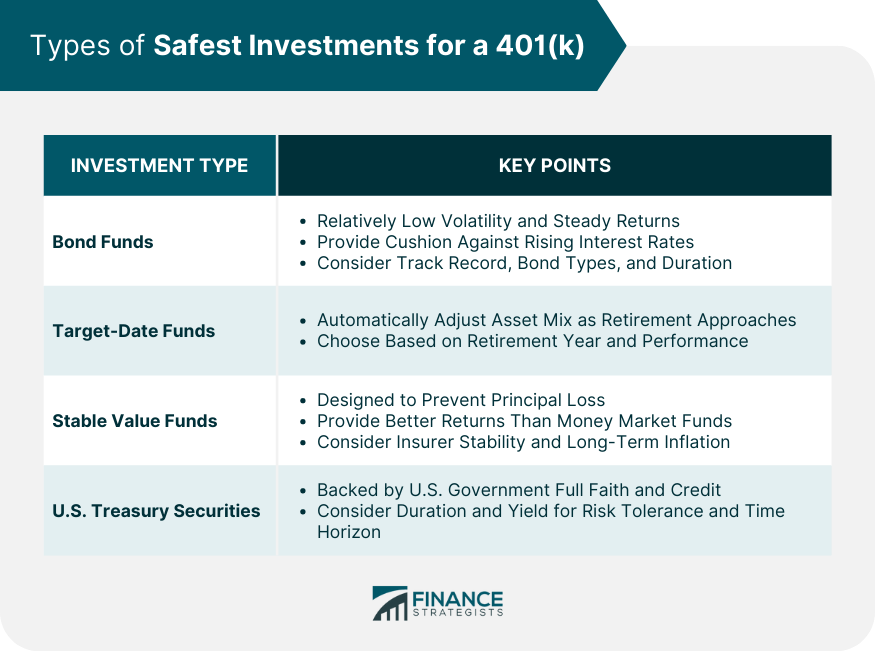

The safest investments for a 401(k) highlight the need for low-risk options that provide stability and protection of principal. In this context, several investment choices stand out. Bond funds, which primarily invest in bonds, offer relatively low volatility and steady returns. Target-date funds automatically adjust the asset mix based on your retirement date, becoming more conservative as you approach that milestone. Stable value funds aim to preserve capital while providing steady returns through insurance-backed strategies. U.S. Treasury securities, backed by the government, are widely considered one of the safest investments available. Diversification and regular portfolio rebalancing further contribute to safety by spreading risk and maintaining desired asset allocations. By understanding these safe investment options and implementing prudent strategies, you can protect and grow your 401(k) savings while working towards a secure retirement. Retirement portfolio typically incorporate a variety of investment types. Each option carries its own risk and reward characteristics. Let's delve into some of the safest investment choices for a 401(k). Bond funds are mutual funds that invest primarily in bonds. They are considered safe investments due to their relatively low volatility. When interest rates are stable or falling, bond funds typically provide steady returns. Even in times of rising interest rates, well-managed bond funds can cushion the impact through strategic bond selections. Investing in bond funds within a 401(k) requires careful consideration. Some points to bear in mind include the fund's track record, the types of bonds it invests in, and the duration of those bonds. While bond funds can be a good safe choice, it's vital to remember that no investment is without risk. Target-date funds, also known as lifecycle funds, are designed to provide a simplified investment strategy based on a specified retirement date. They are considered safe because they automatically adjust the asset mix to become more conservative as the target retirement date approaches. When choosing a target-date fund, look for one that matches your expected retirement year. Also, examine the fund's asset allocation strategy, fees, and performance history. Remember that the fund's projected retirement date is just a guideline, and the actual suitable time to start drawing from the fund might vary based on your individual circumstances. Stable value funds are insurance-backed funds that aim to preserve capital while providing steady returns. They are considered safe because they are designed to prevent principal loss. Additionally, stable value funds provide better returns than money market funds, another common low-risk choice. When considering stable-value funds, remember that they are not entirely risk-free. For instance, there could be a risk if the insurer backing the fund goes out of business. Additionally, stable-value funds might not keep up with inflation over the long term, potentially diminishing your purchasing power. U.S. Treasury securities are government-backed instruments, such as Treasury bonds, notes, and bills. They are generally considered the safest investment since they are backed by the full faith and credit of the U.S. government. When investing in Treasury securities within a 401(k), remember to consider factors like duration and yield. Longer-term Treasury securities offer higher yields but are more susceptible to interest rate risk. Therefore, you need to carefully choose the type of Treasury security based on your risk tolerance and time horizon. Diversification is vital in a 401(k) because it reduces the concentration of risk. By allocating your investments across various asset classes, such as stocks, bonds, and alternative investments, you can potentially offset losses in one area with gains in another. This can help minimize the impact of market volatility and enhance the overall stability of your portfolio. Additionally, diversification reduces the reliance on any single investment, reducing the risk of losing a substantial portion of your savings due to poor performance or economic downturns. It allows you to participate in the potential growth of different sectors and asset classes, potentially increasing the likelihood of achieving your long-term retirement goals. Diversification contributes to safety by reducing the impact of market fluctuations and minimizing the risk of substantial losses. Here are a few ways in which diversification enhances the safety of your 401(k) investments: Diversification helps spread risk across multiple investments, reducing the exposure to any single asset or sector. If one investment performs poorly, other investments may be able to offset the losses, thereby reducing the overall impact on your portfolio. Different asset classes, such as stocks, bonds, and commodities, tend to have varying levels of correlation with each other. By investing in assets that have a low or negative correlation, you can potentially achieve a more balanced portfolio that is less susceptible to systematic risks. Diversification can help stabilize your portfolio's performance by reducing volatility. When some investments decline in value, others may rise or remain stable, smoothing out the overall fluctuations in your portfolio and reducing the potential for significant losses. By diversifying across safe investment options, such as bonds and stable value funds, you can prioritize the preservation of capital while still aiming for modest returns. This helps protect the principal amount you have accumulated in your 401(k) and ensures that it remains intact for your retirement needs. While diversification is crucial, it's essential to approach it strategically to maximize its benefits. Here are some tips for achieving effective diversification within your 401(k) investments: Determine your risk tolerance and investment objectives to establish an appropriate asset allocation. Allocate your investments across a mix of asset classes, such as stocks, bonds, and cash equivalents, based on your risk tolerance and investment goals. Consider your time horizon until retirement when determining your asset allocation. If you have many years until retirement, you may be able to afford a higher allocation to growth-oriented assets like stocks. As you near retirement, gradually shift towards more conservative investments to protect your portfolio from potential market downturns. Utilize the available investment options within your 401(k) to diversify across different asset classes. Explore funds that focus on various sectors, market caps, and geographic regions to enhance diversification. Regularly review and rebalance your portfolio to ensure that your asset allocation remains in line with your desired levels. Rebalancing involves selling investments that have appreciated significantly and buying those that may have underperformed, thus maintaining the desired asset mix. Consider consulting a financial advisor who specializes in retirement planning and investment management. They can provide personalized advice and help you construct a well-diversified portfolio based on your specific circumstances and goals. Ensuring safety within a 401(k) portfolio is crucial to secure a comfortable retirement. A few recommended low-risk options include bond funds, target-date funds, stable value funds, and U.S. Treasury securities, all offering stable returns and varying degrees of capital preservation. Crucial to enhancing safety is the diversification strategy, which helps spread risk across multiple asset classes, thus protecting against substantial losses and market volatility. Your diversification should align with your risk tolerance, investment objectives, and time horizon. Moreover, regular portfolio rebalancing helps maintain your desired asset allocation, keeping the portfolio risk level in check. Lastly, seeking professional guidance can be beneficial in optimizing these strategies to your unique needs and goals, ensuring that your retirement savings are not only safe but also productive.Overview of Safe Investments in a 401(k)

Types of Safest Investments for a 401(k)

Bond Funds

Target-Date Funds

Stable Value Funds

U.S. Treasury Securities

Diversification as a Strategy for Safe Investments in a 401(k)

Importance of Diversification in a 401(k)

How Diversification Contributes to Safety

Risk Spreading

Asset Class Correlation

Portfolio Stability

Capital Preservation

Tips for Achieving Effective Diversification

Asset Allocation

Consider Time Horizon

Broaden Investment Choices

Rebalance Regularly

Seek Professional Guidance

Conclusion

Safest Investments for a 401(k) FAQs

Bond funds are mutual funds that primarily invest in bonds. They are considered safe due to their relatively low volatility, especially when interest rates are stable or falling. While they provide steady returns, they aren't entirely risk-free, especially in rising interest rate environments.

Target-date funds automatically adjust their asset mix based on a specified retirement date, becoming more conservative as the date approaches. They simplify investment strategy and reduce the risk of being overly exposed to volatile markets close to retirement.

Stable value funds are insurance-backed and designed to prevent principal loss while offering steady returns. They generally provide better returns than money market funds and are considered safe because of their design to protect capital. However, they aren't completely risk-free and might not always keep pace with inflation.

U.S. Treasury securities are backed by the full faith and credit of the U.S. government, making them one of the most secure investments. However, like all investments, they come with risks, especially related to interest rates and duration.

The frequency of rebalancing can depend on individual investment strategies and market conditions. Typically, many financial advisors recommend reviewing your portfolio at least annually or when your asset allocation drifts significantly from your target. However, it's crucial to consider any associated costs or tax implications before making rebalancing decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.