The transition from the accumulation phase to the distribution phase occurs when individuals retire. During your working years, you contribute a portion of your pre-tax income to your 401(k) account, which is known as the accumulation phase. During this time, your investments can grow on a tax-deferred basis, allowing you to potentially amass significant retirement savings over time. Matching contributions from your employer further boost this growth, effectively offering you free money toward your retirement. Upon retirement, your 401(k) enters the distribution phase. At this stage, instead of contributing to your account, you start withdrawing from it to fund your retirement expenses. Unlike the accumulation phase, where your focus might have been growth or capital appreciation, during the distribution phase, the focus shifts to the preservation of capital and income generation. While working, you might have been more inclined to take investment risks for higher returns. However, upon retirement, it's crucial to reassess your risk tolerance and possibly switch to more conservative investments. After all, a significant market downturn can severely deplete your savings when you are withdrawing from your account and not contributing to it. From the age of 59 ½ you can start making penalty-free withdrawals from your 401(k). You may choose to take lump-sum withdrawals, regular distributions akin to a paycheck, or annuitize your savings into a steady stream of lifetime income. Withdrawals from your traditional 401(k) will be subject to income tax at your current tax rate. Hence, you must carefully plan your withdrawals, considering both your financial needs and potential tax liabilities. For example, substantial withdrawals might push you into a higher tax bracket. Consider crafting a withdrawal strategy that offers a steady income stream, similar to a paycheck. This could involve systematic withdrawals or purchasing an annuity with a portion of your savings. It's crucial to balance your immediate income needs with the need to ensure your savings last your lifetime. From the age of 73, the IRS requires you to start taking minimum distributions from your 401(k), known as Required Minimum Distributions or RMDs. These mandatory withdrawals ensure that the government can start collecting taxes on your savings. The amount of your RMD is calculated each year based on your account balance at the end of the previous year and a life expectancy factor set by the IRS. The RMD calculation can be complex, and you may wish to consult with a financial advisor to ensure accuracy. Failure to take RMDs on time can lead to severe penalties. If you don't withdraw the required amount, you may be subject to a 50% excise tax on the amount that should have been distributed. Withdrawals from a traditional 401(k) are taxed as ordinary income. Therefore, understanding your tax bracket in retirement is critical for managing your withdrawal strategy. Other income sources, including Social Security benefits and pension income, can affect your overall tax situation in retirement. Depending on your total income, a portion of your Social Security benefits may be taxable. Proper tax planning can help optimize your after-tax income in retirement. This may involve a strategic withdrawal strategy, tax-efficient investing, or even converting a traditional 401(k) to a Roth 401(k) or Roth IRA. Maintaining a balanced and diversified portfolio is crucial during retirement. A mix of stocks, bonds, and cash investments can help manage risk while providing growth and income potential. As your goals and time horizon change in retirement, so should your investment strategy. If you have a longer retirement period, you might maintain a portion of your portfolio in growth-oriented investments. Inflation is a significant concern in retirement. Over time, it can erode the purchasing power of your savings. Thus, having some growth-oriented investments can help ensure your savings keep pace with inflation over the long term. Ensuring that you have designated beneficiaries for your 401(k) account is crucial. If you pass away, your 401(k) assets can be directly transferred to your beneficiaries without going through probate. Inherited 401(k) assets can have significant tax implications for your heirs. Recent legislation changes have limited the ability of non-spouse beneficiaries to stretch distributions over their lifetimes, which may lead to larger taxable distributions. When planning your estate, you should consider the tax implications of passing on retirement assets. It may be beneficial to consult with a financial advisor or estate planning attorney to understand your options. Part-Time Work After Retirement: Working part-time after retirement can offer both financial and personal benefits. It can supplement your retirement income, reduce the amount you need to withdraw from your savings and provide a sense of purpose. Impact on Social Security and Taxes: Earning income during retirement may affect your Social Security benefits and taxes. Benefits of Continued Employment: Aside from financial benefits, continued employment can offer personal advantages such as social engagement, mental stimulation, and a sense of purpose and achievement. Challenges and Benefits of Early Retirement: Retiring early can provide more time for personal pursuits but also means a longer retirement period to fund. You'll need a larger nest egg and a solid strategy for making your savings last. Early Retirement Withdrawal Strategies and Penalties: If you retire before age 59 ½, you'll need to navigate around the 10% early withdrawal penalty from your 401(k). Factors to Consider: When contemplating early retirement, consider factors such as healthcare costs, your lifespan, lifestyle expectations, and the impact of leaving the workforce early on your Social Security benefits. Understanding your 401(k) after retirement is crucial for financial security and peace of mind. The transition from the accumulation phase to the distribution phase necessitates a shift in your investment strategy and careful planning around withdrawals, taxes, and RMDs. Considering other income sources, such as part-time work or Social Security benefits, is also essential. Tax management strategies, maintaining a balanced portfolio, and taking inflation into account can help ensure your savings last throughout retirement. Early retirement adds another layer of complexity, requiring a larger nest egg and careful navigation around early withdrawal penalties. With thorough planning and sound advice, you can successfully manage your 401(k) in retirement and enjoy this rewarding phase of life.Transition From Accumulation to Distribution Phase

Accumulation Phase During Employment

Transition to the Distribution Phase

Differences in Fund Management

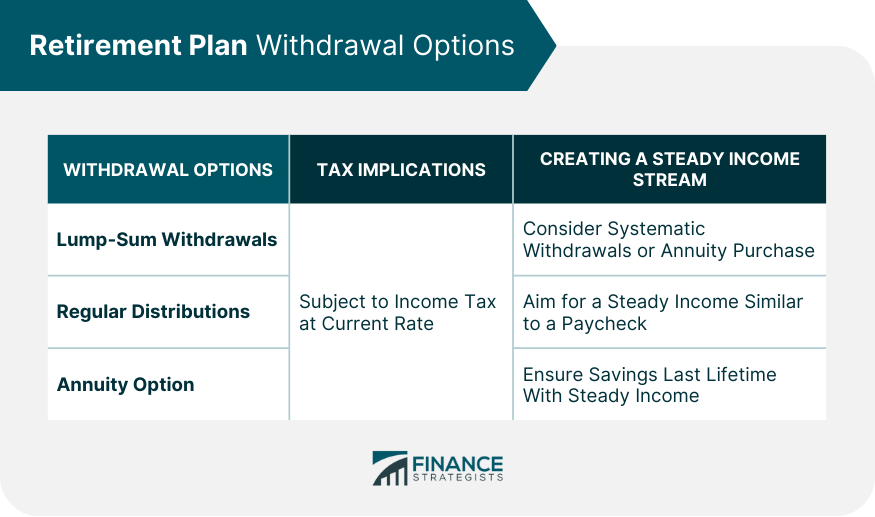

Retirement Plan Withdrawal Options

Overview of Withdrawal Options

Tax Implications and Financial Needs

Creating a Steady Income Stream

Required Minimum Distributions (RMDs)

What are RMDs?

Understanding RMD Amounts

Consequences of Missing RMDs

Tax Considerations in Retirement

Taxation of 401(k) Withdrawals

Social Security and Other Income

Strategies for Tax Management

Investing During Retirement

Need for Balanced Investments

Adjusting Risk Based on Goals and Time Horizon

Inflation and Long-Term Financial Sustainability

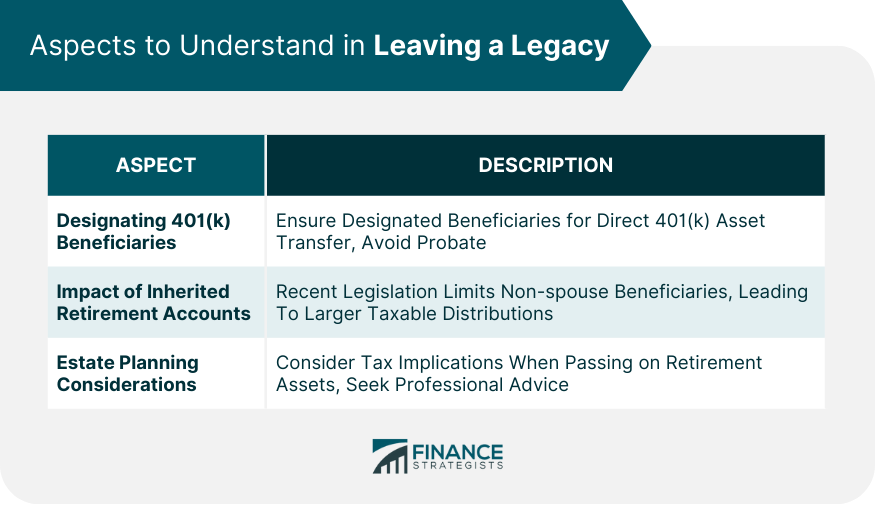

Leaving a Legacy: Beneficiaries and Estate Planning

Designating 401(k) Beneficiaries

Impact of Inherited Retirement Accounts

Estate Planning Considerations

Working Part-Time in Retirement

If you begin receiving Social Security benefits while working, part or all of your benefits may be temporarily withheld based on your income level.Early Retirement Considerations

Options include setting up substantially equal periodic payments (SEPP) or first tapping into taxable investment accounts.Conclusion

How a 401(k) Works After Retirement FAQs

When you retire, your 401(k) enters the distribution phase. This means you stop contributing to it and start withdrawing funds to cover your retirement expenses. You can start making penalty-free withdrawals from age 59 ½. From age 73, you're required to start taking Required Minimum Distributions (RMDs) annually.

Withdrawals from a traditional 401(k) are taxed as ordinary income based on your current tax rate. The amount of tax you'll pay depends on your overall income and the tax bracket you fall into during retirement.

Upon retirement, it's recommended to adjust your investment strategy to focus on capital preservation and income generation. You may need to switch to more conservative investments to reduce the risk of depleting your savings. However, maintaining a diversified portfolio with some growth-oriented investments can help counter inflation over time.

Early retirement can provide more time for personal pursuits, but it also extends the period you need to fund. If you retire before age 59 ½, you may face a 10% early withdrawal penalty unless you set up specific withdrawal strategies, like substantially equal periodic payments (SEPP).

Yes, you can work part-time after retirement, which can supplement your retirement income and reduce the amount you need to withdraw from your savings. However, be aware that it may impact your Social Security benefits and overall tax situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.