An employer match is a type of contribution made by an employer to a worker's retirement plan, based on the latter's own contributions. By providing a match, companies and organizations incentivize employees to save for retirement and increase overall retirement savings. Employer matching contributions play a crucial role in retirement planning by encouraging employees to participate in retirement plans and providing an additional source of retirement income. These contributions can significantly enhance an individual's retirement savings, making it easier to achieve long-term financial goals. A 401(k) plan is a type of employer-sponsored retirement plan that allows employees to make pre-tax contributions. Employers may offer a matching contribution, where they duplicate a portion of the employee's own contributions, up to a certain limit. Similar to 401(k) plans, 403(b) plans cater to employees of non-profit organizations, public schools, and certain religious institutions. Employers may provide matching contributions based on employee salary deferrals. Designed for state and local government employees and certain non-governmental organizations, 457 plans may also include employer matching contributions based on worker salary deferrals. A SIMPLE plan is designed for small businesses with 100 or fewer employees. Employers are required to make either matching or non-elective contributions to their employees' retirement accounts. Under this formula, employers match employee contributions dollar-for-dollar, up to a specified limit. For example, an employer may offer a dollar-for-dollar match on the first $2,000 of an employee's contribution to their retirement account. So, if an employee contributes $2,000 to their retirement account, the employer will contribute an additional $2,000. Employers contribute a certain percentage of the employee's contribution, up to a specified limit. In this formula, the employer will match a percentage of the employee's contribution to their retirement account, up to a certain percentage of the employee's salary. Employers can set maximum limits on the amount they will match, typically expressed as a percentage of the employee's salary or a specific dollar amount. Additionally, it must be noted that the Internal Revenue Service (IRS) sets annual contribution limits for each type of plan, and employers must ensure that their matching contributions do not exceed these limits. Employers may require employees to complete a minimum length of service before they become eligible for the matching contribution. Employers may restrict eligibility for matching contributions to certain employee classifications, such as full-time or management-level employees. Employers may allow employees to become immediately vested in their matching contributions, meaning they gain full ownership upon receipt. Under a graded vesting schedule, employees gain ownership of matching contributions gradually over a specified period, usually in annual increments. With cliff vesting, employees become fully vested in matching contributions after a specific period of service, with no partial vesting in the interim. By offering a matching contribution, employers encourage workers to save for retirement. Employer match aids workers in achieving long-term financial security. Employer matching contributions can significantly boost employees' retirement savings, making it easier to attain a comfortable retirement. Offering a competitive employer match can help attract and retain top talent. Employees are more likely to sign and remain with a company that supports their long-term financial goals. Employers can benefit from tax deductions for matching contributions made to their employees' retirement plans, reducing their overall taxable income. Some employees may not participate in their retirement plan or contribute enough to take full advantage of the employer match, potentially leaving valuable retirement savings on the table. Employers may face financial constraints that limit their ability to offer a competitive matching program, impacting their ability to attract and retain top talent. Understanding retirement plan structures and the variety of investment options can be challenging for employees, potentially leading to suboptimal decisions and reduced retirement savings. Employers should actively promote awareness and understanding of their matching program to ensure employees take full advantage of the benefits, which may require ongoing education and communication efforts. Employees should contribute enough to their retirement plan to receive the full matching contribution, ensuring they maximize their retirement savings. Employees should periodically review and adjust their contributions to ensure they continue to receive the maximum match as their salary or employer's matching policy changes. Employees should familiarize themselves with their plan's vesting schedule to ensure they understand when they will gain full ownership of their employer's matching contributions. Employees may benefit from seeking professional financial advice to help them make informed decisions about their retirement planning and take full advantage of their employer's matching contributions. Employer matching contributions are vital in supporting employees' retirement planning efforts, offering incentives for participation, and fostering a culture of long-term financial security. By providing a competitive employer match, companies can attract and retain top talent while helping their employees achieve their retirement goals. Employers should strive to offer competitive matching programs that incentivize employees to save for their retirement and actively participate in their retirement plans. By doing so, employers can contribute to their employees' long-term financial well-being and satisfaction. Continued education and communication with employees about retirement planning and employer match programs can help them make informed decisions and maximize the benefits of their retirement plans. Employers should prioritize fostering a culture of financial wellness, ensuring their workforce is well-equipped for a secure retirement.What Is an Employer Match?

Types of Retirement Plans With Employer Matches

401(k) Plans

403(b) Plans

457 Plans

Savings Incentive Match Plan for Employees (SIMPLE) Plans

Factors Affecting Employer Matches

Matching Formulas

Dollar-For-Dollar Match

Percentage-Based Match

For example, an employer may offer a 50% match on the first 6% of an employee's salary that is contributed to their retirement account.

So, if an employee earns $50,000 per year and contributes 6% of their salary ($3,000) to their retirement account, the employer will contribute $1,500 (50% of $3,000) to the account.Maximum Match Limits

Eligibility Requirements

Minimum Length of Service

Employee Classifications

Vesting Schedules

Immediate Vesting

Graded Vesting

Cliff Vesting

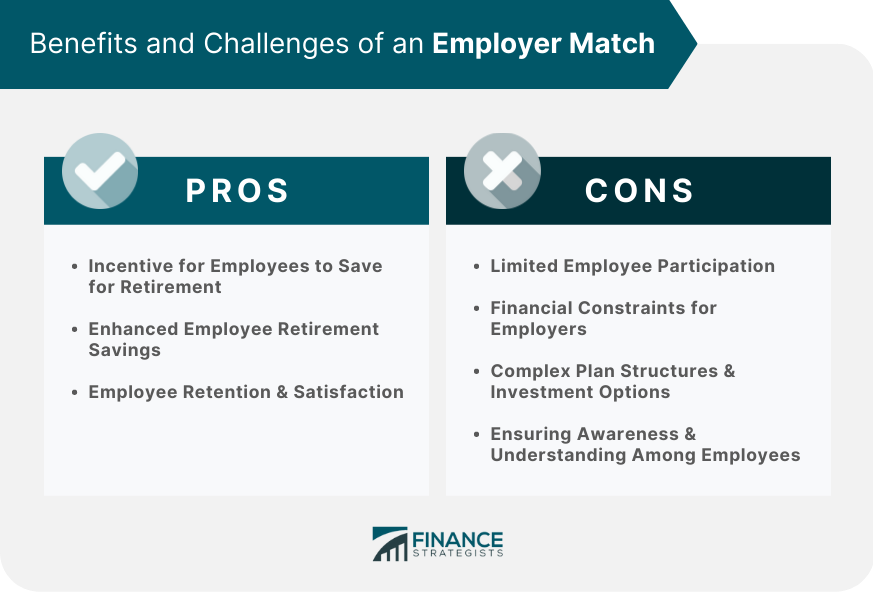

Benefits of Employer Matches

Incentive for Employees to Save for Retirement

Enhanced Retirement Savings for Employees

Employee Retention and Satisfaction

Tax Advantages for Employers

Challenges and Barriers Related to Employer Matches

Limited Employee Participation

Financial Constraints for Employers

Complex Plan Structures and Investment Options

Ensuring Awareness and Understanding Among Employees

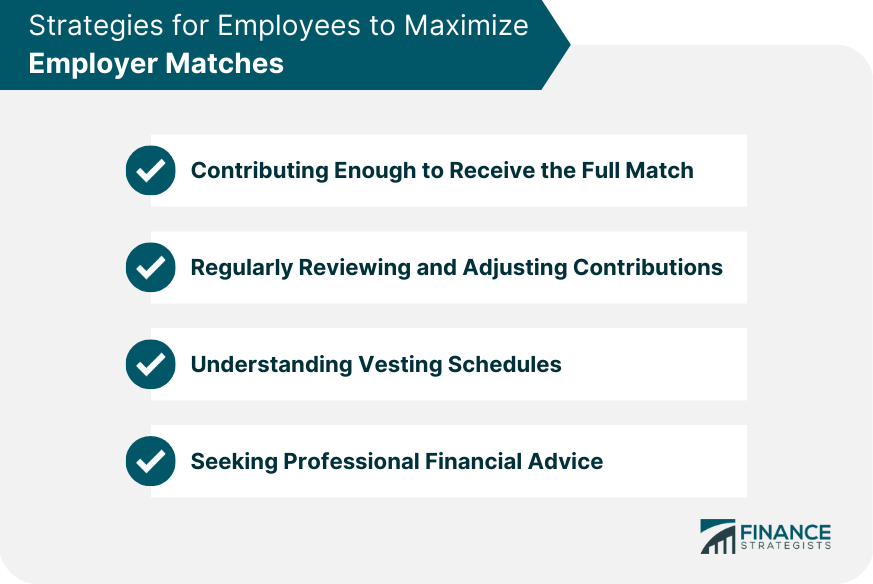

Strategies for Employees to Maximize Employer Matches

Contributing Enough to Receive the Full Match

Regularly Reviewing and Adjusting Contributions

Understanding Vesting Schedules

Seeking Professional Financial Advice

Conclusion

Employer Match FAQs

An employer match is a type of retirement plan contribution where an employer matches a portion of an employee's contribution to their retirement plan, such as a 401(k) or 403(b). For example, an employer may match 50 cents on the dollar for the first 6% of the employee's salary that they contribute to the plan.

An employer match encourages employees to save for retirement by offering additional contributions to their retirement plan. The employer match is usually a percentage of the employee's contribution, up to a certain limit.

The advantages of an employer match include building a larger nest egg for retirement, potentially receiving a higher retirement income, and reducing taxable income. An employer match is essentially free money, so it's important to take advantage of it if available.

No, not all employers are required to offer an employer match. However, many employers do offer an employer match as a way to attract and retain employees.

To determine if your employer offers an employer match, review your employer's benefits package or ask your human resources department. If your employer offers an employer match, it's important to understand the contribution structure, such as the match percentage and any limits on the match.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.