401(k) recordkeepers are entities that handle the administrative duties associated with 401(k) plans. They maintain detailed, participant-level records for 401(k) plans, ensuring the accuracy of data pertaining to each plan participant. This includes tracking contributions, distributions, loan repayments, and investment selections. The importance of recordkeepers cannot be overstated. They ensure that all transactions, such as employee contributions and employer matches, are properly recorded, allocated, and reported. Additionally, they manage the investment options within the plan, execute trades at the direction of participants, and track investment gains and losses. They also provide essential services like processing loans, hardship withdrawals, and handling distributions when a participant leaves the company or retires. At the heart of recordkeeping is maintaining accurate, up-to-date records for each plan participant. This includes personal information, beneficiary designations, contribution rates, investment choices, and account balances. Recordkeepers often provide online platforms where participants can manage their accounts. Recordkeepers meticulously track contributions made to the plan. This includes pre-tax and Roth contributions from employees, employer matching contributions, and any profit-sharing contributions. They ensure these are allocated to the right accounts and invested according to the participants' directions. Recordkeepers administer the investment lineup of the plan, executing trades as directed by participants. They track the performance of these investments and update account balances accordingly. 401(k) plans are subject to complex regulations. Recordkeepers help ensure compliance by providing necessary reporting and testing. This includes nondiscrimination testing to ensure the plan does not overly favor highly compensated employees. Recordkeepers often provide essential communication services. They may send out legally required disclosures, annual statements, and other plan-related communications. They also may provide resources to help participants make informed decisions about their accounts. The employer is the plan sponsor and has the ultimate responsibility for the plan's operation and compliance. They select the recordkeeper and other service providers, decide the plan's design and investment lineup, and are responsible for contributing any employer match or profit-sharing contributions. As discussed, the recordkeeper handles the day-to-day administration of the plan. While they provide essential services, they do not make strategic decisions about the plan's design or investment options; those responsibilities lie with the employer. Financial advisors may help employers design their plans and select the investment lineup. They can also provide advice to participants, helping them make decisions about contribution rates and investment selections. If a plan has 100 or more participants, it usually needs an annual audit by a qualified CPA. The auditor ensures that the plan's operations comply with federal regulations and that the financial statements are accurate. The recordkeeper will provide the necessary data for the audit. Professional recordkeepers have systems in place to ensure accurate, timely recordkeeping. This helps prevent errors that could lead to compliance issues or financial losses for participants. 401(k) plans are subject to numerous laws and regulations. Failure to comply can result in significant penalties. Recordkeepers understand these requirements and provide services to help ensure compliance. Professional recordkeepers can streamline administrative processes, making life easier for employers and participants. They can automate many tasks, reducing the time and resources employers need to devote to plan administration. Many recordkeepers provide tools and resources to help employees understand their 401(k) and make informed decisions. They may offer online calculators, educational articles, webinars, or even one-on-one consultations with financial advisors. Recordkeeping services come at a cost, which is usually paid from plan assets. High recordkeeping fees can erode participants' retirement savings over time. If the recordkeeper makes mistakes, it can lead to compliance issues or financial losses for participants. Employers need to monitor their recordkeeper's performance to ensure they are doing their job correctly. Most recordkeeping is done digitally. If the recordkeeper's technology is outdated or unreliable, it can lead to errors and inefficiencies. It can also make it difficult for participants to manage their accounts. Effective communication between the recordkeeper, employer, and participants is essential. If the recordkeeper does not provide clear, timely communications, it can lead to confusion and mistakes. Not all recordkeepers are created equal. When choosing a provider, employers should consider their expertise and experience in 401(k) recordkeeping. They should ask for references and talk to other clients to assess their satisfaction. Employers should evaluate the recordkeeper's technology. They should look for a user-friendly platform that makes it easy for participants to manage their accounts. They should also consider the recordkeeper's ability to integrate with the company's payroll system and other software. While cost shouldn't be the only factor, it's an important consideration. Employers should understand all fees associated with the recordkeeping service and how they are paid. They should also ensure that fees are reasonable in relation to the services provided. Employers should look for a recordkeeper that provides robust support and education for participants. This can help employees make the most of their 401(k) and achieve their retirement goals. In the dynamic landscape of 401(k) plan management, the role of 401(k) recordkeepers is pivotal. Their key responsibilities around accurate record-keeping, regulatory compliance, and participant communication are crucial to the smooth functioning of a 401(k) plan. While there are challenges, such as cost implications and technological dependence, the advantages they bring in terms of streamlined processes, reduced administrative burden, and offering employee education are immense. The future of 401(k) recordkeeping is promising, with technological advancements leading the way, evolving regulatory landscapes offering new opportunities, and increasing importance placed on cybersecurity. Employers must carefully evaluate and choose their 401(k) recordkeepers, bearing in mind their expertise, technological capabilities, cost, and participant support systems. 401(k) recordkeepers will continue to play an indispensable role in shaping an efficient, compliant, and participant-friendly retirement planning ecosystem.What Are 401(k) Recordkeepers?

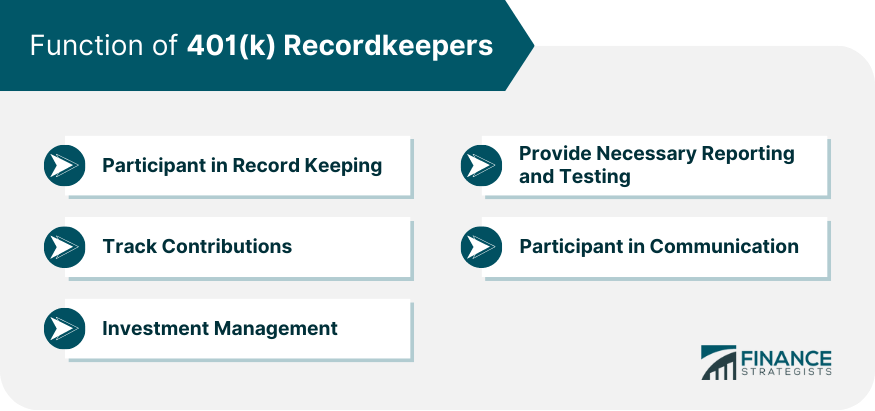

How 401(k) Recordkeepers Function

Participant in Record Keeping

Track Contributions

Investment Management

Provide Necessary Reporting and Testing

Participants in Communication

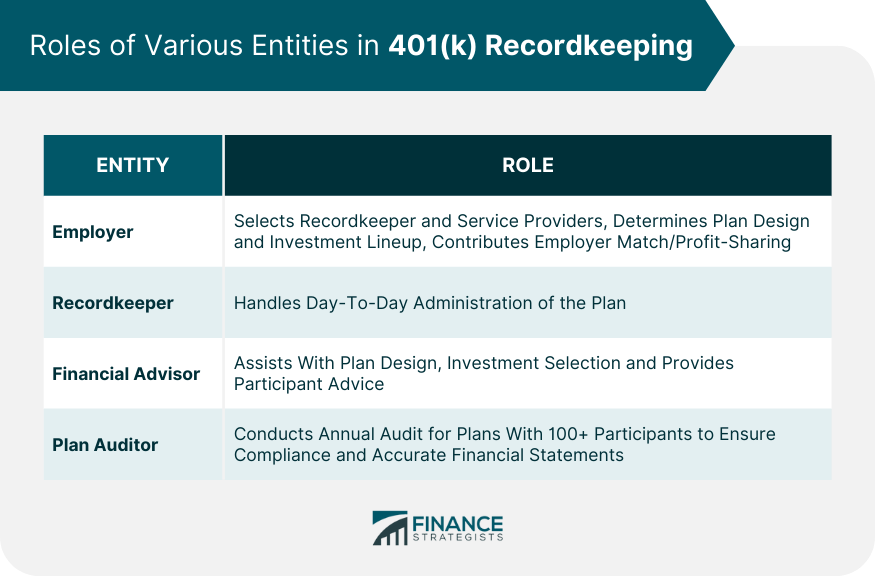

Roles of Various Entities in 401(k) Recordkeeping

Role of the Employer

Role of the Recordkeeper

Role of the Financial Advisor

Role of the Plan Auditor

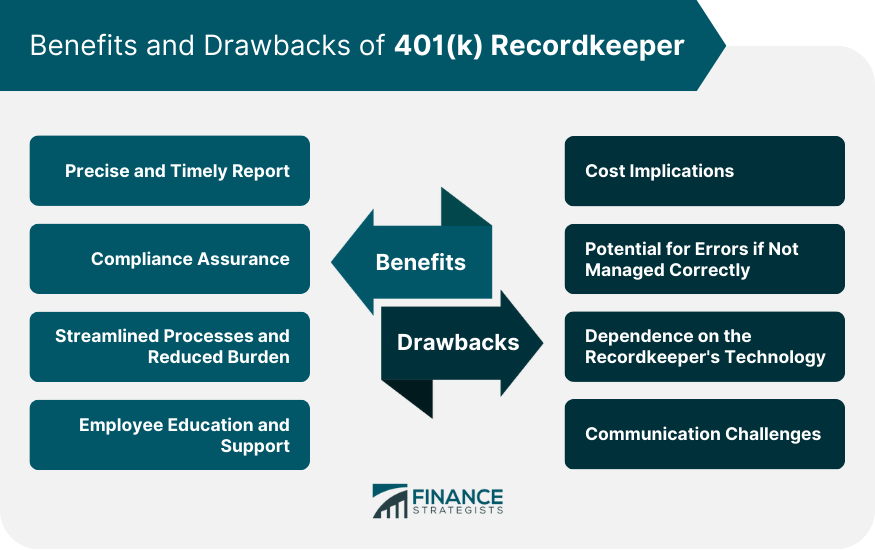

Benefits of Professional 401(k) Recordkeepers

Precise and Timely Report

Compliance Assurance

Streamlined Processes and Reduced Administrative Burden

Employee Education and Support

Drawbacks of 401(k) Recordkeepers

Cost Implications

Potential for Errors if Not Managed Correctly

Dependence on the Recordkeeper's Technology

Communication Challenges

How to Choose the Right 401(k) Recordkeeper

Evaluate Expertise and Experience

Assess Technological Capabilities

Cost Considerations

Employee Support and Education

Conclusion

401(k) Recordkeepers FAQs

A 401(k) recordkeeper is an entity that administers the operational duties of a 401(k) plan. They maintain accurate records for each plan participant, track contributions, manage investment options within the plan, and help ensure regulatory compliance.

401(k) recordkeepers are essential for ensuring the accuracy and compliance of 401(k) plans. They handle complex administrative tasks, facilitate participant communications, ensure contributions are properly allocated and invested, and assist in compliance reporting and testing.

Professional 401(k) recordkeepers offer several benefits, including precise and timely reporting, compliance assurance, streamlined processes, and reduced administrative burden. They also often provide educational resources and support to help employees understand and manage their accounts.

Potential challenges include cost implications, the potential for errors if not managed correctly, dependence on the recordkeeper's technology, and communication challenges between the recordkeeper, employer, and participants.

When choosing a 401(k) recordkeeper, employers should consider their expertise and experience, technological capabilities, cost, and the support and education they provide to participants. They should also consider the recordkeeper's ability to adapt to future trends and changes in the industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.