A 401(k) plan is a defined contribution retirement savings account that offers significant tax advantages. Navigating its division fairly and knowledgeably ensures that both parties can achieve financial independence post-divorce. Consequently, understanding how these are divided in a divorce is critical for both parties' financial future. The division of a 401(k) is subject to various factors, including the length of the marriage, contributions to the 401(k) during the marriage, and the economic circumstances of each spouse. Under the law, 401(k) accounts are often viewed as marital property and can be divided between spouses during divorce proceedings. However, only the amount added to the 401(k) during the marriage is typically considered marital property. Any money contributed before the marriage or after separation is usually considered separate property. The division of a 401(k) also largely depends on whether the state in question is a "community property" state or an "equitable distribution" state. In community property states, marital property is typically divided 50/50. In contrast, equitable distribution states divide property based on a variety of factors in an attempt to achieve a fair distribution. In most divorces, both parties start by attempting to negotiate the division of assets, including 401(k) plans. This process may involve discussions between the spouses themselves, between their attorneys, or during mediation. Each party must disclose their respective financial assets and liabilities, which includes the value of the 401(k) account. It's important to understand the value and potential future value of a 401(k) as part of this process, as these retirement plans can be substantial assets. If the parties cannot agree on the division of the 401(k), a court will make the determination. This decision is usually based on the equitable distribution or community property laws of the particular state, as well as considerations such as each party's income and earning potential, the length of the marriage, and the contributions of each party to the marital estate. In some cases, the entire 401(k) may be considered marital property or only the portion that was accumulated during the marriage. A QDRO is a legal document issued by the court that directs the administrator of a 401(k) plan how to divide the account. The QDRO will specify what percentage of the 401(k) each party will receive, or it may specify a particular dollar amount. The QDRO must meet certain legal requirements to be valid, including stating the amount or percentage of the participant's benefits to be paid to the alternate payee, and it must not alter the amount of benefits provided by the plan. The Plan Administrator Divides the 401(k) Based on the QDRO: Once the QDRO is received, the 401(k) plan administrator will execute the division of the account in accordance with the order. This may involve creating a new account for the recipient spouse, or it may involve a direct transfer of funds. It's important to note that there are tax implications involved in this process, which can be mitigated if the funds are transferred directly to another qualified retirement account, such as an IRA. It's also worth noting that the division of a 401(k) does not typically occur until the divorce is final, although the specifics can vary based on the terms of the QDRO and the policies of the 401(k) plan. Generally, the longer the marriage, the more likely it is that the 401(k) will be split evenly. This is because a longer marriage typically involves a more significant mingling of financial assets and a more substantial shared contribution to the 401(k). The amount contributed to the 401(k) during the marriage significantly influences how it's divided in a divorce. Typically, contributions made during the marriage are considered marital property, while contributions made before or after the marriage are viewed as separate property. The economic circumstances of each spouse also influence the division of a 401(k). For example, if one spouse has a much higher income or significantly more assets, they may end up with a smaller portion of the 401(k). Prenuptial and postnuptial agreements can significantly impact how a 401(k) is divided. If these agreements specify how a 401(k) should be divided, courts will generally honor this, provided the agreement is fair and was entered into freely and with full disclosure by both parties. Typically, early withdrawal of 401(k) funds incurs a penalty and is subject to tax. However, if the division is done correctly with a QDRO during a divorce, the tax penalty can be avoided. Still, when the recipient spouse eventually withdraws the money in retirement, it will be taxed as ordinary income. The use of a QDRO allows for the penalty-free transfer of 401(k) funds between spouses in a divorce. Without a QDRO, a premature distribution would trigger a 10% early withdrawal penalty if the fund owner is under 59 ½. Given the complexity of the 401(k) division in a divorce, seeking help from financial advisors and divorce attorneys can be extremely beneficial. These professionals can provide necessary legal and financial advice, help with QDRO preparation, and ensure an equitable division. Financial advisors and attorneys can help ensure a fair split by considering all relevant factors, including the length of the marriage, each spouse's economic circumstances, and any existing prenuptial or postnuptial agreements. They can also advise on potential tax implications and strategies for minimizing them. Knowledge is power. Understanding your rights and options can help you protect your interests during the division of a 401(k). This includes knowing the value of your 401(k), being aware of the rules surrounding its division, and understanding the impact of various division strategies. Negotiating a fair split of a 401(k) requires an open and honest discussion about your finances. Both parties should be prepared to disclose fully their assets and income. It may be possible to trade off assets, for example, one party keeping more of the 401(k) in exchange for the other party keeping more of another asset. Professionals can often help facilitate these discussions and suggest creative solutions. The division of a 401(k) in a divorce is a complex process heavily influenced by factors such as state laws, the length of the marriage, the timing and amount of contributions, and the financial standing of each spouse. Additionally, the division must follow a specific legal process involving negotiation, potential court intervention, the issuance of a QDRO, and the final execution by the plan administrator. Tax implications and early withdrawal penalties can further complicate the process. To navigate these complexities, seeking assistance from financial advisors or divorce attorneys can be advantageous. Not only can they provide necessary legal and financial advice, but they can also help ensure an equitable division.Basics of a 401(k) in a Divorce

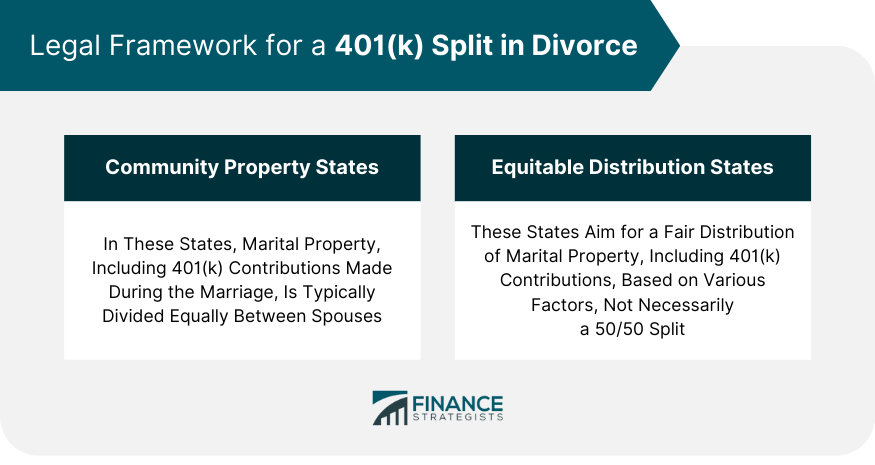

Legal Framework Surrounding a 401(k) Split in Divorce

Marital Property and 401(k)

Role of State Laws

Process of Splitting a 401(k) in Divorce

Negotiation

Court Decision

Qualified Domestic Relations Order (QDRO) Issuance

Division Execution

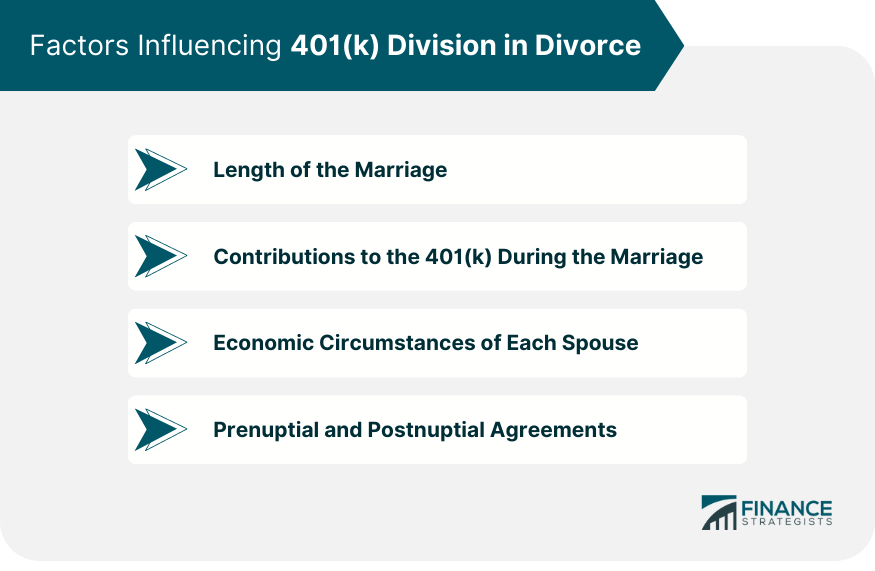

Factors Influencing 401(k) Division in Divorce

Length of the Marriage

Contributions to the 401(k) During the Marriage

Economic Circumstances of Each Spouse

Prenuptial and Postnuptial Agreements

Taxes and Penalties When Splitting a 401(k) in Divorce

Tax Implications of a 401(k) Division

Avoiding Penalties When Splitting a 401(k)

Seeking Professional Help

Consultation With a Financial Advisor And/or Divorce Attorney

Ensuring a Fair and Equitable Split

Strategies for Protecting 401(k) in a Divorce

Understand Your Rights and Options

Negotiating a Fair Split of a 401(k)

Bottom Line

How a 401(k) Is Split in a Divorce FAQs

A 401(k) is typically split in a divorce through negotiations or court decisions, followed by issuing a Qualified Domestic Relations Order (QDRO).

A QDRO is a legal document that provides the framework to allocate a portion of the 401(k) to the non-employee spouse without incurring penalties.

If handled correctly with a Qualified Domestic Relations Order (QDRO), a 401(k) division in a divorce can avoid early withdrawal penalties, but eventual withdrawals will be taxed as income.

State laws influence whether a 401(k) is divided 50/50 (community property states) or based on factors to achieve fair distribution (equitable distribution states).

Understanding your rights and options, seeking professional help, and negotiating a fair split are key strategies to protect a 401(k) in a divorce.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.