Experiencing a decline in your 401(k) account can be disheartening and may prompt feelings of uncertainty about your financial future. Market fluctuations, economic shifts, and unforeseen events can all contribute to temporary losses in your retirement savings. However, it's essential not to panic but rather take a rational and proactive approach to navigate through such situations. There are practical steps and strategies to address a shrinking 401(k) balance, helping you make informed decisions, regain control, and position yourself for long-term financial success. Seeing a drop in your 401(k) balance can be unnerving. Here are steps to consider. Retirement investing is a long-term game. The stock market has historically trended upward over time, despite short-term fluctuations. Panic selling often locks in losses and can lead to missed opportunities when markets recover. Emotions and investment decisions often don't mix well, so it's crucial to remain rational and not let fear drive your choices. The first step is to evaluate your current investment strategy. Does it align with your risk tolerance and retirement goals? Are you diversified across different asset classes? A diversified portfolio can help mitigate the risks of market volatility and provide a balanced return over time. Remember that your investment strategy should be unique to your personal situation, and a well-diversified portfolio is often the key to weathering market storms. A financial advisor can provide valuable guidance in navigating a 401(k) that's losing money. They can assess your current financial situation, retirement goals, and risk tolerance and help formulate a tailored investment strategy. Financial advisors have the expertise and knowledge to help you navigate complex investment scenarios and can provide objective advice during emotional times. Financial markets naturally ebb and flow due to a variety of influences, such as economic indicators, geopolitical events, and changes in investor sentiment. These fluctuations can cause temporary dips in the value of investments, including your 401(k) assets. However, over a long-term investment horizon, markets have historically trended upward despite periods of volatility. Therefore, these temporary decreases in value are generally not a cause for concern and are typically recovered over time. If a specific fund within your 401(k) portfolio consistently underperforms, it may indicate issues with that particular investment. This underperformance could be due to factors such as poor management, changes in the industry or market in which the fund operates, or fundamental issues with the companies in which the fund is invested. In such instances, it's crucial to perform a detailed analysis and potentially seek expert advice to understand the root cause of the underperformance and consider adjusting your investment strategy accordingly. Investment risk and diversification are key concepts in retirement planning. Diversification is the practice of spreading investments across a variety of assets or asset classes to reduce exposure to any one investment. In the context of a 401(k), this could mean having a mix of different types of mutual funds, stocks, bonds, and money market funds. By spreading your investments, you can help ensure that a decline in one sector won't wipe out your entire portfolio. The right level of diversification depends on your individual risk tolerance and investment horizon. Different asset classes come with varying levels of risk and potential return. Stocks, or equities, are considered riskier but can provide higher returns. Bonds are typically more stable but offer lower potential returns. Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Understanding these differences is key to building a portfolio that suits your risk tolerance and investment goals. To diversify your 401(k), first review the investment options offered by your plan. Try to spread your contributions among different types of investments to balance risk and return. The appropriate mix depends on factors like your age, risk tolerance, and investment goals. Diversification is a continuous process and requires regular reviews to ensure it's achieving your desired balance of risk and reward. Diversification can help soften the blow when certain investments are performing poorly. If one sector of the market is down, but others are up, the gains can help offset the losses, potentially stabilizing your overall returns. This balance can make your investment journey less rocky and can help provide a smoother ride through various market conditions. Rebalancing involves adjusting your portfolio to keep it aligned with your original investment strategy. Over time, some investments may perform better than others, which could shift your portfolio's balance. For instance, a strong performance in stocks could leave you with a higher risk level than you initially intended. Rebalancing can help bring your portfolio back in line with your original goals and risk tolerance. There's no one-size-fits-all answer to how often you should rebalance your 401(k). Some experts suggest doing it annually, while others recommend doing it when your allocation shifts by a certain percentage. The right frequency for you may depend on factors such as your investment strategy, your comfort with risk, and any costs associated with rebalancing. Always consider these factors and consult with a financial advisor if you're unsure. When it's time to rebalance, you'll need to review your current allocations and compare them to your target. If certain investments are overweight, you may need to sell some shares and invest the proceeds into underweight areas. This process can help ensure your portfolio remains balanced and aligned with your long-term goals. Retirement planning is a marathon, not a sprint. It's about focusing on the long term rather than reacting to short-term market fluctuations. The significance of a long-term perspective in retirement planning can't be overstated. While your 401(k) might suffer temporary losses, the goal is to grow your savings over decades. Historically, the markets have trended upward over long periods. Maintaining a long-term view can help you stay the course during market downturns. Emotions can be a powerful driver of investment decisions, but they often lead to mistakes. For example, selling in a downturn out of fear can lock in losses and leave you out of the market when it recovers. Staying disciplined and sticking to your investment strategy, even in challenging times, can help you avoid these common mistakes. Despite market fluctuations, it's important to keep your ultimate goal in mind: building a nest egg for retirement. Consider your current losses in the context of your long-term retirement savings plan. As long as you are consistently contributing to your 401(k) and following a diversified, risk-appropriate investment strategy, you are making progress toward your goal. It's important to remember that occasional dips in your 401(k) are part of the normal cycle of financial markets, and a long-term perspective is key to successful retirement planning. Cultivating calm, evaluating your investment strategy, and seeking professional advice can help you navigate these challenging situations. Understanding the principles of diversification and rebalancing can equip you with the tools necessary to mitigate risk and stay aligned with your retirement goals. While emotions can cloud investment decisions, keeping a disciplined approach and focusing on your long-term retirement savings plan can prove beneficial. Even when experiencing losses, continuing to contribute to your 401(k) and following a diversified, risk-appropriate investment strategy ensures you're making progress toward your retirement. Lastly, if navigating these complexities seems overwhelming, don't hesitate to seek the assistance of a professional retirement planning service for tailored and expert advice.Overview of 401(k) Losses

Immediate Steps to Take if Your 401(k) Is Losing Money

Cultivate Calm

Evaluate Current Investment Strategy

Seek Professional Insight

Common Causes for 401(k) Losses

Normal Market Fluctuations

Specific Fund Issues

Navigating Investment Risk and Diversification

Master Diversification

Demystify Asset Classes

Embark on Diversification

Mitigate Losses

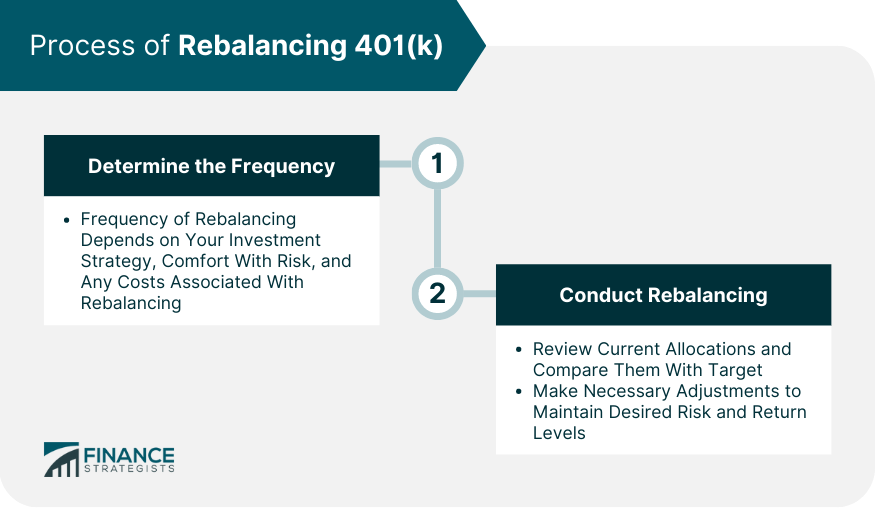

Steps Involved in Rebalancing Your 401(k)

Understanding Rebalancing

Determine the Frequency

Conduct Rebalancing

Focusing on the Long-Term

Recognize the Significance of Long-Term Investing

Tackle Emotional Reactions

Remember Retirement Goals

Bottom Line

What to Do if Your 401(k) Is Losing Money? FAQs

Market volatility, economic downturns, changes in interest rates, and company-specific issues can lead to temporary losses in your 401(k).

Remain calm, evaluate your investment strategy, consider seeking professional advice, ensure your investments are diversified, and regularly rebalance your portfolio.

Diversification spreads your investments across different assets, reducing exposure to any one investment. It can soften the blow when certain investments perform poorly.

Rebalancing is adjusting your portfolio to maintain your desired risk and return levels. It keeps your portfolio in line with your original goals and risk tolerance.

No, retirement investing is a long-term endeavor. Short-term market fluctuations are expected. Maintaining a long-term perspective helps you stay the course during market downturns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.