The Roth 401(k) is a type of retirement savings account that allows an individual to contribute a portion of their salary after taxes. This retirement savings vehicle combines the features of a traditional 401(k) with those of a Roth IRA. Unlike the traditional 401(k), the Roth 401(k) offers the potential for tax-free income in retirement, provided certain conditions are met. Though contributions to a Roth 401(k) come from post-tax dollars, the funds grow tax-free and qualified distributions at retirement are also tax-free. Therefore, the Roth 401(k) can offer significant tax advantages, particularly for those who anticipate being in a higher tax bracket during their retirement years.

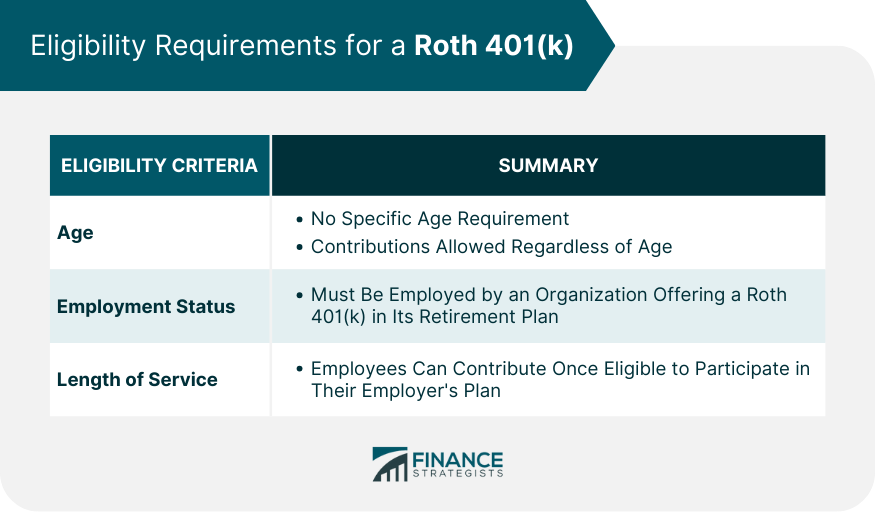

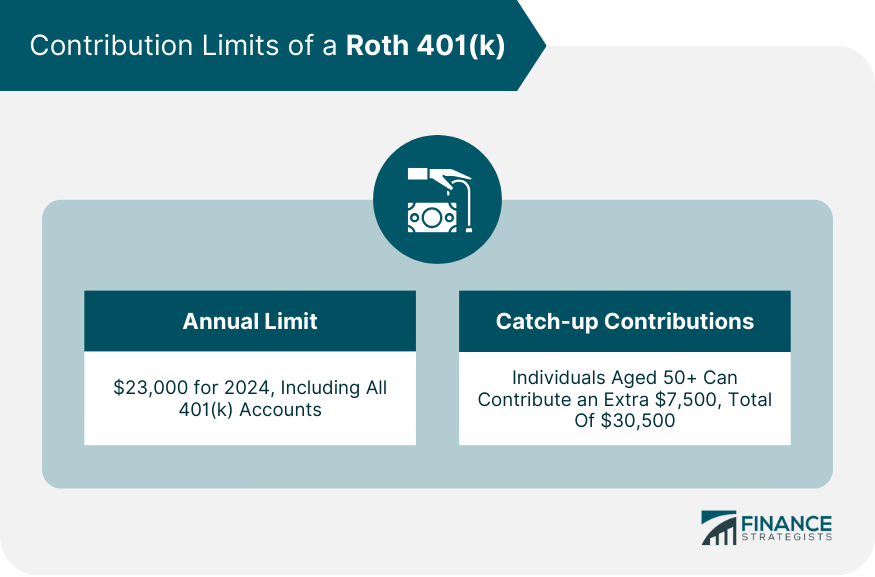

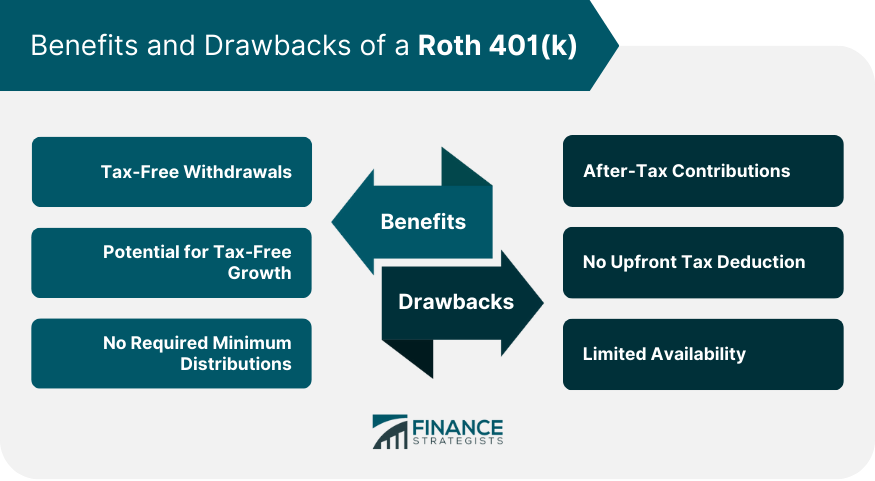

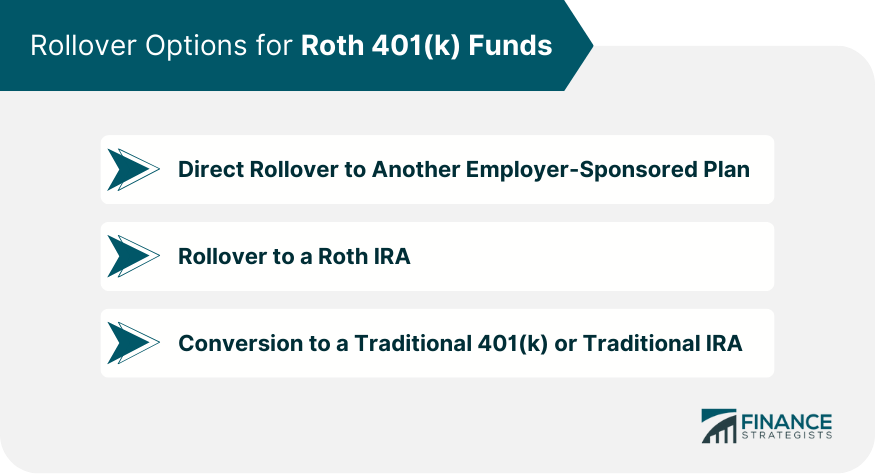

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I once worked with a client who felt they were too late to start saving for retirement. We decided to contribute to a Roth 401(k), leveraging post-tax dollars for tax-free growth and withdrawals in retirement. Despite starting in their mid-40s, by maximizing their contributions and harnessing the power of compound interest, they're now on track for a comfortable retirement. Whether you're just starting or reevaluating your strategy, let's tailor a plan to achieve your goals. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation A Roth 401(k) plan functions similarly to a traditional 401(k), except for the manner in which contributions and withdrawals are taxed. Participants make contributions to a Roth 401(k) using after-tax dollars, which means taxes are paid upfront. This contrasts with the pre-tax contributions made to a traditional 401(k). When it comes time for retirement, qualified distributions from a Roth 401(k) are tax-free. To qualify for this benefit, a participant must have held the account for at least five years and be at least 59 ½ years old. Unlike a traditional 401(k), the Roth 401(k) doesn’t require minimum distributions during the lifetime of the original owner, offering greater flexibility in retirement planning. There is no specific age requirement to contribute to a Roth 401(k). As long as an individual is employed by a company that offers this type of retirement plan, they can make contributions regardless of their age. This is a marked advantage over the Roth IRA, which imposes income limitations on potential contributors. To be eligible to contribute to a Roth 401(k), an individual must be employed by an organization that provides a Roth 401(k) option in its retirement plan. The availability of a Roth 401(k) is not universal; it’s up to the employer to decide whether or not to offer this type of retirement plan. In general, an employee can start contributing to a Roth 401(k) as soon as they are eligible to participate in their employer's retirement plan. The specific requirements, including the length of service, may vary from one employer to another. It's important for employees to check with their Human Resources department or plan administrator to understand the specific eligibility rules applicable to their retirement plan. For the year 2024, the annual contribution limit for a Roth 401(k) is $23,000. This is the total amount an individual can contribute across all 401(k) accounts they may have, including both traditional 401(k) and Roth 401(k) accounts. The limit applies to the sum of an individual's contributions, not including any employer-matching funds. Once an individual reaches the age of 50, they are allowed to make additional contributions to their Roth 401(k) above the regular annual limit. For 2024, the catch-up contribution limit is $7,500. This means individuals aged 50 and above can contribute up to a total of $30,500 to their Roth 401(k) in 2024. One of the main benefits of a Roth 401(k) is the ability to take tax-free withdrawals in retirement. Provided the distribution is qualified, participants are not required to pay any taxes on their withdrawals. This includes both the original contributions and any earnings accrued over the life of the account. The Roth 401(k) offers the potential for tax-free growth. Since contributions are made with after-tax dollars, all funds within the account, including any investment gains, can grow tax-free. This can make the Roth 401(k) an attractive option for those who anticipate their investments will significantly appreciate over time. Unlike traditional 401(k)s and traditional IRAs, the Roth 401(k) has no required minimum distributions (RMDs) during the account holder's lifetime. This can provide greater flexibility in managing retirement income and tax liabilities. While the tax-free withdrawals of a Roth 401(k) can be beneficial, it's important to remember that contributions are made with after-tax dollars. This means individuals will have less take-home pay now in exchange for tax-free income later. Contributions to a Roth 401(k) are not tax-deductible. Unlike contributions to a traditional 401(k), which reduce an individual's taxable income in the year they are made, Roth 401(k) contributions have no impact on current-year taxes. Not all employers offer a Roth 401(k) option as part of their retirement plans. The availability of this type of plan is determined by individual employers, meaning some workers may not have access to a Roth 401(k). If you change jobs, you can roll over your Roth 401(k) funds to another Roth 401(k) or a Roth 403(b) with your new employer. This allows your money to continue growing tax-free without any immediate tax consequences. You can also roll over your Roth 401(k) funds to a Roth IRA. This can be a good option if your new employer doesn't offer a Roth 401(k) or Roth 403(b), or if you want to consolidate your retirement savings in one place. In certain situations, it may be beneficial to convert Roth 401(k) funds to a traditional 401(k) or traditional IRA. However, such conversions are taxable events. Before making this decision, it's important to understand the potential tax implications and consider seeking advice from a tax or financial advisor. The Roth 401(k) allows individuals to contribute a portion of their salary after taxes, providing the potential for tax-free income in retirement, subject to certain conditions. The tax advantages of the Roth 401(k), including tax-free withdrawals and growth, make it an appealing option for individuals looking to minimize their tax obligations during retirement. The absence of required minimum distributions (RMDs) provides flexibility in managing retirement income and tax liabilities. However, it's important to consider the drawbacks of the Roth 401(k), such as after-tax contributions and the lack of upfront tax deductions. The availability of a Roth 401(k) is also dependent on employer sponsorship, limiting its accessibility for some individuals. When it comes to rollover options, individuals have the choice to transfer Roth 401(k) funds to another employer-sponsored plan or a Roth IRA, ensuring continued tax-free growth. The Roth 401(k) offers valuable tax advantages and flexibility, making it a valuable tool for retirement planning. What Is a Roth 401(k)?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How Does a Roth 401(k) Work

Eligibility Requirements for a Roth 401(k)

Age

Employment Status

Length of Service

Contribution Limits of a Roth 401(k)

Annual Contribution Limit

Catch-up Contributions for Individuals Aged 50 and Above

Benefits of a Roth 401(k)

Tax-Free Withdrawals

Potential for Tax-Free Growth

No Required Minimum Distributions

Drawbacks of a Roth 401(k)

After-Tax Contributions

No Upfront Tax Deduction

Limited Availability

Rollover Options for Roth 401(k) Funds

Direct Rollover to Another Employer-Sponsored Plan

Rollover to a Roth IRA

Conversion to a Traditional 401(k) or Traditional IRA

Conclusion

Roth 401(k) FAQs

Early withdrawals from a Roth 401(k) may be subject to taxes and a 10% penalty unless an exception applies.

Yes, employers can match Roth 401(k) contributions, but the match is made with pre-tax dollars and is stored in a separate account that will be taxed upon withdrawal.

No, unlike Roth IRAs, there are no income limits for contributing to a Roth 401(k).

Yes, you can split your contributions between a Roth 401(k) and a traditional 401(k) in the same year, but the combined amount cannot exceed the annual limit.

At retirement, you can withdraw your funds tax-free, continue to let them grow tax-free with no RMDs, or roll them over into a Roth IRA or another employer's Roth 401(k) or Roth 403(b).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.