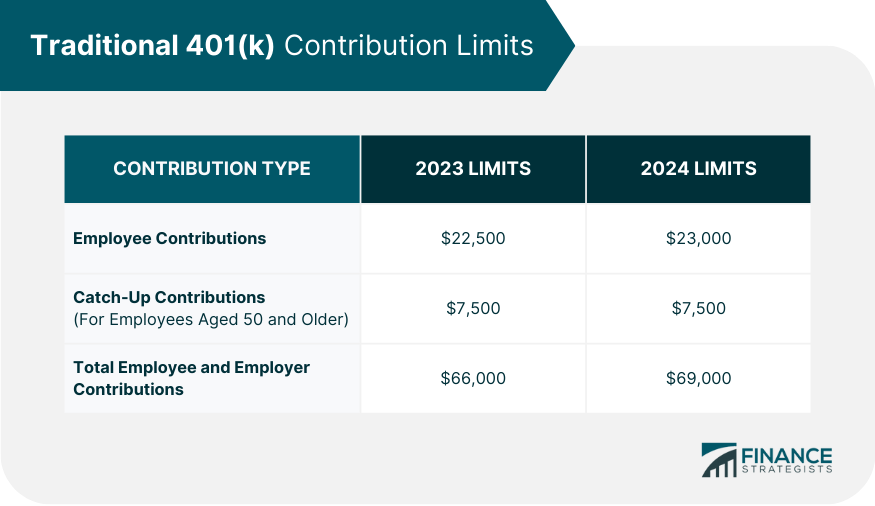

A traditional 401(k) is a type of retirement plan available to employees of private companies in the United States. It allows them to contribute pre-tax salary and any matching contributions made by their employer into an investment savings account. Participants can invest in various financial vehicles within a traditional 401(k), including stocks, bonds, and mutual funds. The contributions and respective earnings in a traditional 401(k) accumulate tax-free until it is withdrawn, usually at retirement age. Both employers and employees must follow the contribution limits set by the Internal Revenue Service (IRS) for these accounts. The IRS may adjust contribution limits annually. Being aware of these limits is essential since over-contributing can result in penalties. The IRS has updated the annual contribution limits for those who participate in a traditional 401(k) plan. Employees can now contribute a maximum of $23,000 in pre-tax contributions for 2024. Some companies offer matching contributions to an employee's 401(k) plan. Matching contributions do not have their own limits. However, when combined with the employee's contributions, these contributions must not exceed the total annual limit for a traditional 401(k). In 2024, the combined limit for employee and employer contributions is $69,000. This means that employers can contribute up to an additional $46,000 ($69,000-$23,000) to each employee's traditional 401(k) for this year. For those aged 50 years or older, the catch-up contribution is $7,500 in 2024. It means the total annual contribution amount for individuals in this age group can reach $30,500 annually or $76,500 if combined with matching contributions from employers. There are several tax rules that participants in a traditional 401(k) need to know about, including the following: The money you put into your traditional 401(k) plan is deducted from your pre-tax income. This means that the IRS does not include your contributions when computing your income tax, allowing you to reduce the total taxes you need to pay. For example, you earn a gross income of $45,000 and contribute $2,000 to a traditional 401(k). You only need to pay income taxes on the remaining $43,000. However, it is essential to note that the tax computation for Social Security and Medicare is still based on your gross income. All withdrawals from a traditional 401(k) plan are taxed as ordinary income based on your current tax bracket at that time. However, if you withdraw from a traditional 401(k) before the age of 59 ½, the IRS will also require you to withhold 20% of the amount withdrawn. In addition, the IRS will charge a 10% early withdrawal fee on top of these taxes. It is important to note that certain circumstances, such as disability and medical expenses, can exclude you from paying an early withdrawal penalty. Retired traditional 401(k) plan holders cannot keep money in the account indefinitely and must start withdrawing the required minimum distribution (RMD) from their accounts at age 73. If they fail to take an RMD, the IRS may charge a 25% penalty for the undistributed amount. The main difference between a traditional 401(k) plan and a Roth 401(k) plan is that the former accepts pre-tax contributions, which you are taxed later during withdrawal. On the other hand, Roth 401(k) plans feature after-tax contributions, meaning that the money taken out of paychecks will already have been taxed. Roth 401(k) contributed funds and any investment earnings can be withdrawn completely tax-free, provided certain conditions are met (including having held the account for more than five years). It makes Roth 401(k) plans an excellent choice for individuals who expect to be in a higher tax bracket upon retirement. You shoulder the tax burden during the contribution phase to later enjoy higher, tax-exempt withdrawals. Traditional 401(k) plans might be more suitable if you need to free up money for current expenses or if you expect to be in a lower tax bracket later. The decision ultimately rests on your current financial situation and retirement plans. Starting a traditional 401(k) plan is relatively straightforward. Here are some steps that you can follow: Employee registration to a traditional 401(k) is voluntary, but some employers can automatically enroll you. In 2025, all companies must register their employees to a workplace retirement plan by virtue of the SECURE 2.0 Act. It is still voluntary since employees can opt-out. Once registered, your employer typically starts you with a low contribution amount which you can adjust depending on your preferred participation level and investment decisions. You control how much of your pre-tax salary is invested in your account. When considering your 401(k) investments, it is vital to understand the types of assets available in your plan. You can then choose to invest in one or more financial vehicles that best suit your current situation, retirement objectives, and risk tolerance. For example, some 401(k) plans may include mutual funds focusing on small-cap stocks or funds tracking an index such as the S&P 500 or NASDAQ. There are also options to invest in larger companies or bonds for more conservative individuals. Your company may also provide a default investment option for your 401(k). Before going with this option, take some time to research and understand the various investments available so you can make an informed decision about where to allocate your money. Fees and expenses can significantly impact your return. Some plans charge higher fees than others, depending on your investment type. For example, mutual funds may carry an expense ratio that goes toward administrative costs associated with managing the fund. Before investing in any particular product, read the fund prospectus or other disclosures to understand all applicable fees and expenses. Ensure that you select an investment option that provides the best potential for return after accounting for costs. You can work with your employer to understand the details of their traditional 401(k) plan. Many companies will offer an employer match as part of employee benefits, which can significantly improve your return on investment. Generally, the employer may contribute up to a certain percentage of your salary or contribution amount. For example, if you contribute 5% of your salary and the employer provides a 50% match, they would invest 2.5%. Ensure you contribute enough to take full advantage of any employer matching programs available in your plan. It is also essential to review the vesting schedule to understand when the matching contributions become yours and are no longer subject to forfeiture by the company. Traditional 401(k) plans can be a great way to save for retirement, but you should also consider other savings options. For example, consider opening an individual retirement account (IRA) in addition to your 401(k). IRAs provide tax-advantaged ways for individuals to invest for their retirement and come with different rules than traditional 401(k)s. You may also invest in a taxable brokerage account if you have other financial goals, such as saving for a house down payment or college tuition expenses. This type of account is not tax-deferred like a 401(k) but allows you to access your funds at any time without penalty. A traditional 401(k) plan accepts contributions from employees and employers on a pre-tax basis. Companies often offer matching 401(k) contributions to encourage employees to save for retirement. Contributions to a traditional 401(k) will grow tax-deferred until retirement. Meanwhile, all withdrawals are generally taxed as ordinary income. For early withdrawals before age 59 ½, the IRS may charge a 10% penalty and require 20% of the amount to be withheld. If you participate in a traditional 401(k), you can set aside up to $23,000 for 2024. If you are 50 or older, you are also allowed a catch-up contribution of up to $7,500. Traditional 401(k)s differ from Roth 401(k)s, which feature after-tax contributions and tax-exempt withdrawals. If you have the option to choose, you can carefully study which of these two alternatives you prefer. However, aside from 401(k)s, there are other investment options such as IRAs and taxable brokerage accounts. For additional information on traditional 401(k) plans and valuable guidance on your retirement planning needs, you may consult a qualified financial advisor.What Is a Traditional 401(k)?

Traditional 401(k) Contribution Limits

Traditional 401(k) Tax Rules

Contributions

Withdrawals

Traditional 401(k) vs Roth 401(k)

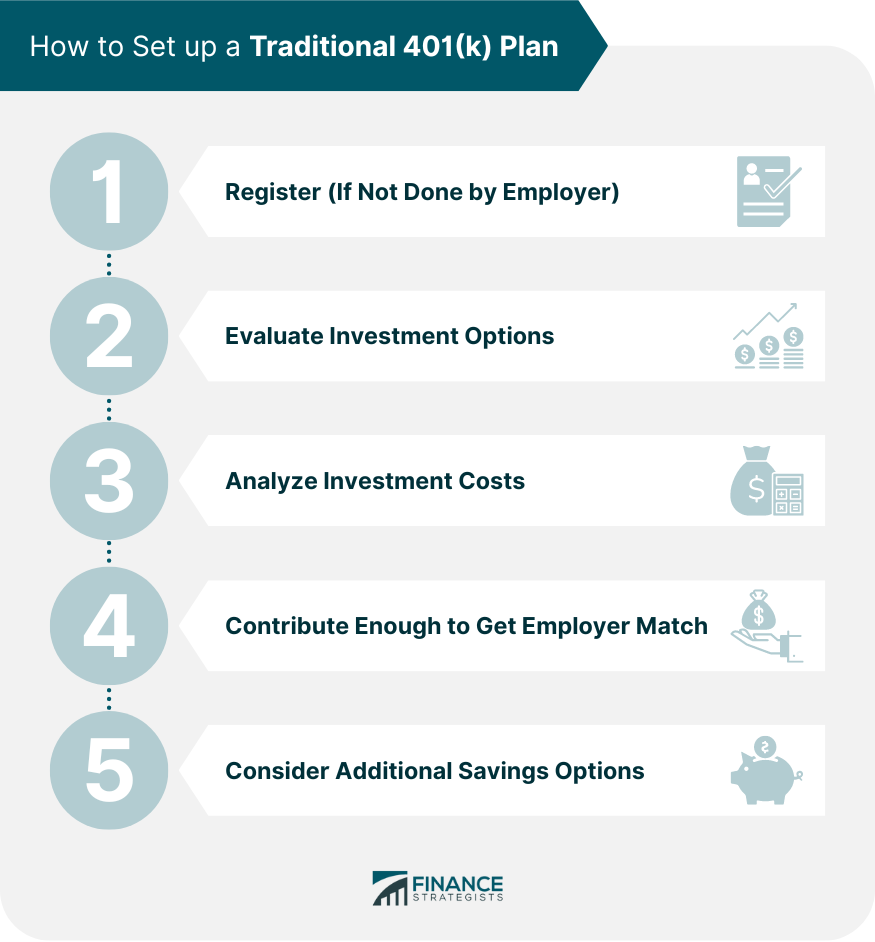

How to Set up a Traditional 401(k) Plan

Register (If Not Done by Employer)

Evaluate Investment Options

Analyze Investment Costs

Contribute Enough to Get Employer Match

Consider Additional Savings Options

Final Thoughts

Traditional 401(k) FAQs

A traditional 401(k) allows you to save for retirement and grow your money on a tax-deferred basis. You can also increase your savings with matching contributions from employers. Investment decisions are entirely your own, so you can choose based on your objectives and risk profile.

Generally, you can withdraw from your traditional 401(k) plan at age 59 ½. Early withdrawals can trigger a 10% penalty, with certain exceptions. After age 73, you must take a required minimum distribution (RMD), or you will be asked to pay a 25% penalty.

The amount you should contribute to a traditional 401(k) depends on your financial situation, current expenses, risk tolerance, and retirement goals. However, the maximum pre-tax contribution employees can make to a traditional 401(k) plan is $23,000 in 2024.

The main difference between the two types of 401(k)s is how the money is taxed. Contributions to a traditional 401(k) are made with pre-tax dollars and are only taxed once money is withdrawn. In contrast, contributions to a Roth 401(k) are from post-tax dollars, and all earnings can be withdrawn tax-free in retirement once certain conditions are met.

Yes, withdrawals from a traditional 401(k) account are taxed as regular income. However, contributions are made with pre-tax dollars.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.