A 401(k) loan is a type of loan that allows you to borrow funds directly from your own 401(k) retirement account. In essence, you're lending money to yourself, and the loan amount is subtracted from your existing 401(k) balance. The main purpose of a 401(k) loan is to provide a convenient and accessible source of funds for immediate financial needs. This provision can be particularly beneficial in cases of unexpected expenses or emergencies or when acquiring a traditional loan might be challenging due to credit considerations. However, it's critical to understand that while a 401(k) loan may offer a short-term solution, it also comes with risks and potential implications for your long-term retirement savings. The application process for a 401(k) loan is generally straightforward. You usually apply through your 401(k) plan's administrator, specifying the amount you want to borrow. The loan amount is then deducted from your account. Repayment terms are typically set to a five-year period, but they can be longer if the loan is used for a home purchase. Repayments are often handled through automatic payroll deductions. Interest rates on 401(k) loans are often comparable to those on traditional loans. However, the key difference is that you pay the interest back into your own account. Some plans may also charge an origination fee. If you fail to repay your loan on time, it's considered a default. The loan amount becomes a distribution, subject to taxes and a 10% early withdrawal penalty if you're under 59 ½ years old. One significant advantage of 401(k) loans is the ease of access to funds. Because you're borrowing from yourself, approval is virtually guaranteed and doesn't depend on credit score or income. When you pay back the loan, the interest paid goes back into your 401(k) account, not to a bank or other lender. Because you're borrowing from your own savings, your credit score does not affect your ability to take out a 401(k) loan, making it a viable option for those with less-than-stellar credit. Borrowing from your 401(k) can potentially derail your retirement savings. This happens because the money you borrow is no longer invested and growing, which can significantly affect your long-term savings goals. There are also restrictions on how much you can borrow. Generally, you can borrow up to 50% of your vested account balance or $50,000, whichever is less. If you leave your job or are terminated, your 401(k) loan may become due much sooner than the original term, often within 60 to 90 days. If you can't repay it, the remaining balance is considered a taxable distribution. With a 401(k) loan, you're essentially taxed twice on the interest. You repay the loan with after-tax dollars, and then you're taxed again when you withdraw those funds in retirement. Personal loans can be a good alternative to 401(k) loans, especially for those with a strong credit score. They offer fixed interest rates and payment schedules but don't jeopardize your retirement savings. For homeowners, home equity loans or lines of credit can provide a lower interest rate compared to personal loans, making them a viable alternative. However, your home serves as collateral, so it's essential to be confident in your ability to repay the loan. While not ideal due to high-interest rates, credit cards can be used as a last resort for emergency expenses. Balance transfer cards or those with introductory 0% APR offers can provide temporary relief. Assess Financial Health: Before considering a 401(k) loan, evaluate your overall financial situation. Make sure to consider all options and the potential impact on your retirement savings. Comprehend Plan's Regulations: Every 401(k) plan has its own set of rules and restrictions concerning loans. Make sure you understand these rules before taking out a loan. Formulate a Repayment Plan: Having a solid repayment plan is crucial when taking out a 401(k) loan. This not only includes planning for the regular payments but also considering what would happen if you were to lose your job. 401(k) loans present an accessible yet complex solution for immediate financial needs. Offering simplicity in application and repayment, they also allow interest payments to go back into your own account, with approval being unaffected by your credit score. However, they also carry risks, such as potentially derailing retirement savings, being subject to restrictions and limits, and posing additional implications if job loss occurs. Alternatives like personal loans, home equity loans, and, in some cases, credit cards may be more suitable. Regardless of the choice made, a careful evaluation of one's financial health, a thorough understanding of the chosen option's regulations, and a well-thought-out repayment plan are crucial to safeguard one's financial future. In all cases, the objective should be to ensure long-term financial stability without jeopardizing retirement savings.What Are 401(k) Loans?

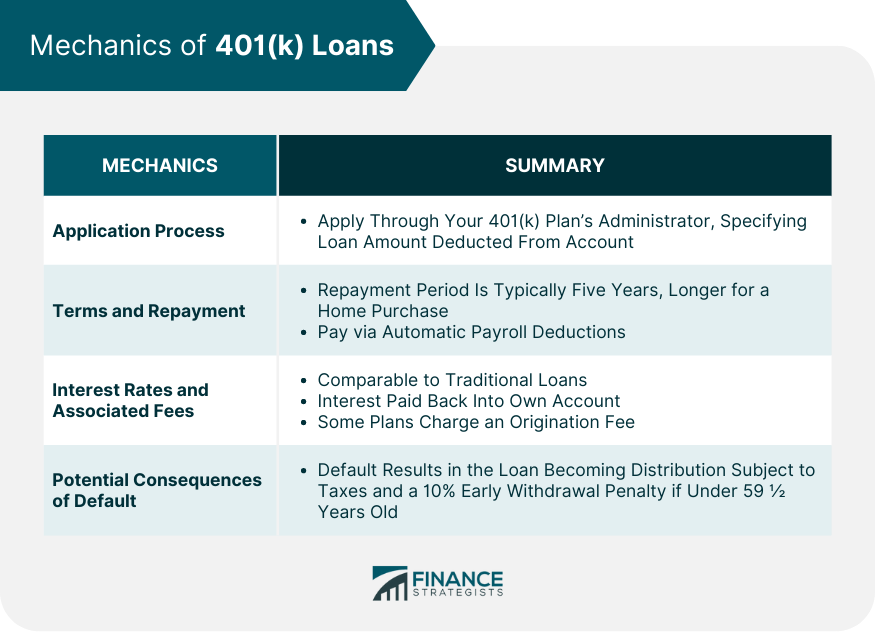

Mechanics of 401(k) Loans

Application Process

Terms and Repayment

Interest Rates and Associated Fees

Potential Consequences of Default

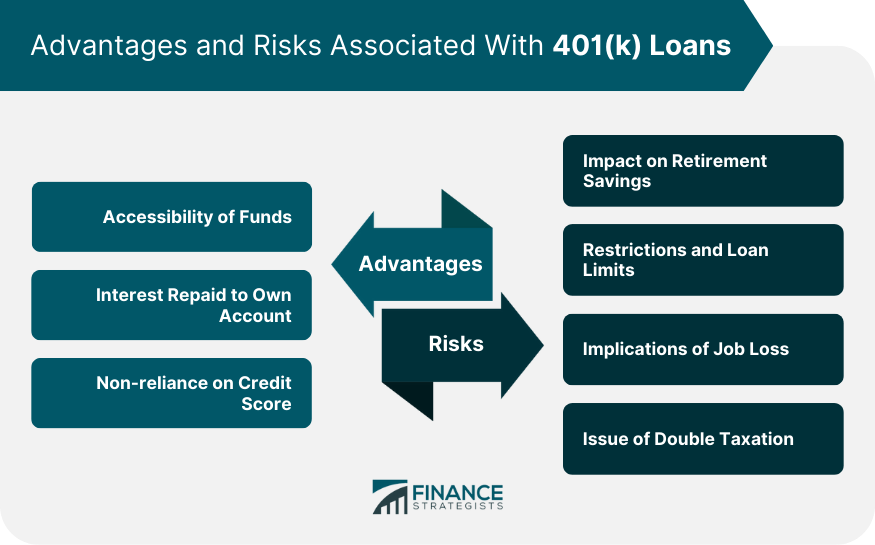

Advantages of 401(k) Loans

Accessibility of Funds

Interest Repaid to Own Account

Non-reliance on Credit Score

Risks Associated With 401(k) Loans

Impact on Retirement Savings

Restrictions and Loan Limits

Implications of Job Loss

Issue of Double Taxation

Alternatives to 401(k) Loans

Personal Loans

Home Equity Loans

Credit Cards

Strategies to 401(k) Loans

Bottom Line

401(k) Loans FAQs

A 401(k) loan allows you to borrow funds directly from your 401(k) retirement account. It's like lending money to yourself, with the loan amount deducted from your 401(k) balance.

Repayment terms for a 401(k) loan are typically set to a five-year period and are often handled through automatic payroll deductions. If the loan is used for a home purchase, the repayment period can be longer.

The benefits of a 401(k) loan include easy access to funds, the fact that the interest paid goes back into your own account, and the non-reliance on credit score for loan approval.

The risks include the potential derailment of your retirement savings, restrictions on the amount you can borrow, potential complications if you lose your job, and double taxation on the interest.

Alternatives to a 401(k) loan include personal loans, home equity loans, and, in some cases, credit cards. These options don't jeopardize your retirement savings, but they have their own terms and conditions to consider.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.