessibility for investors. Green revenue bonds, which finance projects with environmental benefits, are gaining popularity as governments and investors increasingly prioritize sustainability and climate resilience. Public-private partnerships are becoming more common in the financing of public projects, with revenue bonds playing a key role in facilitating these collaborations. This trend is expected to continue, as governments seek innovative ways to finance essential infrastructure and services. As the global economy becomes increasingly interconnected, governments may look to issue revenue bonds in international markets, attracting foreign investment and diversifying their investor base. Revenue bonds are an important financing tool for governments to fund public projects that generate income. They offer various benefits, such as lower borrowing costs and off-balance-sheet financing, but also come with challenges and risks, such as default risk and potential misuse of funds. Understanding the role of revenue bonds in public finance can help governments and investors make informed decisions when considering this type of financing for public projects. To ensure the successful issuance and management of revenue bonds, governments should prioritize transparency and accountability, engage in thorough financial feasibility assessments, and collaborate with experienced underwriters and financial advisors. Investors should carefully evaluate the risks and rewards associated with revenue bonds, considering factors such as credit ratings, interest rate risk, and the specifics of the projects being financed.Definition of Revenue Bonds

Purpose and Characteristics of Revenue Bonds

Revenue Bonds vs. General Obligation Bonds

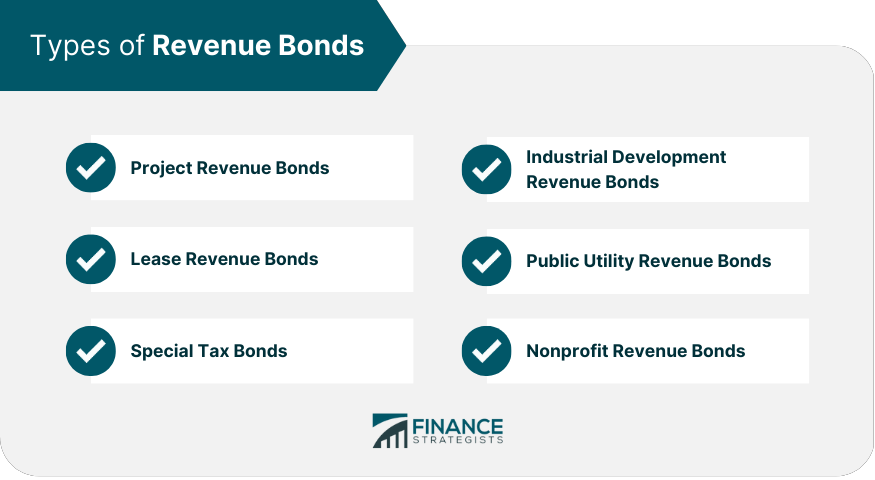

Types of Revenue Bonds

Project Revenue Bonds

Lease Revenue Bonds

Special Tax Bonds

Industrial Development Revenue Bonds

Public Utility Revenue Bonds

Nonprofit Revenue Bonds

Issuance and Sale of Revenue Bonds

Role of Underwriters and Financial Advisors

Pricing and Interest Rates

Credit Ratings and Their Impact

Primary and Secondary Markets

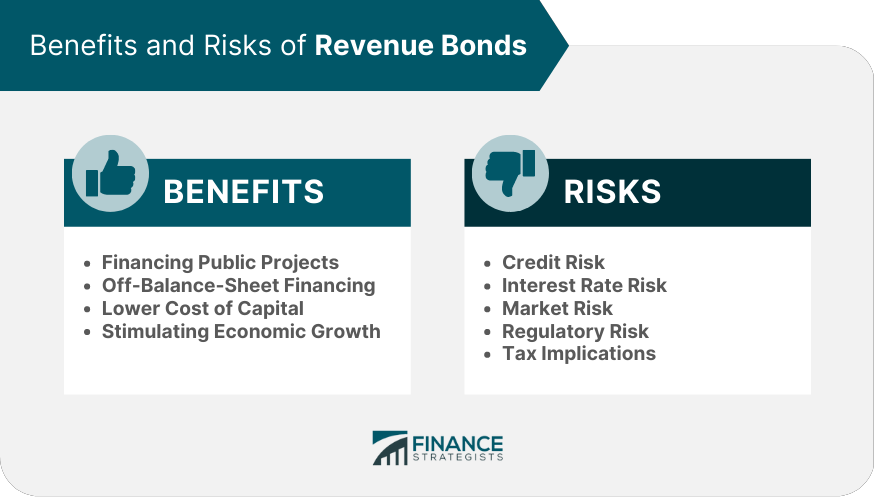

Benefits of Revenue Bonds

Financing Public Projects

Off-Balance-Sheet Financing

Lower Cost of Capital

Stimulating Economic Growth

Risks of Revenue Bonds

Credit Risk

Interest Rate Risk

Market Risk

Regulatory Risk

Tax Implications

Challenges and Criticisms of Revenue Bonds

Default Risk

Moral Hazard

Transparency and Accountability Concerns

Potential Misuse of Funds

Case Studies of Revenue Bond Projects

Successful Revenue Bond Projects

Failed Revenue Bond Projects

Lessons Learned From Case Studies

Future Outlook and Trends

Impact of Emerging Technologies on Revenue Bond Issuance

Green Revenue Bonds and Sustainable Financing

Public-Private Partnerships

Globalization and Cross-Border Issuance of Revenue Bonds

Conclusion

Revenue Bonds FAQs

Revenue bonds are a type of municipal bond issued by governments to finance income-generating public projects, such as infrastructure, utilities, or transportation systems. The principal and interest payments are secured by the revenues generated from the project itself. In contrast, general obligation bonds are backed by the full faith and credit of the issuing government and repaid through tax revenues.

Revenue bonds can finance a wide range of public projects, including toll roads, airports, public housing developments, public utilities (such as water and sewer systems), and facilities for nonprofit organizations, such as hospitals and schools. The key requirement is that the projects generate revenue to repay the bondholders.

Investing in revenue bonds carries several risks, such as credit risk (the possibility of the issuer defaulting on principal or interest payments), interest rate risk (the potential for bond prices to decrease as market interest rates rise), market risk (the possibility of bond prices declining due to changes in investor sentiment or economic conditions), regulatory risk (the potential for changes in government regulations or policies that negatively impact the project or issuer), and tax implications.

Revenue bonds provide an important source of funding for public projects without increasing taxes, as they are repaid from the income generated by the project itself. They also offer off-balance-sheet financing, which can help governments maintain a favorable debt-to-income ratio, and typically have lower borrowing costs than other forms of debt.

Investors can evaluate the creditworthiness of revenue bonds by examining the credit ratings assigned by rating agencies, which assess the issuer's financial strength and the feasibility of the project being financed. Additionally, investors should consider factors such as the interest rate environment, the specifics of the project, and the issuer's track record with similar projects.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.