After-tax income is the total earnings an individual or corporation has left over after all federal, state, and withholding taxes have been deducted from gross income. It clarifies the disposable income available for living expenses, savings, investments, or debt repayments. The significance of understanding after-tax income lies in its practical implications. It enables individuals and businesses to assess their actual income, plan their budgets, make informed financial decisions, and evaluate their overall financial health. Gross income refers to the total income earned before any deductions, such as taxes and contributions to retirement accounts. Net income, often used in a business context, is the revenue left after subtracting all expenses, taxes, and costs. On the other hand, after-tax income is strictly about what remains following tax deductions. Different jurisdictions have different tax rates and structures. Some use a progressive tax system, where the rate of taxation increases as the income level increases, while others use a flat tax rate. This is the amount of income subject to taxes after allowable deductions. For individuals, deductions can include certain types of insurance premiums, retirement contributions, and mortgage interest. For businesses, it could include business expenses such as salaries, rent, utilities, interest expense, and depreciation. Tax credits directly reduce the amount of tax owed. Examples of tax credits include credits for child and dependent care, education expenses, and energy-efficient home improvements. These reduce the amount of tax due, effectively increasing after-tax income. Different types of income may be taxed at different rates. For example, in many jurisdictions, long-term capital gains and dividends are taxed at a lower rate than regular income. This means that people who receive a significant portion of their income from these sources could have higher after-tax income. The tax benefits and the tax brackets can vary depending on the filing status of an individual – single, married filing jointly, married filing separately, head of household, etc. The filing status can significantly impact the tax liability and thus the after-tax income. Tax laws and regulations often change, and these changes can impact after-tax income. These can include changes in tax rates, introduction or removal of tax credits, and changes to what is considered taxable income or allowable deductions. This is a supplemental income tax that applies to individuals or corporations that have exemptions or special circumstances allowing for lower payments of standard income tax. Alternative Minimum Tax (AMT) is designed to prevent tax-evasion and can affect after-tax income. The first step is to grasp how tax brackets work. Tax brackets are ranges of income to which different tax rates apply—the rate increases as the taxable income increases. Understanding these brackets can help individuals anticipate their tax liabilities and, subsequently, their after-tax income. 1. Determine your gross income. 2. Subtract any adjustments to income, such as contributions to a traditional IRA or student loan interest, to find your adjusted gross income. 3. Deduct either the standard deduction or the total of your itemized deductions from your adjusted gross income. 4. Apply the appropriate tax rate to this amount based on your tax bracket. After-tax income is an essential component of personal finance management. It directly influences budgeting, savings, investment decisions, and debt repayment. A person's budget is primarily based on their after-tax income, as it accurately reflects the funds available for allocation to various needs and wants. The amount of after-tax income can dictate how much a person can save or invest. Higher after-tax income may lead to increased savings or investments, providing more significant potential for wealth accumulation. Knowing your after-tax income can inform debt repayment strategies. It helps determine how much you can comfortably allocate towards debt without straining your budget. After-tax contributions to retirement accounts are made from income that has already been taxed. The benefits come at the time of withdrawal, where typically, only the gains are taxed. After-tax income is a crucial consideration when planning for retirement income. It helps individuals understand how much they need to save to maintain their desired lifestyle during retirement. It's also important to understand the difference between after-tax and pre-tax income in retirement. Pre-tax income refers to income before taxes are deducted, often associated with traditional 401(k) or IRA contributions. These contributions lower taxable income in the contribution year but are subject to income tax upon withdrawal in retirement. Conversely, after-tax contributions, such as those to a Roth IRA, are taxed before deposit but allow for tax-free withdrawals in retirement. This includes deductions related to mortgage interest, student loan interest, health savings accounts, retirement contributions, tuition payments, and certain business expenses. Tax codes can be complex, so it may be beneficial to consult with a tax professional. Gains from investments are typically taxed, but the rate can vary depending on several factors. For example, long-term capital gains are usually taxed at a lower rate than ordinary income. Also, some accounts, like Roth IRAs, allow for tax-free withdrawals in retirement. Making smart, tax-efficient investment decisions can significantly increase your after-tax income. This involves transferring income from a high tax rate individual to a lower one. For example, if you own a business, you could hire a family member in a lower tax bracket and shift some of your income to them. Note, however, that there are strict rules about income shifting, and it's important to stay within legal boundaries. Unlike deductions, which reduce your taxable income, tax credits reduce your tax bill dollar-for-dollar. Examples of tax credits include the Child Tax Credit, Earned Income Tax Credit (EITC), and education-related tax credits. Some individuals and businesses choose to incorporate or move abroad to countries with lower tax rates. While this can be a complex and drastic measure, it can potentially lead to significant tax savings. Be aware, however, of all legal implications and requirements, both in your home country and the new one. If you start a side business, you can deduct many expenses from your taxable income, such as equipment, travel, and home office expenses. Just be sure that your business is legitimate, as the IRS may disallow deductions from "hobby" businesses. If you can't increase your salary, consider negotiating for benefits that are not taxable, such as health insurance, life insurance, tuition reimbursement, and more. These can increase your effective income without increasing your tax bill. After-tax income represents the earnings left over after deducting all applicable taxes, providing a clear picture of available disposable income. Understanding after-tax income enables informed financial decisions, effective budgeting, and assessment of overall financial health. Factors such as tax rates, taxable income, tax credits, filing status, and tax legislation changes impact after-tax income, necessitating awareness of evolving tax laws. After-tax income has significant implications for personal finance, influencing budgeting, savings, investment decisions, and debt repayment. In retirement planning, after-tax income plays a crucial role by shaping contributions to retirement accounts and understanding the distinction between after-tax and pre-tax income during retirement. Strategies to increase after-tax income include maximizing deductions, implementing tax-efficient investment approaches, considering income shifting, utilizing tax credits, exploring legal tax havens, starting a side business, and negotiating for non-taxable benefits. By effectively managing after-tax income, individuals and businesses can optimize their financial well-being and work towards achieving their financial goals.What Is After-Tax Income?

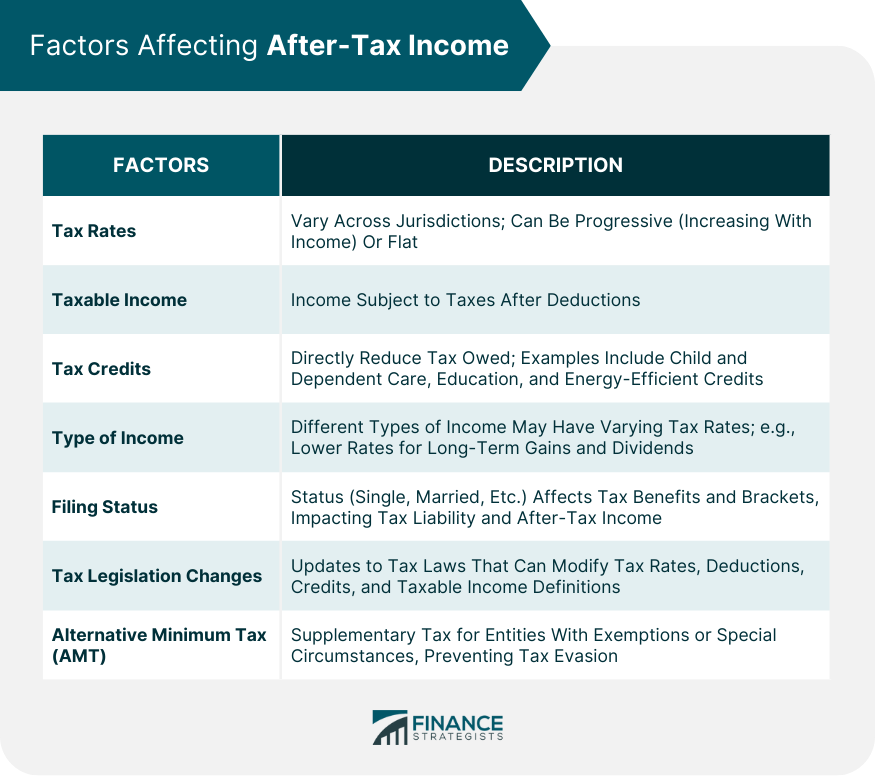

Factors Affecting After-Tax Income

Tax Rates

Taxable Income

Tax Credits

Type of Income

Filing Status

Tax Legislation Changes

Alternative Minimum Tax (AMT)

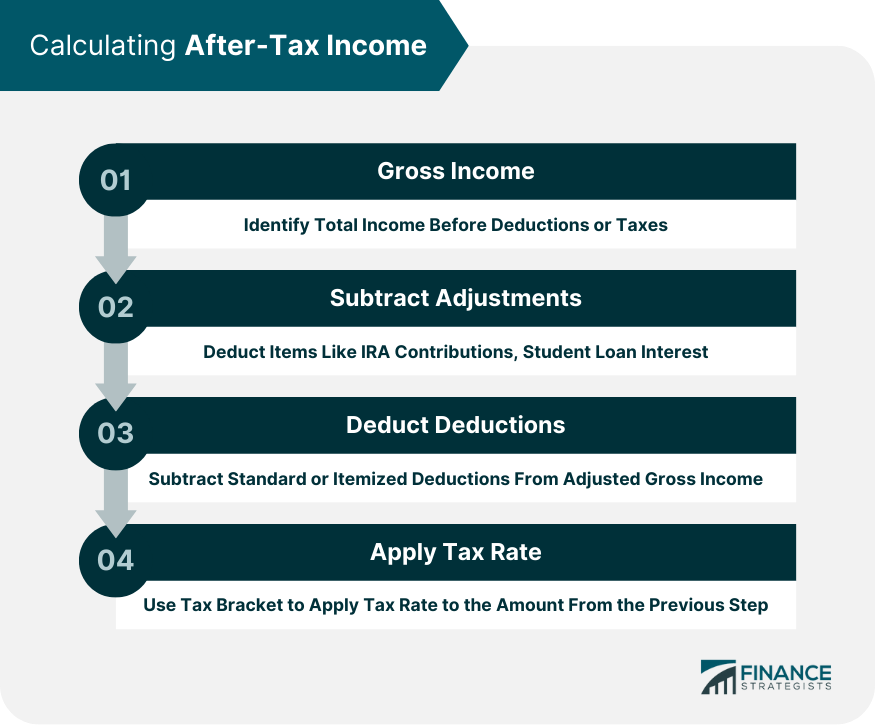

Calculation of After-Tax Income

Understanding the Tax Brackets

Step-By-Step Process

After-Tax Income and Personal Finances

Budgeting

Savings and Investment Decisions

Debt Repayment

After-Tax Income and Retirement Planning

Contributions to Retirement Accounts

After-Tax Income in Retirement Income Planning

After-Tax Income vs Pre-tax Income in Retirement

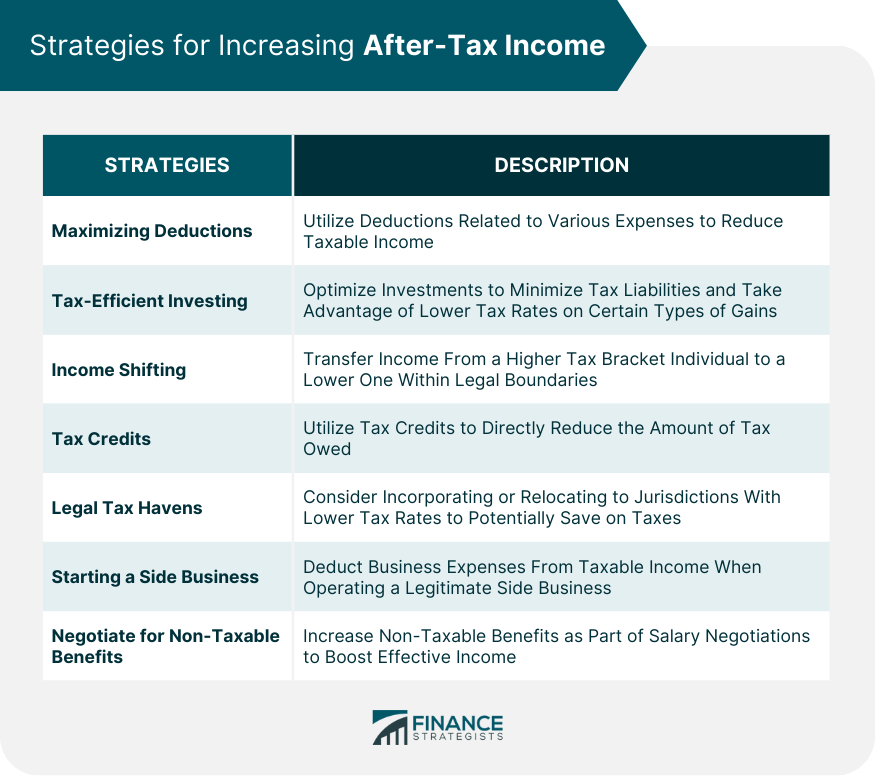

Strategies for Increasing After-Tax Income

Maximizing Deductions

Tax-Efficient Investing

Income Shifting

Tax Credits

Legal Tax Havens

Starting a Side Business

Negotiate for Non-taxable Benefits

Conclusion

After-Tax Income FAQs

After-Tax Income is the amount of money an individual or business has left over after all federal, state, and withholding taxes have been deducted from taxable income. It's the income that you take home and can spend.

After-Tax Income is calculated by subtracting total tax liability from gross income. This includes deductions for federal and state income taxes, Social Security and Medicare taxes, and any other tax withholdings.

After-Tax Income is important because it represents the actual income available to an individual or a business for spending, saving, or investing. It gives a more accurate picture of financial health than gross income because it takes into account the impact of taxes.

Yes, After-Tax Income can be increased by reducing taxable income. This can be done through tax deductions and credits, contributing to tax-advantaged retirement accounts, or by using other tax planning strategies. It's recommended to consult with a tax professional to understand the best strategies for your specific situation.

After-Tax Income and Net Income are often used interchangeably in personal finance, but they can mean different things in a business context. For individuals, both typically refer to income after taxes. For businesses, Net Income generally refers to profits after all expenses, including taxes, have been paid, while After-Tax Income specifically refers to income after tax expenses have been deducted.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.