Lifetime income refers to the total amount of money an individual earns throughout their working years. It encompasses all sources of income, including wages, bonuses, investments, and passive income streams. Understanding one's lifetime income is crucial in making informed financial decisions and planning for retirement. Financial planning involves setting financial goals, creating a strategy to achieve those goals, and regularly reviewing the progress. Lifetime income plays a vital role in this process as it enables individuals to create realistic budgets, set achievable goals, and determine their financial needs during retirement. Higher education and skills are associated with higher-paying jobs, leading to higher lifetime income. Investing in education and skill development can significantly impact one's earning potential throughout their career. The choice of career, industry, and job stability affects lifetime income. In general, higher-paying fields and positions with long-term growth opportunities contribute to higher lifetime income. Lifetime income typically increases with age as individuals gain experience and progress in their careers. However, it may plateau or decrease in later years as people approach retirement or reduce working hours. Gender pay gaps still persist in many industries, affecting lifetime income. Women tend to earn less than men over their careers, resulting in lower lifetime income. Geographical location influences lifetime income due to variations in the cost of living, job availability, and local wages. Personal choices, such as starting a family, taking time off work, or pursuing hobbies, can impact lifetime income. In addition, financial behavior, such as saving and investing, can significantly affect the total income earned over a lifetime. Economic factors, such as recessions or periods of high inflation, can negatively affect lifetime income by reducing job opportunities, wages, and investment returns. This method calculates lifetime income by projecting future earnings based on historical income data, career progression, and expected retirement age. The replacement rate approach estimates the percentage of pre-retirement income required to maintain a similar lifestyle during retirement. This percentage is then applied to calculate the total lifetime income needed. This approach focuses on estimating financial needs during retirement, including basic living expenses, healthcare costs, and discretionary spending. The sum of these needs determines the required lifetime income. Unemployment and job loss can significantly impact lifetime income. Building an emergency fund and maintaining marketable skills can help mitigate the financial impact of job loss. Health issues or disabilities can disrupt one's career and affect lifetime income. Purchasing disability insurance and maintaining a healthy lifestyle can help protect against income loss due to health issues. Inflation and market fluctuations can erode the purchasing power of savings and investments. Implementing an investment strategy that accounts for these risks can help safeguard lifetime income. Continuous learning and skill development can lead to better job opportunities and higher income potential. Strategically planning one's career, seeking promotions, and networking can contribute to maximizing lifetime income. Pursuing additional income streams, such as freelance work or part-time jobs, can increase lifetime income. Investing in assets that generate passive income, such as rental properties or dividend stocks, can help boost lifetime earnings. Contributing to retirement accounts, such as 401(k)s or IRAs, can help maximize lifetime income through tax advantages and compound interest. Investing in a diversified portfolio of stocks, bonds, and other assets can help maximize returns and grow lifetime income. Social Security benefits are an essential source of retirement income for many individuals. Understanding the eligibility criteria, benefit calculation, and optimal claiming strategies can help maximize lifetime income from Social Security. Pensions can be a significant source of retirement income. Knowing the different types of pension plans (defined benefit or defined contribution) and their eligibility requirements can help individuals make informed decisions regarding their retirement income. Effectively coordinating Social Security, pension benefits, and personal savings can help individuals optimize their lifetime income and maintain their desired lifestyle during retirement. Understanding how income tax applies to various income sources, such as wages and investments, can help individuals minimize their tax burden and maximize lifetime income. Capital gains tax applies to the profits from the sale of investments or assets. Knowing the applicable tax rates and strategies for minimizing capital gains tax can help maximize lifetime income. Withdrawals from retirement accounts, such as 401(k)s or IRAs, may be subject to taxes. Planning for tax-efficient withdrawals can help preserve lifetime income and reduce the overall tax burden. Seeking professional financial advice, attending workshops, or enrolling in personal finance courses can help individuals make better decisions regarding their lifetime income and financial planning. Various online calculators and tools can help individuals estimate their lifetime income, project retirement needs, and evaluate different financial scenarios. Several government and non-profit organizations provide resources and guidance on financial planning, retirement, and maximizing lifetime income. Utilizing these resources can help individuals make more informed decisions. Joining financial networking groups, online forums, or support groups can provide valuable insights and advice from others who have experience in maximizing lifetime income and navigating financial challenges. Planning for lifetime income is critical to achieving financial stability and independence throughout one's life. By understanding the factors that affect lifetime income, implementing strategies to maximize earnings, diversifying income sources, saving and investing wisely, and preparing for risks and uncertainties, individuals can maintain their desired lifestyle and secure a comfortable retirement. Moreover, being aware of tax implications associated with various income sources, coordinating retirement income sources effectively, and utilizing available resources and tools can help individuals make informed decisions about their financial future. Adapting to changes and uncertainties in personal circumstances and economic conditions is essential for preserving financial well-being. As lifetime income planning can be complex, consider hiring the services of an insurance broker who can provide personalized advice, help navigate potential risks, and recommend insurance products, such as disability or life insurance, to safeguard your financial future.Definition of Lifetime Income

Importance of Lifetime Income in Financial Planning

Factors Affecting Lifetime Income

Education and Skills

Employment and Career

Demographics

Age

Gender

Location

Personal Choices and Behavior

Economic Conditions

Lifetime Income Calculation Methods

Earnings-Based Approach

Replacement Rate Approach

Needs-Based Approach

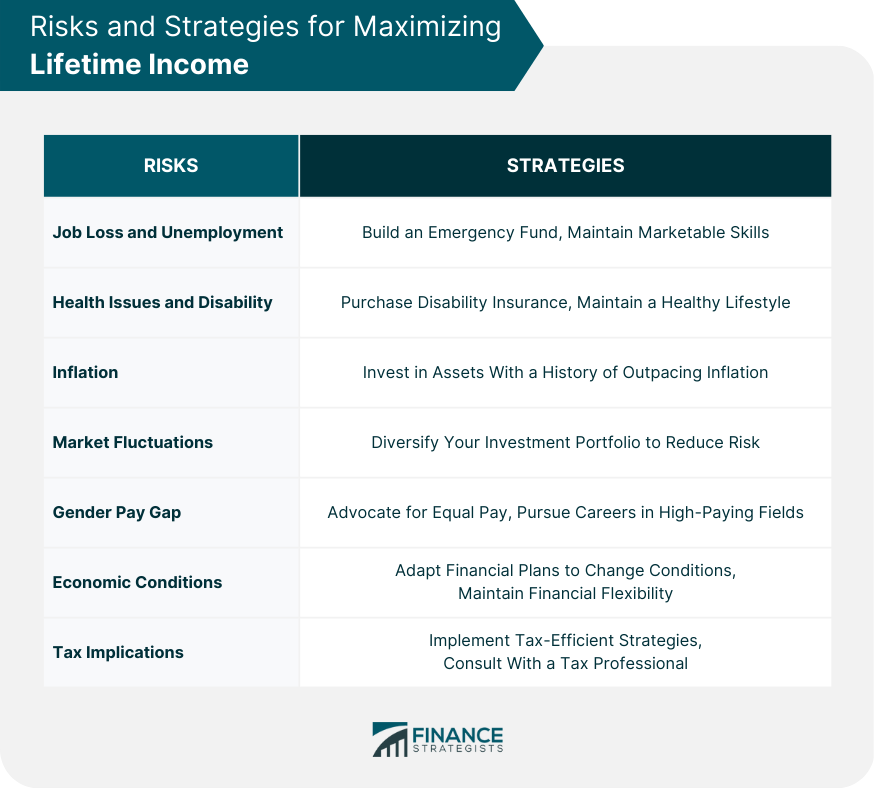

Risks and Uncertainties for Maximizing Lifetime Income

Job Loss and Unemployment

Health Issues and Disability

Inflation and Market Fluctuations

Strategies for Maximizing Lifetime Income

Investing in Education and Skill Development

Career Planning and Advancement

Diversifying Income Sources

Side Hustles

Passive Income

Saving and Investing

Retirement Accounts

Asset Allocation

Social Security and Pension Considerations

Understanding Social Security Benefits

Pension Types and Eligibility

Coordinating Retirement Income Sources

Tax Implications of Lifetime Income

Income Tax

Capital Gains Tax

Retirement Account Withdrawals

Further Resources and Tools

Financial Planning and Education

Online Calculators and Tools

Government and Non-profit Organizations

Networking and Support Groups

Final Thoughts

Lifetime Income FAQs

Factors affecting lifetime income include education and skills, employment and career choices, demographics (age, gender, location), personal choices and behavior, and economic conditions. To maximize your lifetime income, invest in education and skill development, plan your career strategically, diversify your income sources, save and invest wisely, and adapt to changes and uncertainties.

There are three primary methods for calculating lifetime income: the earnings-based approach, the replacement rate approach, and the needs-based approach. Each method has its advantages and limitations, so it's essential to choose the one that best suits your financial situation and goals.

Social Security and pension benefits can contribute significantly to your lifetime income during retirement. Understanding your eligibility for these benefits, how they're calculated, and the best strategies for claiming them can help you optimize your retirement income.

Taxes can impact your lifetime income through income tax, capital gains tax, and taxes on retirement account withdrawals. Understanding these tax implications and implementing tax-efficient strategies can help you minimize your tax burden and maximize your lifetime income.

To safeguard your lifetime income, prepare for risks such as job loss, health issues, disability, inflation, and market fluctuations. Building an emergency fund, maintaining marketable skills, purchasing appropriate insurance products, and implementing an investment strategy that accounts for risks can help protect your financial well-being. Hiring the services of an insurance broker can also provide valuable guidance in navigating potential risks and securing your lifetime income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.